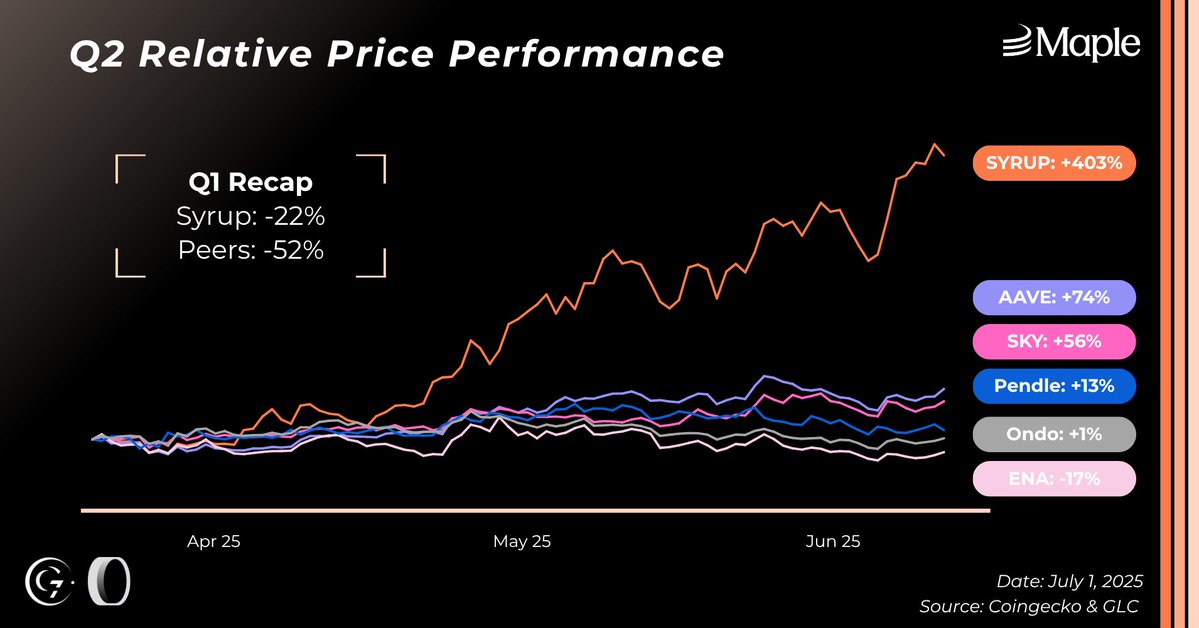

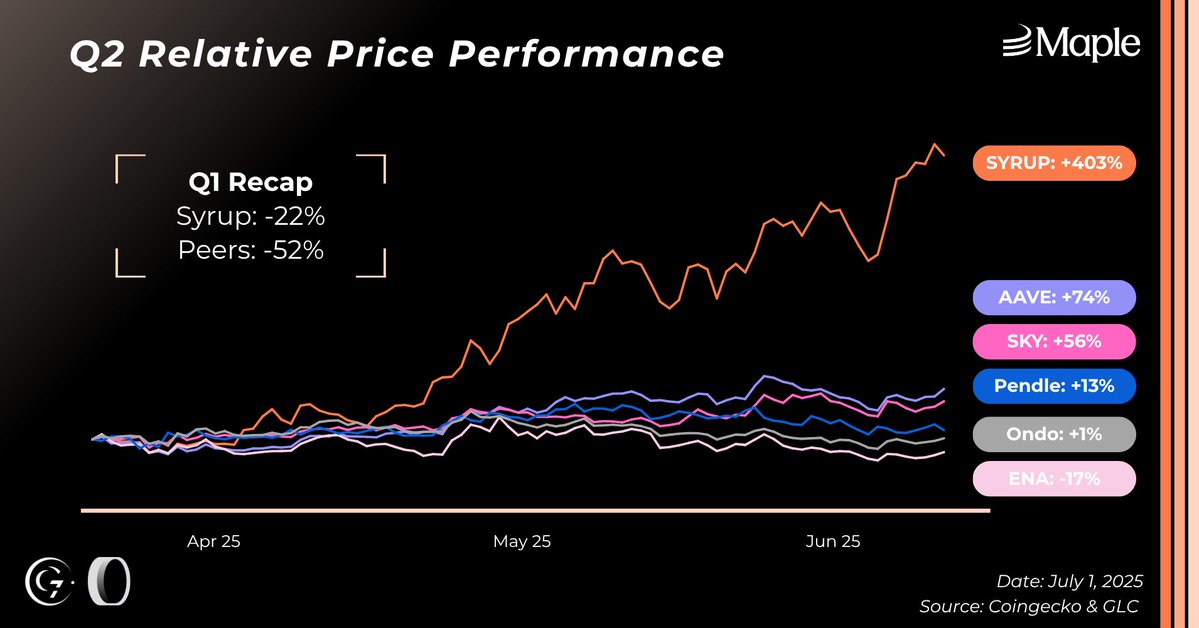

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  GLC [@GLC_Research](/creator/twitter/GLC_Research) on x 6921 followers Created: 2025-07-21 16:55:07 UTC We've been asked several times recently: "How can we explain $SYRUP's underperformance?" It's important to zoom out. $SYRUP significantly outperformed its peers throughout Q1 and Q2. After such a strong run, some consolidation around key levels is expected and it feels healthy. Let’s also keep the fundamentals in perspective: 🔸TVL now stands at $3.2B 🔸Outstanding loans have reached $1.2B 🔸Revenue is up only YTD, on pace to hit $25M annualized That said, one possible factor behind the recent price action could be the distribution and conversion of DRIPS into $SYRUP, which may have introduced some short-term selling pressure. This remains a hypothesis but could help contextualize current market behavior. So far, not much to worry about. syrUP.  XXXXXX engagements  **Related Topics** [$32b](/topic/$32b) [q2](/topic/q2) [$syrups](/topic/$syrups) [glc](/topic/glc) [$syrup](/topic/$syrup) [syrup maple finance](/topic/syrup-maple-finance) [coins defi](/topic/coins-defi) [coins real world assets](/topic/coins-real-world-assets) [Post Link](https://x.com/GLC_Research/status/1947339567578615863)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

GLC @GLC_Research on x 6921 followers

Created: 2025-07-21 16:55:07 UTC

GLC @GLC_Research on x 6921 followers

Created: 2025-07-21 16:55:07 UTC

We've been asked several times recently: "How can we explain $SYRUP's underperformance?"

It's important to zoom out. $SYRUP significantly outperformed its peers throughout Q1 and Q2. After such a strong run, some consolidation around key levels is expected and it feels healthy.

Let’s also keep the fundamentals in perspective:

🔸TVL now stands at $3.2B

🔸Outstanding loans have reached $1.2B

🔸Revenue is up only YTD, on pace to hit $25M annualized

That said, one possible factor behind the recent price action could be the distribution and conversion of DRIPS into $SYRUP, which may have introduced some short-term selling pressure. This remains a hypothesis but could help contextualize current market behavior.

So far, not much to worry about.

syrUP.

XXXXXX engagements

Related Topics $32b q2 $syrups glc $syrup syrup maple finance coins defi coins real world assets