[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Evan Vassos [@evanvassos](/creator/twitter/evanvassos) on x XXX followers Created: 2025-07-24 02:40:30 UTC My notes from the most recent Digital X webinar $DCC $DCC.AX: "Bitcoin outperforms the cost of capital - that is what we are going to leverage". "Bitcoin is transitioning from a niche investments to an institutional asset" Create a flywheel - hoping to be the leader in Australia and New Zealand. "We expect to acquire significantly more Bitcoin". Market cap to increase in order to attract passive flows, targeting ASX XXX inclusion ($800m market cap). Q&A: Goal - accumulate as much Bitcoin as possible via all instruments. Liquidate all other crypto assets, BTC first and BTC only. Funding Source - huge range of options. Debt, preferred shares, convert to premium. Looking at other funding structures from global markets to acquire more capital to purchase Bitcoin. NAV Multiple - no specific number decided upon. The share price will dictate capital raising strategies but will not dictate how and when we buy bitcoin. Constant shifting in strategy - is the move to BTC only the right one? Changes in shareholders and board have occurred and led to changes in strategy. Board is now committed to long term Bitcoin first strategy. BTC has outperformed over the longer term vs other digital assets. We think that BTC can solve monetary debasement problem. Superannuation funds are looking at trying to make BTC accessible to their members. In discussions with these groups and building assets under management to make products that are suitable for them. Ongoing recruitment for a CEO. Capital Raise was driven by institutional group, is there a plan to come back to current shareholders? $20.7m was max capacity and there was significant demand. Shareholders had opportunity to participate previously. "Backing the fastest horse in a one horse race". "Digital X's focus is on their Bitcoin Treasury, we are here for the longer term" #Bitcoin #BTCTreasury #BTCAustralia Disclosure: Held & Not Advice  XXX engagements  **Related Topics** [$dccl](/topic/$dccl) [market cap](/topic/market-cap) [new zealand](/topic/new-zealand) [australia](/topic/australia) [$dccax](/topic/$dccax) [$dcc](/topic/$dcc) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/evanvassos/status/1948211661183336761)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Evan Vassos @evanvassos on x XXX followers

Created: 2025-07-24 02:40:30 UTC

Evan Vassos @evanvassos on x XXX followers

Created: 2025-07-24 02:40:30 UTC

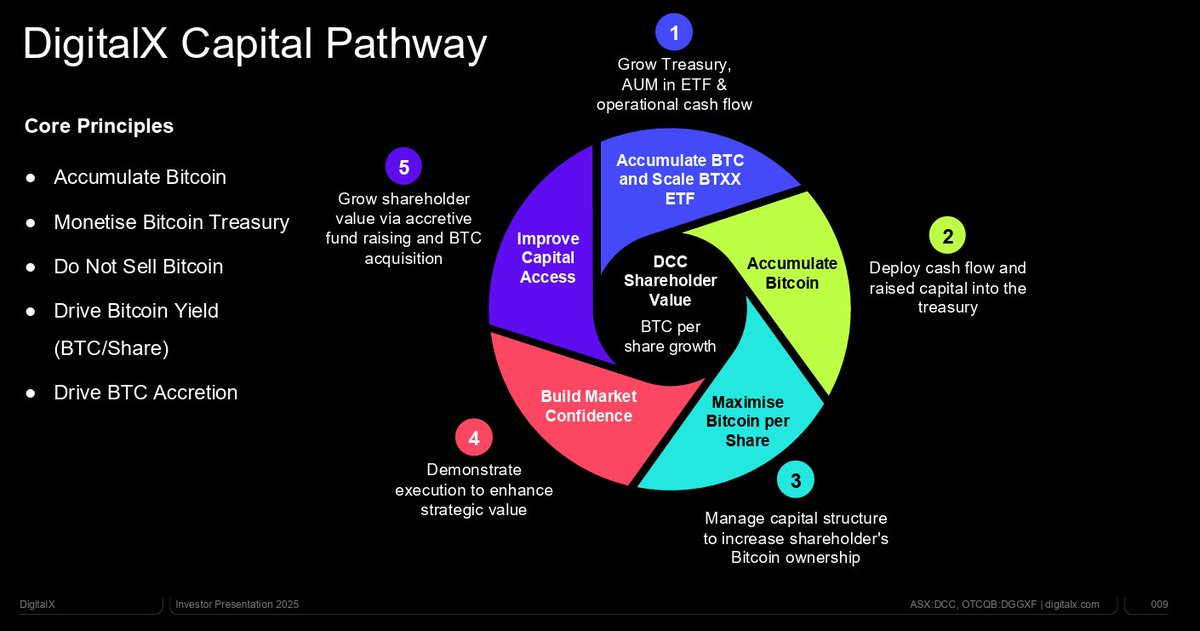

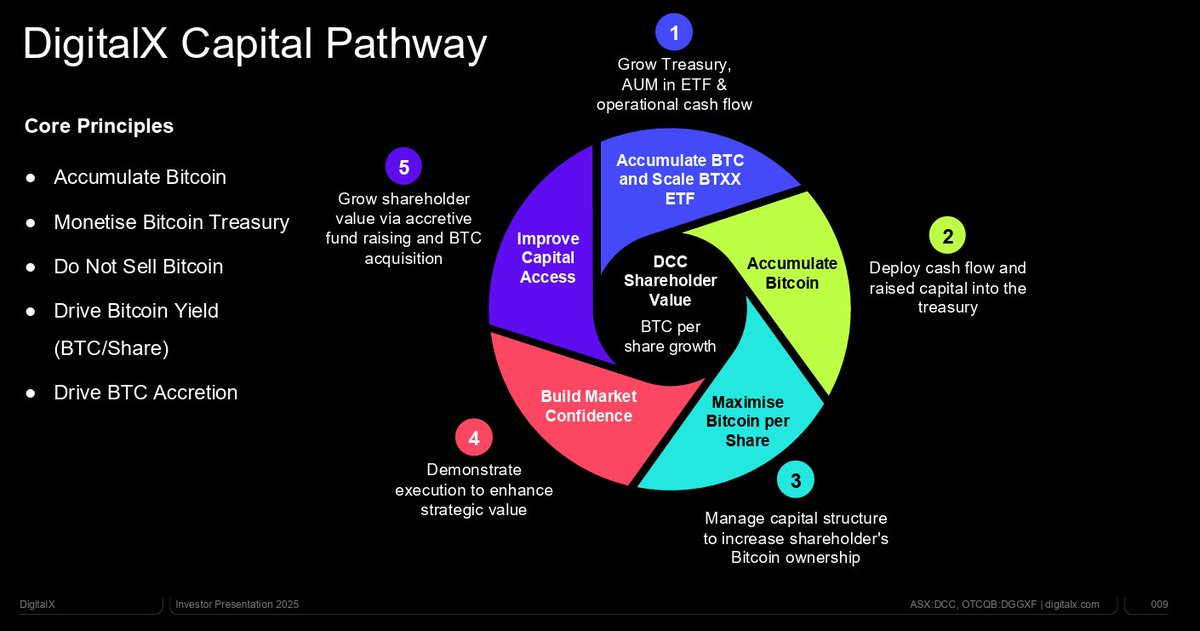

My notes from the most recent Digital X webinar $DCC $DCC.AX:

"Bitcoin outperforms the cost of capital - that is what we are going to leverage".

"Bitcoin is transitioning from a niche investments to an institutional asset"

Create a flywheel - hoping to be the leader in Australia and New Zealand.

"We expect to acquire significantly more Bitcoin".

Market cap to increase in order to attract passive flows, targeting ASX XXX inclusion ($800m market cap).

Q&A:

Goal - accumulate as much Bitcoin as possible via all instruments. Liquidate all other crypto assets, BTC first and BTC only.

Funding Source - huge range of options. Debt, preferred shares, convert to premium. Looking at other funding structures from global markets to acquire more capital to purchase Bitcoin.

NAV Multiple - no specific number decided upon.

The share price will dictate capital raising strategies but will not dictate how and when we buy bitcoin.

Constant shifting in strategy - is the move to BTC only the right one? Changes in shareholders and board have occurred and led to changes in strategy. Board is now committed to long term Bitcoin first strategy. BTC has outperformed over the longer term vs other digital assets. We think that BTC can solve monetary debasement problem.

Superannuation funds are looking at trying to make BTC accessible to their members. In discussions with these groups and building assets under management to make products that are suitable for them.

Ongoing recruitment for a CEO.

Capital Raise was driven by institutional group, is there a plan to come back to current shareholders? $20.7m was max capacity and there was significant demand. Shareholders had opportunity to participate previously.

"Backing the fastest horse in a one horse race". "Digital X's focus is on their Bitcoin Treasury, we are here for the longer term"

#Bitcoin #BTCTreasury #BTCAustralia

Disclosure: Held & Not Advice

XXX engagements

Related Topics $dccl market cap new zealand australia $dccax $dcc bitcoin coins layer 1