[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ape 🦍 [@immrape](/creator/twitter/immrape) on x 429K followers Created: 2025-07-23 06:47:43 UTC ETH: The First Post-Bitcoin Asset Wall Street Is Betting On Long-Term As the AI frenzy cools down, institutional capital is quietly rotating into Ethereum. No longer seen as a risky altcoin, ETH is maturing into a long-term investment — a new “king” in the portfolios of TradFi giants. After a year chasing AI stocks like Nvidia, Palantir, and Super Micro Computer — many of which are now priced to perfection — institutional investors are starting to lose interest. The AI narrative feels exhausted. “TradFi funds are running out of narratives. They know AI stocks are in bubble territory,” said MONK, researcher at Messari. “Now they’re turning to Ethereum — familiar, reasonably priced, and easily accessible through institutional-grade rails.” Why Ethereum — But Not Another Altcoin? Out of thousands of tokens, institutions are picking Ethereum. Not because it’s new, but because it’s big, secure, and — most importantly — mature enough to support long-term bets. After Bitcoin, Ethereum is arguably the most reasonable landing zone for capital seeking growth with controlled risk. Liquidity & Size: ETH is the second-largest crypto asset globally, with deep liquidity and a massive market cap. Institutions can deploy hundreds of millions without fear of slippage — something few altcoins can handle. Yield: Since the switch to Proof-of-Stake, ETH offers a consistent 4–6% APY through staking — a compelling proposition for asset managers. In their eyes, Ethereum is becoming a digital bond: yield-bearing, with upside potential. Even BlackRock proposed allowing staking for its Ethereum ETF. Utility: ETH isn’t just money — it’s infrastructure. Ethereum powers most of DeFi, NFTs, stablecoins, and emerging financial primitives. If Bitcoin is digital gold, Ethereum is the base layer of on-chain finance. Ray Youssef, CEO of NoOnes, once described Ethereum as a “hybrid between tech stock and digital currency.” ETH is an asset, a yield machine, and a core service layer — all at once. Regulatory Clarity: ETH and BTC are among the few digital assets the U.S. regulators have classified as commodities. That makes ETH one of the safest crypto assets from a legal standpoint — unlike the bulk of altcoins still in regulatory limbo. TradFi Rails: Futures on CME, futures ETFs, spot ETFs in Europe and now the U.S. — Ethereum has what institutions need. Right now, no other altcoin checks all these boxes. Wall Street Is Quietly Accumulating Ethereum ETH is no longer just a Web3 dream. In H1 2025, the token saw aggressive accumulation via regulated, fiat-onboarding investment products. July 16, 2025, may go down as a pivotal moment. In a single trading day, U.S.-listed Ethereum ETFs saw $726M in net inflows, smashing all previous records. Between July 14–18, total spot ETF inflows reached nearly $2.2B, the highest since launch. No hype, no headlines — just cold, hard filings submitted to the SEC. And leading the charge? BlackRock, as always. As of July 16, 2025, BlackRock’s iShares Ethereum Trust (ETHA) holds over X million ETH (~2% of global supply), valued at $7.73B. Ethereum is no longer just for crypto natives. Every ETF "Buy" now moves tens of thousands of ETH straight into cold wallets. ETH's price has surged accordingly — up XXX% from its March 2025 lows, recently touching $3,800, its highest in months. More than price, though, ETH is reclaiming its role as a capital flow leader. The ETH/BTC ratio is rising, and Bitcoin dominance is dropping, hinting at an incoming altcoin season. Even corporations are now stacking ETH — reminiscent of the 2020–2021 Bitcoin accumulation era. Peter Thiel’s Founders Fund just invested hundreds of millions into BitMine, a company holding over XXXXXXX ETH as treasury reserves and staking collateral. According to Cointelegraph, public companies accumulated over XXXXXXX ETH (worth ~$1.8B) between mid-June and mid-July 2025. Meanwhile, CTs Is Still FUDing ETH? One of the strangest market dynamics in 2025 is the disconnect between crypto natives and institutions — especially in how they view Ethereum. ETH is still being mocked by some as a “dead asset,” underperforming meme coins, Solana, and newer chains. Yet institutional money keeps flowing into ETH — via ETFs, corporate treasuries, and managed funds. The difference lies in how each group defines value. Crypto natives tend to look at metrics like daily users, gas fees, TVL — all of which declined post-2022. Many declared ETH’s relevance over. Institutions, on the other hand, see ETH as an investable commodity. They don’t care about daily DEX volumes — they care about supply caps, inflation rates, liquidity depth, and whether Ethereum is becoming the base layer for global finance. To institutions, ETH isn’t just a gas token — it's a financial primitive. Meanwhile, Solana continues to dominate headlines in retail circles: user numbers are up, meme coins are booming, and builders are shipping. But SOL's price remains muted — possibly because it hasn’t yet seen strong institutional demand or a spot ETF approval. ETH: As the Asset Detaches from the Infrastructure, Where Does Price Go? A new narrative is emerging: ETH is decoupling from the Ethereum network — not technically, but in how the market perceives and prices it. In previous cycles, ETH’s value was directly tied to on-chain activity — gas usage, DeFi metrics, NFT trends. That’s changed. Today, institutions are buying ETH not because of dApp usage or TVL spikes, but because they see it as a digital commodity — like gold or Treasuries — with staking yield and legal clarity. This detachment gives ETH a new role: no longer just a utility token, but a financial asset recognized by the traditional financial system. Tom Lee, Head of Research at Fundstrat, forecasts $XXXXX short-term, and $10,000–$15,000 mid-term for ETH. Fundstrat even compares Ethereum to private giants like Circle, arguing that ETH’s role as infrastructure deserves a far higher valuation. More importantly, Ethereum is riding a new mega-trend: Real World Asset tokenization (RWA). As BlackRock’s Robbie Mitchnick puts it, Ethereum is becoming the “default infrastructure” for moving traditional assets on-chain. If this narrative plays out, ETH could blow past its previous ATH. Even if the market corrects, ETH remains a conviction play — the inflows are real, and the narrative is just getting started. But given the recent rally, timing entries is key. ETH may be ready to run — but smart money doesn’t chase, it waits for the right price. OG : @Moomsxxx @stacy_muur @Defi_Warhol @Nick_Researcher @Jonasoeth @CryptoKoryo @CryptoShiro @DefiIgnas @PinkBrains_io @0xBreadguy @100y_eth @SiwonHuh @13300RPM @FourPillarsFP @S4mmyEth @Satyams2468 @jinglingcookies @Moomsxxx  XXXXXX engagements  **Related Topics** [palantir](/topic/palantir) [stocks](/topic/stocks) [investment](/topic/investment) [altcoin](/topic/altcoin) [coins ai](/topic/coins-ai) [longterm](/topic/longterm) [wall street](/topic/wall-street) [ethereum](/topic/ethereum) [Post Link](https://x.com/immrape/status/1947911487613505799)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ape 🦍 @immrape on x 429K followers

Created: 2025-07-23 06:47:43 UTC

Ape 🦍 @immrape on x 429K followers

Created: 2025-07-23 06:47:43 UTC

ETH: The First Post-Bitcoin Asset Wall Street Is Betting On Long-Term

As the AI frenzy cools down, institutional capital is quietly rotating into Ethereum. No longer seen as a risky altcoin, ETH is maturing into a long-term investment — a new “king” in the portfolios of TradFi giants.

After a year chasing AI stocks like Nvidia, Palantir, and Super Micro Computer — many of which are now priced to perfection — institutional investors are starting to lose interest. The AI narrative feels exhausted.

“TradFi funds are running out of narratives. They know AI stocks are in bubble territory,” said MONK, researcher at Messari. “Now they’re turning to Ethereum — familiar, reasonably priced, and easily accessible through institutional-grade rails.”

Why Ethereum — But Not Another Altcoin?

Out of thousands of tokens, institutions are picking Ethereum. Not because it’s new, but because it’s big, secure, and — most importantly — mature enough to support long-term bets. After Bitcoin, Ethereum is arguably the most reasonable landing zone for capital seeking growth with controlled risk.

Liquidity & Size: ETH is the second-largest crypto asset globally, with deep liquidity and a massive market cap. Institutions can deploy hundreds of millions without fear of slippage — something few altcoins can handle.

Yield: Since the switch to Proof-of-Stake, ETH offers a consistent 4–6% APY through staking — a compelling proposition for asset managers. In their eyes, Ethereum is becoming a digital bond: yield-bearing, with upside potential. Even BlackRock proposed allowing staking for its Ethereum ETF.

Utility: ETH isn’t just money — it’s infrastructure. Ethereum powers most of DeFi, NFTs, stablecoins, and emerging financial primitives. If Bitcoin is digital gold, Ethereum is the base layer of on-chain finance.

Ray Youssef, CEO of NoOnes, once described Ethereum as a “hybrid between tech stock and digital currency.” ETH is an asset, a yield machine, and a core service layer — all at once.

Regulatory Clarity: ETH and BTC are among the few digital assets the U.S. regulators have classified as commodities. That makes ETH one of the safest crypto assets from a legal standpoint — unlike the bulk of altcoins still in regulatory limbo.

TradFi Rails: Futures on CME, futures ETFs, spot ETFs in Europe and now the U.S. — Ethereum has what institutions need. Right now, no other altcoin checks all these boxes.

Wall Street Is Quietly Accumulating Ethereum

ETH is no longer just a Web3 dream. In H1 2025, the token saw aggressive accumulation via regulated, fiat-onboarding investment products.

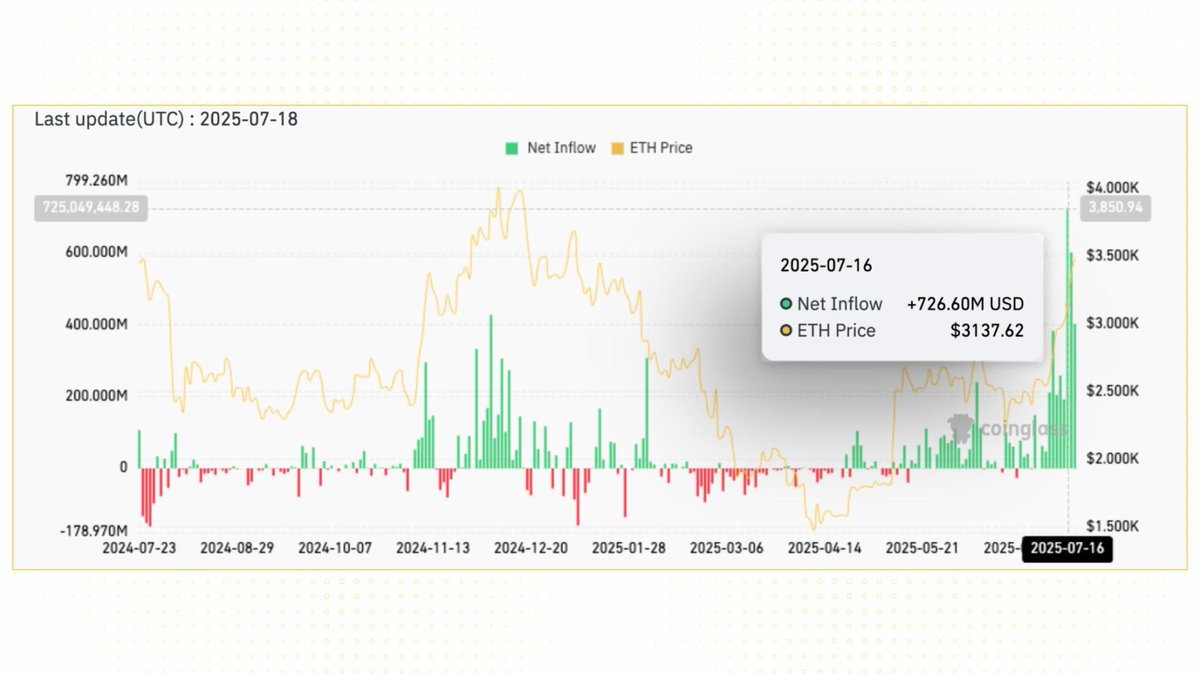

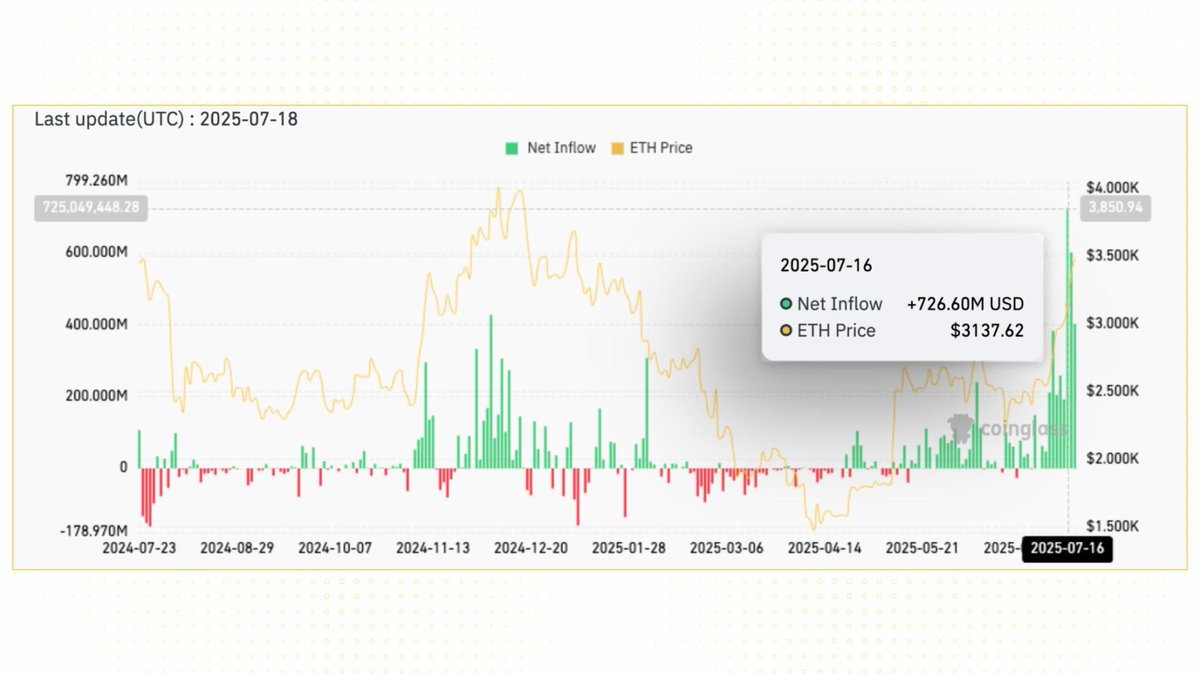

July 16, 2025, may go down as a pivotal moment. In a single trading day, U.S.-listed Ethereum ETFs saw $726M in net inflows, smashing all previous records. Between July 14–18, total spot ETF inflows reached nearly $2.2B, the highest since launch.

No hype, no headlines — just cold, hard filings submitted to the SEC. And leading the charge? BlackRock, as always.

As of July 16, 2025, BlackRock’s iShares Ethereum Trust (ETHA) holds over X million ETH (~2% of global supply), valued at $7.73B. Ethereum is no longer just for crypto natives. Every ETF "Buy" now moves tens of thousands of ETH straight into cold wallets.

ETH's price has surged accordingly — up XXX% from its March 2025 lows, recently touching $3,800, its highest in months. More than price, though, ETH is reclaiming its role as a capital flow leader. The ETH/BTC ratio is rising, and Bitcoin dominance is dropping, hinting at an incoming altcoin season.

Even corporations are now stacking ETH — reminiscent of the 2020–2021 Bitcoin accumulation era. Peter Thiel’s Founders Fund just invested hundreds of millions into BitMine, a company holding over XXXXXXX ETH as treasury reserves and staking collateral.

According to Cointelegraph, public companies accumulated over XXXXXXX ETH (worth ~$1.8B) between mid-June and mid-July 2025.

Meanwhile, CTs Is Still FUDing ETH?

One of the strangest market dynamics in 2025 is the disconnect between crypto natives and institutions — especially in how they view Ethereum.

ETH is still being mocked by some as a “dead asset,” underperforming meme coins, Solana, and newer chains. Yet institutional money keeps flowing into ETH — via ETFs, corporate treasuries, and managed funds.

The difference lies in how each group defines value.

Crypto natives tend to look at metrics like daily users, gas fees, TVL — all of which declined post-2022. Many declared ETH’s relevance over.

Institutions, on the other hand, see ETH as an investable commodity. They don’t care about daily DEX volumes — they care about supply caps, inflation rates, liquidity depth, and whether Ethereum is becoming the base layer for global finance.

To institutions, ETH isn’t just a gas token — it's a financial primitive.

Meanwhile, Solana continues to dominate headlines in retail circles: user numbers are up, meme coins are booming, and builders are shipping. But SOL's price remains muted — possibly because it hasn’t yet seen strong institutional demand or a spot ETF approval.

ETH: As the Asset Detaches from the Infrastructure, Where Does Price Go? A new narrative is emerging: ETH is decoupling from the Ethereum network — not technically, but in how the market perceives and prices it.

In previous cycles, ETH’s value was directly tied to on-chain activity — gas usage, DeFi metrics, NFT trends. That’s changed.

Today, institutions are buying ETH not because of dApp usage or TVL spikes, but because they see it as a digital commodity — like gold or Treasuries — with staking yield and legal clarity.

This detachment gives ETH a new role: no longer just a utility token, but a financial asset recognized by the traditional financial system.

Tom Lee, Head of Research at Fundstrat, forecasts $XXXXX short-term, and $10,000–$15,000 mid-term for ETH. Fundstrat even compares Ethereum to private giants like Circle, arguing that ETH’s role as infrastructure deserves a far higher valuation.

More importantly, Ethereum is riding a new mega-trend: Real World Asset tokenization (RWA). As BlackRock’s Robbie Mitchnick puts it, Ethereum is becoming the “default infrastructure” for moving traditional assets on-chain.

If this narrative plays out, ETH could blow past its previous ATH. Even if the market corrects, ETH remains a conviction play — the inflows are real, and the narrative is just getting started.

But given the recent rally, timing entries is key. ETH may be ready to run — but smart money doesn’t chase, it waits for the right price.

OG : @Moomsxxx @stacy_muur @Defi_Warhol @Nick_Researcher @Jonasoeth @CryptoKoryo @CryptoShiro @DefiIgnas @PinkBrains_io @0xBreadguy @100y_eth @SiwonHuh @13300RPM @FourPillarsFP @S4mmyEth @Satyams2468 @jinglingcookies @Moomsxxx

XXXXXX engagements

Related Topics palantir stocks investment altcoin coins ai longterm wall street ethereum