[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Le Chiffre [@LeChiffreZK](/creator/twitter/LeChiffreZK) on x 6678 followers Created: 2025-07-22 15:44:21 UTC 🚨 My prediction for @LineaBuild TGE & Airdrop On this tweet, I will expose all my methodology to forecast the airdrop and tge of Linea. I have to be careful to not be too bullish but also I need to be realistic. It’s a tricky exercise as we don’t have many hints from the team regarding the TGE & airdrop. So I may be much more wrong then compared to my analysis regarding the strategy of ETH-SBET-LINEA-REX. What we need to know to forecast and be XXX% sure for an airdrop: => Number of eligible wallet => Marketcap/FDV at launch => % supply allowed for the community (tokenomics) => Criteria conditions (linear lxp? by group: alpha, beta, gamma, delta, omega?) What we actually know: => number of total LXP after removing Sybils => number of total LXP wallet after removing Sybils => number of total LXP-L => number of total LXP-L wallet => “We're going to reward our very patient LXP token holders” from @ethereumJoseph himself => "We're gonna change the game at Layer 2" from Joe again => And there’s no VC allocation (important for the tokenomics) So, it’s impossible for anyone to answering you: 3500 LXP = xxxx $ Do not trust them. They are farming engagement. Yes, if you have 8000 LXP, it sound very good for you, but forecasting exact number? it's impossible. It’s also impossible to say: X LXP = 0,40 cents. It doesn’t make any sense if you don’t have more information regarding the first section. Let’s use another methodology to be more or less accurate about the ‘macro’ airdrop of Linea. Of course, I will need to make assumptions here, as we don’t have many informations. Let’s process: => Number of LXP after Sybils removals: X XXX XXX XXX => Number of wallet (we don’t know if all will be eligible, let's talk about it later): XXX XXX => Average LXP per wallet: 2268 LXP => Number of LXP-L: 130.7b => Number of wallet (we don’t know if all will be eligible): X XXX XXX => Average LXP-L per wallet: XX XXX LXP Let’s make a first assumption: LXP will be worth 50x more than LXP-L. In fact, it’s not a surprise for anyone here that LXP will be more weighted than LXP-L. The number is unknown, but let’s make an assumption and say 50x. Second assumption: LXP-L will have a threshold, for obvious reasons. They're not gonna reward every single of the 2m LXP-L holders. I’m taking your attention for those three important subjects that everyone will ask in comment, so I’m preshooting some of your comments: I don’t know if LXP will have a threshold. Some people in Linea were favorable, some not, and I’m not gonna mention anyone as it’s a tricky subject for some of you. Let’s consider all of LXP wallet are eligible: 780k. I don’t know if communities or initiatives will be rewarded like some other projects did in the past: Pudgy Penguins with LayerZero & zkSync, devs activities with StarkNet and so on. Let’s keep with what we know atm and because Joe already hinted regarding the LXP holders. Do not compare Linea and Hyperliquid. Hyperliquid was an anomaly (a very good anomaly) for three reasons: → Very low number of wallet participants (90k) and "de facto" eligible with a points system → Some early participants but mostly many KOLs get a big part of the pie due to the referral program, that create a special atmosphere on CT (remember CC2) → Price going up crazy after TGE (it may be the same, let's see first the Linea tokenomics) So how the fuck I’m going to do with those low information to not get too optimist but also realist? Well, we have some information, some assumptions but also some study cases from the past: Arbitrum, Starknet, zkSync. Let’s take those examples. I took all the data from those airdrops. It’s tricky to copy/paste all, as for example StarkNet airdropped to 1.3m users, but only half of them were users of Starknet, the other half was users of StarkEx or Ethereum stakers and many tokens was for devs. Also, we can see some anomalies, like zkSync that decide to make a huge difference between the lowest to the highest eligible wallet. The supply of zkSync is 21B compared to Starknet & Arbitrum at 10B. We should be careful when using this table. So what about Linea? The result you will find will depend on if you are bullish or not on Linea. If you follow my last few tweets about Linea, you should be bullish, if not go to read it now! Let’s make many assumptions about everything now. I’m sorry in advance to put (assumption) in many sentences, but I have no choice. Everyone will quote me like it’s a leak or whatever, which is not. It’s just assumptions and I may be totally wrong. Linea repartition of the supply: It’s clear for me that Linea will be more or less like the Ethereum repartition (assumption) of the supply during the launch in 2015, but you’ll need to adapt with the current context. Don’t ask Grok, I’m gonna give you the number of Ethereum tokenomics at launch: → XXXX% was allowed for the initial distribution → XXXX% for the Ethereum foundation → 4,17% for Ethereum developers → 4,17% for Developer Purchase Program Please, don’t get me wrong, I’m not saying Linea will airdrop XXXX% of the supply for LXP & LXP-L holders, that doesn’t make any sense. I’m saying the repartition of the supply will be more or less the same. Let’s table XX - XX% for the community (assumption) with multiple programs - maybe to build more apps on Linea, use some tokens with a special tokenomics mechanism? The rest for the foundation and cex listing/mm liquidity. → Linea allocation for the airdrop at TGE will be closer to what did zkSync (assumption) with XXXX% of the supply upfront then to Starknet that rewarded X% of the supply for their Starknet users. I remembering that to you: Linea was the first to implement a transparent points programs. No hidding, no insider airdrop activity, no shady criteria. That's a huge advantage. → FDV at launch is one of the most important metrics. With all the tweets I write about Linea the last few days, will you consider it like a tier X ($4.5b), tier X ($1.5b) , or tier X ($500m) project Layer 2? You also need to consider that: Linea is launching at the best time possible, with all the catalysts that they create themself (SBET, Etherex, Tokenomics, XXX% EVM compatibility, Gateway of institutional ETH treasury company…). If I want to give you more hopium, I’ll tell you: "can Linea launch at $30b/$40b like Starknet did?” but it’s not reasonable and at $40b day 1, let’s be honest, it will be hard to support the price, whatever the project. → Number of eligible wallets (assumption): 780k wallet LXP holders that pass the sybils filter and 2M LXP-L wallet holders. Let’s take a number of 900k wallet (assumption) that will be rewarded. That makes sense: many participants of the LXP program also participate in the LXP-L program. A threshold will be implemented (assumption) for LXP-L tokens holders and I hardly think that they will reward 2m of wallets. ________________________________________________ TDLR: (assumptions with 900k eligible wallets) => Linea will be closer to what @arbitrum did in terms of average wallet - somewhere between $1500 & $3000 worth of Linea tokens. Will it surpass Arbitrum? It may, it may not. That also mean if you have many LXP and/or LXP-L, you'll get much more then $3000. If you have low amount of LXP/LXP-L, don't think you can get more then $1500 or $2000 worth of Linea tokens. Check out the table below regarding the LXP repartition, so you can have an idea of your ranking position: => Linea between $3b & $6B FDV at launch is reasonable imo. I’m too bullish to give you my own number I have in mind, so I will not. But the most important metrics for a Layer 2, is the TVL, and we'll be going fast to reach the $3B TVL quickly after the TGE. => Linea tokenomics will reduce the sell pressure at launch, as there's no VC. It's a huge win to have an organic price action. It may be a good option to not jeet your airdrop. Yeah it’s a bold prediction regarding all the price action to every single L2. Let’s analyse the tokenomics when it will be available, I’ll give you my honest feedback. Take a close look at what will be the role of the sequencer! => Linea allocation will be closer to what zkSync did (17.5%) then what Starknet did (7%) => Why I'm extremely bullish? (well, I'm not saying it will reach $100b, at least for now!) I'm personally thinking that Linea isn't a "regular layer 2". It's a real clone of Ethereum with faster & low cost tx, a perfect environment for all the ETH treasury company that @ethereumJoseph is the main character for it and slowly found the League of Extraordinary ETH Accumulator Gentlemen. Consensys isn't also a regular company as I mention many time: it's THE company which is fully dedicated to Ethereum success. Regarding Linea, @DeclanFox14 is one of the most knowledge product man on ZK and leading perfectly the team, @alexand_belling is the biggest ZK brain I ever speak to, @Alain_Ncls create the very beautiful Linea Hub and many surprises will come (I don't know, yet!), @goinfrexeth did an incredible job for the sybils campaign, and of course all the other team members of Linea. I cannot mention all, but every time I speak to someone from the team, it's always interesting and they're all high iq and that make me more bullish. To conclude: I'm seeing Ethereum as a public good I'm seeing Linea as a public good I'm seeing Metamask as a public good I'm seeing Verax as a public good I'm seeing Etherex as a public good Trust, vision, decentralisation, alignement, security and a non-extractive environment that will shape the future of the "Trustware era" is what I would say to finish my long tweet.  XXXXXXX engagements  **Related Topics** [linea](/topic/linea) [tge](/topic/tge) [le](/topic/le) [Post Link](https://x.com/LeChiffreZK/status/1947684145682891094)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Le Chiffre @LeChiffreZK on x 6678 followers

Created: 2025-07-22 15:44:21 UTC

Le Chiffre @LeChiffreZK on x 6678 followers

Created: 2025-07-22 15:44:21 UTC

🚨 My prediction for @LineaBuild TGE & Airdrop

On this tweet, I will expose all my methodology to forecast the airdrop and tge of Linea. I have to be careful to not be too bullish but also I need to be realistic.

It’s a tricky exercise as we don’t have many hints from the team regarding the TGE & airdrop. So I may be much more wrong then compared to my analysis regarding the strategy of ETH-SBET-LINEA-REX.

What we need to know to forecast and be XXX% sure for an airdrop: => Number of eligible wallet => Marketcap/FDV at launch => % supply allowed for the community (tokenomics) => Criteria conditions (linear lxp? by group: alpha, beta, gamma, delta, omega?)

What we actually know: => number of total LXP after removing Sybils => number of total LXP wallet after removing Sybils => number of total LXP-L => number of total LXP-L wallet => “We're going to reward our very patient LXP token holders” from @ethereumJoseph himself => "We're gonna change the game at Layer 2" from Joe again => And there’s no VC allocation (important for the tokenomics)

So, it’s impossible for anyone to answering you: 3500 LXP = xxxx $ Do not trust them. They are farming engagement. Yes, if you have 8000 LXP, it sound very good for you, but forecasting exact number? it's impossible.

It’s also impossible to say: X LXP = 0,40 cents. It doesn’t make any sense if you don’t have more information regarding the first section.

Let’s use another methodology to be more or less accurate about the ‘macro’ airdrop of Linea. Of course, I will need to make assumptions here, as we don’t have many informations.

Let’s process: => Number of LXP after Sybils removals: X XXX XXX XXX => Number of wallet (we don’t know if all will be eligible, let's talk about it later): XXX XXX => Average LXP per wallet: 2268 LXP

=> Number of LXP-L: 130.7b => Number of wallet (we don’t know if all will be eligible): X XXX XXX => Average LXP-L per wallet: XX XXX LXP

Let’s make a first assumption: LXP will be worth 50x more than LXP-L. In fact, it’s not a surprise for anyone here that LXP will be more weighted than LXP-L. The number is unknown, but let’s make an assumption and say 50x.

Second assumption: LXP-L will have a threshold, for obvious reasons. They're not gonna reward every single of the 2m LXP-L holders.

I’m taking your attention for those three important subjects that everyone will ask in comment, so I’m preshooting some of your comments:

I don’t know if LXP will have a threshold. Some people in Linea were favorable, some not, and I’m not gonna mention anyone as it’s a tricky subject for some of you. Let’s consider all of LXP wallet are eligible: 780k.

I don’t know if communities or initiatives will be rewarded like some other projects did in the past: Pudgy Penguins with LayerZero & zkSync, devs activities with StarkNet and so on. Let’s keep with what we know atm and because Joe already hinted regarding the LXP holders.

Do not compare Linea and Hyperliquid. Hyperliquid was an anomaly (a very good anomaly) for three reasons: → Very low number of wallet participants (90k) and "de facto" eligible with a points system → Some early participants but mostly many KOLs get a big part of the pie due to the referral program, that create a special atmosphere on CT (remember CC2) → Price going up crazy after TGE (it may be the same, let's see first the Linea tokenomics)

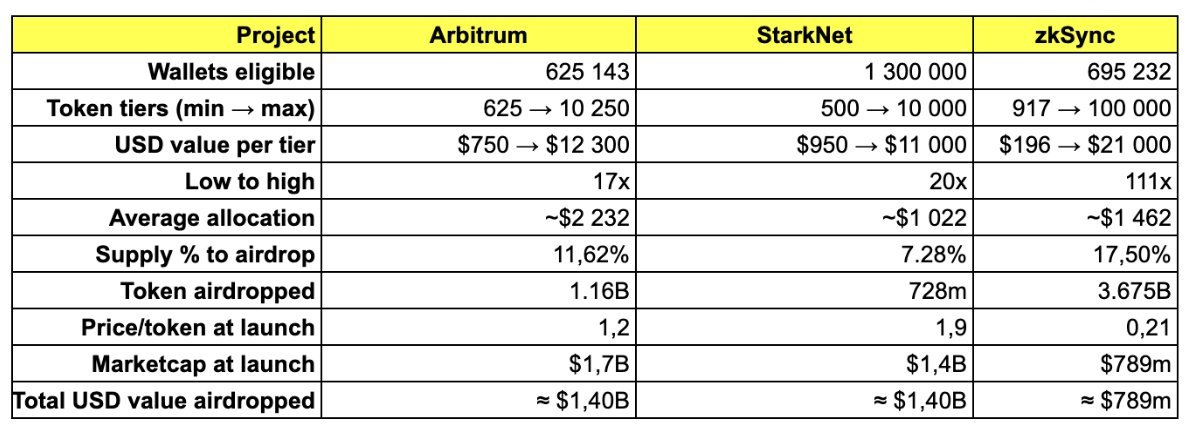

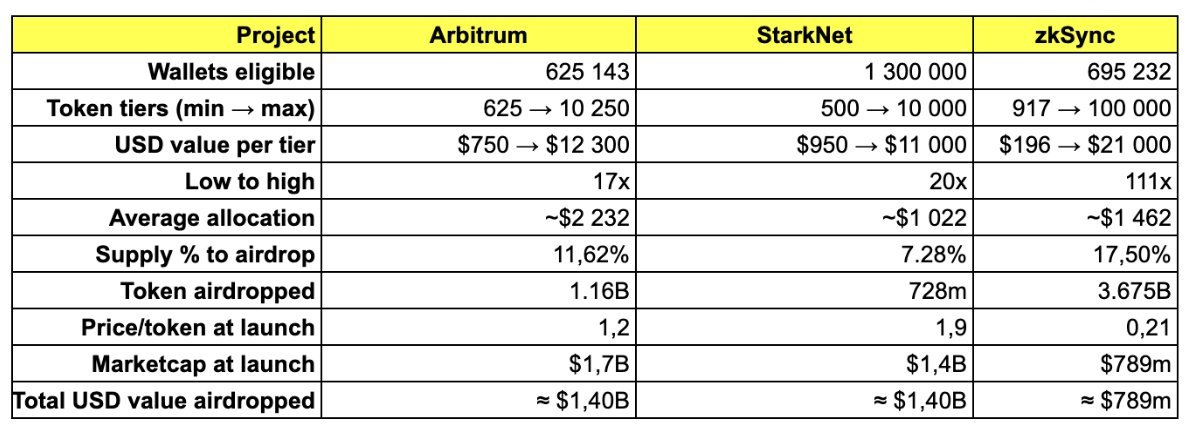

So how the fuck I’m going to do with those low information to not get too optimist but also realist? Well, we have some information, some assumptions but also some study cases from the past: Arbitrum, Starknet, zkSync.

Let’s take those examples. I took all the data from those airdrops. It’s tricky to copy/paste all, as for example StarkNet airdropped to 1.3m users, but only half of them were users of Starknet, the other half was users of StarkEx or Ethereum stakers and many tokens was for devs. Also, we can see some anomalies, like zkSync that decide to make a huge difference between the lowest to the highest eligible wallet. The supply of zkSync is 21B compared to Starknet & Arbitrum at 10B. We should be careful when using this table.

So what about Linea? The result you will find will depend on if you are bullish or not on Linea. If you follow my last few tweets about Linea, you should be bullish, if not go to read it now!

Let’s make many assumptions about everything now. I’m sorry in advance to put (assumption) in many sentences, but I have no choice. Everyone will quote me like it’s a leak or whatever, which is not. It’s just assumptions and I may be totally wrong.

Linea repartition of the supply: It’s clear for me that Linea will be more or less like the Ethereum repartition (assumption) of the supply during the launch in 2015, but you’ll need to adapt with the current context. Don’t ask Grok, I’m gonna give you the number of Ethereum tokenomics at launch: → XXXX% was allowed for the initial distribution → XXXX% for the Ethereum foundation → 4,17% for Ethereum developers → 4,17% for Developer Purchase Program

Please, don’t get me wrong, I’m not saying Linea will airdrop XXXX% of the supply for LXP & LXP-L holders, that doesn’t make any sense. I’m saying the repartition of the supply will be more or less the same. Let’s table XX - XX% for the community (assumption) with multiple programs - maybe to build more apps on Linea, use some tokens with a special tokenomics mechanism? The rest for the foundation and cex listing/mm liquidity.

→ Linea allocation for the airdrop at TGE will be closer to what did zkSync (assumption) with XXXX% of the supply upfront then to Starknet that rewarded X% of the supply for their Starknet users. I remembering that to you: Linea was the first to implement a transparent points programs. No hidding, no insider airdrop activity, no shady criteria. That's a huge advantage.

→ FDV at launch is one of the most important metrics. With all the tweets I write about Linea the last few days, will you consider it like a tier X ($4.5b), tier X ($1.5b) , or tier X ($500m) project Layer 2? You also need to consider that: Linea is launching at the best time possible, with all the catalysts that they create themself (SBET, Etherex, Tokenomics, XXX% EVM compatibility, Gateway of institutional ETH treasury company…). If I want to give you more hopium, I’ll tell you: "can Linea launch at $30b/$40b like Starknet did?” but it’s not reasonable and at $40b day 1, let’s be honest, it will be hard to support the price, whatever the project.

→ Number of eligible wallets (assumption): 780k wallet LXP holders that pass the sybils filter and 2M LXP-L wallet holders. Let’s take a number of 900k wallet (assumption) that will be rewarded. That makes sense: many participants of the LXP program also participate in the LXP-L program. A threshold will be implemented (assumption) for LXP-L tokens holders and I hardly think that they will reward 2m of wallets.

TDLR: (assumptions with 900k eligible wallets) => Linea will be closer to what @arbitrum did in terms of average wallet - somewhere between $1500 & $3000 worth of Linea tokens. Will it surpass Arbitrum? It may, it may not. That also mean if you have many LXP and/or LXP-L, you'll get much more then $3000. If you have low amount of LXP/LXP-L, don't think you can get more then $1500 or $2000 worth of Linea tokens. Check out the table below regarding the LXP repartition, so you can have an idea of your ranking position:

=> Linea between $3b & $6B FDV at launch is reasonable imo. I’m too bullish to give you my own number I have in mind, so I will not. But the most important metrics for a Layer 2, is the TVL, and we'll be going fast to reach the $3B TVL quickly after the TGE.

=> Linea tokenomics will reduce the sell pressure at launch, as there's no VC. It's a huge win to have an organic price action. It may be a good option to not jeet your airdrop. Yeah it’s a bold prediction regarding all the price action to every single L2. Let’s analyse the tokenomics when it will be available, I’ll give you my honest feedback. Take a close look at what will be the role of the sequencer!

=> Linea allocation will be closer to what zkSync did (17.5%) then what Starknet did (7%)

=> Why I'm extremely bullish? (well, I'm not saying it will reach $100b, at least for now!) I'm personally thinking that Linea isn't a "regular layer 2". It's a real clone of Ethereum with faster & low cost tx, a perfect environment for all the ETH treasury company that @ethereumJoseph is the main character for it and slowly found the League of Extraordinary ETH Accumulator Gentlemen. Consensys isn't also a regular company as I mention many time: it's THE company which is fully dedicated to Ethereum success.

Regarding Linea, @DeclanFox14 is one of the most knowledge product man on ZK and leading perfectly the team, @alexand_belling is the biggest ZK brain I ever speak to, @Alain_Ncls create the very beautiful Linea Hub and many surprises will come (I don't know, yet!), @goinfrexeth did an incredible job for the sybils campaign, and of course all the other team members of Linea. I cannot mention all, but every time I speak to someone from the team, it's always interesting and they're all high iq and that make me more bullish.

To conclude:

I'm seeing Ethereum as a public good

I'm seeing Linea as a public good

I'm seeing Metamask as a public good

I'm seeing Verax as a public good

I'm seeing Etherex as a public good

Trust, vision, decentralisation, alignement, security and a non-extractive environment that will shape the future of the "Trustware era" is what I would say to finish my long tweet.

XXXXXXX engagements