[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  YashasEdu [@YashasEdu](/creator/twitter/YashasEdu) on x 6832 followers Created: 2025-07-23 15:20:07 UTC So @strata_money caught my attention. Here’s why🧵 It is building something different. A yield tranching protocol that splits @ethena_labs’ sUSDe into two risk profiles. Think of it as choosing between a steady paycheck or commission based income, but for DeFi yields. The protocol just crossed $16M TVL in under X days, showing there's real demand for structured yield products. > $16.06M total deposited > XXX unique depositors > Average deposit: $37K > $273K withdrawn (58:1 deposit to withdraw ratio) Two wallets dropped $2M each, X wallets w 1M+, while hundreds of others positioned between $10K-50K. Here’s how @strata_money works👇 > You deposit USDe/eUSDe and choose your risk appetite > Conservative users pick stUSDe for protected yields > Risk takers choose stJLP for leveraged exposure > Both sides benefit from the same LP Check out more Current rewards for pre depositors consists of 30x Strata points + 30x Ethena points + 1x Ethereal points. Potential multiplier with upcoming integrations w @pendle_fi @ethena_labs’ sUSDe yields have been volatile, swinging from X% to 10%+. For DAOs holding treasury funds or protocols managing liquidity, this volatility is a headache. @strata_money turns that problem into a feature. The @convergeonchain chain angle is what caught my attention. Positioned myself with a few thousand dollars for exposure to where institutional DeFi might be heading. When @Securitize & @ethena_labs align on infra, it's worth paying attention. This creates a secondary market for risk. Junior tranche holders are essentially selling volatility insurance to senior holders. That's a primitive DeFi has been missing. NFA, but structured products bringing predictability to DeFi yields feels like natural evolution. TradFi solved this decades ago. Crypto is just catching up with better rails.  XXXXX engagements  **Related Topics** [$1606m](/topic/$1606m) [$16m](/topic/$16m) [susde](/topic/susde) [ethenalabs](/topic/ethenalabs) [protocol](/topic/protocol) [Post Link](https://x.com/YashasEdu/status/1948040437887127692)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

YashasEdu @YashasEdu on x 6832 followers

Created: 2025-07-23 15:20:07 UTC

YashasEdu @YashasEdu on x 6832 followers

Created: 2025-07-23 15:20:07 UTC

So @strata_money caught my attention. Here’s why🧵

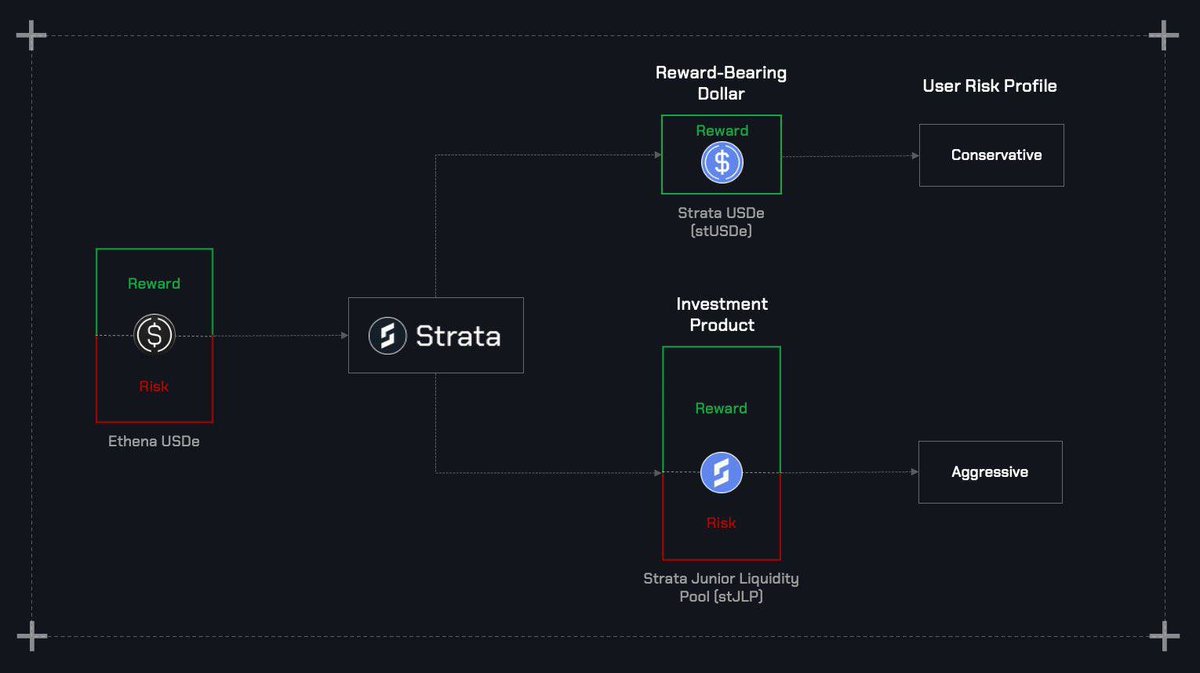

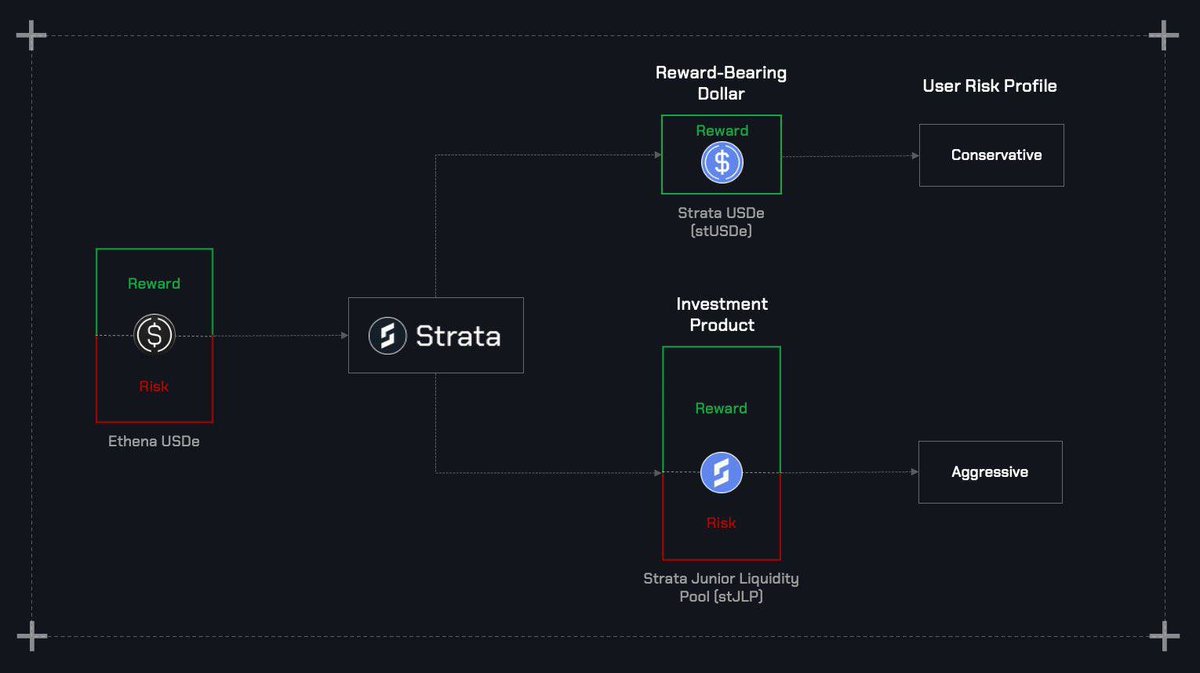

It is building something different. A yield tranching protocol that splits @ethena_labs’ sUSDe into two risk profiles. Think of it as choosing between a steady paycheck or commission based income, but for DeFi yields.

The protocol just crossed $16M TVL in under X days, showing there's real demand for structured yield products.

$16.06M total deposited XXX unique depositors Average deposit: $37K $273K withdrawn (58:1 deposit to withdraw ratio)

Two wallets dropped $2M each, X wallets w 1M+, while hundreds of others positioned between $10K-50K. Here’s how @strata_money works👇

You deposit USDe/eUSDe and choose your risk appetite Conservative users pick stUSDe for protected yields Risk takers choose stJLP for leveraged exposure Both sides benefit from the same LP

Check out more Current rewards for pre depositors consists of 30x Strata points + 30x Ethena points + 1x Ethereal points. Potential multiplier with upcoming integrations w @pendle_fi

@ethena_labs’ sUSDe yields have been volatile, swinging from X% to 10%+. For DAOs holding treasury funds or protocols managing liquidity, this volatility is a headache. @strata_money turns that problem into a feature.

The @convergeonchain chain angle is what caught my attention. Positioned myself with a few thousand dollars for exposure to where institutional DeFi might be heading. When @Securitize & @ethena_labs align on infra, it's worth paying attention.

This creates a secondary market for risk. Junior tranche holders are essentially selling volatility insurance to senior holders. That's a primitive DeFi has been missing.

NFA, but structured products bringing predictability to DeFi yields feels like natural evolution. TradFi solved this decades ago. Crypto is just catching up with better rails.

XXXXX engagements

Related Topics $1606m $16m susde ethenalabs protocol