[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Joao Wedson [@joao_wedson](/creator/twitter/joao_wedson) on x 7589 followers Created: 2025-07-22 18:19:50 UTC USDT Supply Showdown: Tron vs Ethereum Unleashed The distribution of USDT supply between Ethereum and Tron has been a key indicator in the stablecoin ecosystem. The charts highlight the Tron/Ethereum ratio, the supply delta, and their relationship with BTC price. Let’s critically analyze these data. X. USDT Supply Ratio (Tron / Ethereum) The chart shows the ratio was low (0.3) in 2019 but rose above XXX in 2022-2023, reflecting Tron’s rise due to lower fees. A notable curiosity is that when Tron’s USDT supply first surpassed Ethereum’s in 2021, it coincided with BTC’s peak at $64K. Recently (2024-2025), the ratio declined, aligning with BTC peaks ($100K+). This suggests that, in bull markets, investors may prefer Ethereum for its security despite higher fees. The visual correlation with BTC indicates market cycle influence, though Tron has regained dominance! X. USDT Supply (Tron vs Ethereum) Total supply has grown exponentially since 2019. Ethereum led initially, but Tron reached values near $60B and then over $80B in 2025. This parallel growth shows diversification, with Tron gaining traction. Supply peaks align with BTC highs, suggesting USDT expansions follow market optimism. Ethereum retains relevance during volatility, likely due to its DeFi infrastructure. X. USDT Supply Delta (Tron - Ethereum) The delta was negative until 2021 but turned positive ($3-8B) in 2022-2023, indicating Tron’s leadership. In 2025, the delta dropped to negative, hinting at a return to Ethereum. This oscillation reflects dynamic competition, sensitive to macro factors like BTC price, with Tron currently leading by +$3.9B more USDT than Ethereum.  XXXXX engagements  **Related Topics** [has been](/topic/has-been) [delta](/topic/delta) [coins stablecoin](/topic/coins-stablecoin) [usdt](/topic/usdt) [joao](/topic/joao) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/joao_wedson/status/1947723275603517658)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Joao Wedson @joao_wedson on x 7589 followers

Created: 2025-07-22 18:19:50 UTC

Joao Wedson @joao_wedson on x 7589 followers

Created: 2025-07-22 18:19:50 UTC

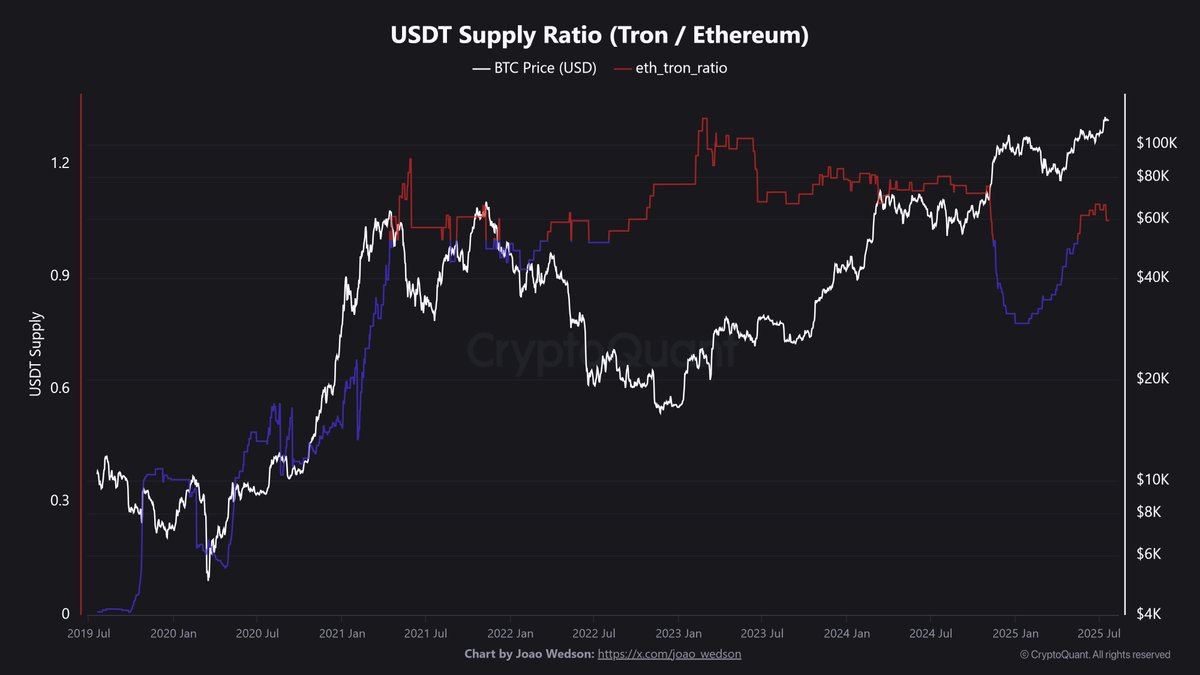

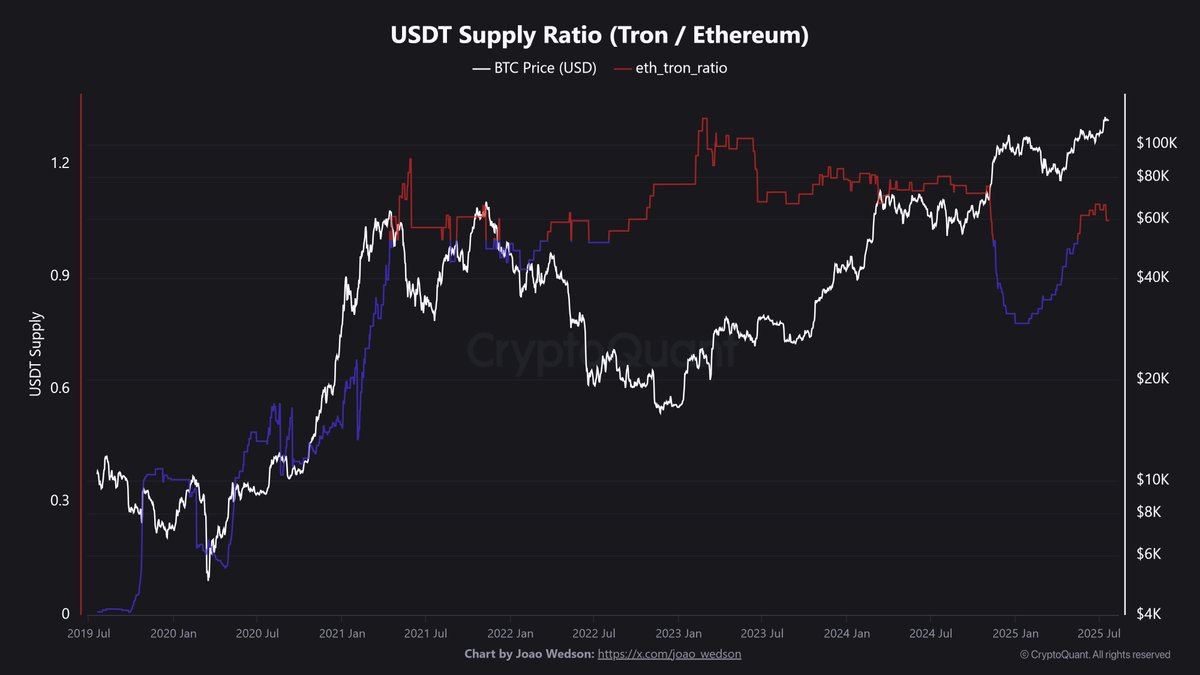

USDT Supply Showdown: Tron vs Ethereum Unleashed The distribution of USDT supply between Ethereum and Tron has been a key indicator in the stablecoin ecosystem. The charts highlight the Tron/Ethereum ratio, the supply delta, and their relationship with BTC price. Let’s critically analyze these data.

X. USDT Supply Ratio (Tron / Ethereum) The chart shows the ratio was low (0.3) in 2019 but rose above XXX in 2022-2023, reflecting Tron’s rise due to lower fees. A notable curiosity is that when Tron’s USDT supply first surpassed Ethereum’s in 2021, it coincided with BTC’s peak at $64K. Recently (2024-2025), the ratio declined, aligning with BTC peaks ($100K+). This suggests that, in bull markets, investors may prefer Ethereum for its security despite higher fees. The visual correlation with BTC indicates market cycle influence, though Tron has regained dominance!

X. USDT Supply (Tron vs Ethereum) Total supply has grown exponentially since 2019. Ethereum led initially, but Tron reached values near $60B and then over $80B in 2025. This parallel growth shows diversification, with Tron gaining traction. Supply peaks align with BTC highs, suggesting USDT expansions follow market optimism. Ethereum retains relevance during volatility, likely due to its DeFi infrastructure.

X. USDT Supply Delta (Tron - Ethereum) The delta was negative until 2021 but turned positive ($3-8B) in 2022-2023, indicating Tron’s leadership. In 2025, the delta dropped to negative, hinting at a return to Ethereum. This oscillation reflects dynamic competition, sensitive to macro factors like BTC price, with Tron currently leading by +$3.9B more USDT than Ethereum.

XXXXX engagements

Related Topics has been delta coins stablecoin usdt joao ethereum coins layer 1 bitcoin