[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  J. P. Mayall [@jpmayall](/creator/twitter/jpmayall) on x 8802 followers Created: 2025-07-24 02:26:07 UTC While the argument that Monero fixes the supposed flaws of Bitcoin as a medium of exchange may sound innovative to someone who just discovered the asset, probably yesterday morning given the inexperienced tone and omission of market history, it ignores fundamental principles of the Austrian school of economics, such as Mises' regression theorem, which requires that money evolve from a collectible with superior salability to preserve value before becoming a viable medium of exchange in economies with structured prices or dominated by high-performing assets like Bitcoin. Just look at the data: Monero reached its historical peak of about XXXXXXX BTC in 2018, but in July 2025 it is around XXXXXX BTC, representing a drop of approximately XX% relative to Bitcoin, which makes it useless for value preservation. Who would use a medium of exchange that loses so much to a superior reserve, encouraging hoarding in the stronger asset instead of forced circulation? Furthermore, its extreme privacy, via ring signatures and stealth addresses, sacrifices the essential transparency for auditing total emissions, transactions, and updates, potentially hiding hidden inflation, bugs, whales, or frauds, contrasting with Bitcoin's auditable scarcity that builds trust and sustainable adoption. It's no wonder that every bull market revives the hype of "more privacy," but projects like Zcash, DarkCoin (now Dash), and Bitcoin Private have always failed to outperform Bitcoin in the long term, limiting themselves to speculative niches without achieving sound money. Monero follows the same path, prioritizing marginal use over the saving incentives that Mises, Menger and Austrians defend as the basis for a sound money.  XXXXX engagements  **Related Topics** [money](/topic/money) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [$issc](/topic/$issc) [Post Link](https://x.com/jpmayall/status/1948208041850966089)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

J. P. Mayall @jpmayall on x 8802 followers

Created: 2025-07-24 02:26:07 UTC

J. P. Mayall @jpmayall on x 8802 followers

Created: 2025-07-24 02:26:07 UTC

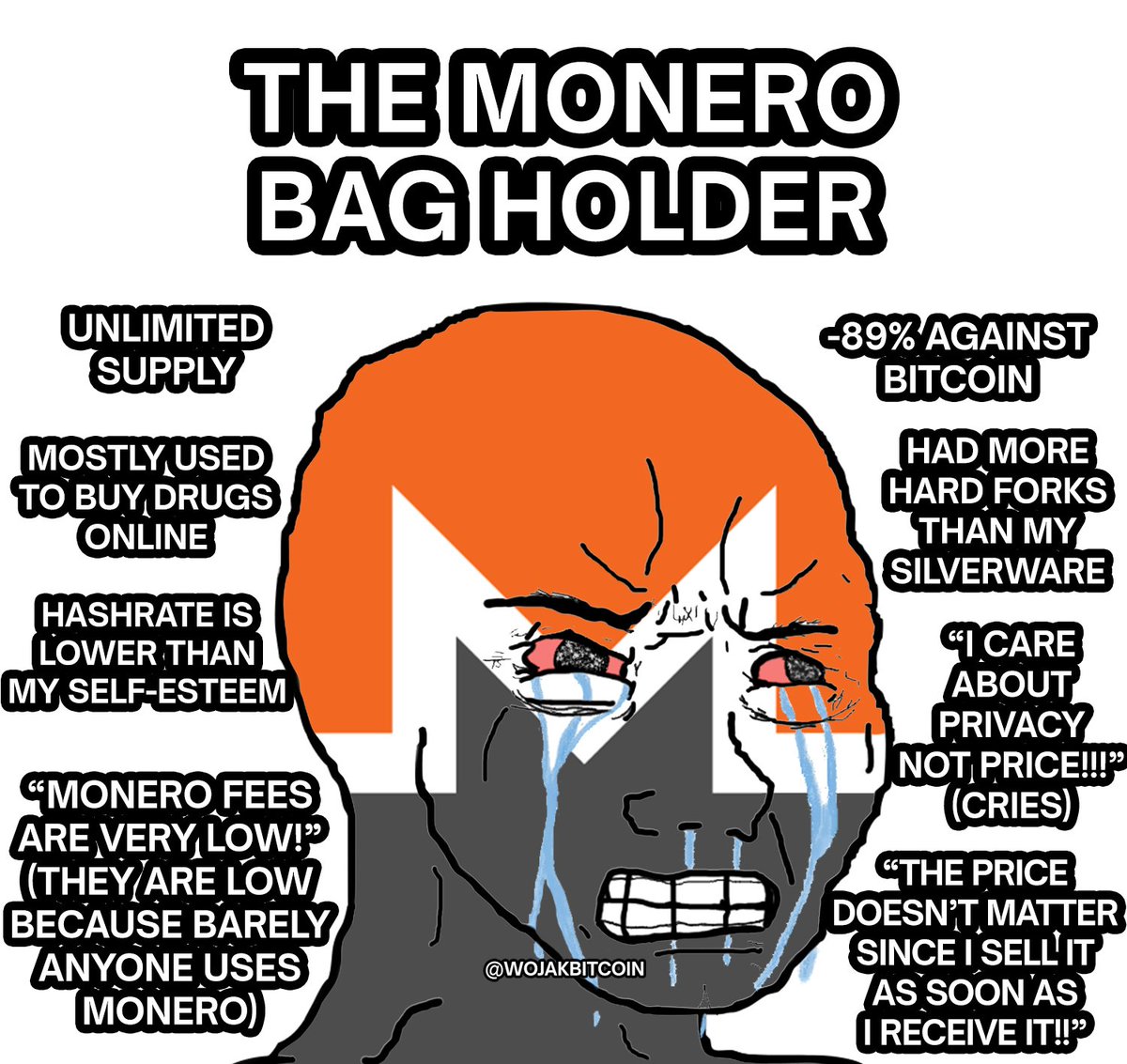

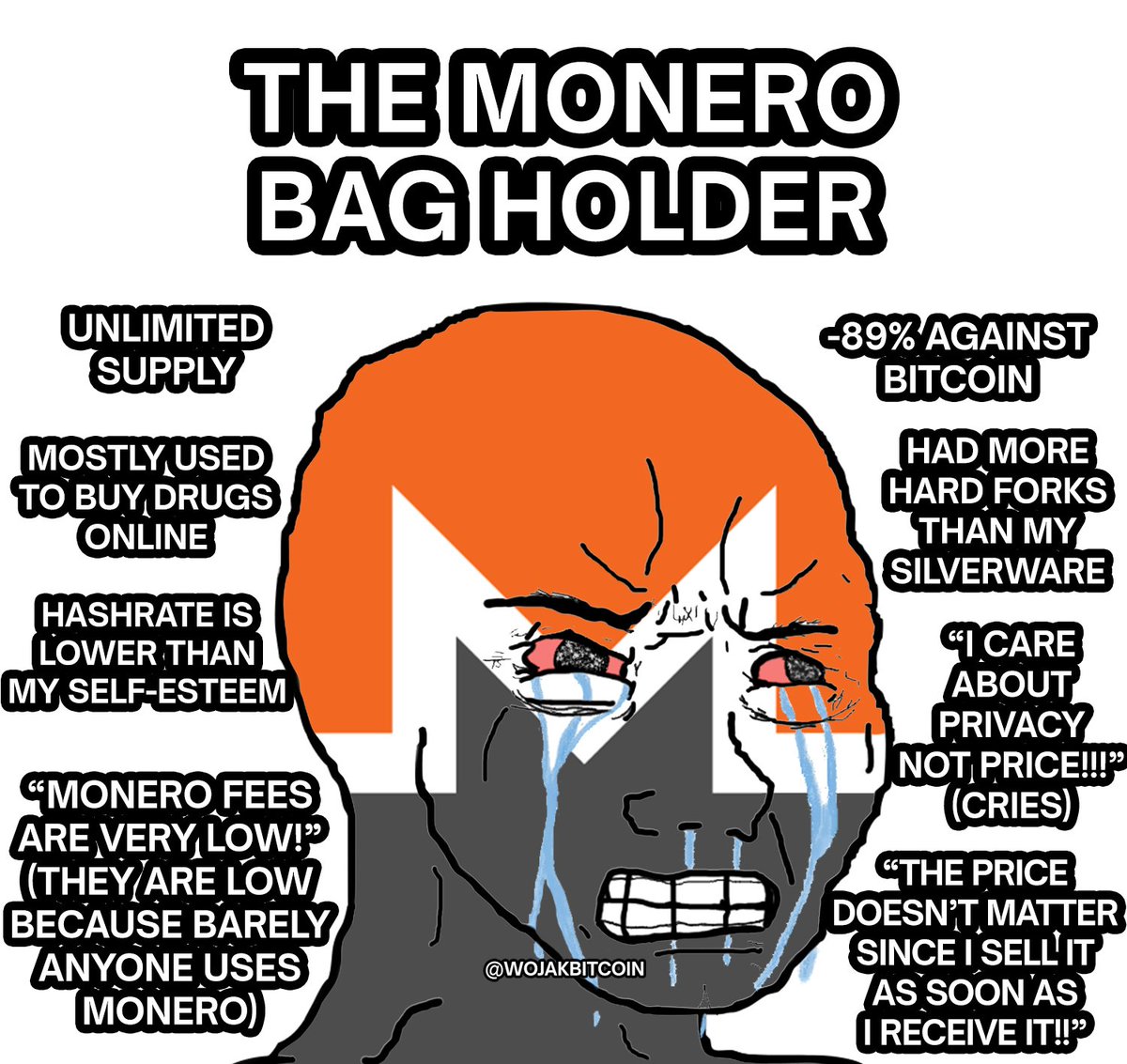

While the argument that Monero fixes the supposed flaws of Bitcoin as a medium of exchange may sound innovative to someone who just discovered the asset, probably yesterday morning given the inexperienced tone and omission of market history, it ignores fundamental principles of the Austrian school of economics, such as Mises' regression theorem, which requires that money evolve from a collectible with superior salability to preserve value before becoming a viable medium of exchange in economies with structured prices or dominated by high-performing assets like Bitcoin.

Just look at the data: Monero reached its historical peak of about XXXXXXX BTC in 2018, but in July 2025 it is around XXXXXX BTC, representing a drop of approximately XX% relative to Bitcoin, which makes it useless for value preservation.

Who would use a medium of exchange that loses so much to a superior reserve, encouraging hoarding in the stronger asset instead of forced circulation?

Furthermore, its extreme privacy, via ring signatures and stealth addresses, sacrifices the essential transparency for auditing total emissions, transactions, and updates, potentially hiding hidden inflation, bugs, whales, or frauds, contrasting with Bitcoin's auditable scarcity that builds trust and sustainable adoption. It's no wonder that every bull market revives the hype of "more privacy," but projects like Zcash, DarkCoin (now Dash), and Bitcoin Private have always failed to outperform Bitcoin in the long term, limiting themselves to speculative niches without achieving sound money.

Monero follows the same path, prioritizing marginal use over the saving incentives that Mises, Menger and Austrians defend as the basis for a sound money.

XXXXX engagements

Related Topics money bitcoin coins layer 1 coins bitcoin ecosystem coins pow $issc