[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  「 𝕲𝖔𝖔𝖓」 [@goon_crypto](/creator/twitter/goon_crypto) on x 6149 followers Created: 2025-07-23 03:59:49 UTC $fxSAVE is the engine. $FXN is the play. While most protocols chase TVL with inflation and mercenary yield, @protocol_fx has taken the hard road: Build the most trusted decentralised stablecoin, backed by real fees and long-term alignment. Here’s why the next phase of Protocol f(x) puts $FXN in prime position... ➠ What is fxSAVE? » It’s the protocol’s stability vault. » Users deposit $fxUSD or $USDC to keep $fxUSD pegged and liquid. » They earn real yield from protocol fees... not emissions. » $fxSAVE doesn’t gamble against users. » It earns like a counterparty, but without the risk. » Current APY: ~10.8% » Backed by trading activity and collateral yield ➠ Where does the yield come from? » f(x) charges one-time fees on opening/closing leveraged trades » It also earns from ETH/BTC collateral yields » Soon: fees from shorts, limit orders, stop losses This means $fxSAVE yield grows with usage... not token printing. And the deeper the $fxSAVE pool, the more leverage the system can support. More leverage = more fees = more rewards. (flywheel) This is a positive sum loop between stability and growth. ➠ What’s coming next? » sPOSITIONS «» allow users to short markets » Adds buy pressure on $fxUSD, reducing fxSAVE strain » Shorters churn more volume(traders typically hold shorts for less time) = more fee revenue. Then: » Limit Orders + Stop Losses... full trading suite » @base deployment (more users) » Upcoming integrations with forks like @RegnumAurum, @ZhenglongFi , and @sigmadotmoney.. These aren’t just features... they’re volume multipliers. Volume = fees. Fees = value to $fxSAVE and $FXN. ➠ How does this all benefit $FXN? Right now, most fees go to $fxSAVE to bootstrap trust and liquidity.. That’s by design. Stablecoins without trust die in silence. But as trust builds, fee distribution can shift... massively. » $veFXN holders already earn voting bribes and incentives » $fxSAVE won’t need as much yield to attract capital once $fxUSD is trusted » That excess yield flows to $veFXN lockers » Revenue share from friendly forks » Current APY ~22.1% And it compounds: » More TVL → more leverage → more fees » More fees → more rewards → stronger $FXN case The long game is obvious. Once $fxUSD becomes a top XX stablecoin, $FXN becomes a cashflow monster... ➠ $fxSAVE is the protocol’s heartbeat. It anchors the peg, attracts liquidity, and powers growth. But $FXN is the long-term winner. Because when trust catches up, the protocol can redirect the firehose of fees straight to lockers! Betting on $FXN is betting on trust in on-chain money... And it’s already happening.  XXXXX engagements  **Related Topics** [fxusd](/topic/fxusd) [fxn](/topic/fxn) [$fxusd](/topic/$fxusd) [fxsave](/topic/fxsave) [protocol](/topic/protocol) [longterm](/topic/longterm) [coins stablecoin](/topic/coins-stablecoin) [inflation](/topic/inflation) [Post Link](https://x.com/goon_crypto/status/1947869231812599983)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

「 𝕲𝖔𝖔𝖓」 @goon_crypto on x 6149 followers

Created: 2025-07-23 03:59:49 UTC

「 𝕲𝖔𝖔𝖓」 @goon_crypto on x 6149 followers

Created: 2025-07-23 03:59:49 UTC

$fxSAVE is the engine. $FXN is the play.

While most protocols chase TVL with inflation and mercenary yield, @protocol_fx has taken the hard road:

Build the most trusted decentralised stablecoin, backed by real fees and long-term alignment.

Here’s why the next phase of Protocol f(x) puts $FXN in prime position...

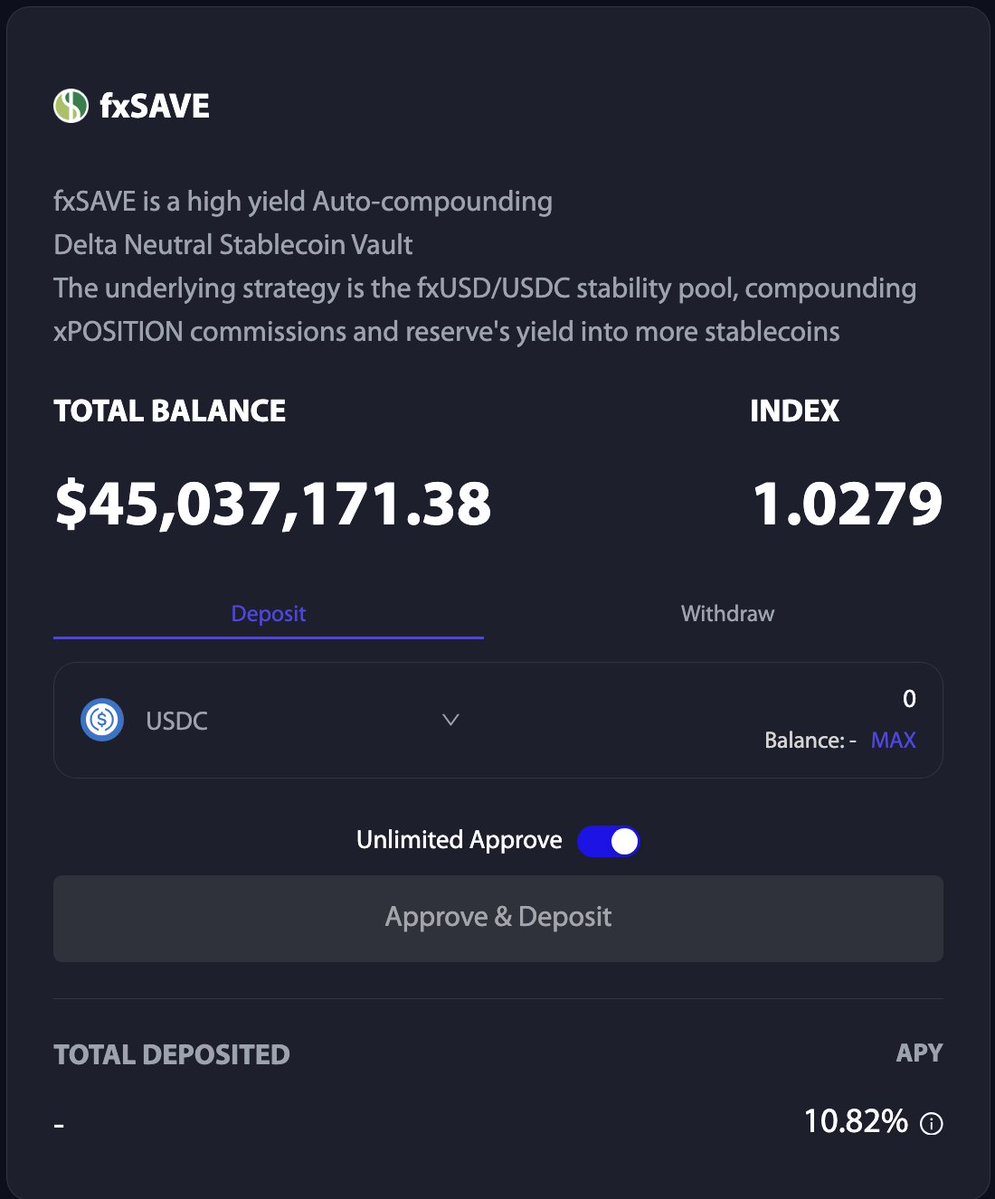

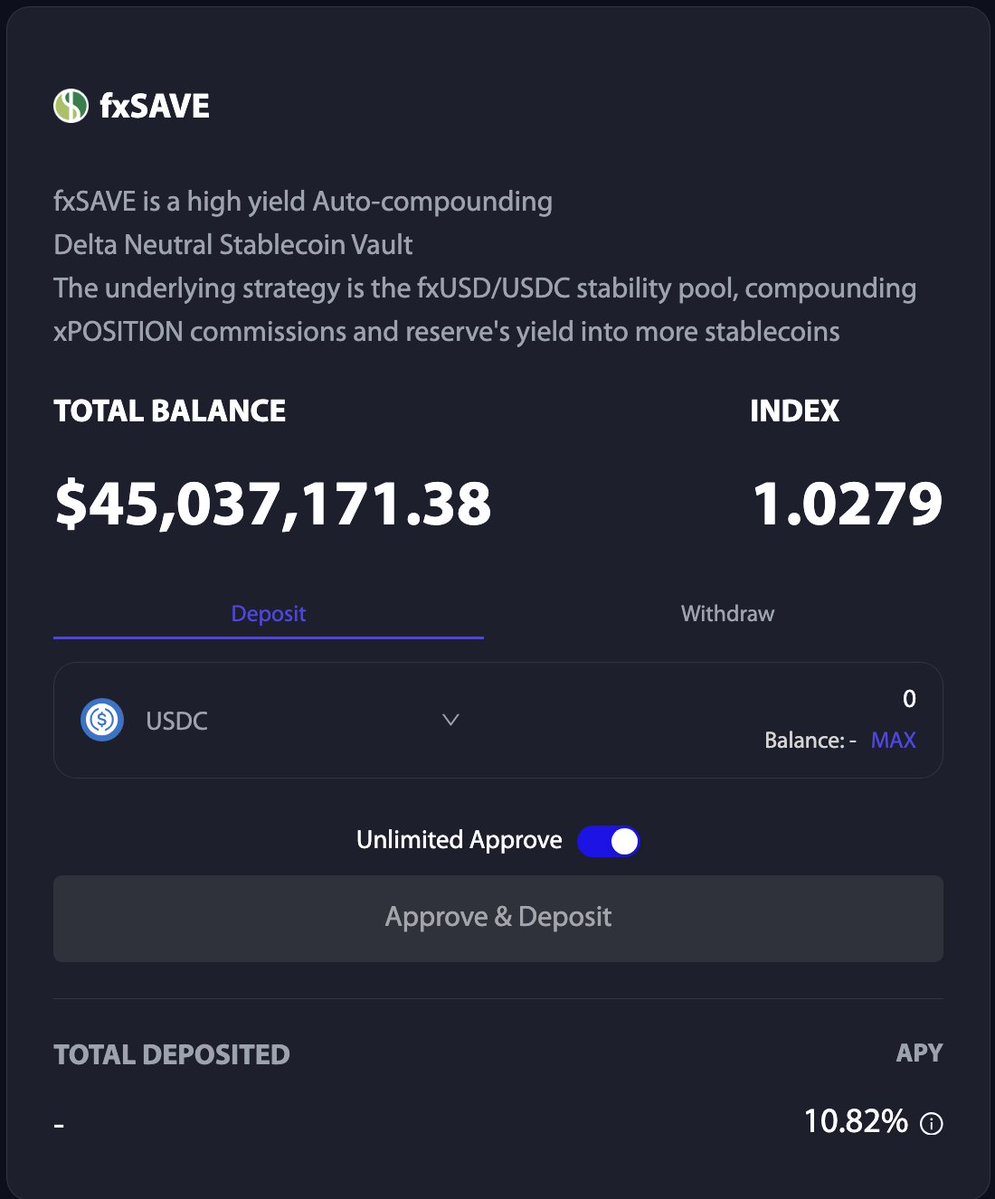

➠ What is fxSAVE?

» It’s the protocol’s stability vault. » Users deposit $fxUSD or $USDC to keep $fxUSD pegged and liquid. » They earn real yield from protocol fees... not emissions. » $fxSAVE doesn’t gamble against users. » It earns like a counterparty, but without the risk. » Current APY: ~10.8% » Backed by trading activity and collateral yield

➠ Where does the yield come from?

» f(x) charges one-time fees on opening/closing leveraged trades » It also earns from ETH/BTC collateral yields » Soon: fees from shorts, limit orders, stop losses This means $fxSAVE yield grows with usage... not token printing.

And the deeper the $fxSAVE pool, the more leverage the system can support.

More leverage = more fees = more rewards. (flywheel) This is a positive sum loop between stability and growth.

➠ What’s coming next?

» sPOSITIONS «» allow users to short markets

» Adds buy pressure on $fxUSD, reducing fxSAVE strain » Shorters churn more volume(traders typically hold shorts for less time) = more fee revenue.

Then: » Limit Orders + Stop Losses... full trading suite » @base deployment (more users) » Upcoming integrations with forks like @RegnumAurum, @ZhenglongFi , and @sigmadotmoney.. These aren’t just features... they’re volume multipliers.

Volume = fees. Fees = value to $fxSAVE and $FXN.

➠ How does this all benefit $FXN?

Right now, most fees go to $fxSAVE to bootstrap trust and liquidity..

That’s by design. Stablecoins without trust die in silence. But as trust builds, fee distribution can shift... massively.

» $veFXN holders already earn voting bribes and incentives » $fxSAVE won’t need as much yield to attract capital once $fxUSD is trusted » That excess yield flows to $veFXN lockers » Revenue share from friendly forks » Current APY ~22.1%

And it compounds: » More TVL → more leverage → more fees » More fees → more rewards → stronger $FXN case The long game is obvious.

Once $fxUSD becomes a top XX stablecoin, $FXN becomes a cashflow monster...

➠ $fxSAVE is the protocol’s heartbeat.

It anchors the peg, attracts liquidity, and powers growth. But $FXN is the long-term winner.

Because when trust catches up, the protocol can redirect the firehose of fees straight to lockers!

Betting on $FXN is betting on trust in on-chain money... And it’s already happening.

XXXXX engagements

Related Topics fxusd fxn $fxusd fxsave protocol longterm coins stablecoin inflation