[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  WealthyReadings [@WealthyReadings](/creator/twitter/WealthyReadings) on x 6643 followers Created: 2025-07-23 11:17:47 UTC $ISRG remains expensive, trading XX% above an optimum cost basis for a long-term position - two years minimum. Optimum Cost Basis: $XXX. Alpha vs $SPY at today's price 🔴 My rating: Uptrend - Buy retests or range's lows if average remains below APT. Assumptions. 2Y Revenue CAGR: XX% 5Y Revenue CAGR: XX% Net margin: XX% Average P/E: x60 Average P/S: x15 Value Returned to Shareholders: X% dillution. Margin of Error: X% $ISRG is a leader when it comes to minimal invasive or even more invasive robotic surgery with its Da Vinci system. The company is growing its grasp on the entire market and is now installing its hardware all around the world, which justifies the premium at which the stock actually trades. Based on those assumptions & current price. FAIR PRICE FY26: $XXX UPSIDE: Negative CAGR: Negative FAIR PRICE FY29: $XXX UPSIDE: XXXX% CAGR: XXX% Alpha vs $SPY 🔴 Price action is the only hedge individual investors have on Wall Street as it tells us what the market likes & dislikes. There is no point buying a stock too early as prices can go much lower than our fair value assumptions, or the market can know something we don't. In $ISRG's case, we are still in a bull trend, which makes the breakout retests & ranges' lows great entry points as long as our average price remains under the optimum accumulation price. --------------- I only buy stocks discounted enough to offer returns on investment above the $SPY average - around 11%, after confirmation from price action that a bottom has been set under my accumulation target. Buying well is the most important step to beat the market over the long term. --------------- This is only an opinion based on personal expectations, not meant to be investment advice!  XXXXX engagements  **Related Topics** [spy](/topic/spy) [apt](/topic/apt) [longterm](/topic/longterm) [$isrg](/topic/$isrg) [stocks healthcare](/topic/stocks-healthcare) [$spy](/topic/$spy) [Post Link](https://x.com/WealthyReadings/status/1947979450106183868)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

WealthyReadings @WealthyReadings on x 6643 followers

Created: 2025-07-23 11:17:47 UTC

WealthyReadings @WealthyReadings on x 6643 followers

Created: 2025-07-23 11:17:47 UTC

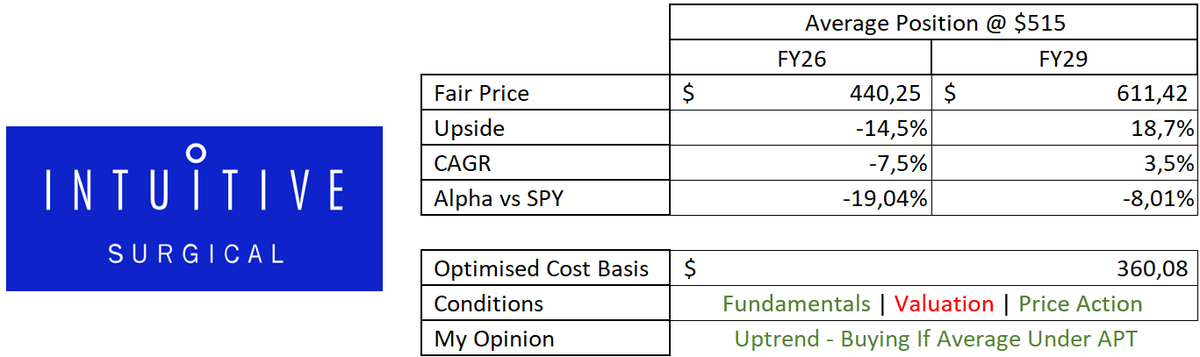

$ISRG remains expensive, trading XX% above an optimum cost basis for a long-term position - two years minimum.

Optimum Cost Basis: $XXX. Alpha vs $SPY at today's price 🔴 My rating: Uptrend - Buy retests or range's lows if average remains below APT.

Assumptions. 2Y Revenue CAGR: XX% 5Y Revenue CAGR: XX% Net margin: XX% Average P/E: x60 Average P/S: x15 Value Returned to Shareholders: X% dillution. Margin of Error: X%

$ISRG is a leader when it comes to minimal invasive or even more invasive robotic surgery with its Da Vinci system. The company is growing its grasp on the entire market and is now installing its hardware all around the world, which justifies the premium at which the stock actually trades.

Based on those assumptions & current price. FAIR PRICE FY26: $XXX UPSIDE: Negative CAGR: Negative

FAIR PRICE FY29: $XXX UPSIDE: XXXX% CAGR: XXX% Alpha vs $SPY 🔴

Price action is the only hedge individual investors have on Wall Street as it tells us what the market likes & dislikes. There is no point buying a stock too early as prices can go much lower than our fair value assumptions, or the market can know something we don't.

In $ISRG's case, we are still in a bull trend, which makes the breakout retests & ranges' lows great entry points as long as our average price remains under the optimum accumulation price.

I only buy stocks discounted enough to offer returns on investment above the $SPY average - around 11%, after confirmation from price action that a bottom has been set under my accumulation target.

Buying well is the most important step to beat the market over the long term.

This is only an opinion based on personal expectations, not meant to be investment advice!

XXXXX engagements

Related Topics spy apt longterm $isrg stocks healthcare $spy