[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  SK XCHANGE [@Koyum_1](/creator/twitter/Koyum_1) on x 12.5K followers Created: 2025-07-23 04:29:32 UTC Overview of Yield Farming & Structured Products on @Novastro_xyz Novastro has introduced a unified module that brings together Yield Farming and Structured Products, all underpinned by a robust Risk Management framework. Here’s a concise breakdown: X. Central Module At the core is @Novastro_xyz integrated module combining both yield-generating strategies and structured financial offerings, forming the foundation of the platform. X. Yield Farming (Left) Users can earn rewards through several methods: Native Staking: Lock up Novastro’s native token to support the network and earn returns. Liquidity Mining: Provide token pairs to liquidity pools and earn incentives. Governance Participation: Vote on proposals and earn rewards for contributing to platform decisions. X. Structured Products (Right) Novastro offers tailored investment tools, including: Diversified Yield Vaults: Spread risk across multiple strategies to optimize returns. Automated Rebalancing Pools: Adjust allocations automatically based on rules or market shifts. Cross-Chain Yield Aggregators: Capture yield opportunities across different blockchains with ease. X. Risk Management (Bottom) The system is supported by key risk controls: DTCs: Decentralized tools for secure asset management and governance. Oracle Integrations: Real-time external data feeds ensure reliable smart contract execution. Conclusion @Novastro_xyz modular setup empowers users to earn from both simple and advanced DeFi strategies while maintaining a strong focus on risk mitigation.  XXXXX engagements  **Related Topics** [asset allocation](/topic/asset-allocation) [robust](/topic/robust) [Post Link](https://x.com/Koyum_1/status/1947876712869454257)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

SK XCHANGE @Koyum_1 on x 12.5K followers

Created: 2025-07-23 04:29:32 UTC

SK XCHANGE @Koyum_1 on x 12.5K followers

Created: 2025-07-23 04:29:32 UTC

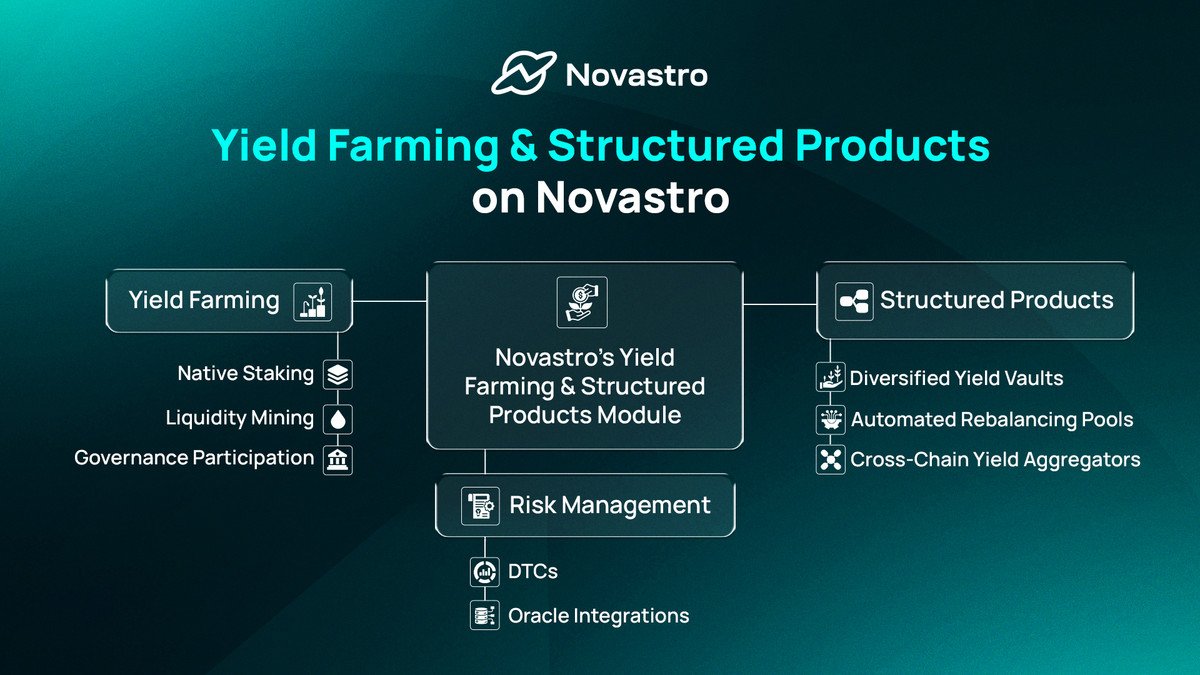

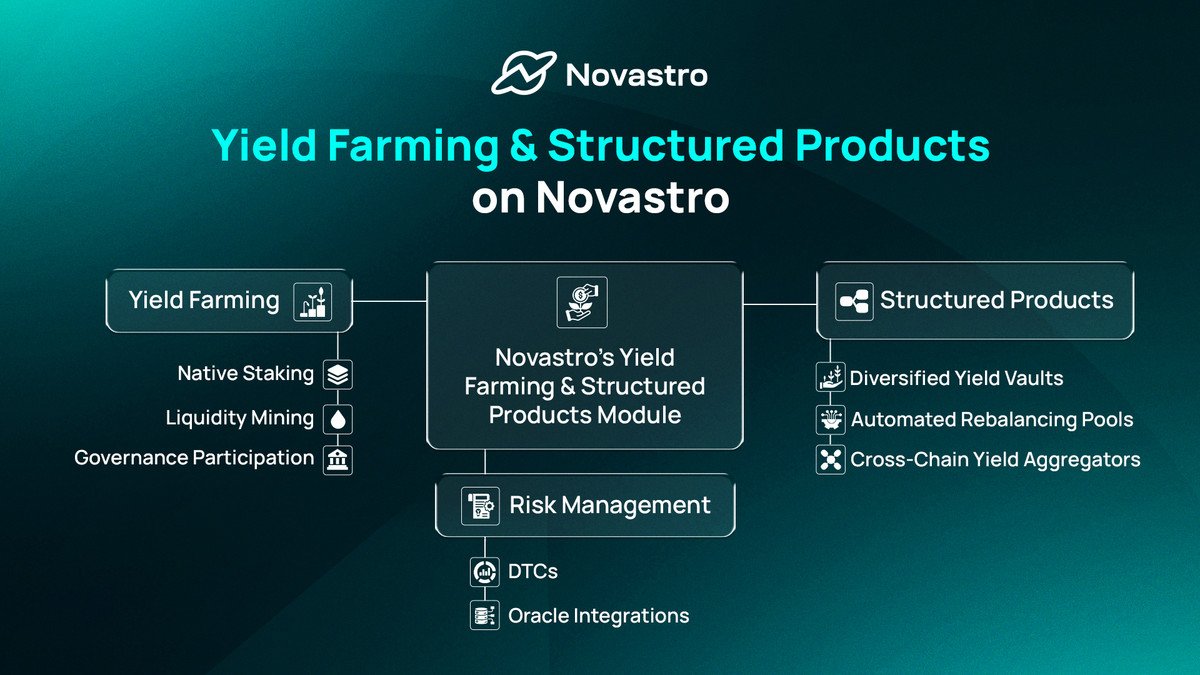

Overview of Yield Farming & Structured Products on @Novastro_xyz

Novastro has introduced a unified module that brings together Yield Farming and Structured Products, all underpinned by a robust Risk Management framework. Here’s a concise breakdown:

X. Central Module At the core is @Novastro_xyz integrated module combining both yield-generating strategies and structured financial offerings, forming the foundation of the platform.

X. Yield Farming (Left) Users can earn rewards through several methods:

Native Staking: Lock up Novastro’s native token to support the network and earn returns.

Liquidity Mining: Provide token pairs to liquidity pools and earn incentives.

Governance Participation: Vote on proposals and earn rewards for contributing to platform decisions.

X. Structured Products (Right) Novastro offers tailored investment tools, including:

Diversified Yield Vaults: Spread risk across multiple strategies to optimize returns.

Automated Rebalancing Pools: Adjust allocations automatically based on rules or market shifts.

Cross-Chain Yield Aggregators: Capture yield opportunities across different blockchains with ease.

X. Risk Management (Bottom) The system is supported by key risk controls:

DTCs: Decentralized tools for secure asset management and governance.

Oracle Integrations: Real-time external data feeds ensure reliable smart contract execution.

Conclusion @Novastro_xyz modular setup empowers users to earn from both simple and advanced DeFi strategies while maintaining a strong focus on risk mitigation.

XXXXX engagements

Related Topics asset allocation robust