[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eagle Investors [@EagleInvestors](/creator/twitter/EagleInvestors) on x XXX followers Created: 2025-07-23 20:27:35 UTC $CCI $AMT $O $VICI $VZ $T 📢 $CCI Q2 Earnings Recap 🏢 FFO: $XXXX vs. $XXXX est. — beat by $XXXX ✅ 💵 Revenue: $1.06B vs. $1.04B est. — beat by $20M ✅ 📉 Revenue down XXX% YoY, mostly due to lower site rental revenue 📦 Operational Highlights • Net income: $291M vs. $251M a year ago • Adjusted EBITDA: $705M, down slightly from $727M • Cost savings from office closures and staff reductions helped offset softness • Organic site rental billing growth: 4.7%, in line with prior quarters 🏗️ 📅 2025 Outlook • FY25 FFO guidance midpoint: $XXXX — in line with consensus • Core leasing activity and escalators continue to contribute steadily • Adjusted for Sprint cancellations, rental growth remains consistent 📈 Stock Reaction • Shares rose +0.45%, as investors digest cost controls and stable outlook 🧠 Final Take While top-line growth is modest, Crown Castle is managing expenses well and holding firm on full-year FFO and rental guidance — a stable quarter in a challenging telecom infrastructure environment. #CCI #CrownCastle #EarningsRecap #REITs #TelecomInfrastructure #DividendStocks #StockMarket #Investing #Q2Earnings #SiteLeasing #FFO #RealEstate #MarketsToday #FinancialResults  XXX engagements  **Related Topics** [20m](/topic/20m) [$727m](/topic/$727m) [$705m](/topic/$705m) [$251m](/topic/$251m) [$291m](/topic/$291m) [$20m](/topic/$20m) [$104b](/topic/$104b) [$106b](/topic/$106b) [Post Link](https://x.com/EagleInvestors/status/1948117810691084485)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-23 20:27:35 UTC

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-23 20:27:35 UTC

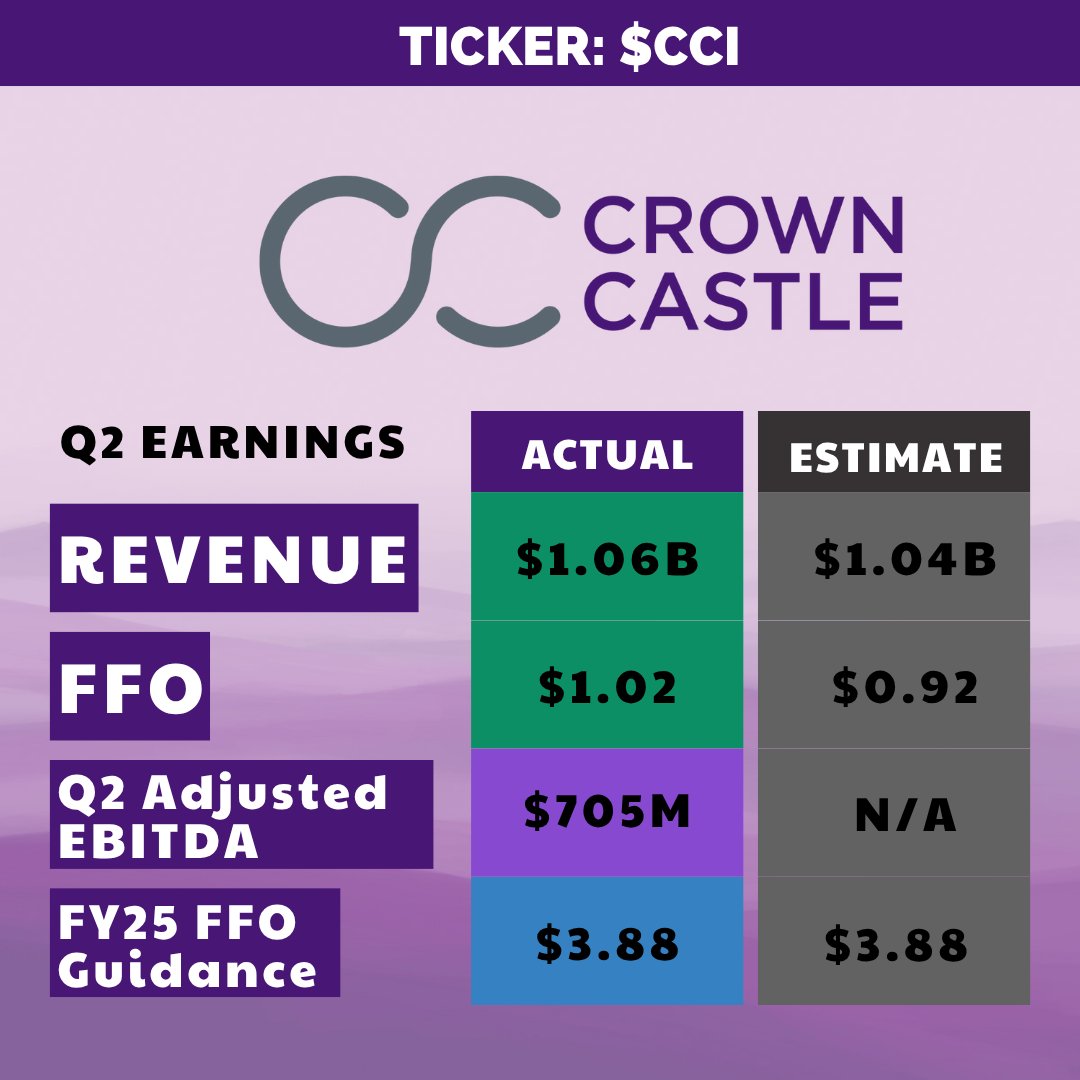

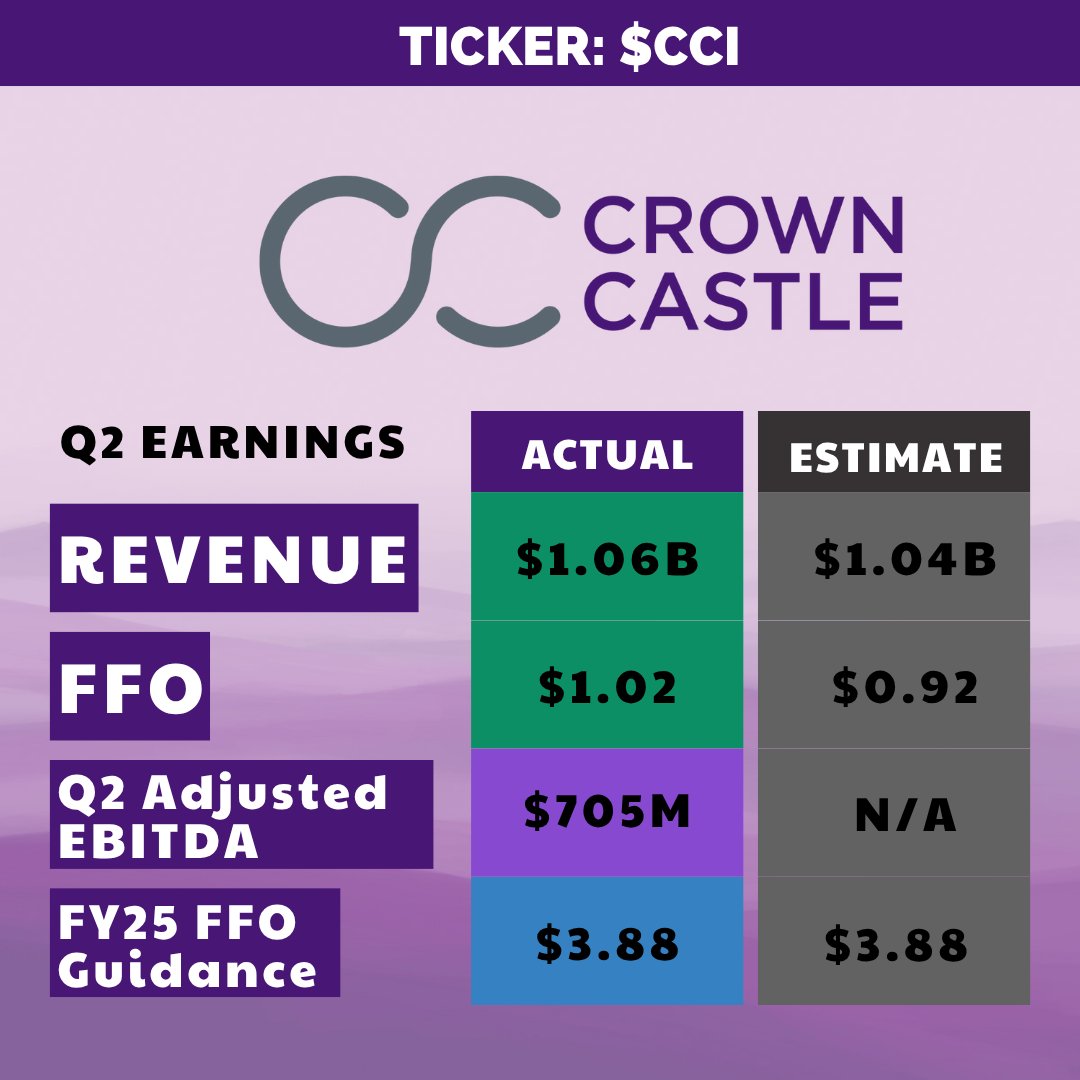

$CCI $AMT $O $VICI $VZ $T 📢 $CCI Q2 Earnings Recap 🏢 FFO: $XXXX vs. $XXXX est. — beat by $XXXX ✅ 💵 Revenue: $1.06B vs. $1.04B est. — beat by $20M ✅ 📉 Revenue down XXX% YoY, mostly due to lower site rental revenue

📦 Operational Highlights • Net income: $291M vs. $251M a year ago • Adjusted EBITDA: $705M, down slightly from $727M • Cost savings from office closures and staff reductions helped offset softness • Organic site rental billing growth: 4.7%, in line with prior quarters 🏗️

📅 2025 Outlook • FY25 FFO guidance midpoint: $XXXX — in line with consensus • Core leasing activity and escalators continue to contribute steadily • Adjusted for Sprint cancellations, rental growth remains consistent

📈 Stock Reaction • Shares rose +0.45%, as investors digest cost controls and stable outlook

🧠 Final Take While top-line growth is modest, Crown Castle is managing expenses well and holding firm on full-year FFO and rental guidance — a stable quarter in a challenging telecom infrastructure environment.

#CCI #CrownCastle #EarningsRecap #REITs #TelecomInfrastructure #DividendStocks #StockMarket #Investing #Q2Earnings #SiteLeasing #FFO #RealEstate #MarketsToday #FinancialResults

XXX engagements