[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  BeatTheBotz [@BeatTheBotz](/creator/twitter/BeatTheBotz) on x XXX followers Created: 2025-07-21 19:55:02 UTC The Reliable Yield Showdown: $JEPI vs $JEPQ vs $SPYI vs $QQQI Which ETF is delivering both income and total return? 📈 1-Year Total Returns (as of July 18, 2025): • $QQQI: +17.49% • $SPYI: +13.16% • $JEPQ: +11.81% • $JEPI: +7.88% 💸 Dividend Yields: • $QQQI: XXXXX% • $SPYI: XXXXX% • $JEPQ: XXXXX% • $JEPI: XXXX% The NEOS twins ( $QQQI & $SPYI) are starting to outshine the JPMorgan giants. Not just in yield, but in growth too. 🧠 Strategy breakdown: JEPI and JEPQ focus on defensive stock selection paired with ELNs (equity-linked notes) to generate call income with reduced volatility. SPYI and QQQI take a more aggressive approach, holding index ETFs (SPY, QQQ) and layering in traditional call-writing for max premium, with a tilt toward growth and tax-efficiency. Reliable yield. Real returns. Which ones earn a spot in your portfolio? Here is the X Year Total Return Chart: #Dividends #IncomeInvesting #PassiveIncome  XXXXX engagements  **Related Topics** [fund manager](/topic/fund-manager) [$qqqi](/topic/$qqqi) [$spyi](/topic/$spyi) [$jepq](/topic/$jepq) [$jepi](/topic/$jepi) [jpmorgan chase](/topic/jpmorgan-chase) [stocks financial services](/topic/stocks-financial-services) [stocks banks](/topic/stocks-banks) [Post Link](https://x.com/BeatTheBotz/status/1947384846076072254)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

BeatTheBotz @BeatTheBotz on x XXX followers

Created: 2025-07-21 19:55:02 UTC

BeatTheBotz @BeatTheBotz on x XXX followers

Created: 2025-07-21 19:55:02 UTC

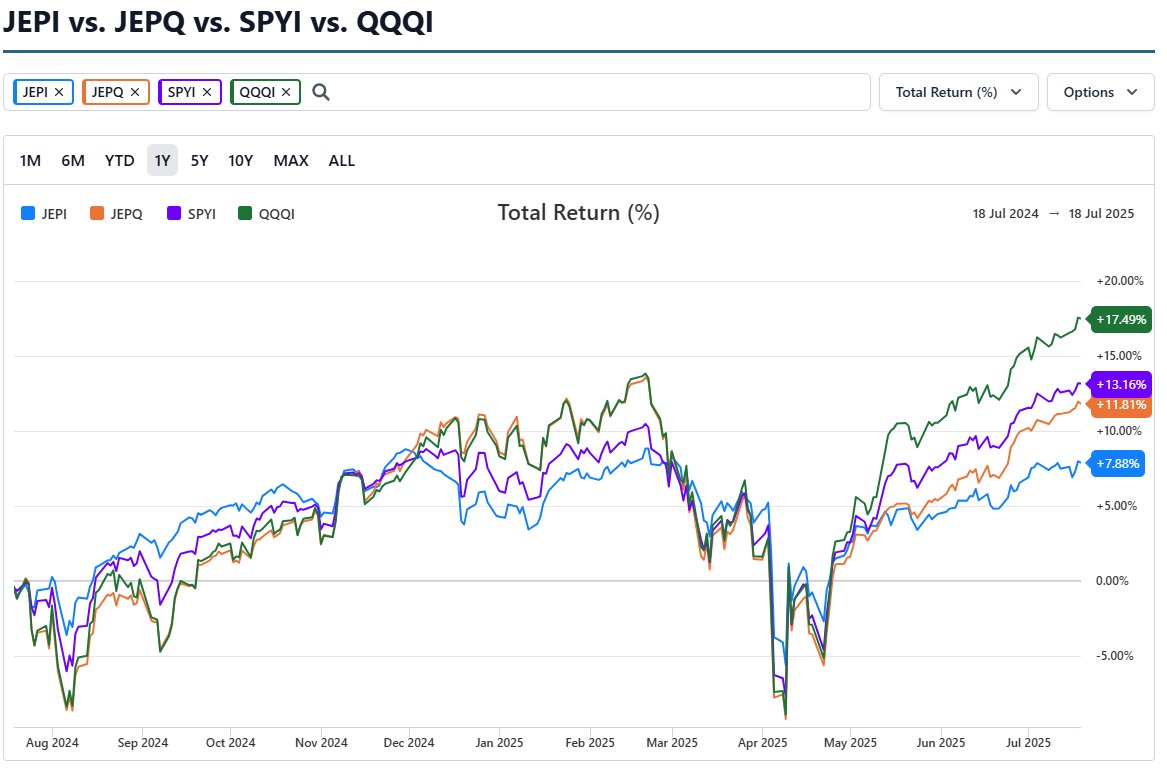

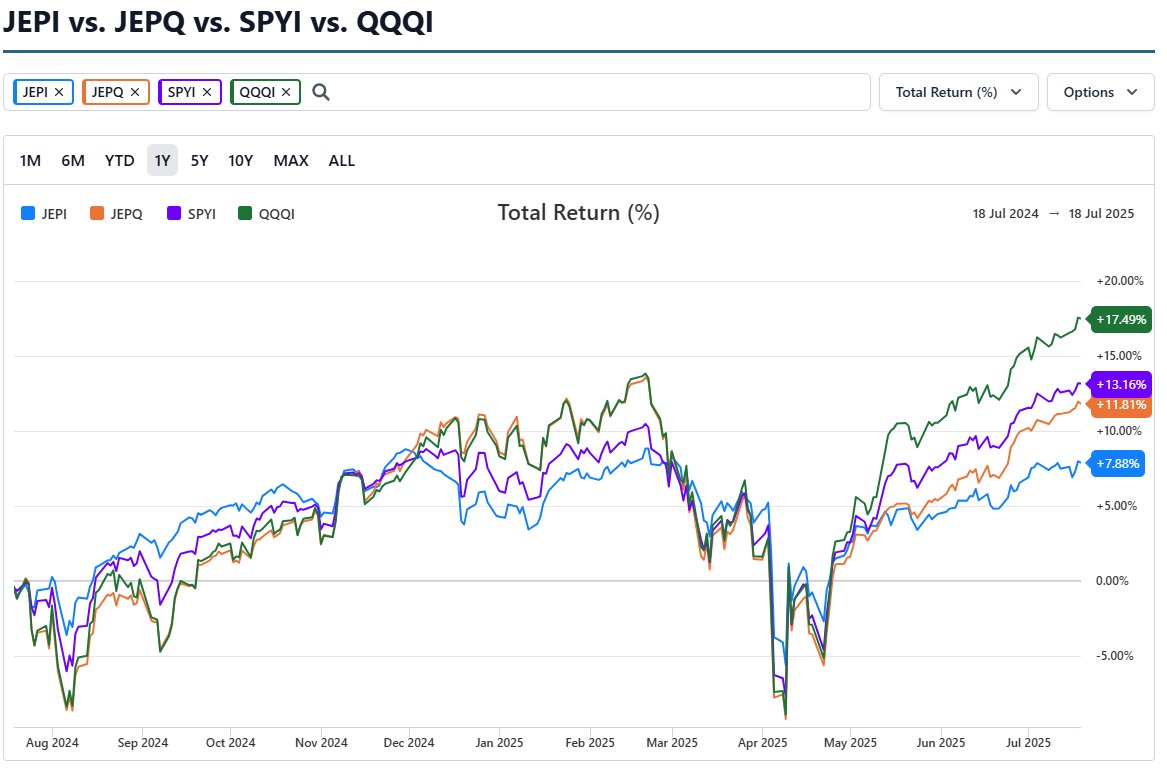

The Reliable Yield Showdown: $JEPI vs $JEPQ vs $SPYI vs $QQQI

Which ETF is delivering both income and total return?

📈 1-Year Total Returns (as of July 18, 2025): • $QQQI: +17.49% • $SPYI: +13.16% • $JEPQ: +11.81% • $JEPI: +7.88% 💸 Dividend Yields: • $QQQI: XXXXX% • $SPYI: XXXXX% • $JEPQ: XXXXX% • $JEPI: XXXX% The NEOS twins ( $QQQI & $SPYI) are starting to outshine the JPMorgan giants. Not just in yield, but in growth too. 🧠 Strategy breakdown: JEPI and JEPQ focus on defensive stock selection paired with ELNs (equity-linked notes) to generate call income with reduced volatility. SPYI and QQQI take a more aggressive approach, holding index ETFs (SPY, QQQ) and layering in traditional call-writing for max premium, with a tilt toward growth and tax-efficiency. Reliable yield. Real returns. Which ones earn a spot in your portfolio? Here is the X Year Total Return Chart: #Dividends #IncomeInvesting #PassiveIncome

XXXXX engagements

Related Topics fund manager $qqqi $spyi $jepq $jepi jpmorgan chase stocks financial services stocks banks