[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Clarence Wong, CCIM [@ClarenceWongCRE](/creator/twitter/ClarenceWongCRE) on x 9581 followers Created: 2025-07-23 16:47:21 UTC For a recapitalization (“recap”), we did provide below for potential LPs at GP firms I’ve worked at. Even for institutional LPs, sharing below is helpful. For more unsophisticated LPs, it’s even more important. So sharing “baseline underwriting” with potential LPs even though they may tweak / do their own underwriting. Great reminder & breakdown, Jonathan Livi. Thanks for sharing. 1) A built out financial model built at the valuation you are trying to achieve (5 year proforma at least) 2) Sources and uses showing where all funds in the transaction are going to go 3) A corporate deck on your firm 4) A narrative on the history of the property, how lease-up is progressing, and why you expect lease-up to excel 5) Clear senior debt terms 6) A RR and T12  XXXXX engagements  **Related Topics** [mergers and acquisitions](/topic/mergers-and-acquisitions) [Post Link](https://x.com/ClarenceWongCRE/status/1948062388747682153)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Clarence Wong, CCIM @ClarenceWongCRE on x 9581 followers

Created: 2025-07-23 16:47:21 UTC

Clarence Wong, CCIM @ClarenceWongCRE on x 9581 followers

Created: 2025-07-23 16:47:21 UTC

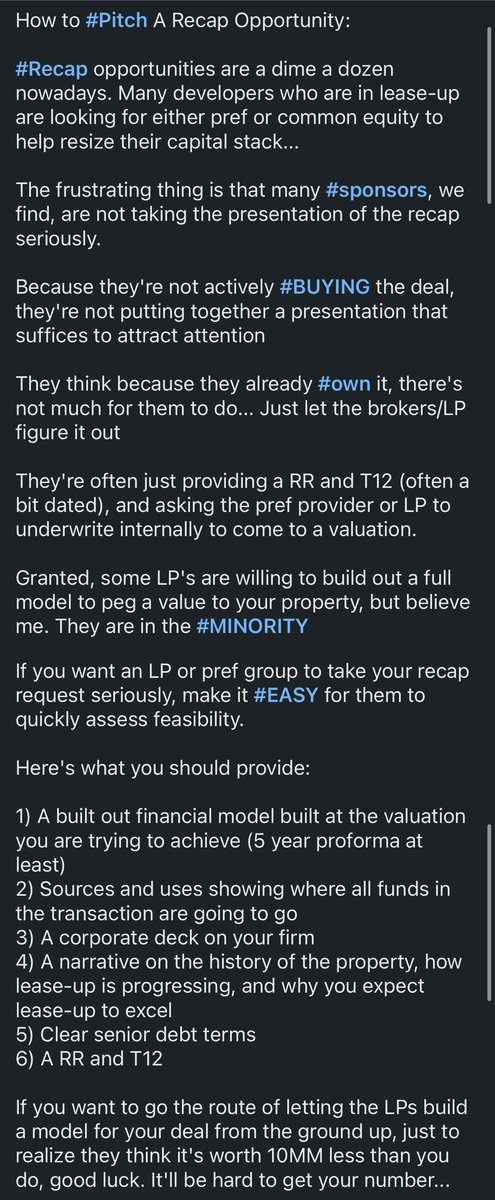

For a recapitalization (“recap”), we did provide below for potential LPs at GP firms I’ve worked at.

Even for institutional LPs, sharing below is helpful. For more unsophisticated LPs, it’s even more important.

So sharing “baseline underwriting” with potential LPs even though they may tweak / do their own underwriting.

Great reminder & breakdown, Jonathan Livi. Thanks for sharing.

- A built out financial model built at the valuation you are trying to achieve (5 year proforma at least)

- Sources and uses showing where all funds in the transaction are going to go

- A corporate deck on your firm

- A narrative on the history of the property, how lease-up is progressing, and why you expect lease-up to excel

- Clear senior debt terms

- A RR and T12

XXXXX engagements

Related Topics mergers and acquisitions