[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  💎 WEB3MAN.exe [@sergey_tutoov](/creator/twitter/sergey_tutoov) on x XXX followers Created: 2025-07-23 14:17:30 UTC 💼 Balance • Spend • Ops • Stables • Depts Just dropped: @alice_und_bob’s 2025-Q2 Polkadot Treasury deep-dive – here’s the degen TL;DR - no white-paper kung fu required 😉 ✧ Balance Sheet – Assets Polkadot DAO sits on XXX M USD (31 M DOT) total: → XX M USD cash & quick-swap stables → XX M USD earmarked for bounties & collectives → XXX M USD parked as protocol-owned liquidity in DeFi rails Polkadot Forum The DAO trustlessly spreads that stack across X chains. → XX % on DeFi parachains (Hydration, Bifrost, Centrifuge, Pendulum…) → XX % of the portfolio live in aDOT (yield-bearing $DOT in @hydration_net's money market) → XXX % riding in $USDC / $USDT stables for spend-velocity control Polkadot Forum ✧ Balance Sheet – Liabilities Social contracts with service providers total XXX M $USD in payables. That leaves a XXX M USD surplus - 💎 life example: stash more than you owe, rinse/repeat ✧ Spending – Q2 Outflows 28M USD gone (6.7 M DOT) vs 4M DOT inflows - net ~2.7 M DOT burn after inflation Top line uses: Economy incentives: X M USD to fuel GIGAHydration & ecosystem hacks Development: X M USD on core runtime, SDKs, bridges & wallets Outreach: XXX M USD for events, content & BD quests Polkadot Forum ✧ DAO Market Ops is turbo-charging liquidity: XXX M USD across four DeFi protocols, smoothing slippage and earning yield ✧ Stablecoin Flows Consistent stable-stack builds: XXX M USD/month in stable acquisitions vs spend, capping volatility swings ✧ DAO Departments Collectives & bounties (Technical Fellowship, ambassador squads) consumed XX % (~7 M USD) of Q2 spend—proof that domain experts + dedicated budgets = streamlined proposals Polkadot’s treasury is leveling up: shared-security rails let the DAO execute trustlessly across chains, while smart allocations to DeFi, dev tooling, and community keep the ecosystem moaning for more. What nugget jumps out at you? 😉 full in comms👇  XXX engagements  **Related Topics** [dot](/topic/dot) [united states dollar](/topic/united-states-dollar) [coins dao](/topic/coins-dao) [balance sheet](/topic/balance-sheet) [quickswap](/topic/quickswap) [quickswap dex](/topic/quickswap-dex) [coins defi](/topic/coins-defi) [Post Link](https://x.com/sergey_tutoov/status/1948024676858388757)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

💎 WEB3MAN.exe @sergey_tutoov on x XXX followers

Created: 2025-07-23 14:17:30 UTC

💎 WEB3MAN.exe @sergey_tutoov on x XXX followers

Created: 2025-07-23 14:17:30 UTC

💼 Balance • Spend • Ops • Stables • Depts

Just dropped: @alice_und_bob’s 2025-Q2 Polkadot Treasury deep-dive – here’s the degen TL;DR

- no white-paper kung fu required 😉

✧ Balance Sheet – Assets Polkadot DAO sits on XXX M USD (31 M DOT) total: → XX M USD cash & quick-swap stables → XX M USD earmarked for bounties & collectives → XXX M USD parked as protocol-owned liquidity in DeFi rails Polkadot Forum

The DAO trustlessly spreads that stack across X chains. → XX % on DeFi parachains (Hydration, Bifrost, Centrifuge, Pendulum…) → XX % of the portfolio live in aDOT (yield-bearing $DOT in @hydration_net's money market) → XXX % riding in $USDC / $USDT stables for spend-velocity control Polkadot Forum

✧ Balance Sheet – Liabilities Social contracts with service providers total XXX M $USD in payables. That leaves a XXX M USD surplus - 💎 life example: stash more than you owe, rinse/repeat

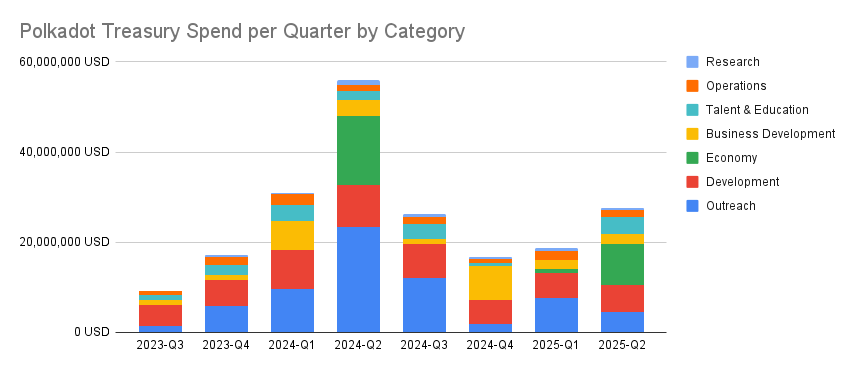

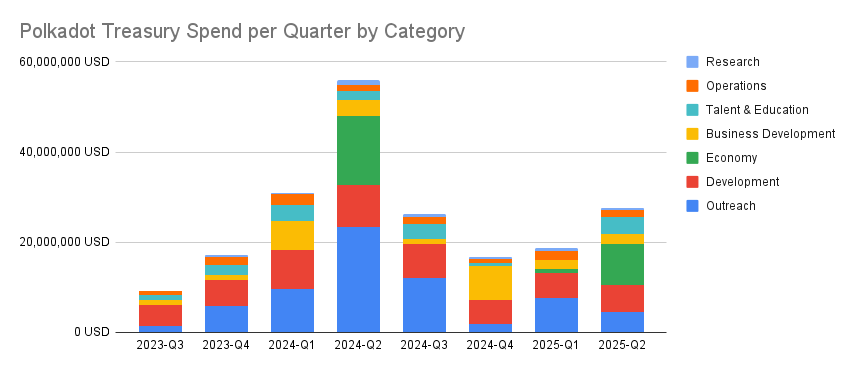

✧ Spending – Q2 Outflows 28M USD gone (6.7 M DOT) vs 4M DOT inflows - net ~2.7 M DOT burn after inflation

Top line uses: Economy incentives: X M USD to fuel GIGAHydration & ecosystem hacks Development: X M USD on core runtime, SDKs, bridges & wallets Outreach: XXX M USD for events, content & BD quests Polkadot Forum

✧ DAO Market Ops is turbo-charging liquidity: XXX M USD across four DeFi protocols, smoothing slippage and earning yield

✧ Stablecoin Flows Consistent stable-stack builds: XXX M USD/month in stable acquisitions vs spend, capping volatility swings

✧ DAO Departments Collectives & bounties (Technical Fellowship, ambassador squads) consumed XX % (~7 M USD) of Q2 spend—proof that domain experts + dedicated budgets = streamlined proposals

Polkadot’s treasury is leveling up: shared-security rails let the DAO execute trustlessly across chains, while smart allocations to DeFi, dev tooling, and community keep the ecosystem moaning for more. What nugget jumps out at you? 😉

full in comms👇

XXX engagements

Related Topics dot united states dollar coins dao balance sheet quickswap quickswap dex coins defi