[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Smart Ape 🔥 [@the_smart_ape](/creator/twitter/the_smart_ape) on x 56.5K followers Created: 2025-07-22 14:48:37 UTC Think again! @Infinit_Labs is not just for LP farmers. It has the potential to automate operations not only for DeFi users, but also for fund managers, VCs, and institutions. The TradFi asset management market is massive, estimated at $XXX trillion AUM. Managing these assets (order execution, staffing, fees, operations, etc.) costs at least X% annually, meaning over $XXX trillion in yearly costs, which is much bigger than the entire DeFi TVL (~$120B). Now think about this, many TradFi operations mirror DeFi processes, just slower, more manual, and not code-based. But in theory, TradFi could also benefit from a swarm of AI agents to automate complex workflows. That’s why it’s no surprise Infinit is developing a private institutional mode tailored to TradFi. One-click zap for a DeFi user could become a one-click bond rotation for BlackRock. + TradFi holds over $400T in liquidity, compared to only $120B in DeFi. It’s a market with little innovation, and Infinit is uniquely positioned to change that. Same infrastructure, same AI agents, just applied to a different audience. The future isn’t about TradFi or DeFi. It’s about agentic finance, and Infinit is leading it. Today, a TradFi asset manager goes through multiple steps: research, allocation, execution. Infinit could turn that into a single agentic sequence: You define the strategy, make it executable in one click, track it, optimize it, saving time, reducing errors, and scaling. In short: INFINIT becomes the abstraction layer between capital and strategy.  XXXXX engagements  **Related Topics** [asset management](/topic/asset-management) [vcs](/topic/vcs) [Post Link](https://x.com/the_smart_ape/status/1947670120320708876)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Smart Ape 🔥 @the_smart_ape on x 56.5K followers

Created: 2025-07-22 14:48:37 UTC

The Smart Ape 🔥 @the_smart_ape on x 56.5K followers

Created: 2025-07-22 14:48:37 UTC

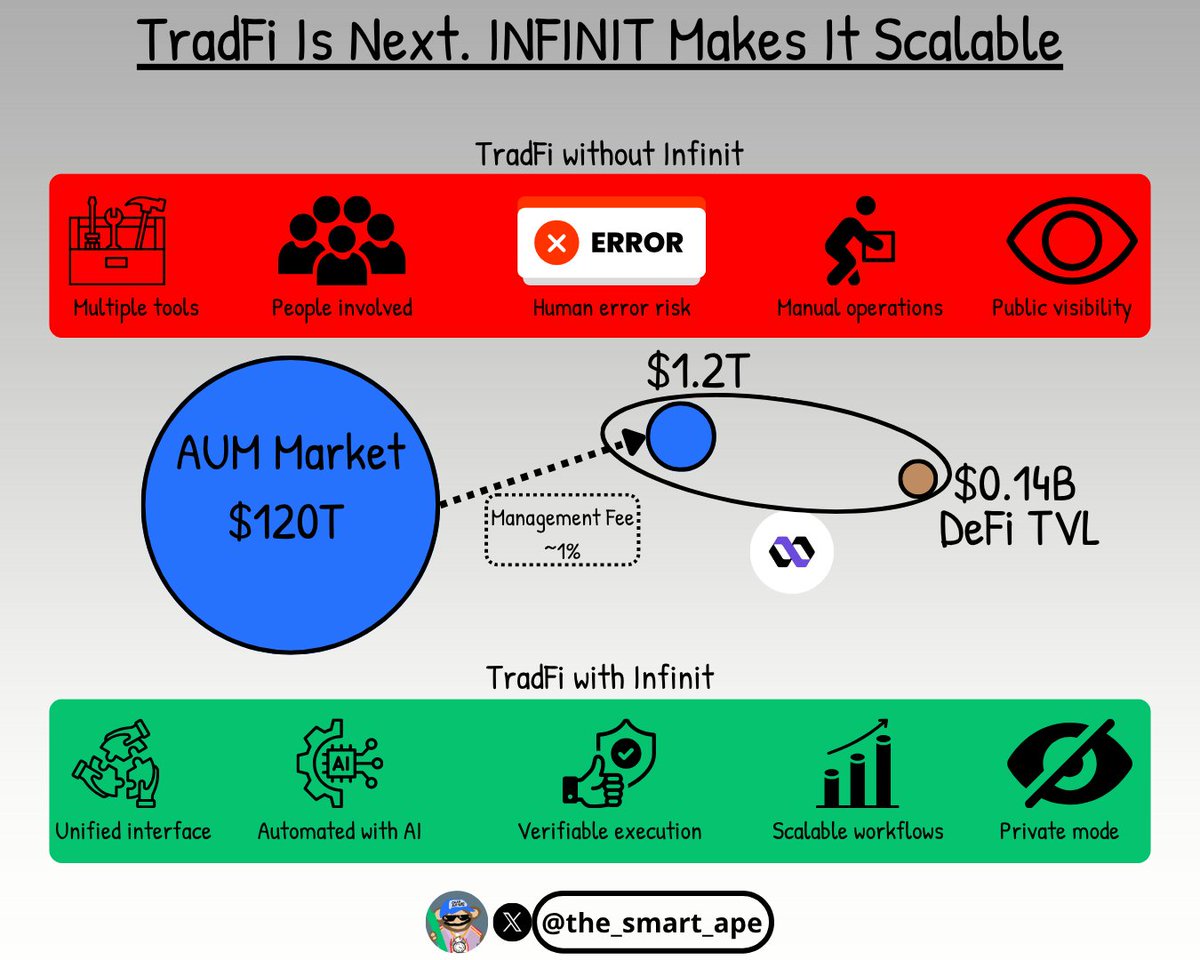

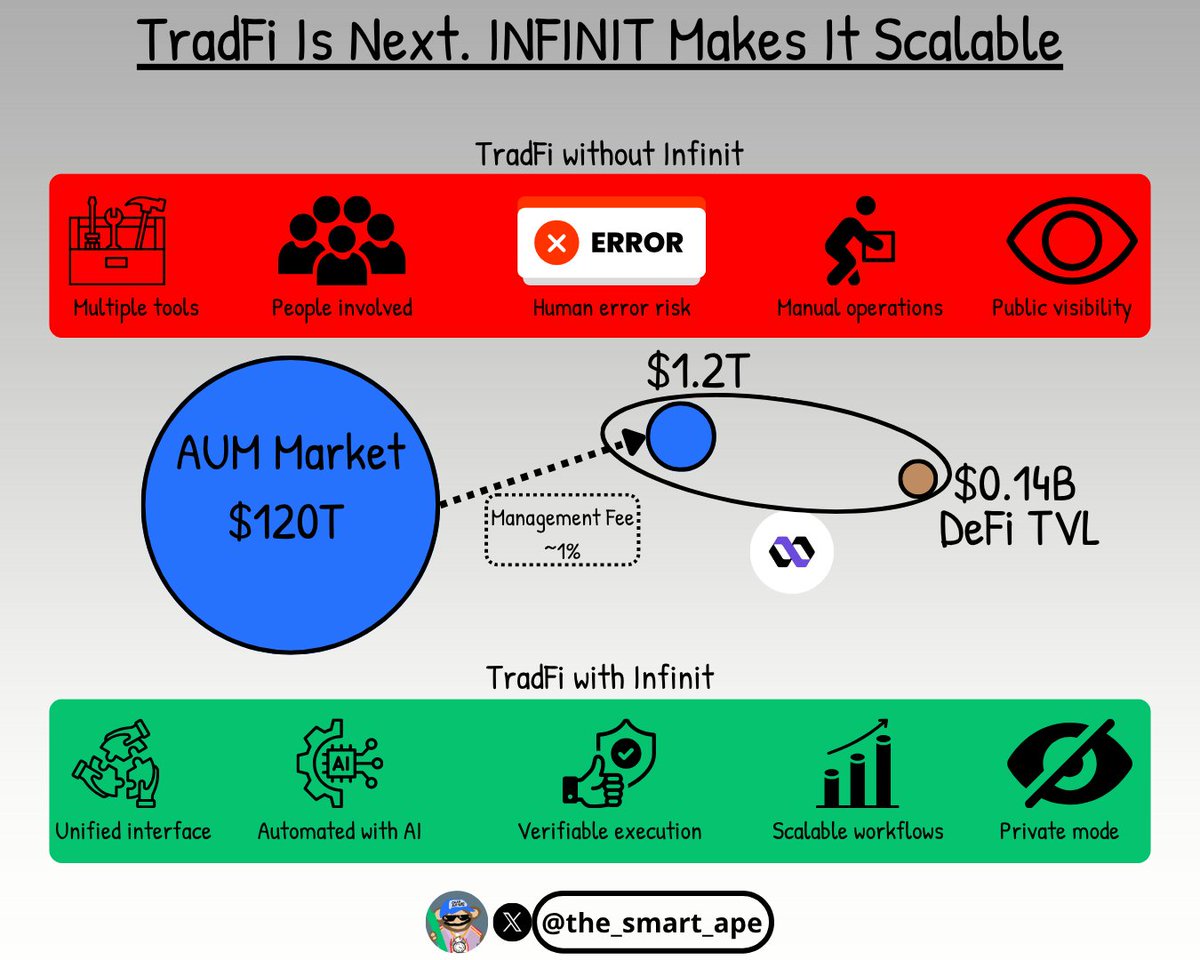

Think again! @Infinit_Labs is not just for LP farmers.

It has the potential to automate operations not only for DeFi users, but also for fund managers, VCs, and institutions.

The TradFi asset management market is massive, estimated at $XXX trillion AUM.

Managing these assets (order execution, staffing, fees, operations, etc.) costs at least X% annually, meaning over $XXX trillion in yearly costs, which is much bigger than the entire DeFi TVL (~$120B).

Now think about this, many TradFi operations mirror DeFi processes, just slower, more manual, and not code-based.

But in theory, TradFi could also benefit from a swarm of AI agents to automate complex workflows.

That’s why it’s no surprise Infinit is developing a private institutional mode tailored to TradFi.

One-click zap for a DeFi user could become a one-click bond rotation for BlackRock.

- TradFi holds over $400T in liquidity, compared to only $120B in DeFi.

It’s a market with little innovation, and Infinit is uniquely positioned to change that.

Same infrastructure, same AI agents, just applied to a different audience.

The future isn’t about TradFi or DeFi. It’s about agentic finance, and Infinit is leading it.

Today, a TradFi asset manager goes through multiple steps: research, allocation, execution.

Infinit could turn that into a single agentic sequence: You define the strategy, make it executable in one click, track it, optimize it, saving time, reducing errors, and scaling.

In short: INFINIT becomes the abstraction layer between capital and strategy.

XXXXX engagements

Related Topics asset management vcs