[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mesh [@MeshClans](/creator/twitter/MeshClans) on x 4677 followers Created: 2025-07-23 23:14:46 UTC Pendle Finance is revolutionizing DeFi yield strategies here’s how. 🔹 What’s new? X. PT-to-PT Swaps @pendle_fi just rolled out Principal Token-to-Principal Token (PT-to-PT) swaps. Now you can seamlessly roll over your fixed yield positions across maturities without exiting the market. Example: Swap from PT-sUSDe (Jul 31, 2025) to PT-sUSDe (Sep 25, 2025) directly on the platform. ✅ Minimal slippage via Pendle’s efficient AMM ✅ User-friendly UI with input/output previews and real-time pricing ✅ No need to redeem and re-enter positions-just swap and stay earning X. Hyperliquid's hwHLP on Ethereum Pendle integrated hwHLP, a yield-bearing token tied to Hyperliquid’s HLP vault (currently ~9.1% APY) on HyperEVM. Now live on Ethereum, this lets you: → Trade hwHLP → Split into PT/ YT for fixed or variable yield exposure → Farm 4x Wave Points (exclusive to Pendle) → Pay X fees, thanks to Hyperwave’s launch incentives X. Upcoming Strata x Pendle integration (teased) Pendle hinted at integrating with Strata, a yield product under the Ethena Converge protocol. In Season 0, users can deposit USDe/eUSDe to earn: → 30x Strata points → 30x Ethena points → Ethereal points Pendle-fying this unlocks tradable yield strategies for stablecoin farmers who want to compound multipliers with fixed returns. Points meta meets Pendle mechanics. --- 🔹 Why this matters: Pendle’s innovation lets you optimize fixed yields, speculate on APYs, and roll positions without yield loss. As volatility rises, these tools give you precision in managing your DeFi income. 🔹 Where to start: → Visit → Explore PT-to-PT swaps and new pools like hwHLP → Get exposure to Hyperliquid yields → Position ahead of the Strata integration → Accumulate yield + points + fixed returns in one place --- Pendle TVL remains strong (esp. in stables), $PENDLE trades around $4.39, and governance via vePENDLE keeps users engaged across Ethereum, Arbitrum, Optimism, and BNB Chain. Future yield trading is here flexible, multi-chain and optimized.  XXXXX engagements  **Related Topics** [positions](/topic/positions) [token](/topic/token) [pendlefi](/topic/pendlefi) [finance](/topic/finance) [$xwp](/topic/$xwp) [Post Link](https://x.com/MeshClans/status/1948159886648545522)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mesh @MeshClans on x 4677 followers

Created: 2025-07-23 23:14:46 UTC

Mesh @MeshClans on x 4677 followers

Created: 2025-07-23 23:14:46 UTC

Pendle Finance is revolutionizing DeFi yield strategies here’s how.

🔹 What’s new?

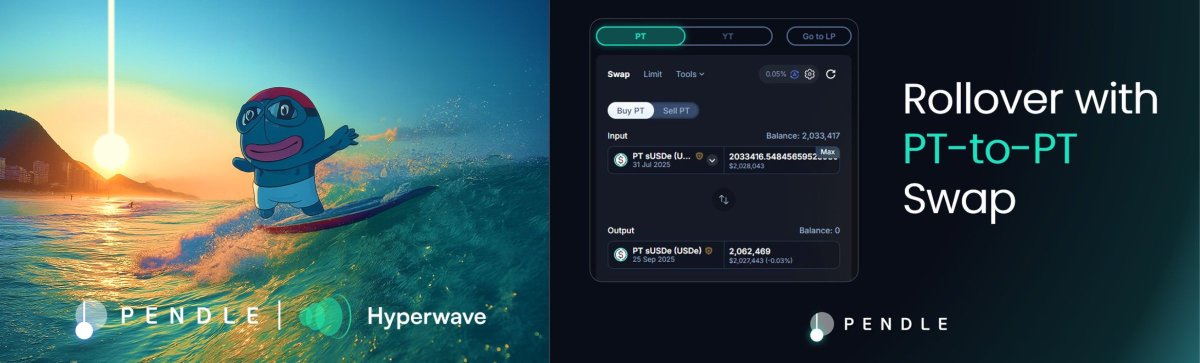

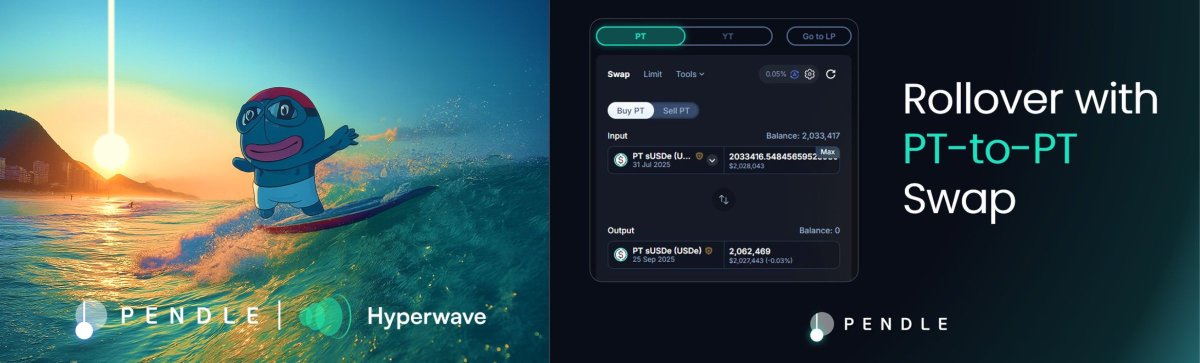

X. PT-to-PT Swaps @pendle_fi just rolled out Principal Token-to-Principal Token (PT-to-PT) swaps.

Now you can seamlessly roll over your fixed yield positions across maturities without exiting the market.

Example: Swap from PT-sUSDe (Jul 31, 2025) to PT-sUSDe (Sep 25, 2025) directly on the platform. ✅ Minimal slippage via Pendle’s efficient AMM ✅ User-friendly UI with input/output previews and real-time pricing ✅ No need to redeem and re-enter positions-just swap and stay earning

X. Hyperliquid's hwHLP on Ethereum Pendle integrated hwHLP, a yield-bearing token tied to Hyperliquid’s HLP vault (currently ~9.1% APY) on HyperEVM.

Now live on Ethereum, this lets you: → Trade hwHLP → Split into PT/ YT for fixed or variable yield exposure → Farm 4x Wave Points (exclusive to Pendle) → Pay X fees, thanks to Hyperwave’s launch incentives

X. Upcoming Strata x Pendle integration (teased) Pendle hinted at integrating with Strata, a yield product under the Ethena Converge protocol. In Season 0, users can deposit USDe/eUSDe to earn: → 30x Strata points → 30x Ethena points → Ethereal points

Pendle-fying this unlocks tradable yield strategies for stablecoin farmers who want to compound multipliers with fixed returns. Points meta meets Pendle mechanics.

🔹 Why this matters: Pendle’s innovation lets you optimize fixed yields, speculate on APYs, and roll positions without yield loss. As volatility rises, these tools give you precision in managing your DeFi income.

🔹 Where to start: → Visit → Explore PT-to-PT swaps and new pools like hwHLP → Get exposure to Hyperliquid yields → Position ahead of the Strata integration → Accumulate yield + points + fixed returns in one place

Pendle TVL remains strong (esp. in stables), $PENDLE trades around $4.39, and governance via vePENDLE keeps users engaged across Ethereum, Arbitrum, Optimism, and BNB Chain.

Future yield trading is here flexible, multi-chain and optimized.

XXXXX engagements