[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Hanif Bayat [@HanifBayat](/creator/twitter/HanifBayat) on x 10.8K followers Created: 2025-07-22 16:15:39 UTC 📺My Interview on Asset Inflation at @BNNBloomberg Since 2001: • Major asset classes: ≥6% CAGR • Money supply growth: +7%/yr → weaker $ • Gold: 10× increase Since 2015: • Bitcoin led with a 400× return • S&P XXX Total Return > Real Estate & Gold Leverage Use: Only real estate allows for long-term high leverage through mortgages --------------------- Provided by Simply Know Your Options🔍  XXXXXX engagements  **Related Topics** [longterm](/topic/longterm) [financial leverage](/topic/financial-leverage) [coins real estate](/topic/coins-real-estate) [rating agency](/topic/rating-agency) [central bank actions](/topic/central-bank-actions) [money](/topic/money) [inflation](/topic/inflation) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/HanifBayat/status/1947692023923810722)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Hanif Bayat @HanifBayat on x 10.8K followers

Created: 2025-07-22 16:15:39 UTC

Hanif Bayat @HanifBayat on x 10.8K followers

Created: 2025-07-22 16:15:39 UTC

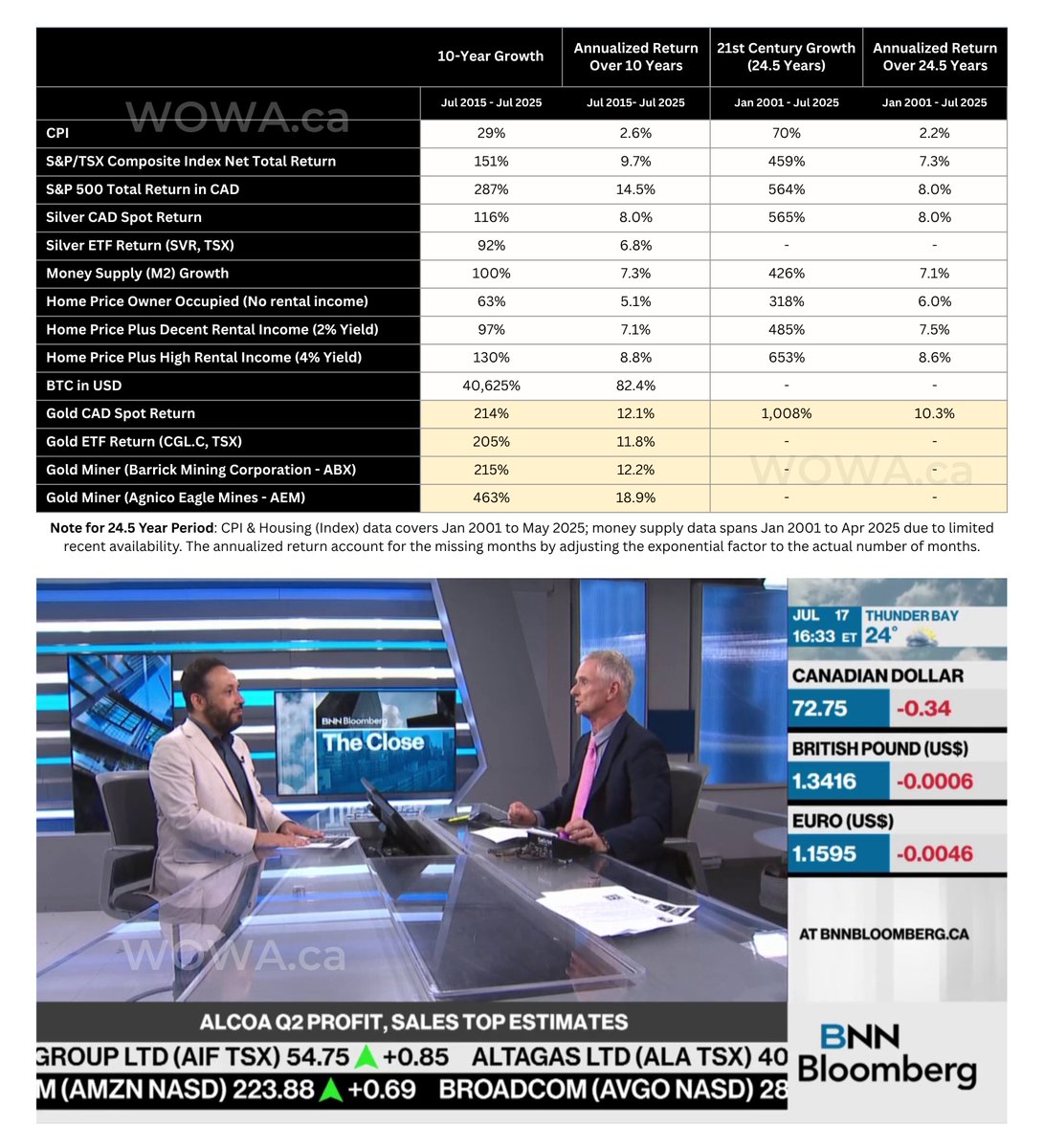

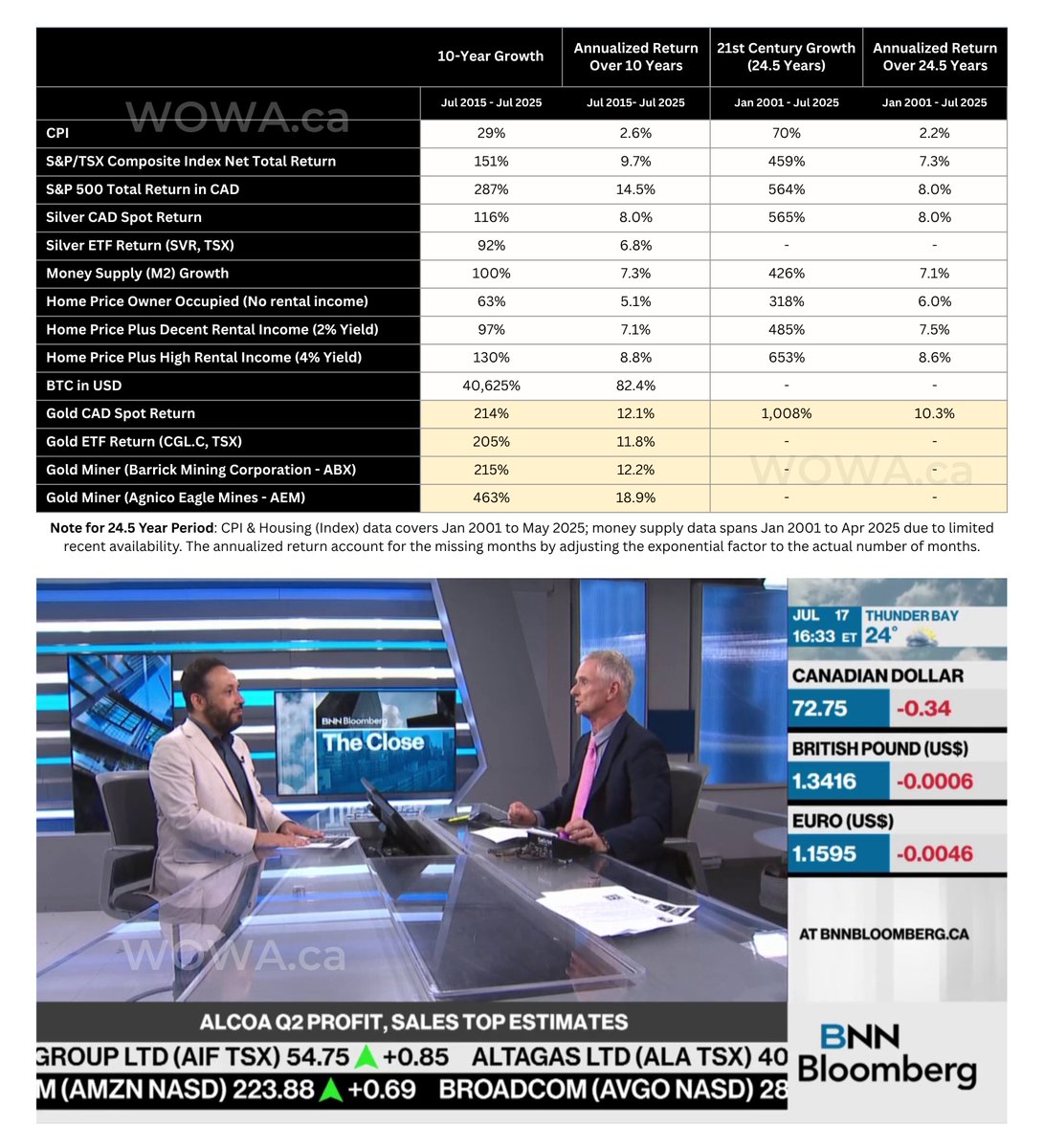

📺My Interview on Asset Inflation at @BNNBloomberg

Since 2001: • Major asset classes: ≥6% CAGR • Money supply growth: +7%/yr → weaker $ • Gold: 10× increase

Since 2015: • Bitcoin led with a 400× return • S&P XXX Total Return > Real Estate & Gold

Leverage Use: Only real estate allows for long-term high leverage through mortgages

Provided by Simply Know Your Options🔍

XXXXXX engagements

Related Topics longterm financial leverage coins real estate rating agency central bank actions money inflation bitcoin