[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-22 11:42:12 UTC 🇺🇸 Lattice Semiconductor Corp (Valuation - Very Expensive) US Stocks: Lattice Semiconductor Corp has a total darwin score of -X and there are X alerts. The valuation ratios for Lattice Semiconductor Corp indicate a premium pricing relative to its peers. The forward P/E ratio is 50.0, significantly higher than the peer average of 30.5, while the trailing P/E ratio is XXXXX compared to a peer average of XXXX. The enterprise value to EBITDA ratio is also high at 75.1, against a peer average of XXXX. Furthermore, the price-to-sales ratio of XXXX is more than double the peer average of XXX. These metrics suggest that the stock is priced at a premium, indicating that investors are paying more for each unit of earnings and sales compared to similar companies, leading to a 'very expensive' valuation rating. #DarwinKnows #LatticeSemiconductor #LSCC $LSCC #FreeTrialAvailable #AskDarwin #StockToWatch  XX engagements  **Related Topics** [stocks](/topic/stocks) [$0981hk](/topic/$0981hk) [Post Link](https://x.com/Darwin_Knows/status/1947623206602322246)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-22 11:42:12 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-22 11:42:12 UTC

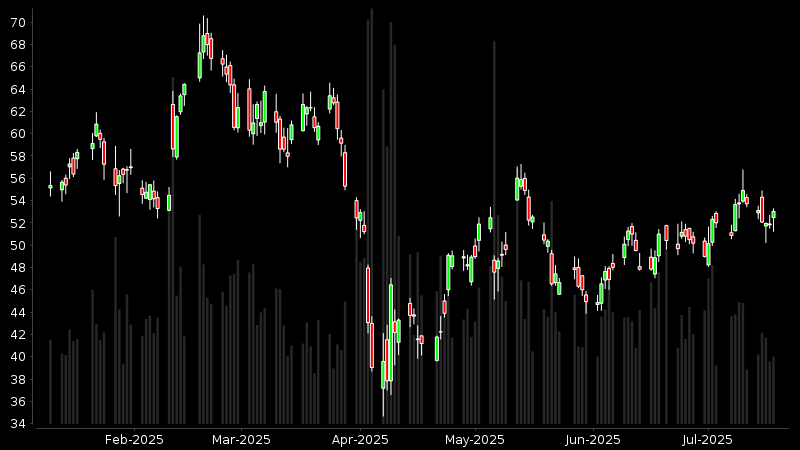

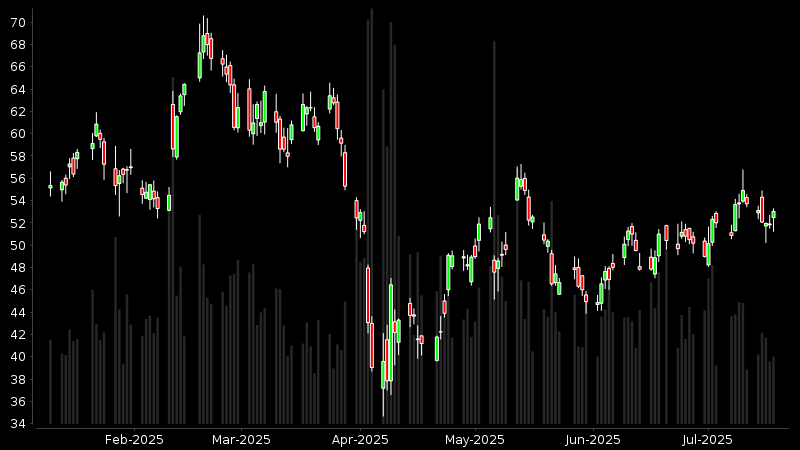

🇺🇸 Lattice Semiconductor Corp (Valuation - Very Expensive)

US Stocks: Lattice Semiconductor Corp has a total darwin score of -X and there are X alerts.

The valuation ratios for Lattice Semiconductor Corp indicate a premium pricing relative to its peers. The forward P/E ratio is 50.0, significantly higher than the peer average of 30.5, while the trailing P/E ratio is XXXXX compared to a peer average of XXXX. The enterprise value to EBITDA ratio is also high at 75.1, against a peer average of XXXX. Furthermore, the price-to-sales ratio of XXXX is more than double the peer average of XXX. These metrics suggest that the stock is priced at a premium, indicating that investors are paying more for each unit of earnings and sales compared to similar companies, leading to a 'very expensive' valuation rating.

#DarwinKnows #LatticeSemiconductor #LSCC $LSCC

#FreeTrialAvailable #AskDarwin #StockToWatch

XX engagements