[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Andy ττ [@bittingthembits](/creator/twitter/bittingthembits) on x 8337 followers Created: 2025-07-22 00:23:53 UTC Chutes (SN-64) token can melt faces with just a little buy-pressure. Why I think so? $TAO bull run pulls every subnet token higher, often by a bigger percentage than $TAO itself. Cause It’s like a high-octane micro-economy with math that punishes sellers and rewards conviction over time. An AMM pool always keeps the product X · Y = k X = $TAO units in the pool Y = $CHUTE units in the pool At equilibrium the dollar value on each side is roughly XX : XX. Float ≠ Supply • Circulating CHUTE: ONLY XXXX M (≈ X % of max) • Actually sitting in the pool XXX K CHUTE • Price mechanic: P = TAO_in_pool / CHUTE_in_pool CHUTE USD price jumpsThe pool “imports” the a $TAO rally. Even if no one buys CHUTE with dollars directly, its $TAO-denominated price doubles, so USD price ≈ doubles too. Less CHUTE → price up exponentially. Liquidity is thin Pool ratio today: XXXX % TAO / XXXX % CHUTE. One decent market order drains the curve and slaps on double-digit slippage. Translation? The chart can go vertical real quick. Emission trickles in. Chutes earns ~13 % of network emissions. Sounds big right? That’s XXX $TAO/day now → XXX $TAO/day post-halving. New tokens bleed out XXX % of circulating float per week, nowhere near enough to buffer a SERIOUS demand spike. Feedback loop GOES: Demand ↑ → price ↑ → yield ↑ (in $ terms) → stakers rush in → $TAO/ $CHUTES ratio tilts further → price ↑ again. Scarcity is literally programmed in. $TAO emissions feel smallerRewards are paid in $TAO; if each $TAO is now worth $900, weekly CHUTE emissions (paid in $TAO) buy fewer CHUTE units, tightening supply pressure even more.(pool basically reprices CHUTE higher) Price discovery stays chain-nativeNo oracle is needed; the AMM and arbitrage keep CHUTE priced correctly relative to $TAO’s external move. Chutes isn’t “just another alt-alt.” Especially after the halving cuts that tap in half. 🧠⚡️ #Bittensor #TAO #Chutes #DeAI #SubnetEconomics  XXXXX engagements  **Related Topics** [tao](/topic/tao) [$chute](/topic/$chute) [$tao](/topic/$tao) [just a](/topic/just-a) [token](/topic/token) [bittensor](/topic/bittensor) [coins layer 1](/topic/coins-layer-1) [coins dao](/topic/coins-dao) [Post Link](https://x.com/bittingthembits/status/1947452504452588029)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Andy ττ @bittingthembits on x 8337 followers

Created: 2025-07-22 00:23:53 UTC

Andy ττ @bittingthembits on x 8337 followers

Created: 2025-07-22 00:23:53 UTC

Chutes (SN-64) token can melt faces with just a little buy-pressure. Why I think so? $TAO bull run pulls every subnet token higher, often by a bigger percentage than $TAO itself. Cause It’s like a high-octane micro-economy with math that punishes sellers and rewards conviction over time.

An AMM pool always keeps the product X · Y = k X = $TAO units in the pool Y = $CHUTE units in the pool At equilibrium the dollar value on each side is roughly XX : XX.

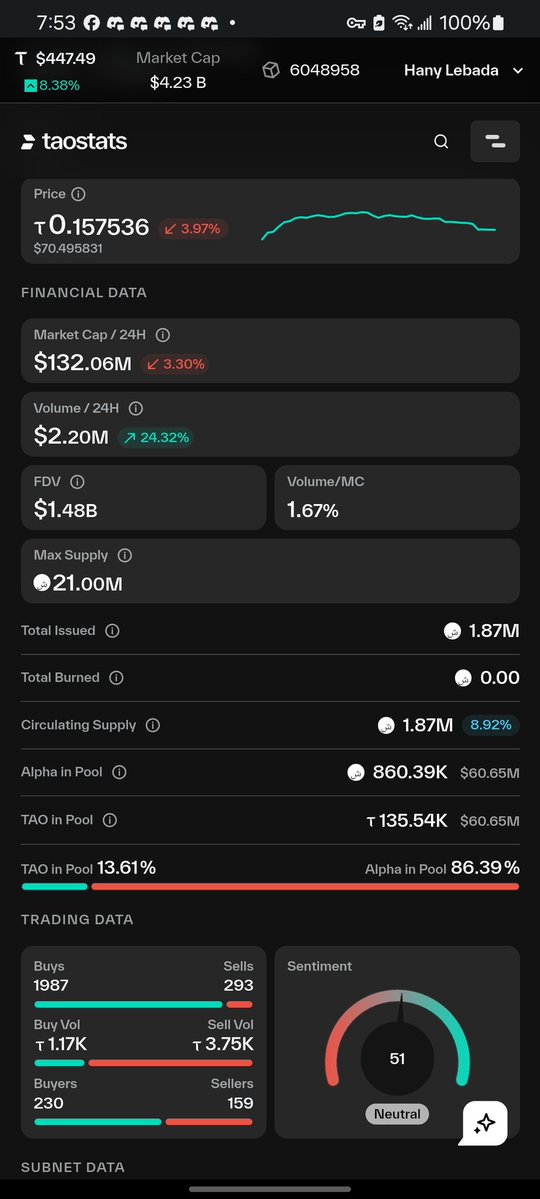

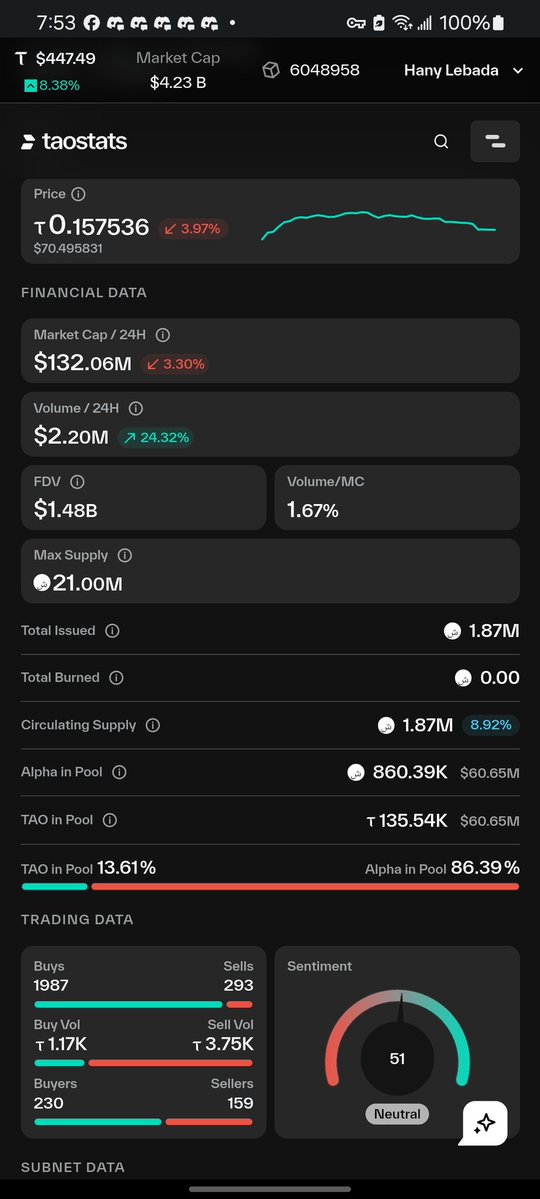

Float ≠ Supply • Circulating CHUTE: ONLY XXXX M (≈ X % of max) • Actually sitting in the pool XXX K CHUTE • Price mechanic: P = TAO_in_pool / CHUTE_in_pool CHUTE USD price jumpsThe pool “imports” the a $TAO rally. Even if no one buys CHUTE with dollars directly, its $TAO-denominated price doubles, so USD price ≈ doubles too. Less CHUTE → price up exponentially.

Liquidity is thin Pool ratio today: XXXX % TAO / XXXX % CHUTE. One decent market order drains the curve and slaps on double-digit slippage. Translation? The chart can go vertical real quick.

Emission trickles in. Chutes earns ~13 % of network emissions. Sounds big right? That’s XXX $TAO/day now → XXX $TAO/day post-halving. New tokens bleed out XXX % of circulating float per week, nowhere near enough to buffer a SERIOUS demand spike.

Feedback loop GOES: Demand ↑ → price ↑ → yield ↑ (in $ terms) → stakers rush in → $TAO/ $CHUTES ratio tilts further → price ↑ again. Scarcity is literally programmed in.

$TAO emissions feel smallerRewards are paid in $TAO; if each $TAO is now worth $900, weekly CHUTE emissions (paid in $TAO) buy fewer CHUTE units, tightening supply pressure even more.(pool basically reprices CHUTE higher) Price discovery stays chain-nativeNo oracle is needed; the AMM and arbitrage keep CHUTE priced correctly relative to $TAO’s external move.

Chutes isn’t “just another alt-alt.” Especially after the halving cuts that tap in half. 🧠⚡️

#Bittensor #TAO #Chutes #DeAI #SubnetEconomics

XXXXX engagements

Related Topics tao $chute $tao just a token bittensor coins layer 1 coins dao