[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Rolf Stocks&Options [@RolfOptions](/creator/twitter/RolfOptions) on x 9646 followers Created: 2025-07-22 13:05:03 UTC IPMCC - backtest #2 I have manually backtested Income Poor Man's Covered Call (IPMCC) strategy, this time with more conservative deltas Manually backtest means actual opening the long trade and then selling short calls every week in ToS OnDemand (Schwab) Focus was on getting the premium paid for LEAPS call covered by extrinsic value gain from short call sold at around 7DTE Entries: XX delta LEAPS @$140 strike cost $XX short calls entered at ~7DTE short calls delta - around XX (0.3 calls) Exits: Closed short calls when extrinsic value lost ~80% or at the expiration day depending on conditions ___________________________ XXX days in the trade stats Stock gained XX% Total extrinsic value gains (sold to open minus bought to close) $XXXX per contract Total Short calls P&L $-XXXXX LEAPS call P&L $XXXXX Total P&L $XXXXX ___________________________ Taking into account that extrinsic value gain is part of total short call P&L, obviously extrinsic value gains could not offset losses from short positions Selling slightly out of the money (OTM) calls have produced better overall results vs ATM calls  XXXXX engagements  **Related Topics** [delta](/topic/delta) [Post Link](https://x.com/RolfOptions/status/1947644058157125809)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Rolf Stocks&Options @RolfOptions on x 9646 followers

Created: 2025-07-22 13:05:03 UTC

Rolf Stocks&Options @RolfOptions on x 9646 followers

Created: 2025-07-22 13:05:03 UTC

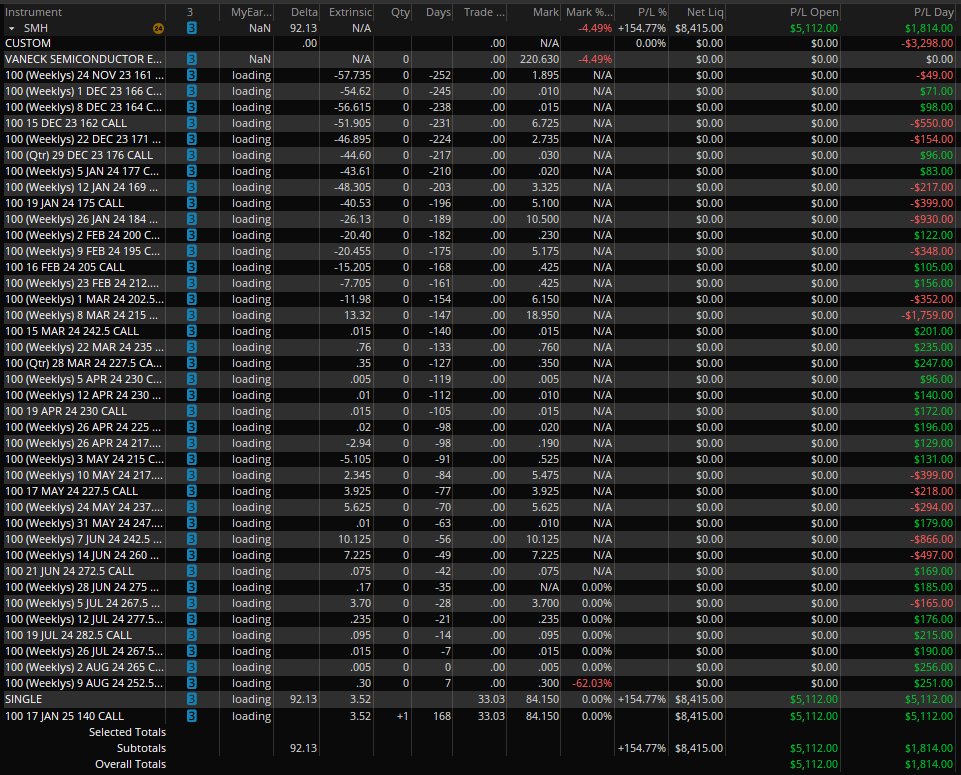

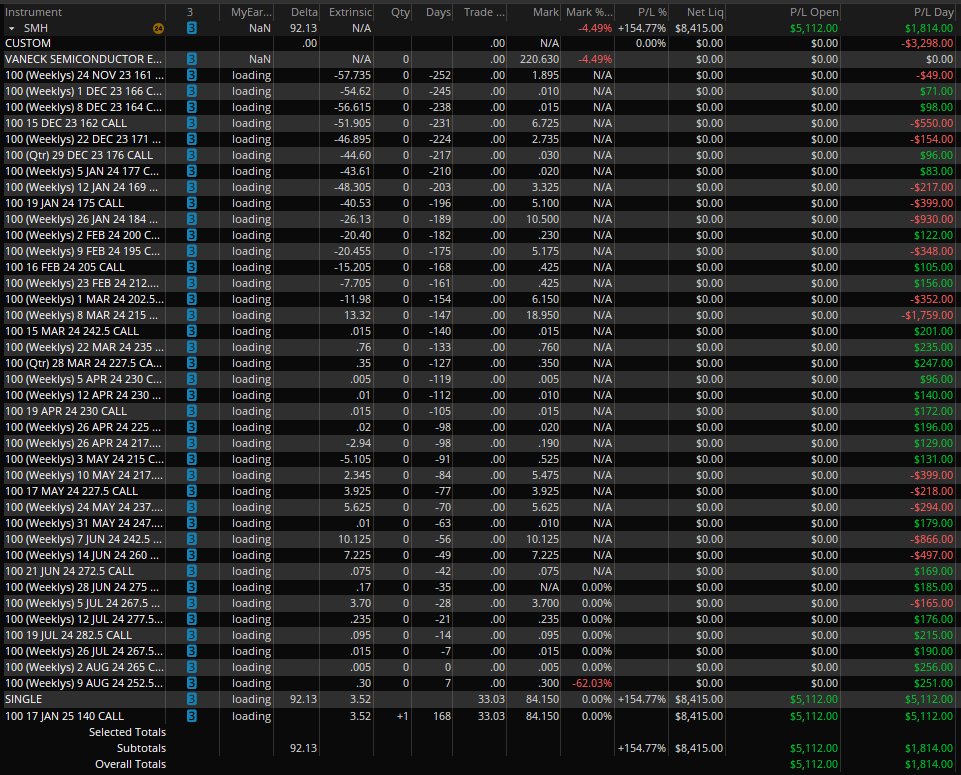

IPMCC - backtest #2

I have manually backtested Income Poor Man's Covered Call (IPMCC) strategy, this time with more conservative deltas

Manually backtest means actual opening the long trade and then selling short calls every week in ToS OnDemand (Schwab)

Focus was on getting the premium paid for LEAPS call covered by extrinsic value gain from short call sold at around 7DTE

Entries: XX delta LEAPS @$140 strike cost $XX short calls entered at ~7DTE short calls delta - around XX (0.3 calls)

Exits: Closed short calls when extrinsic value lost ~80% or at the expiration day depending on conditions

XXX days in the trade stats Stock gained XX% Total extrinsic value gains (sold to open minus bought to close) $XXXX per contract Total Short calls P&L $-XXXXX LEAPS call P&L $XXXXX

Total P&L $XXXXX

Taking into account that extrinsic value gain is part of total short call P&L, obviously extrinsic value gains could not offset losses from short positions

Selling slightly out of the money (OTM) calls have produced better overall results vs ATM calls

XXXXX engagements

Related Topics delta