[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  𝐀𝐆 [@Altcoin_Gold](/creator/twitter/Altcoin_Gold) on x 23.7K followers Created: 2025-07-23 14:38:16 UTC Looks like @TheoriqAI is indeed shaping up to be the favoured opener of the Kaito launchpad. Their round has just been announced: • XX% unlock at TGE (early recoup potential) • Long-term vesting after to maintain alignment • Valued at XX% ($75M) of their previous raise valuation ($150M) I think the vesting terms here, and on @EspressoSys, caught some people off guard. But this is pretty standard for deals like this. It breaks the illusion that these rounds are just free money, ready to dump on day one. It’s a different ball game compared to something like the Virtuals launchpad many Kaito users are familiar with. It’s important to understand that investing in early rounds like this often means: • TGE sometimes never happens • Timelines stretch into years • Results can often underwhelm Not saying that’s the case here, just sharing broader context. You usually only hear about the massive winners that skew perception. And often, it’s those outliers that drive the majority of returns. That’s why most investors tend to spread their bets. That said, the vetting and leverage Kaito has with their platform will likely help minimize these risks. What do you think, would you invest in this round?  XXXXX engagements  **Related Topics** [$150m](/topic/$150m) [$75m](/topic/$75m) [longterm](/topic/longterm) [launchpad](/topic/launchpad) [Post Link](https://x.com/Altcoin_Gold/status/1948029903510569333)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

𝐀𝐆 @Altcoin_Gold on x 23.7K followers

Created: 2025-07-23 14:38:16 UTC

𝐀𝐆 @Altcoin_Gold on x 23.7K followers

Created: 2025-07-23 14:38:16 UTC

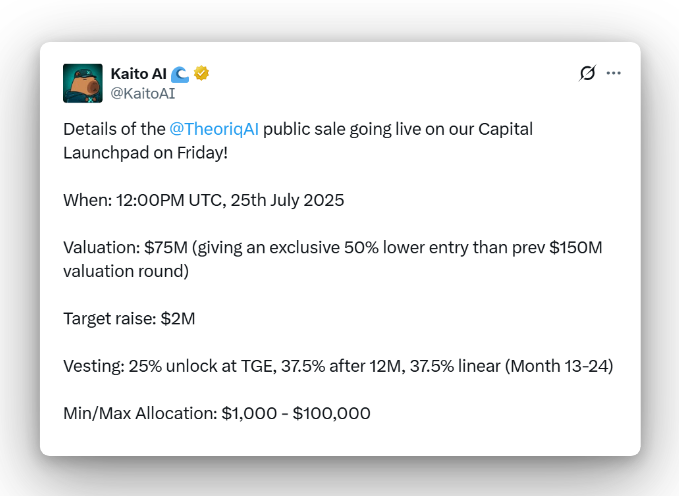

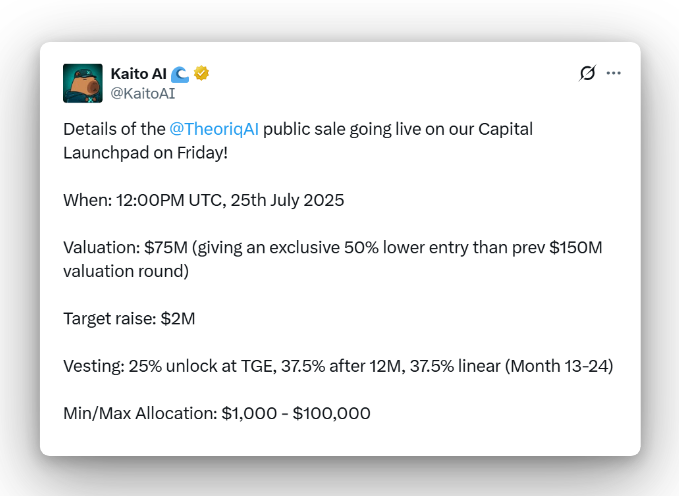

Looks like @TheoriqAI is indeed shaping up to be the favoured opener of the Kaito launchpad.

Their round has just been announced:

• XX% unlock at TGE (early recoup potential) • Long-term vesting after to maintain alignment • Valued at XX% ($75M) of their previous raise valuation ($150M)

I think the vesting terms here, and on @EspressoSys, caught some people off guard.

But this is pretty standard for deals like this.

It breaks the illusion that these rounds are just free money, ready to dump on day one.

It’s a different ball game compared to something like the Virtuals launchpad many Kaito users are familiar with.

It’s important to understand that investing in early rounds like this often means:

• TGE sometimes never happens • Timelines stretch into years • Results can often underwhelm

Not saying that’s the case here, just sharing broader context.

You usually only hear about the massive winners that skew perception.

And often, it’s those outliers that drive the majority of returns.

That’s why most investors tend to spread their bets.

That said, the vetting and leverage Kaito has with their platform will likely help minimize these risks.

What do you think, would you invest in this round?

XXXXX engagements