[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  XO [@Trader_XO](/creator/twitter/Trader_XO) on x 524.2K followers Created: 2025-07-21 16:53:44 UTC $BTC Market Context: Six sessions of overlapping value indicate compressed value and balance = short term equilibrium awaiting directional moves out of this zone. No clear read for me here - no trade zone. Alts Observation: Low Bitcoin volatility regimes are ideal environments for when capital rotates out into alts, which tend to outperform Bitcoin during this window of opportunity. It’s been the perfect setup for select alts so far, until Bitcoin dictates pace again. Initiative Buying Scenario: Acceptance above composite highs of 119s, accompanied by aggressive initiative buying, suggests control is shifting back to buyers. Im looking for range extension higher toward all-time highs, with some altcoins likely to get bid alongside. Initiative Selling: A break below composite value lows would likely trigger selling into a bunch of single prints around the 114s or 112s. I would need to see a reaction here to consider new longs on bitcoin. Also wouldnt be suprised if this leads to some level deleveraging among late long alt positioning, given the build up alt oi over the last few days. My spot positioning has been doing most of the heavy lifting - closed out all long alt perps positions on sunday evening until the next set of plays. Have a fab week ahead.  XXXXXXX engagements  **Related Topics** [volatility](/topic/volatility) [alts](/topic/alts) [$btc](/topic/$btc) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/Trader_XO/status/1947339220273483800)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

XO @Trader_XO on x 524.2K followers

Created: 2025-07-21 16:53:44 UTC

XO @Trader_XO on x 524.2K followers

Created: 2025-07-21 16:53:44 UTC

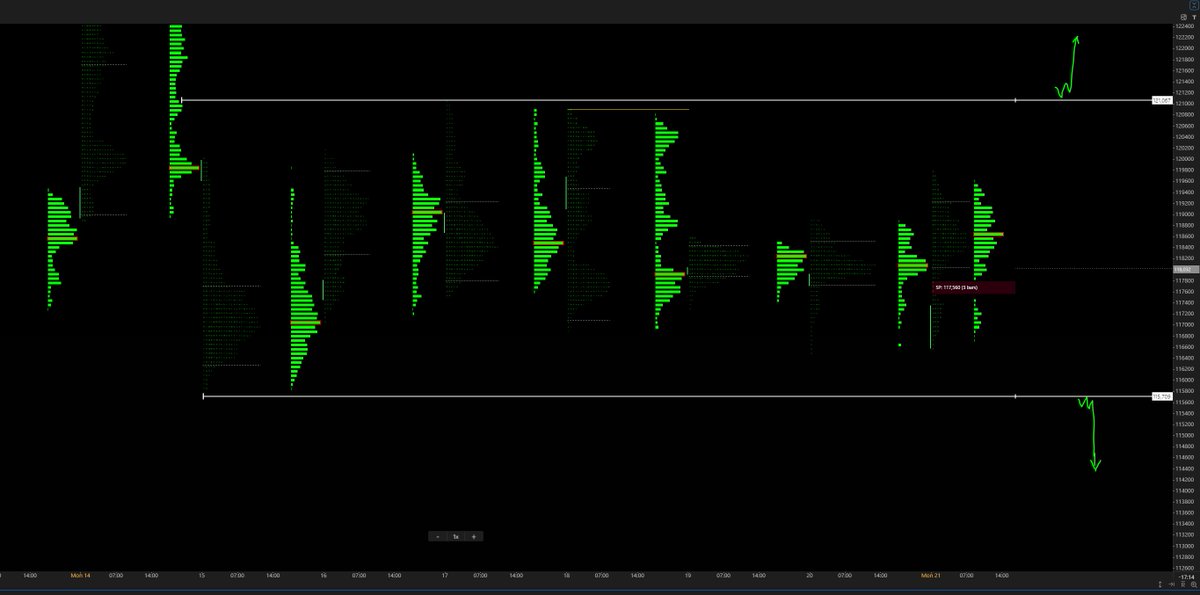

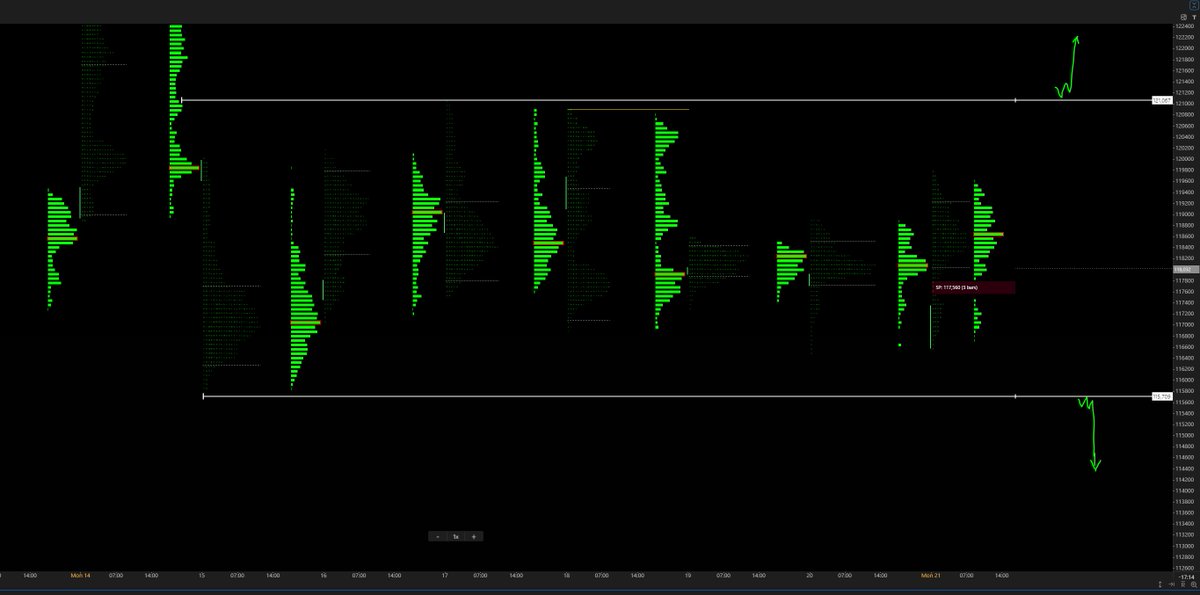

$BTC

Market Context: Six sessions of overlapping value indicate compressed value and balance = short term equilibrium awaiting directional moves out of this zone. No clear read for me here - no trade zone.

Alts Observation: Low Bitcoin volatility regimes are ideal environments for when capital rotates out into alts, which tend to outperform Bitcoin during this window of opportunity. It’s been the perfect setup for select alts so far, until Bitcoin dictates pace again.

Initiative Buying Scenario: Acceptance above composite highs of 119s, accompanied by aggressive initiative buying, suggests control is shifting back to buyers. Im looking for range extension higher toward all-time highs, with some altcoins likely to get bid alongside.

Initiative Selling: A break below composite value lows would likely trigger selling into a bunch of single prints around the 114s or 112s. I would need to see a reaction here to consider new longs on bitcoin. Also wouldnt be suprised if this leads to some level deleveraging among late long alt positioning, given the build up alt oi over the last few days.

My spot positioning has been doing most of the heavy lifting - closed out all long alt perps positions on sunday evening until the next set of plays.

Have a fab week ahead.

XXXXXXX engagements

Related Topics volatility alts $btc bitcoin coins layer 1 coins bitcoin ecosystem coins pow