[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  TheApeOfGoldStreet [@TheApeOfGoldST](/creator/twitter/TheApeOfGoldST) on x 5963 followers Created: 2025-07-23 01:58:20 UTC $AUX.V - GOLDEN CROSS - $32M MCAP $SXGC.V - SOUTHERN CROSS - $1,700M MCAP Golden Cross - Reedy Creek - Green Assets Southern Cross - Sunday Creek - Orange Assets Compare the amount of red high grade gold dots at Reedy Creek and at Sunday Creek (X10), compare the number of ladders (X25), compare the size of the assets (X3), check on which assets the most fault lines with the high grade gold are situated (AUX), check in what direction the Sunday Creek mineralised trends are heading (Ready Creek), check the MCAP ($32M vs $1,700M). Understand that Southern Cross added XX drill rigs, and that Golden Cross started drilling only a few weeks ago, and that it will deliver its first drill results in the coming days and weeks ahead. ————————————— Also for your bedtime story: BM: What I try to do when somebody advertises, I sit down, take a look at what they’ve got, and see is there anything here so compelling that investors will want to put money into it. So, I talked to Matthew Roma who’s the CEO of the company and I said, “Send me bullet points and things that aren’t obvious.” He was one of the early partners in Snowline Gold, okay, and Snowline absolutely was a giant success in the last three years. I think it went from XX cents to almost $X. Well, another giant success was Southern Cross, so Golden Cross happens to be in exactly the same structure, but the numbers are actually stronger for Golden Cross than they were for Southern Cross. Now Southern Cross has done a ton of drilling, they have XX drills operating on the property right now and Golden Cross just got started. Do you understand what a sheeted vein system is? RM: Explain it please. BM: Okay what you have is a series of veins, and the way Southern Cross defined it was that these veins were like a ladder and what you do is you drill down the rungs and you have one high-grade intercept after another. Well Southern Cross had extraordinary management, and they said, “Gee I wonder if there’s any gold in the rock in between the veins?” And that’s something that prior operators who had been operating at Reedy Creek owned by Golden Cross had never tested the material in between the veins. RM: You’re saying the veins are the steps on the ladder and nobody tested between the steps? BM: Yes. RM: Okay, interesting. BM: It turns out that it’s XXX to XXX grams, and a gram of gold right now is worth about $XXX so XXX is something in excess of $XX a tonne; that is absolutely economic. And because you’ve got to move the material anyway, it takes what was considered waste rock and it turns it into ore. So Golden Cross ticked so many boxes that I was compelled, even though I own shares to the placement, I was compelled to go buy some shares in the open market. Let me think of a good way of putting this: If you measure Golden Cross against Southern Cross, Southern Cross is XX times higher market value. If you measure Golden Cross against Snowline, it has 36X higher market valuation, so it’s one of those stocks that has giant potential, they’re drilling now, they’re going to have assays from what was considered waste rock coming out shortly, and they just did a placement for $XXXXXXXXX so they’ve got money in the bank. RM: That’s a great story. BM: Well, here’s what I like, and I’ve been out of the Canadian junior that owned Southern Cross for years, so I don’t have any dog in the fight. And I don’t own Snowline anymore, but the management of Snowline and the management of Southern Cross has been absolutely brilliant, they’ve been really phenomenal stories for the last three years, and Matthew Roma literally was part of both of them. ————————————- I see AUX as the only stock I’ve seen the last X years that I think can do a 50x and that’s no joke. The setup and the potential is there. Either I will eat my words up or I will tweet out their upcoming assays with “told you so” statements across the board with rallying shareprice 😜 let’s see, I’ve bet hard on this one. #GOLD  XXXXX engagements  **Related Topics** [$1700m](/topic/$1700m) [$sxgcv](/topic/$sxgcv) [mcap](/topic/mcap) [$32m](/topic/$32m) [$auxv](/topic/$auxv) [Post Link](https://x.com/TheApeOfGoldST/status/1947838661434720718)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

TheApeOfGoldStreet @TheApeOfGoldST on x 5963 followers

Created: 2025-07-23 01:58:20 UTC

TheApeOfGoldStreet @TheApeOfGoldST on x 5963 followers

Created: 2025-07-23 01:58:20 UTC

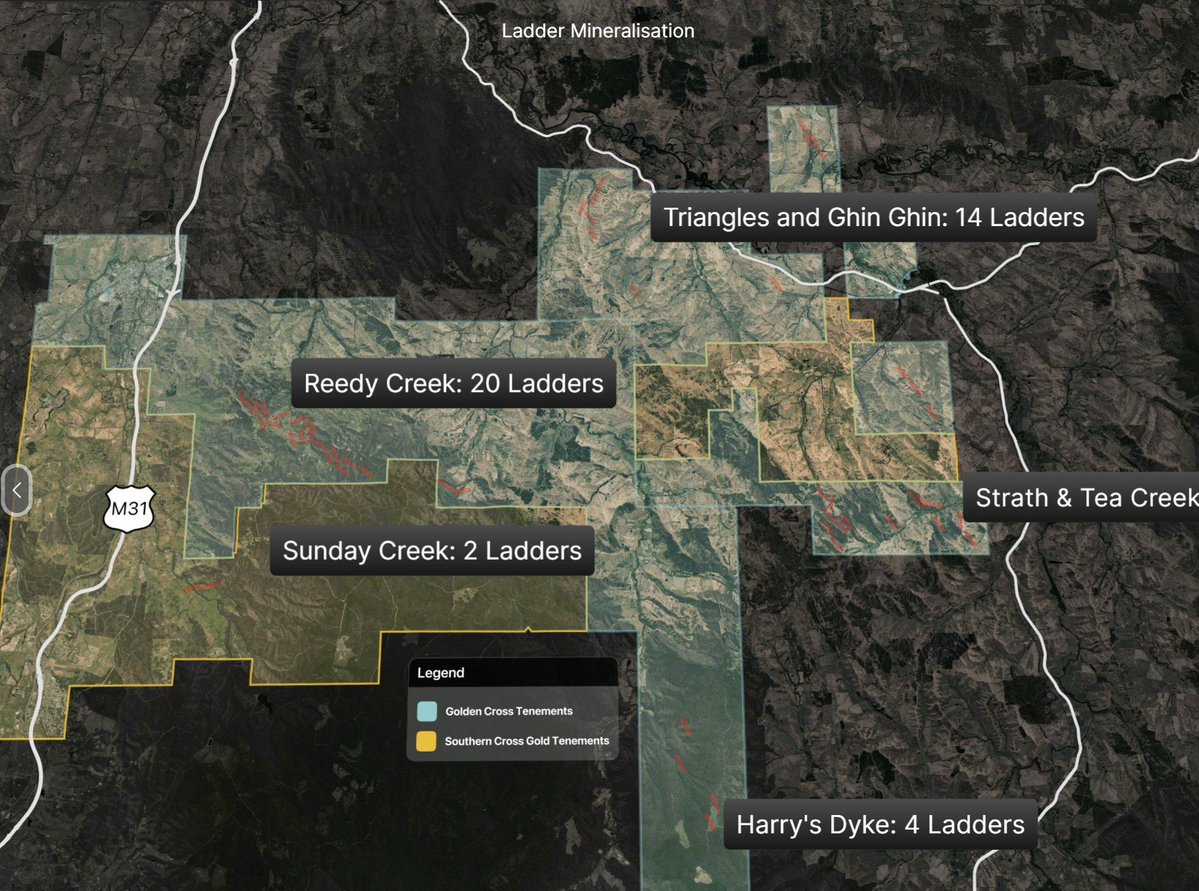

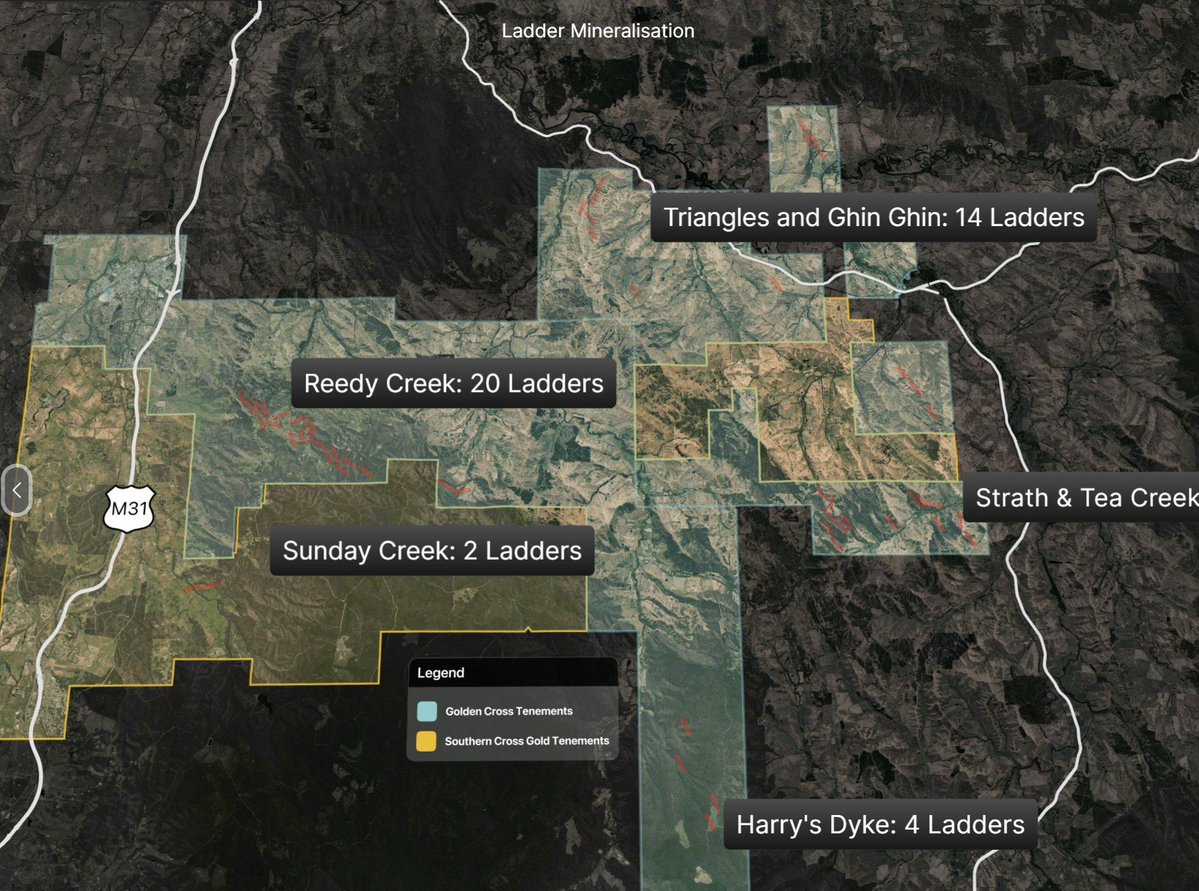

$AUX.V - GOLDEN CROSS - $32M MCAP $SXGC.V - SOUTHERN CROSS - $1,700M MCAP

Golden Cross - Reedy Creek - Green Assets

Southern Cross - Sunday Creek - Orange Assets

Compare the amount of red high grade gold dots at Reedy Creek and at Sunday Creek (X10), compare the number of ladders (X25), compare the size of the assets (X3), check on which assets the most fault lines with the high grade gold are situated (AUX), check in what direction the Sunday Creek mineralised trends are heading (Ready Creek), check the MCAP ($32M vs $1,700M). Understand that Southern Cross added XX drill rigs, and that Golden Cross started drilling only a few weeks ago, and that it will deliver its first drill results in the coming days and weeks ahead.

—————————————

Also for your bedtime story:

BM: What I try to do when somebody advertises, I sit down, take a look at what they’ve got, and see is there anything here so compelling that investors will want to put money into it. So, I talked to Matthew Roma who’s the CEO of the company and I said, “Send me bullet points and things that aren’t obvious.” He was one of the early partners in Snowline Gold, okay, and Snowline absolutely was a giant success in the last three years. I think it went from XX cents to almost $X. Well, another giant success was Southern Cross, so Golden Cross happens to be in exactly the same structure, but the numbers are actually stronger for Golden Cross than they were for Southern Cross. Now Southern Cross has done a ton of drilling, they have XX drills operating on the property right now and Golden Cross just got started. Do you understand what a sheeted vein system is?

RM: Explain it please.

BM: Okay what you have is a series of veins, and the way Southern Cross defined it was that these veins were like a ladder and what you do is you drill down the rungs and you have one high-grade intercept after another. Well Southern Cross had extraordinary management, and they said, “Gee I wonder if there’s any gold in the rock in between the veins?” And that’s something that prior operators who had been operating at Reedy Creek owned by Golden Cross had never tested the material in between the veins.

RM: You’re saying the veins are the steps on the ladder and nobody tested between the steps?

BM: Yes.

RM: Okay, interesting.

BM: It turns out that it’s XXX to XXX grams, and a gram of gold right now is worth about $XXX so XXX is something in excess of $XX a tonne; that is absolutely economic. And because you’ve got to move the material anyway, it takes what was considered waste rock and it turns it into ore. So Golden Cross ticked so many boxes that I was compelled, even though I own shares to the placement, I was compelled to go buy some shares in the open market. Let me think of a good way of putting this: If you measure Golden Cross against Southern Cross, Southern Cross is XX times higher market value. If you measure Golden Cross against Snowline, it has 36X higher market valuation, so it’s one of those stocks that has giant potential, they’re drilling now, they’re going to have assays from what was considered waste rock coming out shortly, and they just did a placement for $XXXXXXXXX so they’ve got money in the bank.

RM: That’s a great story.

BM: Well, here’s what I like, and I’ve been out of the Canadian junior that owned Southern Cross for years, so I don’t have any dog in the fight. And I don’t own Snowline anymore, but the management of Snowline and the management of Southern Cross has been absolutely brilliant, they’ve been really phenomenal stories for the last three years, and Matthew Roma literally was part of both of them.

————————————-

I see AUX as the only stock I’ve seen the last X years that I think can do a 50x and that’s no joke. The setup and the potential is there. Either I will eat my words up or I will tweet out their upcoming assays with “told you so” statements across the board with rallying shareprice 😜 let’s see, I’ve bet hard on this one.

#GOLD

XXXXX engagements