[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Eagle Investors [@EagleInvestors](/creator/twitter/EagleInvestors) on x XXX followers Created: 2025-07-22 12:09:15 UTC 🛩️ Lockheed Martin ($LMT) Q2 2025 Earnings Recap 🚀 Defense giant Lockheed Martin delivered a strong EPS beat but missed on revenue and lowered full-year earnings guidance after taking $1.6B in pre-tax charges. 📊 Q2 Highlights: EPS (Adj.): $XXXX vs. $XXXX est ✅ Revenue: $18.16B vs. $18.54B est ❌ GAAP EPS: $XXXX (↓ XX% Y/Y) due to charges ❌ Backlog: $166.5B, +5.2% Y/Y ✅ 📅 FY25 Outlook: Revenue: $73.75–$74.75B (Reaffirmed) ✅ EPS: Lowered to $21.70–$22.00 vs. prior $27+ ❌ Free Cash Flow: Reaffirmed at $6.6B–$6.8B ✅ 🧾 Operating margin fell sharply to 4.1%, down from XXXX% a year ago. Free cash flow turned negative at -$150M vs. $1.5B last year. Despite solid product demand and a growing backlog, execution and cost pressures weighed on the quarter. Stock dropped over X% post-earnings. #LockheedMartin #LMT #EarningsRecap #AerospaceDefense #StockMarket #EPSBeat #DefenseStocks #MilitarySpending #BacklogGrowth #F35 #EarningsSeason #CashFlow #WallStreet #Investing  XX engagements  **Related Topics** [lmt](/topic/lmt) [$1665b](/topic/$1665b) [$1854b](/topic/$1854b) [$1816b](/topic/$1816b) [$16b](/topic/$16b) [quarterly earnings](/topic/quarterly-earnings) [eagle](/topic/eagle) [lockheed martin](/topic/lockheed-martin) [Post Link](https://x.com/EagleInvestors/status/1947630015505416418)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-22 12:09:15 UTC

Eagle Investors @EagleInvestors on x XXX followers

Created: 2025-07-22 12:09:15 UTC

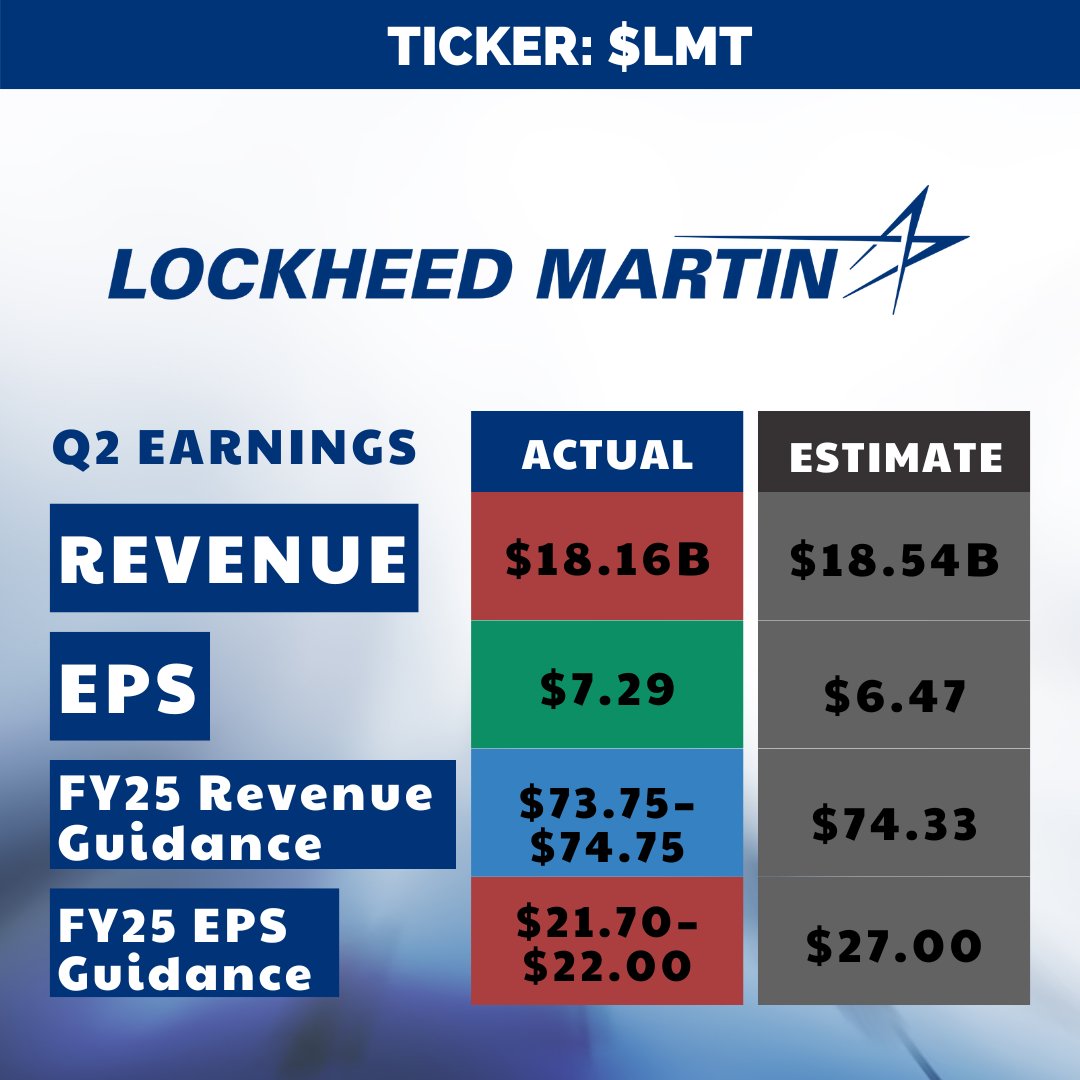

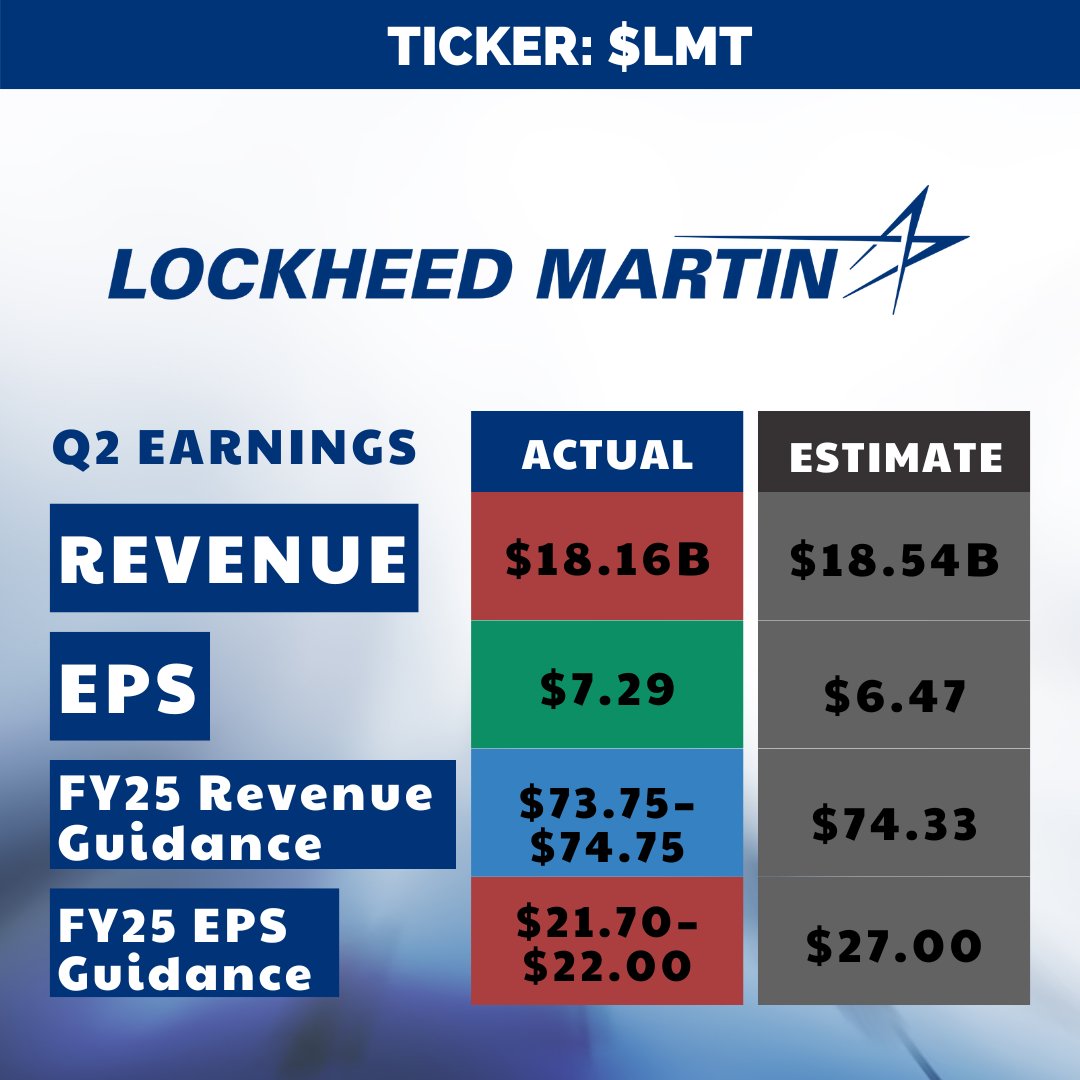

🛩️ Lockheed Martin ($LMT) Q2 2025 Earnings Recap 🚀 Defense giant Lockheed Martin delivered a strong EPS beat but missed on revenue and lowered full-year earnings guidance after taking $1.6B in pre-tax charges.

📊 Q2 Highlights: EPS (Adj.): $XXXX vs. $XXXX est ✅ Revenue: $18.16B vs. $18.54B est ❌ GAAP EPS: $XXXX (↓ XX% Y/Y) due to charges ❌ Backlog: $166.5B, +5.2% Y/Y ✅

📅 FY25 Outlook: Revenue: $73.75–$74.75B (Reaffirmed) ✅ EPS: Lowered to $21.70–$22.00 vs. prior $27+ ❌ Free Cash Flow: Reaffirmed at $6.6B–$6.8B ✅

🧾 Operating margin fell sharply to 4.1%, down from XXXX% a year ago. Free cash flow turned negative at -$150M vs. $1.5B last year.

Despite solid product demand and a growing backlog, execution and cost pressures weighed on the quarter. Stock dropped over X% post-earnings.

#LockheedMartin #LMT #EarningsRecap #AerospaceDefense #StockMarket #EPSBeat #DefenseStocks #MilitarySpending #BacklogGrowth #F35 #EarningsSeason #CashFlow #WallStreet #Investing

XX engagements

Related Topics lmt $1665b $1854b $1816b $16b quarterly earnings eagle lockheed martin