[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Pendle Intern [@PendleIntern](/creator/twitter/PendleIntern) on x 19.2K followers Created: 2025-07-23 01:51:36 UTC ICYMI $SPK has MASSIVELY repriced with a WoW gain of +194%. This makes the near-dated YT-USDS pool EXTREMELY interesting as a high delta play on $SPK price action. With maturity in our sights, its also VERY straight forward to calculate end points AND breakeven threshold for 🪂 allocation. Let's take a look 👇 ______________________________________________________ Step 1: Calculating YT-USDS' cost basis per point The current USDS pool prices Implied Yield at XXXX% APY, meaning $X gets you ~$242 of principal exposure. Each $ is farming XX $SPK points PER DAY which adds up to ~120k points at 🪂 date since snapshot is taken on XX August as per @sparkdotfi's docs. This gives us our cost basis per $SPK point ($/Point). ______________________________________________________ Step 2: Calculating Total Points @ 🪂 Date Kudos to Spark for maintaining real time point tracking which gives us the basis for Current Points. From there, we know there's ~$230m in @pendle_fi SY-USDS contract that's earning XX Points/$/day. After applying a XX% buffer (assuming XXX% of deposits are receiving the XX% referral boost), intern conservatively predicts ~580b $SPK points at maturity. ______________________________________________________ Step 3: Calculating Breakeven 🪂 Allocation We know: 👉 Some % of $SPK supply will go to $SPK point 👉 Est. number of $SPK points at 🪂 date. What we don't know is: 👉 $SPK's FDV at maturity 👉 🪂 Allocation to be given to $SPK Points What I can do is present the BREAKEVEN 🪂 (%) based on different $SPK FDVs: 📌 300m FDV → XXXX% 🪂 📌 600m FDV → XXXX% 🪂 📌 900m FDV → XXXX% 🪂 Based on your expectation of $SPK's FDV and the actual 🪂 allocation to point holders, you can make a good assessment of the RoI for buying YTs! ______________________________________________________ Fun Notes: This is one of the first cases where the 🪂 is fully concentrated to Pendle users, meaning RoI of said 🪂 is inversely related to USDS supply on Pendle. With USDS supply settling, it ultimately means MORE 🪂 per $ - perhaps more so than my original projections 🧐 ______________________________________________________ Now of course, intern will NEVER tell you what to buy and when to buy it. It's now up to you to: X. Predict $SPK FDV X. Predict 🪂 Allocation X. Win It's up to you now little guy. NFA NLA NMA MDMA Pendiddler  XXXXX engagements  **Related Topics** [spk](/topic/spk) [threshold](/topic/threshold) [delta](/topic/delta) [$spk](/topic/$spk) [Post Link](https://x.com/PendleIntern/status/1947836968051871798)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Pendle Intern @PendleIntern on x 19.2K followers

Created: 2025-07-23 01:51:36 UTC

Pendle Intern @PendleIntern on x 19.2K followers

Created: 2025-07-23 01:51:36 UTC

ICYMI $SPK has MASSIVELY repriced with a WoW gain of +194%.

This makes the near-dated YT-USDS pool EXTREMELY interesting as a high delta play on $SPK price action. With maturity in our sights, its also VERY straight forward to calculate end points AND breakeven threshold for 🪂 allocation.

Let's take a look 👇

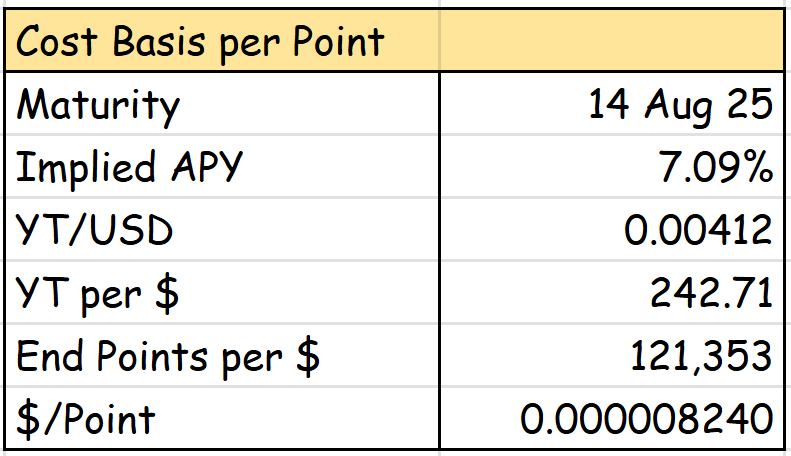

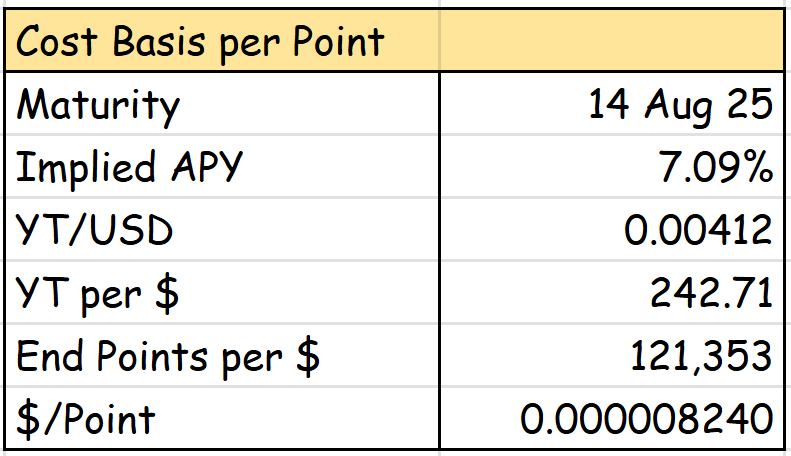

Step 1: Calculating YT-USDS' cost basis per point

The current USDS pool prices Implied Yield at XXXX% APY, meaning $X gets you ~$242 of principal exposure. Each $ is farming XX $SPK points PER DAY which adds up to ~120k points at 🪂 date since snapshot is taken on XX August as per @sparkdotfi's docs.

This gives us our cost basis per $SPK point ($/Point).

Step 2: Calculating Total Points @ 🪂 Date

Kudos to Spark for maintaining real time point tracking which gives us the basis for Current Points. From there, we know there's ~$230m in @pendle_fi SY-USDS contract that's earning XX Points/$/day.

After applying a XX% buffer (assuming XXX% of deposits are receiving the XX% referral boost), intern conservatively predicts ~580b $SPK points at maturity.

Step 3: Calculating Breakeven 🪂 Allocation

We know: 👉 Some % of $SPK supply will go to $SPK point 👉 Est. number of $SPK points at 🪂 date.

What we don't know is: 👉 $SPK's FDV at maturity 👉 🪂 Allocation to be given to $SPK Points

What I can do is present the BREAKEVEN 🪂 (%) based on different $SPK FDVs: 📌 300m FDV → XXXX% 🪂 📌 600m FDV → XXXX% 🪂 📌 900m FDV → XXXX% 🪂

Based on your expectation of $SPK's FDV and the actual 🪂 allocation to point holders, you can make a good assessment of the RoI for buying YTs!

Fun Notes:

This is one of the first cases where the 🪂 is fully concentrated to Pendle users, meaning RoI of said 🪂 is inversely related to USDS supply on Pendle. With USDS supply settling, it ultimately means MORE 🪂 per $ - perhaps more so than my original projections 🧐

Now of course, intern will NEVER tell you what to buy and when to buy it. It's now up to you to: X. Predict $SPK FDV X. Predict 🪂 Allocation X. Win

It's up to you now little guy.

NFA NLA NMA MDMA

Pendiddler

XXXXX engagements