[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ryan [@ryQuant](/creator/twitter/ryQuant) on x 8551 followers Created: 2025-07-22 04:23:34 UTC $MSTR Net Growth Rate = XX% This is a rough framework for how I value @Strategy's net growth rate. I plan on further developing this overtime. I add our BTC price CAGR projection to MSTR's *YoY BTC per share CAGR, *intentionally starting with ~70k BTC instead of ~20k. Then I subtract out the dividend payments, and subtract from that the M2-adjusted decay of the dividends. (which are almost certainly going to be paid for with $MSTR class A_ATM) This bring us to the XX% net growth rate number. A company growing at XX% can conservatively trade at a 30x PE ratio, which brings me to my own subjective fair value of $XXXXX a share. This is absolutely not financial advice. This is a thought experiment.  XXXXXX engagements  **Related Topics** [mstr](/topic/mstr) [dividend](/topic/dividend) [$mstr](/topic/$mstr) [strategy](/topic/strategy) [stocks financial services](/topic/stocks-financial-services) [stocks technology](/topic/stocks-technology) [stocks bitcoin treasuries](/topic/stocks-bitcoin-treasuries) [bitcoin](/topic/bitcoin) [Post Link](https://x.com/ryQuant/status/1947512822104998034)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ryan @ryQuant on x 8551 followers

Created: 2025-07-22 04:23:34 UTC

Ryan @ryQuant on x 8551 followers

Created: 2025-07-22 04:23:34 UTC

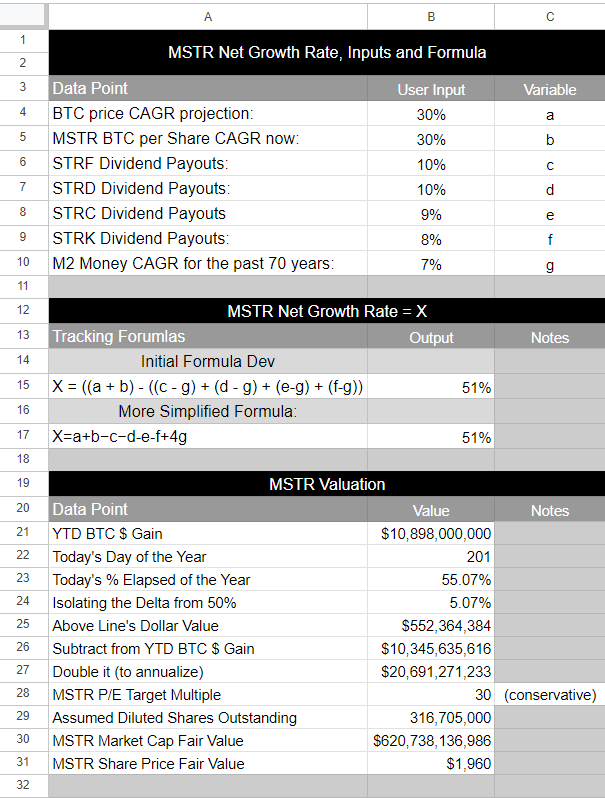

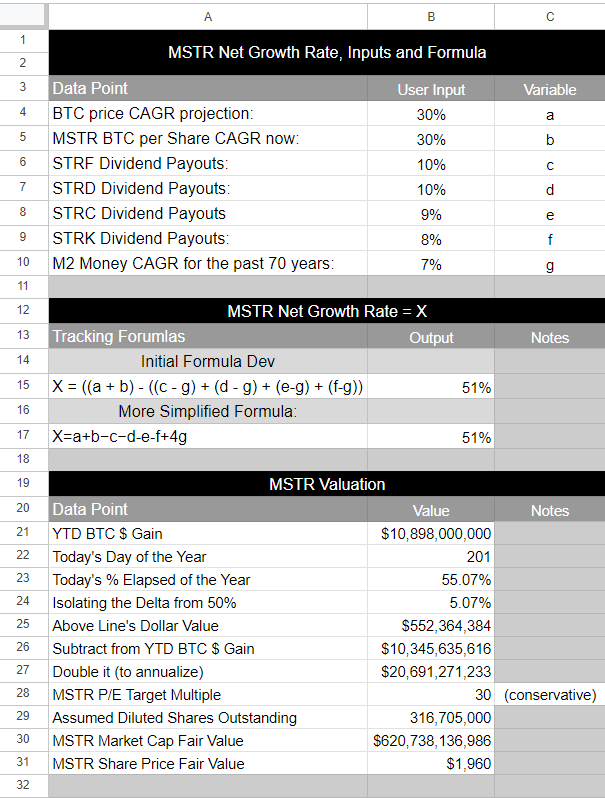

$MSTR Net Growth Rate = XX%

This is a rough framework for how I value @Strategy's net growth rate. I plan on further developing this overtime.

I add our BTC price CAGR projection to MSTR's *YoY BTC per share CAGR, *intentionally starting with ~70k BTC instead of ~20k. Then I subtract out the dividend payments, and subtract from that the M2-adjusted decay of the dividends. (which are almost certainly going to be paid for with $MSTR class A_ATM)

This bring us to the XX% net growth rate number. A company growing at XX% can conservatively trade at a 30x PE ratio, which brings me to my own subjective fair value of $XXXXX a share.

This is absolutely not financial advice. This is a thought experiment.

XXXXXX engagements

Related Topics mstr dividend $mstr strategy stocks financial services stocks technology stocks bitcoin treasuries bitcoin