[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Bubbafox [@bob4punk](/creator/twitter/bob4punk) on x 23.7K followers Created: 2025-07-22 00:27:24 UTC $Link The stars are aligning..... When SWIFT begins using Chainlink’s CCIP (Cross-Chain Interoperability Protocol) in production, it significantly raises the likelihood that the DTCC will also adopt Chainlink infrastructure. This has to do with how closely these two institutions are connected within the financial system, and how infrastructure upgrades tend to cascade across interoperating entities. SWIFT is responsible for the global messaging layer of finance — it doesn’t move money or settle trades directly, but it transmits the instructions between institutions. DTCC, by contrast, is one of the largest post-trade settlement organizations in the world. It maintains the official records of ownership for securities and ensures trades are cleared and finalized properly. In other words, SWIFT handles the "what to do" instructions, while DTCC handles the "official record" of what happened. Because DTCC and its participants already rely on SWIFT for trade messaging and confirmation, if SWIFT begins to route messages over Chainlink’s CCIP — particularly for tokenized asset instructions or cross-chain compliance data — then DTCC will likely need to align with the same messaging standards to avoid operational fragmentation. Discrepancies between how instructions are sent (via Chainlink) and how settlement is recorded (on legacy systems) could introduce errors or inefficiencies, especially in a world where real-time settlement and programmability are increasingly important. Further reinforcing this likelihood is the fact that GLEIF (Global Legal Entity Identifier Foundation), which helps manage trusted legal identities in finance, is also working with Chainlink to provide on-chain verification services. If both SWIFT and GLEIF are utilizing Chainlink’s infrastructure, the DTCC would face increasing pressure — both from an integration standpoint and an industry standards perspective — to adopt similar rails. The financial system prefers interoperability and consistent standards to ensure reliability, compliance, and efficiency. It’s worth noting that the DTCC has already shown interest in blockchain-based systems, through initiatives like Project Ion, and has explored distributed ledger solutions for post-trade processing. So if key upstream players like SWIFT are already beginning to utilize Chainlink, DTCC wouldn’t be starting from scratch — they’d be plugging into an existing, maturing framework that’s becoming increasingly aligned across the industry. In summary, yes — SWIFT going live with Chainlink would strongly increase the likelihood of DTCC following, not because they’re directly tied, but because they operate in a shared system where interoperability, consistency, and standardization are critical. As Chainlink infrastructure becomes more embedded across identity, messaging, and tokenized asset instructions, it will become more practical — and likely necessary — for DTCC and other critical institutions to align with those same standards.  XXXXX engagements  **Related Topics** [cascade](/topic/cascade) [protocol](/topic/protocol) [coins interoperability](/topic/coins-interoperability) [swift](/topic/swift) [$link](/topic/$link) [chainlink](/topic/chainlink) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/bob4punk/status/1947453390826643616)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Bubbafox @bob4punk on x 23.7K followers

Created: 2025-07-22 00:27:24 UTC

Bubbafox @bob4punk on x 23.7K followers

Created: 2025-07-22 00:27:24 UTC

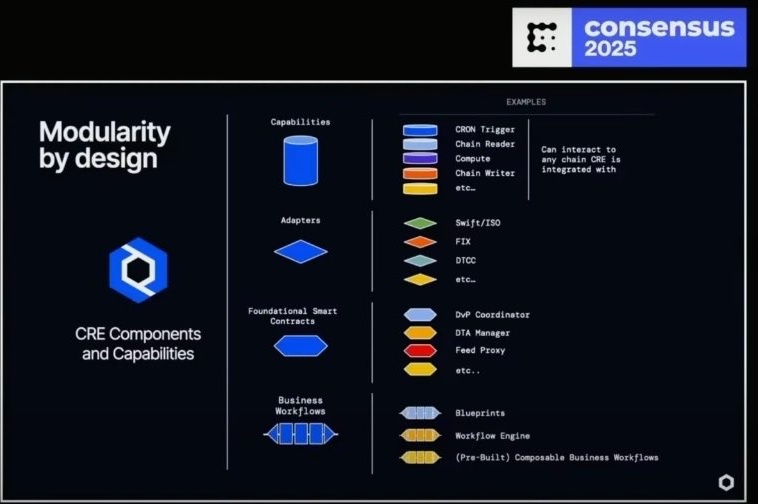

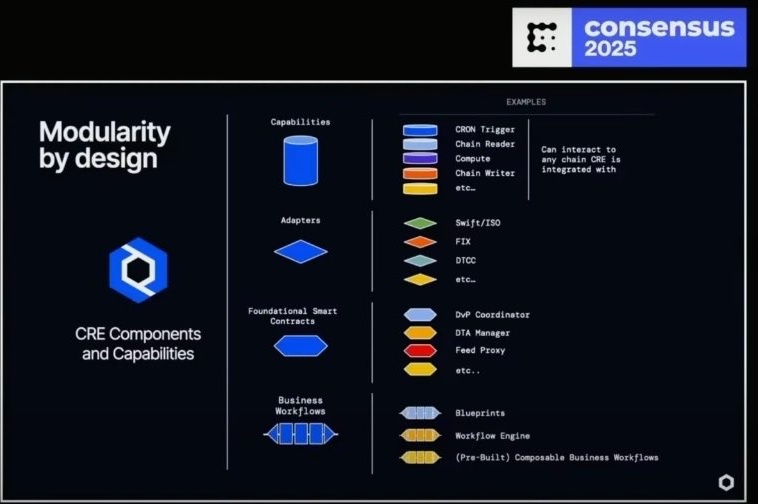

$Link The stars are aligning..... When SWIFT begins using Chainlink’s CCIP (Cross-Chain Interoperability Protocol) in production, it significantly raises the likelihood that the DTCC will also adopt Chainlink infrastructure. This has to do with how closely these two institutions are connected within the financial system, and how infrastructure upgrades tend to cascade across interoperating entities.

SWIFT is responsible for the global messaging layer of finance — it doesn’t move money or settle trades directly, but it transmits the instructions between institutions. DTCC, by contrast, is one of the largest post-trade settlement organizations in the world. It maintains the official records of ownership for securities and ensures trades are cleared and finalized properly. In other words, SWIFT handles the "what to do" instructions, while DTCC handles the "official record" of what happened.

Because DTCC and its participants already rely on SWIFT for trade messaging and confirmation, if SWIFT begins to route messages over Chainlink’s CCIP — particularly for tokenized asset instructions or cross-chain compliance data — then DTCC will likely need to align with the same messaging standards to avoid operational fragmentation. Discrepancies between how instructions are sent (via Chainlink) and how settlement is recorded (on legacy systems) could introduce errors or inefficiencies, especially in a world where real-time settlement and programmability are increasingly important.

Further reinforcing this likelihood is the fact that GLEIF (Global Legal Entity Identifier Foundation), which helps manage trusted legal identities in finance, is also working with Chainlink to provide on-chain verification services. If both SWIFT and GLEIF are utilizing Chainlink’s infrastructure, the DTCC would face increasing pressure — both from an integration standpoint and an industry standards perspective — to adopt similar rails. The financial system prefers interoperability and consistent standards to ensure reliability, compliance, and efficiency.

It’s worth noting that the DTCC has already shown interest in blockchain-based systems, through initiatives like Project Ion, and has explored distributed ledger solutions for post-trade processing. So if key upstream players like SWIFT are already beginning to utilize Chainlink, DTCC wouldn’t be starting from scratch — they’d be plugging into an existing, maturing framework that’s becoming increasingly aligned across the industry.

In summary, yes — SWIFT going live with Chainlink would strongly increase the likelihood of DTCC following, not because they’re directly tied, but because they operate in a shared system where interoperability, consistency, and standardization are critical. As Chainlink infrastructure becomes more embedded across identity, messaging, and tokenized asset instructions, it will become more practical — and likely necessary — for DTCC and other critical institutions to align with those same standards.

XXXXX engagements

Related Topics cascade protocol coins interoperability swift $link chainlink coins defi coins made in usa