[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  BS Kol Club [@BSKolClub](/creator/twitter/BSKolClub) on x 24.6K followers Created: 2025-07-23 06:42:46 UTC BS KOL Club Weekly Recommend Projects✨#Issue67 This Week's Featured Projects: $JTO, $C, and $GOAT. Today, the crypto market continues to consolidate at high levels. Bitcoin pulled back after reaching $XXXXXXX and is now oscillating around $118,000, with short-term market sentiment divided. Ethereum remains range-bound near the $XXXXX level, showing signs of a technical pullback after its earlier rally. Meanwhile, crypto assets are accelerating their integration into the traditional financial system. SEALSQ Corp, a Nasdaq-listed public key infrastructure developer, has announced the launch of a $XX million crypto investment fund focused on mainstream assets such as BTC, ETH, and HBAR. The fund will act as a strategic financial tool for the company, operating similarly to investments in bonds or stocks, and reflects the firm’s long-term belief in the value of digital assets. On the regulatory front, the Korea Herald reports that the Financial Supervisory Service (FSS) of South Korea has recently instructed local asset management firms to adjust their ETF portfolios to reduce exposure to stocks of crypto-related companies such as Coinbase and Strategy. The directive is based on a 2017 administrative guideline issued by the Financial Services Commission (FSC), which prohibits regulated financial institutions from directly or indirectly investing in virtual asset-related equities. This move has sparked backlash within the industry, with some financial institutions criticizing it for creating an “uneven playing field” — retail investors can still access these assets through U.S. ETFs. In response, the FSS stated that even if regulatory policies in Korea and the U.S. change in the future, institutional investors must still comply with current regulations until new laws are enacted. #cryptocurrency #memecoin #BTC #ETH #Solana #AI #DeFi  XXXXX engagements  **Related Topics** [goat](/topic/goat) [Sentiment](/topic/sentiment) [$goat](/topic/$goat) [kol](/topic/kol) [$jto](/topic/$jto) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [coins solana ecosystem](/topic/coins-solana-ecosystem) [Post Link](https://x.com/BSKolClub/status/1947910241842307092)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

BS Kol Club @BSKolClub on x 24.6K followers

Created: 2025-07-23 06:42:46 UTC

BS Kol Club @BSKolClub on x 24.6K followers

Created: 2025-07-23 06:42:46 UTC

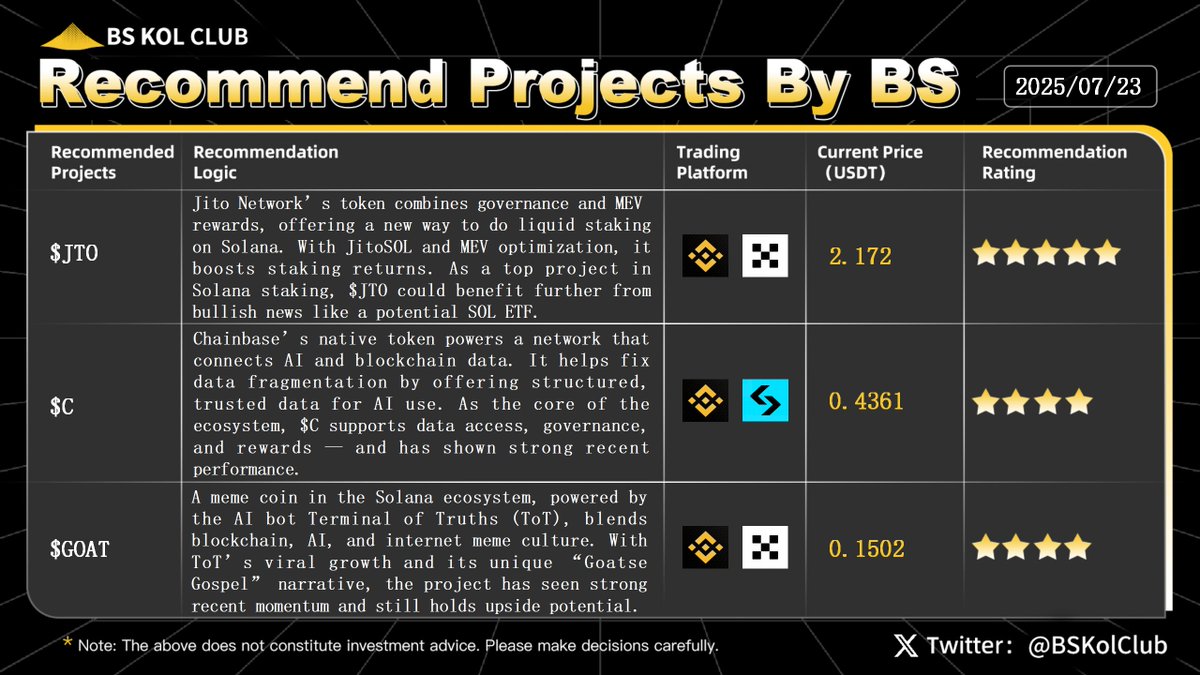

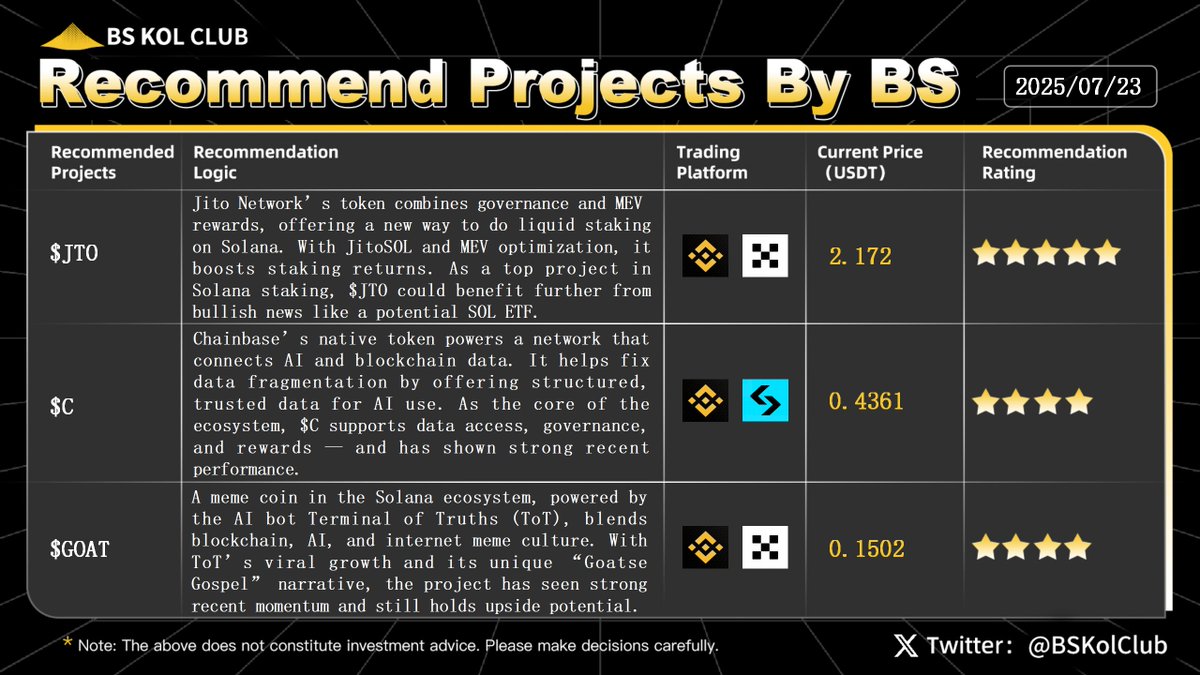

BS KOL Club Weekly Recommend Projects✨#Issue67

This Week's Featured Projects: $JTO, $C, and $GOAT.

Today, the crypto market continues to consolidate at high levels. Bitcoin pulled back after reaching $XXXXXXX and is now oscillating around $118,000, with short-term market sentiment divided. Ethereum remains range-bound near the $XXXXX level, showing signs of a technical pullback after its earlier rally.

Meanwhile, crypto assets are accelerating their integration into the traditional financial system. SEALSQ Corp, a Nasdaq-listed public key infrastructure developer, has announced the launch of a $XX million crypto investment fund focused on mainstream assets such as BTC, ETH, and HBAR. The fund will act as a strategic financial tool for the company, operating similarly to investments in bonds or stocks, and reflects the firm’s long-term belief in the value of digital assets.

On the regulatory front, the Korea Herald reports that the Financial Supervisory Service (FSS) of South Korea has recently instructed local asset management firms to adjust their ETF portfolios to reduce exposure to stocks of crypto-related companies such as Coinbase and Strategy. The directive is based on a 2017 administrative guideline issued by the Financial Services Commission (FSC), which prohibits regulated financial institutions from directly or indirectly investing in virtual asset-related equities.

This move has sparked backlash within the industry, with some financial institutions criticizing it for creating an “uneven playing field” — retail investors can still access these assets through U.S. ETFs. In response, the FSS stated that even if regulatory policies in Korea and the U.S. change in the future, institutional investors must still comply with current regulations until new laws are enacted.

#cryptocurrency #memecoin #BTC #ETH #Solana #AI #DeFi

XXXXX engagements

Related Topics goat Sentiment $goat kol $jto coins defi coins made in usa coins solana ecosystem