[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Mr. Butler.hl [@AlanMayordomo](/creator/twitter/AlanMayordomo) on x XXX followers Created: 2025-07-22 07:52:16 UTC GM, gPiP! Update after 96h: Looks like @prjx_hl is embracing volatility and has slightly closed the gap with Hyperswap in terms of fees generated over the last 24h. As @BOBBYBIGYIELD pointed out yesterday, since @prjx_hl is a newer protocol, many LPs tend to choose tighter ranges, concentrating fees more densely, as long as price stays within those ranges. In my case, yesterday’s volatility played in my favor. While many likely got pushed out of range, I kept farming thanks to a wider price band I had set from the start. It’s a good reminder: it’s not just about maximizing points. The real move is to use the protocol organically, earn consistent yield and stack points. That way, you’re not counting on the airdrop to cover losses later. Here are the updated numbers after 96h of LPing on both @HyperliquidX DEXs 👇 @prjx_hl : $XXXXX → 0.451%/day @HyperSwapX : $XXXXX → 0.497%/day 📈 Daily yield improvement vs 72h: @prjx_hl : +5.6% @HyperSwapX : +5.5%  XXXXX engagements  **Related Topics** [hyperswapx](/topic/hyperswapx) [protocol](/topic/protocol) [generated](/topic/generated) [hyperswap](/topic/hyperswap) [volatility](/topic/volatility) [Post Link](https://x.com/AlanMayordomo/status/1947565343058100707)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Mr. Butler.hl @AlanMayordomo on x XXX followers

Created: 2025-07-22 07:52:16 UTC

Mr. Butler.hl @AlanMayordomo on x XXX followers

Created: 2025-07-22 07:52:16 UTC

GM, gPiP!

Update after 96h:

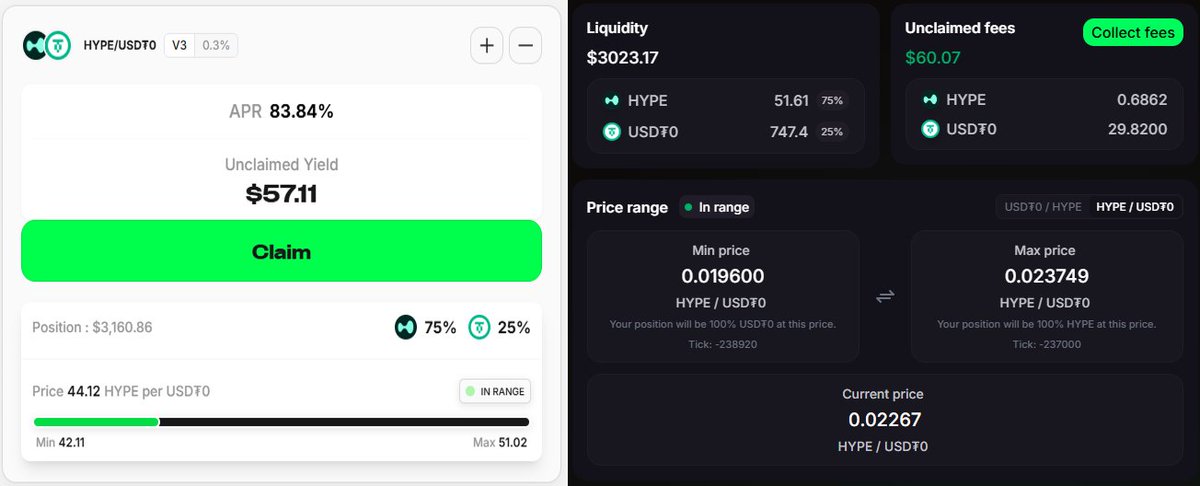

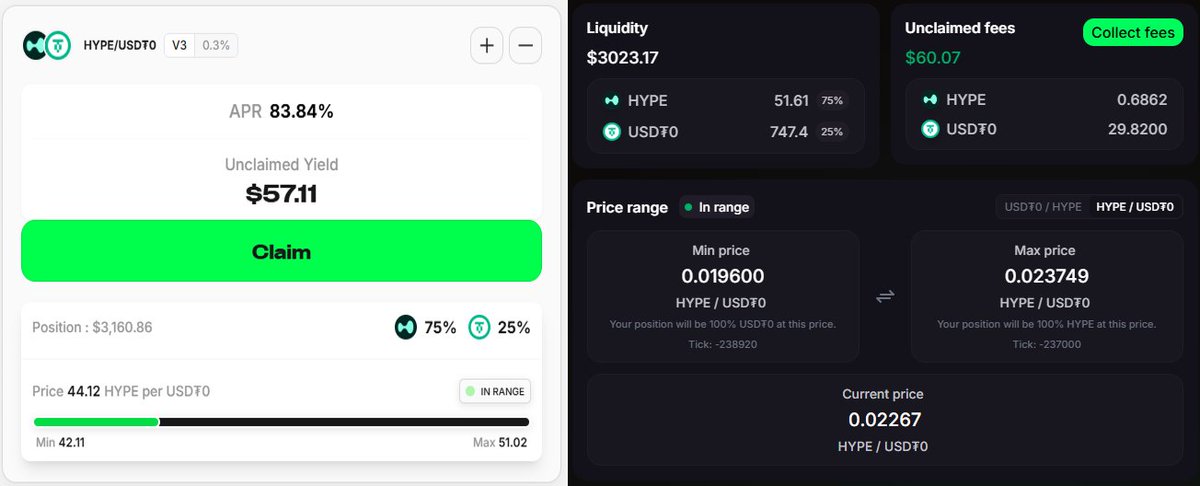

Looks like @prjx_hl is embracing volatility and has slightly closed the gap with Hyperswap in terms of fees generated over the last 24h. As @BOBBYBIGYIELD pointed out yesterday, since @prjx_hl is a newer protocol, many LPs tend to choose tighter ranges, concentrating fees more densely, as long as price stays within those ranges.

In my case, yesterday’s volatility played in my favor. While many likely got pushed out of range, I kept farming thanks to a wider price band I had set from the start.

It’s a good reminder: it’s not just about maximizing points. The real move is to use the protocol organically, earn consistent yield and stack points. That way, you’re not counting on the airdrop to cover losses later.

Here are the updated numbers after 96h of LPing on both @HyperliquidX DEXs 👇

@prjx_hl : $XXXXX → 0.451%/day @HyperSwapX : $XXXXX → 0.497%/day 📈 Daily yield improvement vs 72h: @prjx_hl : +5.6% @HyperSwapX : +5.5%

XXXXX engagements

Related Topics hyperswapx protocol generated hyperswap volatility