[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  LNGtradinghub [@LNGtradinghub](/creator/twitter/LNGtradinghub) on x XX followers Created: 2025-07-23 05:34:20 UTC Baker Hughes, the oil and natural gas field services company and maker of LNG liquefaction equipment, posted a XX percent rise in second-quarter net income to $XXX million, up from $579M in the same three months a year ago. That’s as orders and revenues slipped in the three months to the end of June by X percent and X percent respectively to $XXXX billion and $6.91Bln. Baker Hughes said Industrial and Energy Technology (IET) orders for LNG plants and other facilities continued to add to the backlog. “IET orders totaled $XXX billion in the quarter, resulting in another record backlog for the segment,” said Lorenzo Simonelli, Baker Hughes Chairman and Chief Executive. “Importantly, order momentum remained strong, supported by more than $XXX million of data center related orders, despite the absence of large LNG awards,” stated Simonelli. “Following a strong first half and a positive outlook for second half awards, we are confident of achieving the full-year order guidance range for IET,” the CEO added. Baker Hughes remained confident in its ability to deliver solid performance in 2025, with continued growth in IET helping to offset softness in more market-sensitive areas of Oilfield Services Equipment. “Accordingly, we are raising our full-year revenue and EBITDA guidance for IET and reestablishing full-year guidance for OFSE,” Simonelli declared. Baker Hughes received key awards to support the development of critical data center projects, with year-to-date data center awards of more than $XXX million. In the second quarter, Baker Hughes announced three strategic transactions. First, the company signed an agreement to form a joint venture with a subsidiary of Cactus, Inc., contributing the Oilfield Services & Equipment’s Surface Pressure Control product line in exchange for approximately $XXX million while maintaining a minority ownership stake. Second, the Baker Hughes announced an agreement to sell the Precision Sensors & Instrumentation product line within Industrial & Energy Technology to Crane Company for around $XXXX billion. “These proceeds will enhance the Company’s flexibility to reinvest in higher-growth, higher-return areas that support further margin expansion and improved returns,” the company added. Finally, Baker Hughes agreed to acquire Continental Disc Corporation, a leading provider of pressure management solutions, for about $XXX million. The CDC acquisition strengthens the IET Industrial Products portfolio with a highly complementary, margin-accretive business.  XX engagements  **Related Topics** [$691bln](/topic/$691bln) [$579m](/topic/$579m) [Post Link](https://x.com/LNGtradinghub/status/1947893017559404880)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

LNGtradinghub @LNGtradinghub on x XX followers

Created: 2025-07-23 05:34:20 UTC

LNGtradinghub @LNGtradinghub on x XX followers

Created: 2025-07-23 05:34:20 UTC

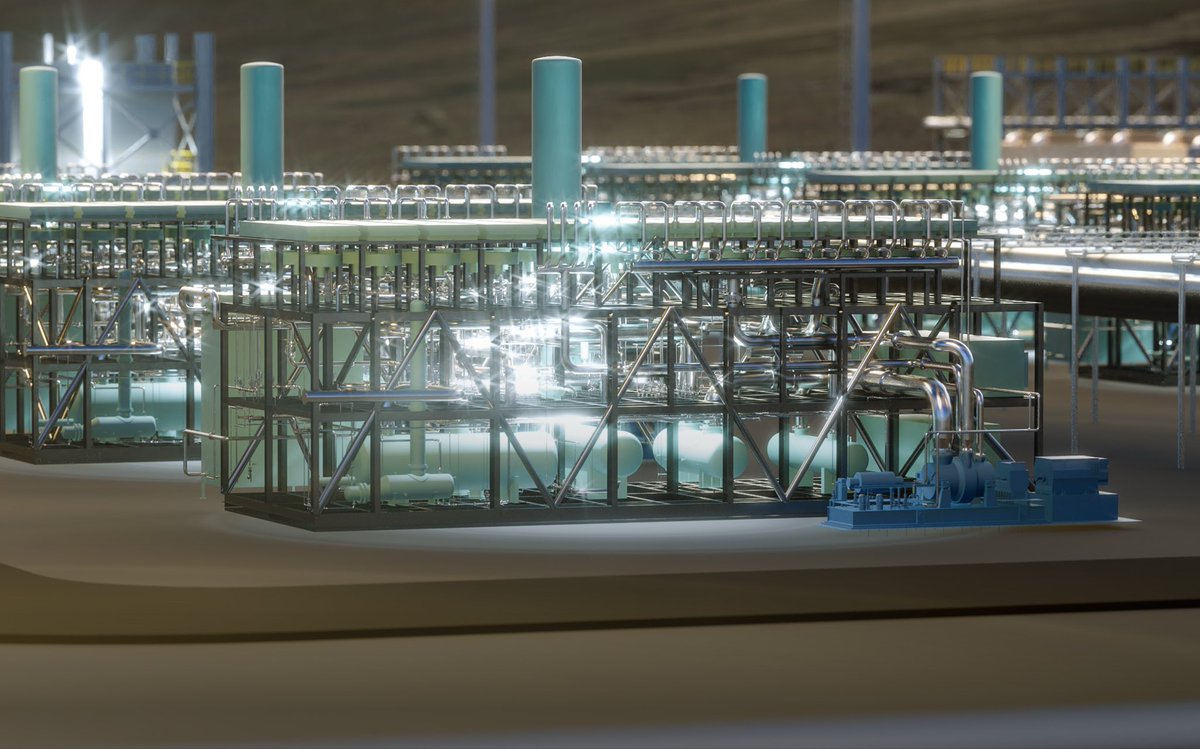

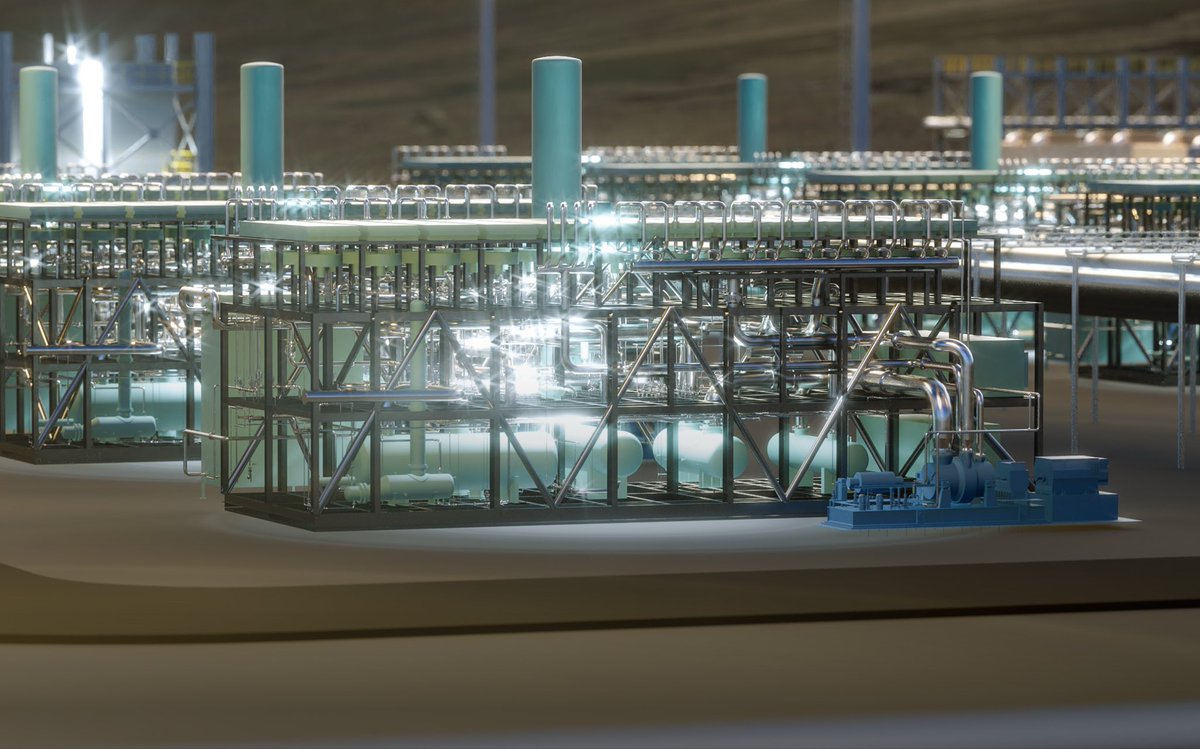

Baker Hughes, the oil and natural gas field services company and maker of LNG liquefaction equipment, posted a XX percent rise in second-quarter net income to $XXX million, up from $579M in the same three months a year ago.

That’s as orders and revenues slipped in the three months to the end of June by X percent and X percent respectively to $XXXX billion and $6.91Bln.

Baker Hughes said Industrial and Energy Technology (IET) orders for LNG plants and other facilities continued to add to the backlog.

“IET orders totaled $XXX billion in the quarter, resulting in another record backlog for the segment,” said Lorenzo Simonelli, Baker Hughes Chairman and Chief Executive.

“Importantly, order momentum remained strong, supported by more than $XXX million of data center related orders, despite the absence of large LNG awards,” stated Simonelli.

“Following a strong first half and a positive outlook for second half awards, we are confident of achieving the full-year order guidance range for IET,” the CEO added.

Baker Hughes remained confident in its ability to deliver solid performance in 2025, with continued growth in IET helping to offset softness in more market-sensitive areas of Oilfield Services Equipment.

“Accordingly, we are raising our full-year revenue and EBITDA guidance for IET and reestablishing full-year guidance for OFSE,” Simonelli declared.

Baker Hughes received key awards to support the development of critical data center projects, with year-to-date data center awards of more than $XXX million.

In the second quarter, Baker Hughes announced three strategic transactions.

First, the company signed an agreement to form a joint venture with a subsidiary of Cactus, Inc., contributing the Oilfield Services & Equipment’s Surface Pressure Control product line in exchange for approximately $XXX million while maintaining a minority ownership stake.

Second, the Baker Hughes announced an agreement to sell the Precision Sensors & Instrumentation product line within Industrial & Energy Technology to Crane Company for around $XXXX billion. “These proceeds will enhance the Company’s flexibility to reinvest in higher-growth, higher-return areas that support further margin expansion and improved returns,” the company added.

Finally, Baker Hughes agreed to acquire Continental Disc Corporation, a leading provider of pressure management solutions, for about $XXX million.

The CDC acquisition strengthens the IET Industrial Products portfolio with a highly complementary, margin-accretive business.

XX engagements