[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  All0ysius🥷 [@alloysiusX](/creator/twitter/alloysiusX) on x 1758 followers Created: 2025-07-22 05:29:39 UTC 💰$INJ Net Inflows Surge Past $155M; Now a Top X Ecosystem by Capital Flow. Over the last X months, @injective has witnessed an impressive net inflow of over $XXX million, with $XXXXX million of that flowing in just this past quarter alone. This massive surge in capital places @Injective as the 3rd-ranked blockchain by net inflows, overtaking major players like Worldchain. It shows growing institutional and retail confidence in Injective’s ecosystem, its products, and its long-term viability as a DeFi-native Layer X chain. The capital inflows reflect the increasing demand for high-performance DeFi platforms with real utility and sustainable token economics. Now imagine what happens when the world’s first $INJ Staked ETF officially goes live. Why This Matters: X. Staked ETF = Institutional Onboarding • The Injective Staked #ETF will allow traditional investors to gain exposure to $INJ while earning passive staking rewards without ever touching a wallet or interacting with DeFi protocols. • This lowers the barrier to entry and brings in a new wave of institutional liquidity. X. More Inflows, Stronger Fundamentals • As more capital flows into the ecosystem, Injective’s network utility, developer incentives, and protocol adoption all strengthen. This creates a flywheel of growth: more users → more apps → more value → more inflows. X. Security and Staking Rewards • A staked #ETF means more tokens will be locked up and actively securing the network, enhancing both decentralization and protocol robustness, while distributing staking yield to ETF holders. X. Ecosystem Expansion • Injective is not just a token, it’s a rapidly growing ecosystem with projects in DeFi, RWAs, AI, and onchain finance. Increased inflows will support builders and liquidity providers, fostering faster innovation and adoption. This is a pivotal moment guys. $INJ is no longer just a speculative asset it’s becoming a core infrastructure asset for the new financial internet. And you shouldn’t miss out on it.  XXXXX engagements  **Related Topics** [inj](/topic/inj) [blockchain](/topic/blockchain) [$155m](/topic/$155m) [surge](/topic/surge) [$inj](/topic/$inj) [coins layer 1](/topic/coins-layer-1) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/alloysiusX/status/1947529451493069197)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

All0ysius🥷 @alloysiusX on x 1758 followers

Created: 2025-07-22 05:29:39 UTC

All0ysius🥷 @alloysiusX on x 1758 followers

Created: 2025-07-22 05:29:39 UTC

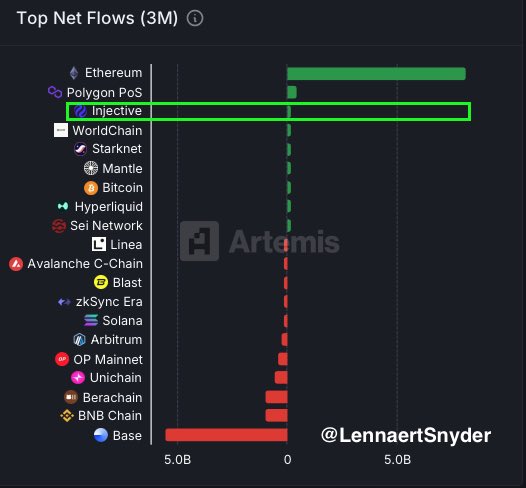

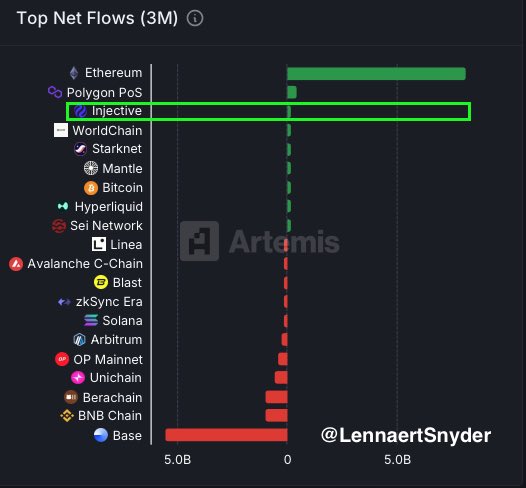

💰$INJ Net Inflows Surge Past $155M; Now a Top X Ecosystem by Capital Flow.

Over the last X months, @injective has witnessed an impressive net inflow of over $XXX million, with $XXXXX million of that flowing in just this past quarter alone. This massive surge in capital places @Injective as the 3rd-ranked blockchain by net inflows, overtaking major players like Worldchain.

It shows growing institutional and retail confidence in Injective’s ecosystem, its products, and its long-term viability as a DeFi-native Layer X chain. The capital inflows reflect the increasing demand for high-performance DeFi platforms with real utility and sustainable token economics.

Now imagine what happens when the world’s first $INJ Staked ETF officially goes live.

Why This Matters: X. Staked ETF = Institutional Onboarding • The Injective Staked #ETF will allow traditional investors to gain exposure to $INJ while earning passive staking rewards without ever touching a wallet or interacting with DeFi protocols.

• This lowers the barrier to entry and brings in a new wave of institutional liquidity.

X. More Inflows, Stronger Fundamentals • As more capital flows into the ecosystem, Injective’s network utility, developer incentives, and protocol adoption all strengthen. This creates a flywheel of growth: more users → more apps → more value → more inflows.

X. Security and Staking Rewards • A staked #ETF means more tokens will be locked up and actively securing the network, enhancing both decentralization and protocol robustness, while distributing staking yield to ETF holders.

X. Ecosystem Expansion • Injective is not just a token, it’s a rapidly growing ecosystem with projects in DeFi, RWAs, AI, and onchain finance. Increased inflows will support builders and liquidity providers, fostering faster innovation and adoption.

This is a pivotal moment guys. $INJ is no longer just a speculative asset it’s becoming a core infrastructure asset for the new financial internet.

And you shouldn’t miss out on it.

XXXXX engagements

Related Topics inj blockchain $155m surge $inj coins layer 1 coins defi coins made in usa