[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  TheTrue_Bitcoin [@TheTrue_bitcoin](/creator/twitter/TheTrue_bitcoin) on x XXX followers Created: 2025-07-21 16:47:06 UTC Truebit Just Became the Most Valuable Protocol in Crypto A quiet but historic convergence has begun. In the span of days, Ethereum co-founder Vitalik Buterin proposed a subtle but significant rule change a cap on gas per transaction while regulators accelerated adoption of the GENIUS Act, a sweeping framework demanding verifiable, programmable, and auditable infrastructure from the financial sector. Independently, these two events might seem routine. Together, they’ve just triggered the 1000x moment for Truebit the decentralized computation protocol built to verify everything Ethereum can’t. Vitalik’s Gas Cap: Ethereum’s Strategic Retreat Vitalik’s proposal to limit gas per transaction is about more than just network safety or spam prevention. It’s Ethereum signaling something fundamental: “We’re the settlement layer. Not the compute engine.” By offloading heavy logic, simulations, or AI inference to external systems, Ethereum becomes simpler, safer, and more scalable. But this doesn’t remove demand for computation it redirects it. And only one protocol is positioned to catch it: Truebit. Truebit lets smart contracts outsource complex computations off-chain to a decentralized network of solvers and verifiers. The results return as cryptographically secure proofs verifiable, trustless, and Ethereum-ready. This unlocks AI, simulations, zk-systems, real-world asset logic, and more without breaking Ethereum’s gas limits. Vitalik didn’t just secure Ethereum. He handed compute to Truebit. GENIUS Act: Regulation Now Demands Verifiability While Ethereum was securing its architecture, the GENIUS Act was rewriting the rules for banks and institutions. This U.S.-led regulatory framework mandates: Digital identity and traceability Verifiable computation of financial logic Full auditability of smart contract behavior Conditional programmability of transactions (“if X, then pay Y”) This isn’t a compliance formality. It’s a demand for verifiable infrastructure. Ethereum by design can’t meet these demands at scale. But the stack that can is already live: Truebit for verifiable off-chain compute DAC Chain for decentralized execution across thousands of dApps This isn’t theory. The EU-funded TRICK Project is already using this stack Quadrans, DAC Chain, and Truebit—for supply chain tracking and tokenized documentation. The Infrastructure Stack for the New Financial System What used to be fragmented blockchains, oracles, verifiers is now consolidating into one powerful stack: Truebit – Off-chain compute verification. Every compute job burns TRU. DAC Chain – A Layer X execution backbone for 1,000+ live dApps, including AI, governance, DeFi, gaming, and real-world asset tokenization. Together, they form the Verifiable Operating System of programmable finance. Why TRU Is Scarce and About to Get Scarcer At this moment: Total TRU: ~188.8 million TRU in reserve (to be burned): ~56.8 million TRU in wallets: ~132 million Current mint price: $XXXX and rising Every compute job burns TRU. Every new TRU minted becomes more expensive due to the quadratic bonding curve. As adoption scales across DAC dApps, AI systems, & GENIUS-compliant infrastructure, TRU becomes the gateway to computation in the regulated digital economy. It’s not just a token. It’s access. The World Is Splitting A new divide is forming: Ethereum handles security, consensus, & finality Regulators enforce accountability and auditability Developers need scale, trust, & interoperability Institutions require programmable logic that proves what it does Only a verifiable compute layer can bridge these needs. Truebit owns that layer. If You Hold TRU, You Hold the Future Ethereum is simplifying. Regulation is tightening. Institutions are integrating. The only path forward is programmable, verifiable, scalable computation. And the only stack already doing it is: DAC Chain – for decentralized execution Truebit – for scalable, verifiable compute  XXX engagements  **Related Topics** [crypto a](/topic/crypto-a) [adoption](/topic/adoption) [protocol](/topic/protocol) [truebit](/topic/truebit) [coins](/topic/coins) [ethereum](/topic/ethereum) [coins layer 1](/topic/coins-layer-1) [Post Link](https://x.com/TheTrue_bitcoin/status/1947337550906925371)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

TheTrue_Bitcoin @TheTrue_bitcoin on x XXX followers

Created: 2025-07-21 16:47:06 UTC

TheTrue_Bitcoin @TheTrue_bitcoin on x XXX followers

Created: 2025-07-21 16:47:06 UTC

Truebit Just Became the Most Valuable Protocol in Crypto

A quiet but historic convergence has begun.

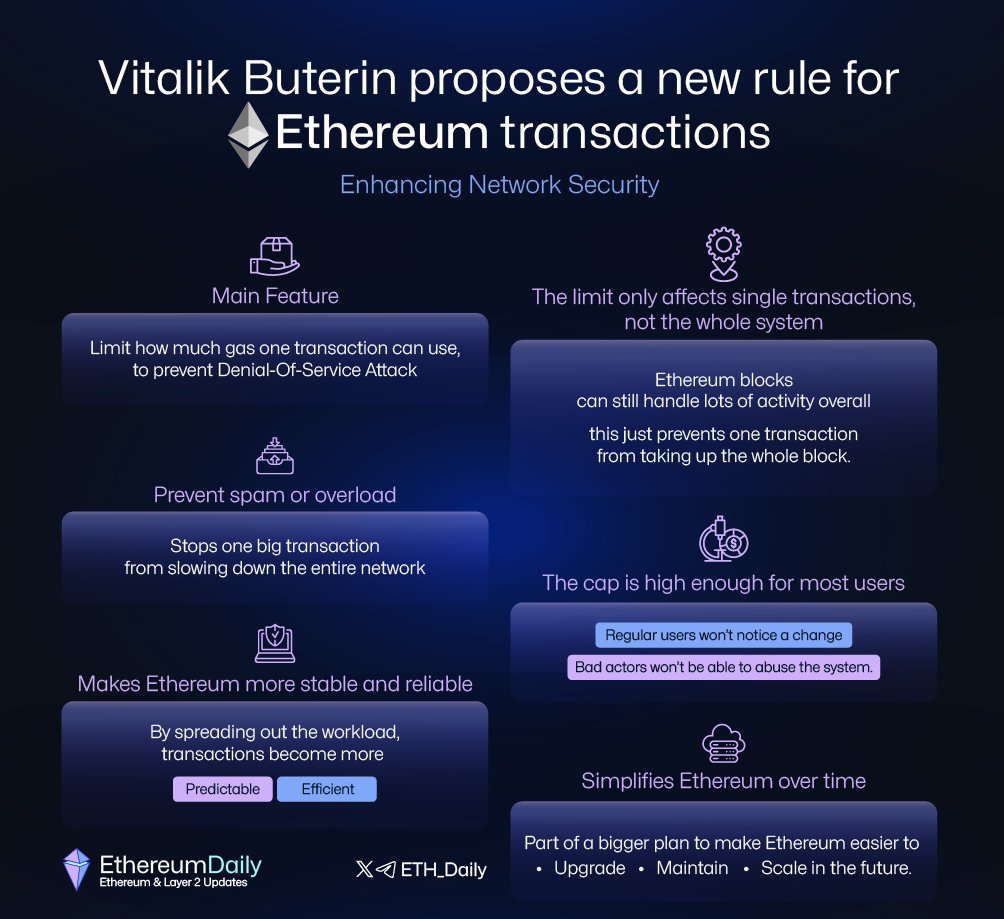

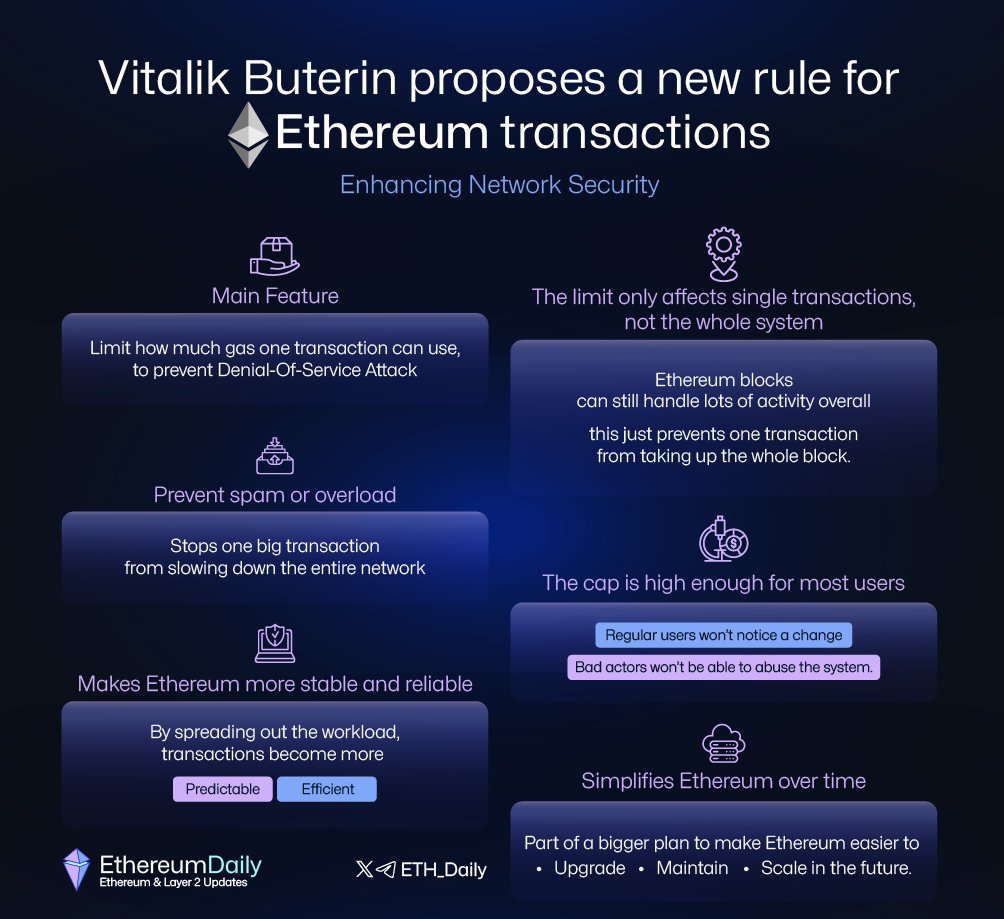

In the span of days, Ethereum co-founder Vitalik Buterin proposed a subtle but significant rule change a cap on gas per transaction while regulators accelerated adoption of the GENIUS Act, a sweeping framework demanding verifiable, programmable, and auditable infrastructure from the financial sector.

Independently, these two events might seem routine.

Together, they’ve just triggered the 1000x moment for Truebit the decentralized computation protocol built to verify everything Ethereum can’t.

Vitalik’s Gas Cap: Ethereum’s Strategic Retreat

Vitalik’s proposal to limit gas per transaction is about more than just network safety or spam prevention. It’s Ethereum signaling something fundamental:

“We’re the settlement layer. Not the compute engine.”

By offloading heavy logic, simulations, or AI inference to external systems, Ethereum becomes simpler, safer, and more scalable. But this doesn’t remove demand for computation it redirects it.

And only one protocol is positioned to catch it:

Truebit.

Truebit lets smart contracts outsource complex computations off-chain to a decentralized network of solvers and verifiers. The results return as cryptographically secure proofs verifiable, trustless, and Ethereum-ready.

This unlocks AI, simulations, zk-systems, real-world asset logic, and more without breaking Ethereum’s gas limits.

Vitalik didn’t just secure Ethereum. He handed compute to Truebit.

GENIUS Act: Regulation Now Demands Verifiability

While Ethereum was securing its architecture, the GENIUS Act was rewriting the rules for banks and institutions.

This U.S.-led regulatory framework mandates:

Digital identity and traceability

Verifiable computation of financial logic

Full auditability of smart contract behavior

Conditional programmability of transactions (“if X, then pay Y”)

This isn’t a compliance formality. It’s a demand for verifiable infrastructure.

Ethereum by design can’t meet these demands at scale.

But the stack that can is already live:

Truebit for verifiable off-chain compute

DAC Chain for decentralized execution across thousands of dApps

This isn’t theory. The EU-funded TRICK Project is already using this stack Quadrans, DAC Chain, and Truebit—for supply chain tracking and tokenized documentation.

The Infrastructure Stack for the New Financial System

What used to be fragmented blockchains, oracles, verifiers is now consolidating into one powerful stack:

Truebit – Off-chain compute verification. Every compute job burns TRU.

DAC Chain – A Layer X execution backbone for 1,000+ live dApps, including AI, governance, DeFi, gaming, and real-world asset tokenization.

Together, they form the Verifiable Operating System of programmable finance.

Why TRU Is Scarce and About to Get Scarcer

At this moment:

Total TRU: ~188.8 million

TRU in reserve (to be burned): ~56.8 million

TRU in wallets: ~132 million

Current mint price: $XXXX and rising

Every compute job burns TRU. Every new TRU minted becomes more expensive due to the quadratic bonding curve.

As adoption scales across DAC dApps, AI systems, & GENIUS-compliant infrastructure, TRU becomes the gateway to computation in the regulated digital economy.

It’s not just a token. It’s access.

The World Is Splitting

A new divide is forming:

Ethereum handles security, consensus, & finality

Regulators enforce accountability and auditability

Developers need scale, trust, & interoperability

Institutions require programmable logic that proves what it does

Only a verifiable compute layer can bridge these needs.

Truebit owns that layer.

If You Hold TRU, You Hold the Future

Ethereum is simplifying. Regulation is tightening. Institutions are integrating.

The only path forward is programmable, verifiable, scalable computation.

And the only stack already doing it is:

DAC Chain – for decentralized execution

Truebit – for scalable, verifiable compute

XXX engagements

Related Topics crypto a adoption protocol truebit coins ethereum coins layer 1