[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Marvin Labs [@marvin_labs](/creator/twitter/marvin_labs) on x XXX followers Created: 2025-07-22 10:35:34 UTC $NXPI 2Q-2025: Falling revenue signals continued semiconductor sector headwinds despite tech cycle hopes. * Revenue: $2.93B, down X% year-on-year and below the consensus expectation of $3.04B * Adjusted EPS: $2.72, down from 2Q-2024 and missing the $XXXX expectation * GAAP gross margin: 53.4%; adjusted operating margin: XXXX% * Free cash flow: $696M; capital returned during the quarter was $461M Year-on-year drops in both revenue and adjusted earnings point to ongoing demand pressure in NXP’s major markets. Margin preservation signals cost discipline, but slow top-line growth risks long-term upside. Earnings call scheduled for today at 08:00 am EDT.  XX engagements  **Related Topics** [$696m](/topic/$696m) [cash flow](/topic/cash-flow) [eps](/topic/eps) [$304b](/topic/$304b) [$293b](/topic/$293b) [$0981hk](/topic/$0981hk) [signals](/topic/signals) [$nxpi](/topic/$nxpi) [Post Link](https://x.com/marvin_labs/status/1947606439008129189)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-22 10:35:34 UTC

Marvin Labs @marvin_labs on x XXX followers

Created: 2025-07-22 10:35:34 UTC

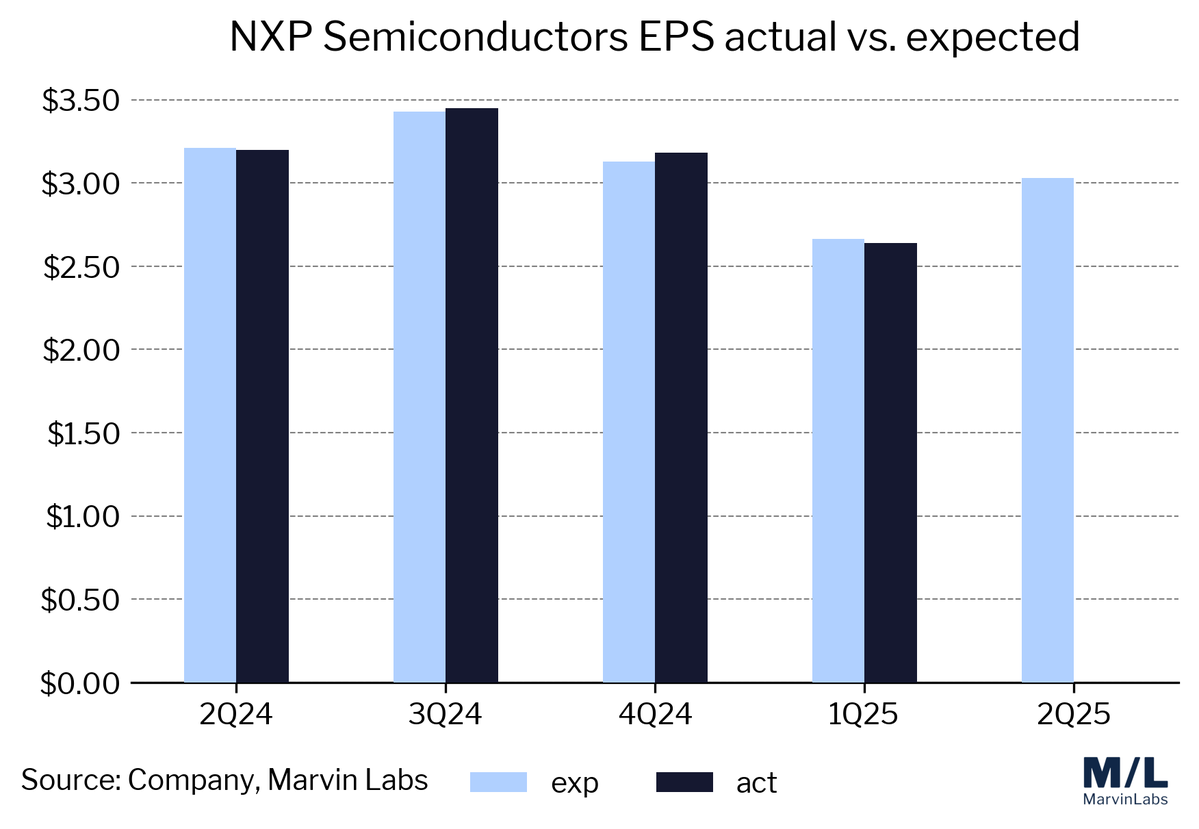

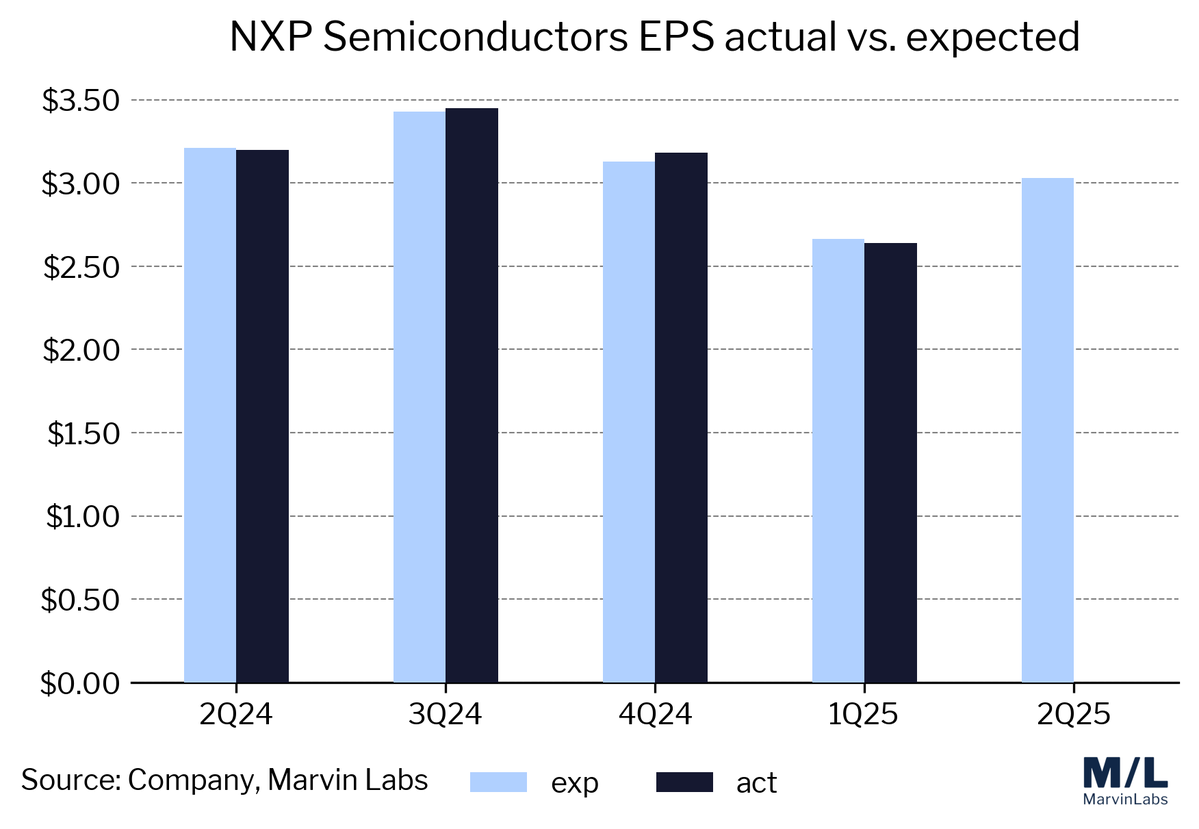

$NXPI 2Q-2025: Falling revenue signals continued semiconductor sector headwinds despite tech cycle hopes.

- Revenue: $2.93B, down X% year-on-year and below the consensus expectation of $3.04B

- Adjusted EPS: $2.72, down from 2Q-2024 and missing the $XXXX expectation

- GAAP gross margin: 53.4%; adjusted operating margin: XXXX%

- Free cash flow: $696M; capital returned during the quarter was $461M

Year-on-year drops in both revenue and adjusted earnings point to ongoing demand pressure in NXP’s major markets. Margin preservation signals cost discipline, but slow top-line growth risks long-term upside.

Earnings call scheduled for today at 08:00 am EDT.

XX engagements

Related Topics $696m cash flow eps $304b $293b $0981hk signals $nxpi