[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  GLC [@GLC_Research](/creator/twitter/GLC_Research) on x 6918 followers Created: 2025-07-22 12:59:49 UTC Q2 SyrupUSDC Performance || @maplefinance ▫️SyrupUSDC, Maple’s yield-bearing dollar, delivered strong performance once again this quarter. When comparing the returns of investing an equal dollar amount at the beginning of Q2, SyrupUSDC clearly outperformed its peers, delivering a XXX% return over the period. For comparison, Aave’s yield, often used as a benchmark, returned 0.85%, while Ethena delivered 1.29%. Despite the fact that loan growth lagged behind TVL growth, which has put some downward pressure on yields, SyrupUSDC still outperformed the competition this quarter. Notably, it also outperformed in Q1, demonstrating consistent relative strength. ▫️Yield Stability and Risk-Adjusted Performance This quarter showed a slight downward trend in USDC yields, as illustrated in the graph below. While SyrupUSDC’s yield did decline modestly, it remained stable throughout the period. The product delivered more consistent returns compared to other DeFi yield options, with a standard deviation of just XXXX% over the quarter. In contrast, Aave’s yield showed a standard deviation of 0.64%, and Ethena’s was more volatile at 1.20%. This level of predictability and consistency is key ! A smoother return profile, combined with a higher overall yield, translates into stronger risk-adjusted performance. These qualities help explain why SyrupUSDC has seen such rapid adoption since the beginning of the year. It is, quite simply, a superior yield-bearing dollar compared to most options in DeFi. ▫️SyrupUSDC Risk Premium is decreasing This is one of the most interesting point of the quarter. We can clearly observe a declining risk premium for SyrupUSDC relative to Aave, which is widely regarded as the benchmark for the safest USDC yield. This suggests that market confidence in Maple is growing, with users increasingly willing to accept a lower yield in exchange for what they now perceive as lower risk. Several factors help explain this shift in sentiment: 🔸Institutional engagements: with firms like @BitwiseInvest and Cantor signal strong external validation. These deals involve deep due diligence by top-tier counterparties, which meaningfully reduces perceived risk for lenders. 🔸Flawless risk management: during multiple liquidation events. Maple has handled these scenarios with no disruptions, reinforcing trust in the platform’s operational resilience. 🔸Instant liquidity on SyrupUSDC: allowing users to withdraw funds quickly and efficiently. This liquidity feature materially reduces the perceived risk associated with locking capital. 🔸Brand momentum: Maple’s visibility and recognition have grown significantly this quarter, bringing greater awareness and confidence from both retail and institutional participants. This analysis is an excerpt from our quarterly report, a comprehensive breakdown of Maple Finance's performance in Q2, produced in collaboration with @OAK_Res_EN ! Quarterly report in the first comment👇  XXXXXX engagements  **Related Topics** [investment](/topic/investment) [money](/topic/money) [maplefinance](/topic/maplefinance) [glc](/topic/glc) [Post Link](https://x.com/GLC_Research/status/1947642739627090378)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

GLC @GLC_Research on x 6918 followers

Created: 2025-07-22 12:59:49 UTC

GLC @GLC_Research on x 6918 followers

Created: 2025-07-22 12:59:49 UTC

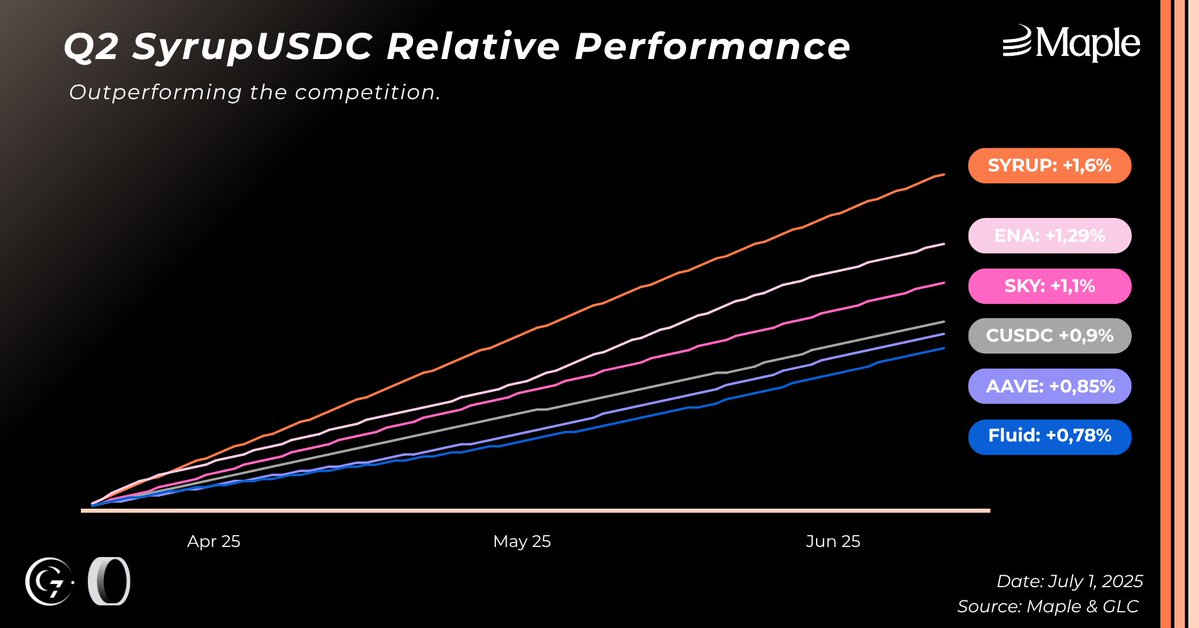

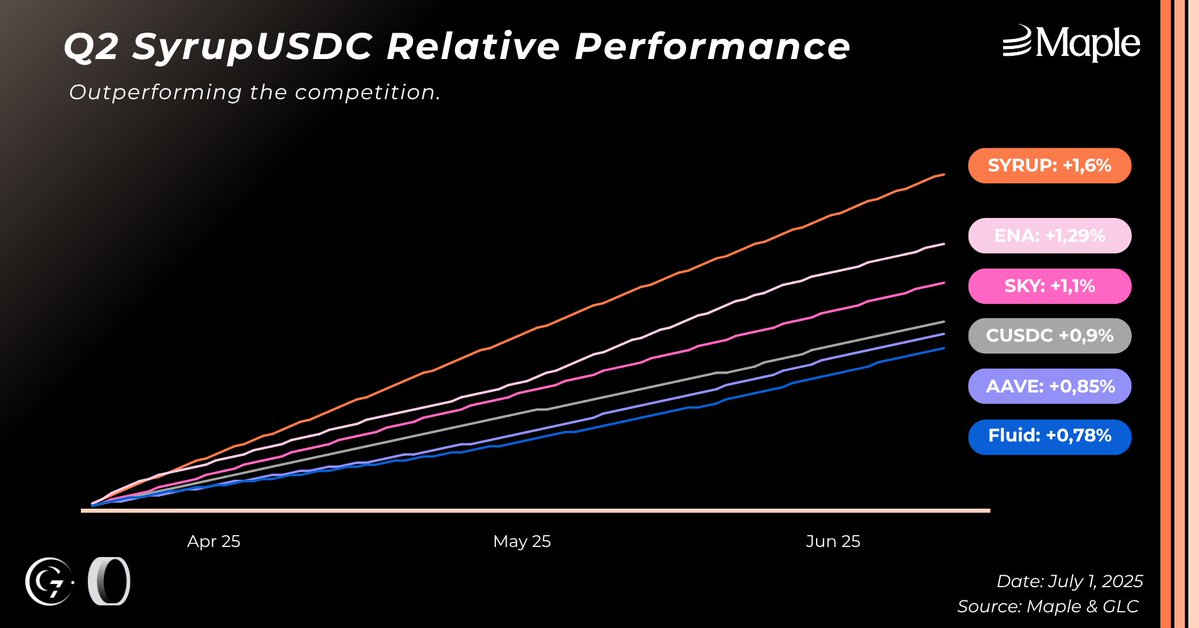

Q2 SyrupUSDC Performance || @maplefinance

▫️SyrupUSDC, Maple’s yield-bearing dollar, delivered strong performance once again this quarter.

When comparing the returns of investing an equal dollar amount at the beginning of Q2, SyrupUSDC clearly outperformed its peers, delivering a XXX% return over the period.

For comparison, Aave’s yield, often used as a benchmark, returned 0.85%, while Ethena delivered 1.29%.

Despite the fact that loan growth lagged behind TVL growth, which has put some downward pressure on yields, SyrupUSDC still outperformed the competition this quarter.

Notably, it also outperformed in Q1, demonstrating consistent relative strength.

▫️Yield Stability and Risk-Adjusted Performance

This quarter showed a slight downward trend in USDC yields, as illustrated in the graph below.

While SyrupUSDC’s yield did decline modestly, it remained stable throughout the period.

The product delivered more consistent returns compared to other DeFi yield options, with a standard deviation of just XXXX% over the quarter.

In contrast, Aave’s yield showed a standard deviation of 0.64%, and Ethena’s was more volatile at 1.20%.

This level of predictability and consistency is key !

A smoother return profile, combined with a higher overall yield, translates into stronger risk-adjusted performance.

These qualities help explain why SyrupUSDC has seen such rapid adoption since the beginning of the year. It is, quite simply, a superior yield-bearing dollar compared to most options in DeFi.

▫️SyrupUSDC Risk Premium is decreasing

This is one of the most interesting point of the quarter. We can clearly observe a declining risk premium for SyrupUSDC relative to Aave, which is widely regarded as the benchmark for the safest USDC yield.

This suggests that market confidence in Maple is growing, with users increasingly willing to accept a lower yield in exchange for what they now perceive as lower risk.

Several factors help explain this shift in sentiment:

🔸Institutional engagements: with firms like @BitwiseInvest and Cantor signal strong external validation. These deals involve deep due diligence by top-tier counterparties, which meaningfully reduces perceived risk for lenders.

🔸Flawless risk management: during multiple liquidation events. Maple has handled these scenarios with no disruptions, reinforcing trust in the platform’s operational resilience.

🔸Instant liquidity on SyrupUSDC: allowing users to withdraw funds quickly and efficiently. This liquidity feature materially reduces the perceived risk associated with locking capital.

🔸Brand momentum: Maple’s visibility and recognition have grown significantly this quarter, bringing greater awareness and confidence from both retail and institutional participants.

This analysis is an excerpt from our quarterly report, a comprehensive breakdown of Maple Finance's performance in Q2, produced in collaboration with @OAK_Res_EN !

Quarterly report in the first comment👇

XXXXXX engagements

Related Topics investment money maplefinance glc