[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kingsman [@29KingsMan96](/creator/twitter/29KingsMan96) on x XXX followers Created: 2025-07-23 05:27:32 UTC 100m $pDAI sell UNFAZED THEORY: If someone tried to sell $XXX million in $pDAI, liquidity needs to absorb that sale without depegging from $X. Here’s how liquidity would realistically be sourced using (Railgun, LibertySwap, tBTC backing, PulseChain tokens, etc.): ⸻ 🧊 X. tBTC Collateral Reserve (Galaxy Digital Backed) •If $pDAI is backed 1:1 with tBTC, and the 80k BTC was converted to tBTC (and shielded via RAILGUN), it can serve as redemption collateral. •This means: for every $pDAI someone wants to sell, tBTC can be redeemed or swapped in, maintaining the $X value. •Think of it as a vault holding real value ($BTC), giving confidence and deep redemption liquidity. ✅ Redemption-backed peg ✅ Sells don’t crash price — they reduce tBTC reserves proportionally ⸻ 🔁 X. LibertySwap Dynamic Liquidity Pools (Bonding Curve + Market Making) •LibertySwap can act as a programmable DEX with bonding curves designed to absorb sell pressure. •If set up correctly, it can: •Offer deep pools: $pDAI/USDC, $pDAI/tBTC •Use arbitrage and bonding curve algorithms to rebalance liquidity •Large sales = deeper dips on the curve = incentivized buyback by bots/arbitrageurs ✅ Market absorption mechanism ✅ Auto-rebalancing curve can mitigate 100m sell pressure ⸻ 🛡 X. RAILGUN Shielded Liquidity Pools •Inside RAILGUN, users can swap anonymously. •If liquidity is set up properly, shielded pools can absorb trades off-chain-style, without publicly visible impact. •This makes whale movement invisible and less manipulative. ✅ Whale sells don’t trigger panic or copycat dumps ✅ Preserves the peg in stealth ⸻ 🧬 X. PulseChain Tokens As Sink or Utility •Utility for PulseChain-native tokens (PLS, PLSX, HEX, etc.) in $pDAI environments: •Protocols may require or encourage $pDAI usage •These tokens can be paired with $pDAI in LPs to boost TVL and absorb volatility •PLS/$pDAI and PLSX/$pDAI pairs can create decentralized ecosystem liquidity ✅ Grows usage/demand layer of $pDAI ✅ Attracts users from PulseChain into the peg system ⸻ 🔄 X. Cross-Chain Arbitrage (Base, Arbitrum, Ethereum) •If $pDAI trades below $X on one chain and at $X elsewhere (say Base or BNB), bots will: •Buy it cheap → bridge → sell it where it’s $X •This corrects price drift quickly •Bridges like Synapse, Across, Orbiter enable fast arbitrage ✅ Helps maintain parity across chains ✅ Liquidity flows to where it’s needed most 🔥 Key Insight: If all mechanisms are in place, even a $100M dump can be absorbed without breaking the peg — but they must be properly funded, deployed, and integrated.  XXXXX engagements  **Related Topics** [$pdai](/topic/$pdai) [100m](/topic/100m) [tbtc](/topic/tbtc) [coins solana ecosystem](/topic/coins-solana-ecosystem) [coins base ecosystem](/topic/coins-base-ecosystem) [coins arbitrum](/topic/coins-arbitrum) [pulsechain](/topic/pulsechain) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/29KingsMan96/status/1947891308921819311)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kingsman @29KingsMan96 on x XXX followers

Created: 2025-07-23 05:27:32 UTC

Kingsman @29KingsMan96 on x XXX followers

Created: 2025-07-23 05:27:32 UTC

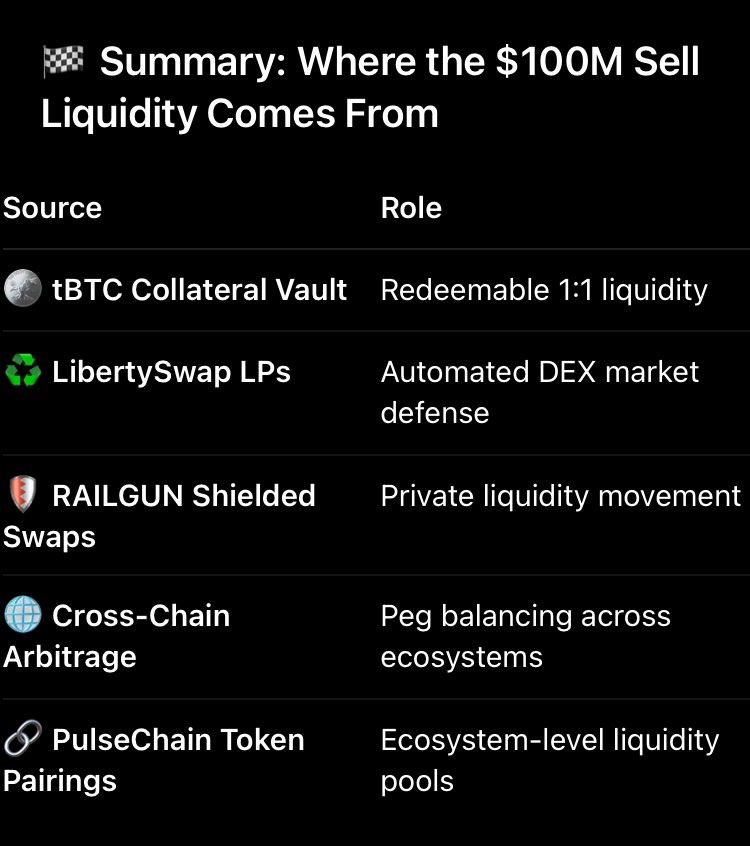

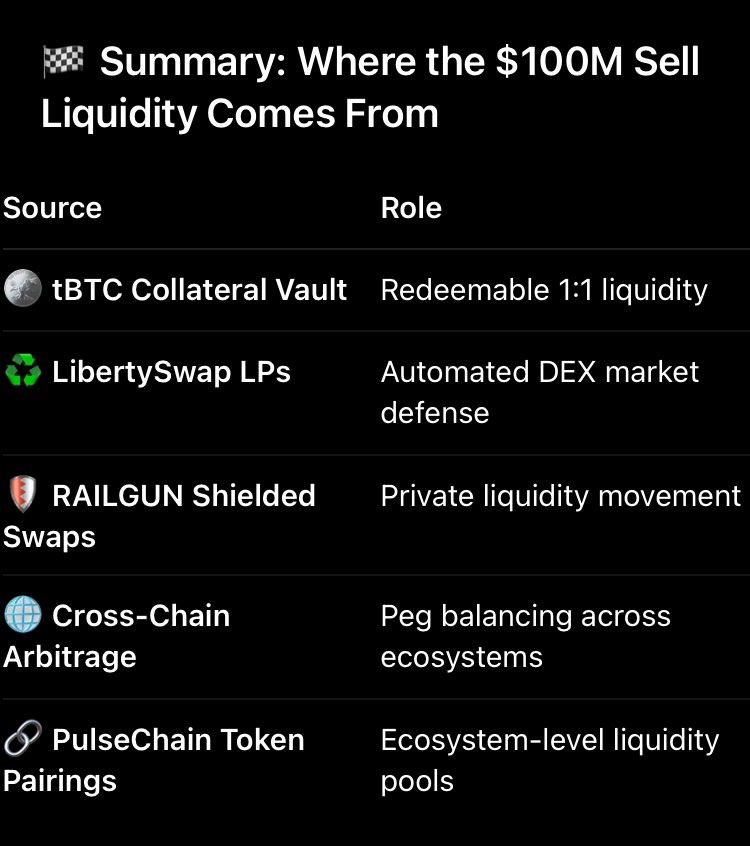

100m $pDAI sell UNFAZED THEORY: If someone tried to sell $XXX million in $pDAI, liquidity needs to absorb that sale without depegging from $X.

Here’s how liquidity would realistically be sourced using (Railgun, LibertySwap, tBTC backing, PulseChain tokens, etc.):

⸻

🧊 X. tBTC Collateral Reserve (Galaxy Digital Backed) •If $pDAI is backed 1:1 with tBTC, and the 80k BTC was converted to tBTC (and shielded via RAILGUN), it can serve as redemption collateral. •This means: for every $pDAI someone wants to sell, tBTC can be redeemed or swapped in, maintaining the $X value. •Think of it as a vault holding real value ($BTC), giving confidence and deep redemption liquidity.

✅ Redemption-backed peg ✅ Sells don’t crash price — they reduce tBTC reserves proportionally

⸻

🔁 X. LibertySwap Dynamic Liquidity Pools (Bonding Curve + Market Making) •LibertySwap can act as a programmable DEX with bonding curves designed to absorb sell pressure. •If set up correctly, it can: •Offer deep pools: $pDAI/USDC, $pDAI/tBTC •Use arbitrage and bonding curve algorithms to rebalance liquidity •Large sales = deeper dips on the curve = incentivized buyback by bots/arbitrageurs

✅ Market absorption mechanism ✅ Auto-rebalancing curve can mitigate 100m sell pressure

⸻

🛡 X. RAILGUN Shielded Liquidity Pools •Inside RAILGUN, users can swap anonymously. •If liquidity is set up properly, shielded pools can absorb trades off-chain-style, without publicly visible impact. •This makes whale movement invisible and less manipulative.

✅ Whale sells don’t trigger panic or copycat dumps ✅ Preserves the peg in stealth

⸻

🧬 X. PulseChain Tokens As Sink or Utility •Utility for PulseChain-native tokens (PLS, PLSX, HEX, etc.) in $pDAI environments: •Protocols may require or encourage $pDAI usage •These tokens can be paired with $pDAI in LPs to boost TVL and absorb volatility •PLS/$pDAI and PLSX/$pDAI pairs can create decentralized ecosystem liquidity

✅ Grows usage/demand layer of $pDAI ✅ Attracts users from PulseChain into the peg system

⸻

🔄 X. Cross-Chain Arbitrage (Base, Arbitrum, Ethereum) •If $pDAI trades below $X on one chain and at $X elsewhere (say Base or BNB), bots will: •Buy it cheap → bridge → sell it where it’s $X •This corrects price drift quickly •Bridges like Synapse, Across, Orbiter enable fast arbitrage

✅ Helps maintain parity across chains ✅ Liquidity flows to where it’s needed most

🔥 Key Insight: If all mechanisms are in place, even a $100M dump can be absorbed without breaking the peg — but they must be properly funded, deployed, and integrated.

XXXXX engagements

Related Topics $pdai 100m tbtc coins solana ecosystem coins base ecosystem coins arbitrum pulsechain coins layer 1