[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Indian Investor [@Anvith_](/creator/twitter/Anvith_) on x 19.3K followers Created: 2025-07-23 16:44:14 UTC Top Performing Nifty XXX Stocks – 1-Year Return (As of July 2025) Missed these rockets? Let’s decode what drove the rally in each. 🔹 JSW Holdings – +215% Holding co. of JSW Group (Steel, Infra, Energy). Re-rating on NAV discount narrowing + group valuation boom. 🔹 Wockhardt – +210% Pharma turnaround play. Debt reduction, UK business revival & new antibiotic launches driving sentiment. 🔹 BSE Ltd – +190% Stock exchange duopoly play. Equity turnover jump, SME listings boom, and India INX traction fueling rerating. 🔹 PG Electroplast – +155% EMS + White Goods OEM. PLI tailwinds, margin expansion & scale-up in AC + washing machine verticals. 🔹 Deepak Fertilisers – +152% Chemicals + agri inputs mix. Backward integration, TAN segment strength & project commissioning narrative. 🔹 Paytm – +108% Fintech sentiment shift. Profitability milestones, cost controls, and RBI relief rally post payment bank ban. 🔹 Reliance Power – +105% High-debt energy play with revival hopes. Debt restructuring + potential merger with Reliance Infra fueled interest. 🔹 Lloyds Metals – +105% Iron ore + sponge iron player. Strong commodity cycle + captive resource integration pushing profitability. 🔹 MCX – +102% Commodity exchange. New trading platform rollout, increasing market share & FPI interest in India’s derivatives market. 🔹 Firstsource Solutions – +92% Mid-cap IT + BPM play. Resilient client base, margin tailwinds & shift to value-focused outsourcing. 💭 Which of these do you believe still have steam left? Which ones were pure FOMO? 🚫 No Recommendation.  XXXXX engagements  **Related Topics** [momentum](/topic/momentum) [money](/topic/money) [Sentiment](/topic/sentiment) [revival](/topic/revival) [debt](/topic/debt) [discount](/topic/discount) [coins energy](/topic/coins-energy) [infra](/topic/infra) [Post Link](https://x.com/Anvith_/status/1948061605868257596)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Indian Investor @Anvith_ on x 19.3K followers

Created: 2025-07-23 16:44:14 UTC

The Indian Investor @Anvith_ on x 19.3K followers

Created: 2025-07-23 16:44:14 UTC

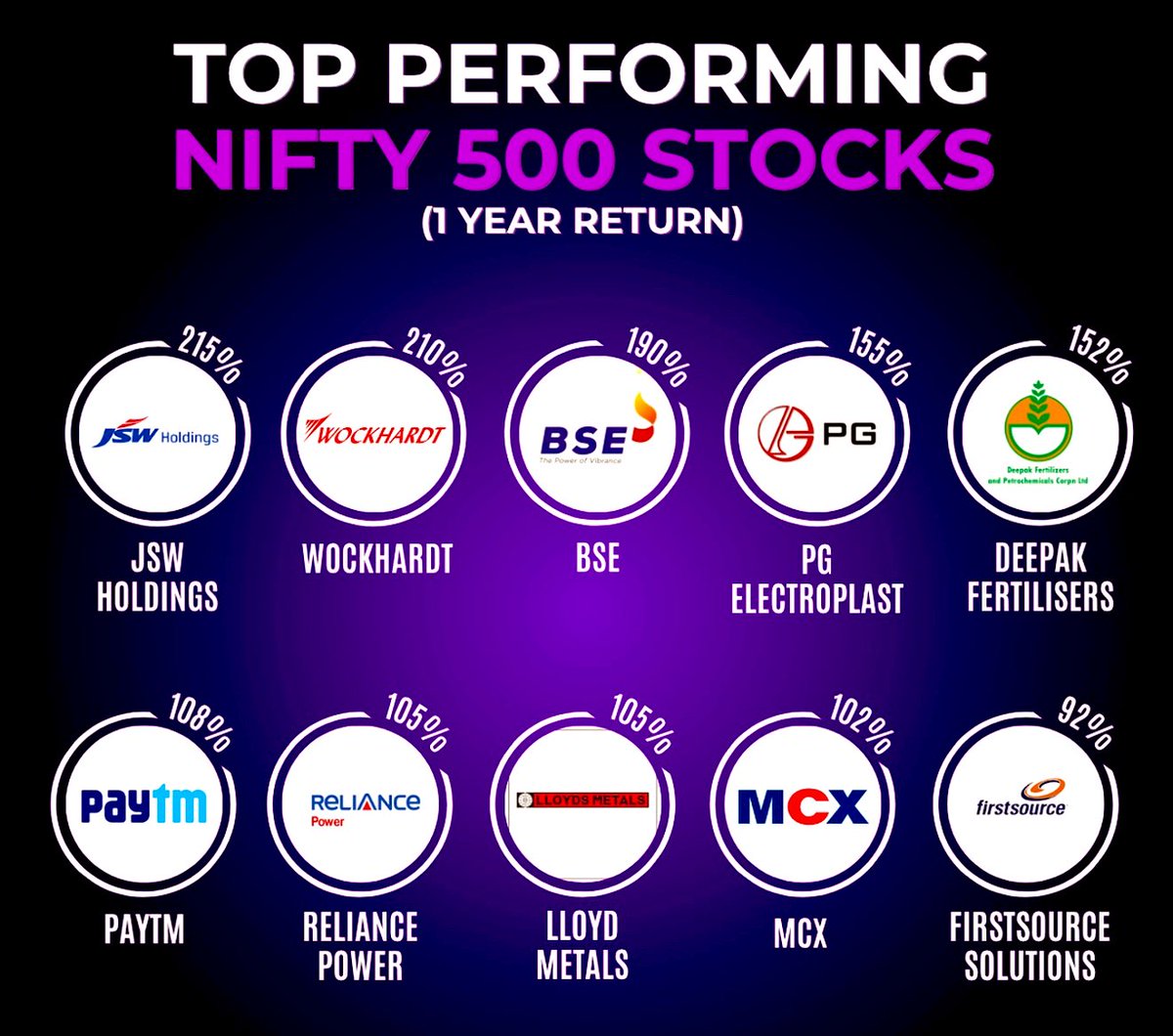

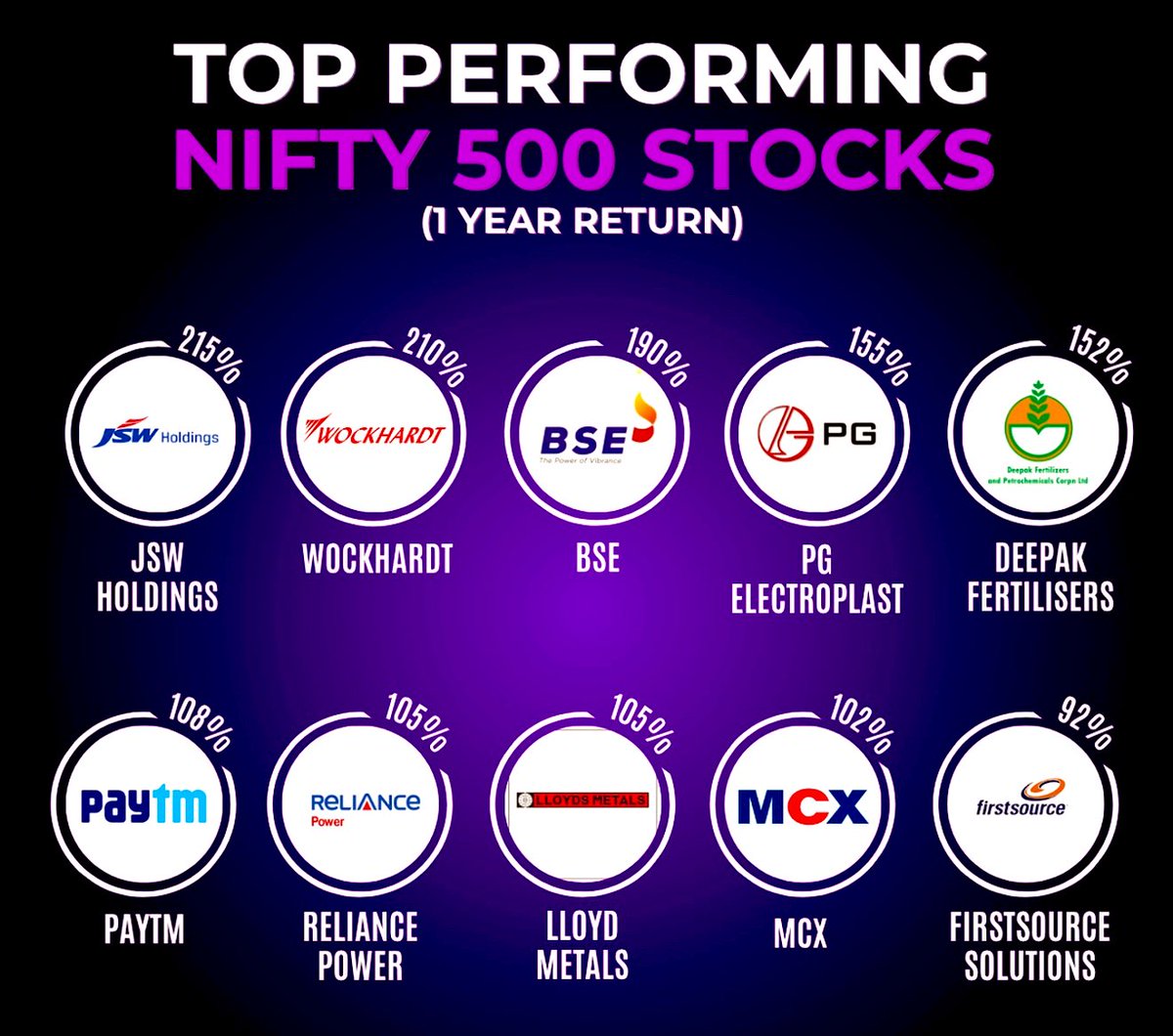

Top Performing Nifty XXX Stocks – 1-Year Return (As of July 2025)

Missed these rockets? Let’s decode what drove the rally in each.

🔹 JSW Holdings – +215% Holding co. of JSW Group (Steel, Infra, Energy). Re-rating on NAV discount narrowing + group valuation boom.

🔹 Wockhardt – +210% Pharma turnaround play. Debt reduction, UK business revival & new antibiotic launches driving sentiment.

🔹 BSE Ltd – +190% Stock exchange duopoly play. Equity turnover jump, SME listings boom, and India INX traction fueling rerating.

🔹 PG Electroplast – +155% EMS + White Goods OEM. PLI tailwinds, margin expansion & scale-up in AC + washing machine verticals.

🔹 Deepak Fertilisers – +152% Chemicals + agri inputs mix. Backward integration, TAN segment strength & project commissioning narrative.

🔹 Paytm – +108% Fintech sentiment shift. Profitability milestones, cost controls, and RBI relief rally post payment bank ban.

🔹 Reliance Power – +105% High-debt energy play with revival hopes. Debt restructuring + potential merger with Reliance Infra fueled interest.

🔹 Lloyds Metals – +105% Iron ore + sponge iron player. Strong commodity cycle + captive resource integration pushing profitability.

🔹 MCX – +102% Commodity exchange. New trading platform rollout, increasing market share & FPI interest in India’s derivatives market.

🔹 Firstsource Solutions – +92% Mid-cap IT + BPM play. Resilient client base, margin tailwinds & shift to value-focused outsourcing.

💭 Which of these do you believe still have steam left? Which ones were pure FOMO?

🚫 No Recommendation.

XXXXX engagements

Related Topics momentum money Sentiment revival debt discount coins energy infra