[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Fabius DeFi [@FabiusDefi](/creator/twitter/FabiusDefi) on x 21.2K followers Created: 2025-07-21 14:11:27 UTC Why did SEI surge XXX% in just X month? 📊 $SEI jumped from around $XXXX in mid-June to nearly $XXXX by mid-July (~145%) It’s now trading around $XXXX with a market cap of ~$2.1B. This breakout came from a mix of solid fundamentals and well-timed catalysts. Let's break down the reasons behind this 👇 🔹 Rapid ecosystem growth from @SeiNetwork ▸ TVL hit a new ATH at $680M – up almost 8x in just a year ▸ 3.3M active wallets, out of a total 40M+ ▸ 4M+ daily transactions (peaking at 12M+ recently) ▸ Stablecoin TVL reached nearly $300M in just four months (since March) These numbers don’t lie. The DeFi/GameFi activity on SEI is exploding with real liquidity, real usage. And that builds a very real floor for the price. 🔹 Binance support Since @SeiNetwork launched in August 2023, Binance has quietly been backing the ecosystem. Launchpool campaigns let users stake BNB, TUSD, FDUSD to farm SEI. Even better – if you were using BNB Vault, you automatically participated and received daily SEI rewards. These are long-form campaigns that create passive income for users, deepen liquidity, and increase community stickiness. That matters – because it feeds the growth loop. Without looking like forced promotion. 🔹 Tech advantage Sei runs on a Twin-Turbo consensus and parallel order execution model, which brings transaction finality down to <400ms. That’s near-instant – built for high-frequency trading, fast GameFi, and DeFi with a web2 feel. It’s also fully EVM-compatible. Which means ERC-20s and Ethereum-native apps can plug in without friction. After the Sei V2 upgrade: ▸ Transactions surged +3691% ▸ TVL climbed +794% + The recent integration of native USDC added even more weight. $SEI is positioning as a cross-chain liquidity hub, tapping into XX chains and fiat access via Circle Mint. In short: SEI’s infra is scaling outward, and that opens the door to new flows. 🔹 Positive policies & sentiment Then came a string of catalysts. – On June 19, 2025, SEI was selected by the state of Wyoming as a candidate for its stablecoin pilot (WYST) – ahead of Ethereum and Solana. The community took that as a clear signal. Speculation around $XXXX started circulating on X, and momentum built from there. – Back in May, Canary Capital had already filed a proposal for SEI ETF in the U.S. That brought SEI onto the radar of institutional players. Altcoins were already recovering, and SEI had both the tech and the news cycle aligned. 🔹 Strategic partnerships ▸ Chainlink is bringing CCIP to SEI, connecting it to 60+ blockchains and 140+ tokens ▸ Circle brought native USDC to SEI using CCTP V2 – billions in stablecoins can now move directly on-chain ▸ Ondo Finance launched USDY – tokenized U.S. Treasuries – now on SEI That last one was a first. Government bonds, fully tokenized, running at scale on a chain like SEI – and offering real yield to investors. To me, it's a clear signal that SEI is ready for the next phase of institutional finance. 🔹Conclusion The numbers and the headlines all point in the same direction. @SeiNetwork was built on a structure with real infra, active users, and layered liquidity. The alignment between onchain growth and offchain validation created a dual-engine rally. And that’s why "Market moves faster on Sei" $/acc!  XXXXXX engagements  **Related Topics** [market cap](/topic/market-cap) [$680m](/topic/$680m) [$21b](/topic/$21b) [sei](/topic/sei) [$sei](/topic/$sei) [coins layer 1](/topic/coins-layer-1) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/FabiusDefi/status/1947298378108592562)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Fabius DeFi @FabiusDefi on x 21.2K followers

Created: 2025-07-21 14:11:27 UTC

Fabius DeFi @FabiusDefi on x 21.2K followers

Created: 2025-07-21 14:11:27 UTC

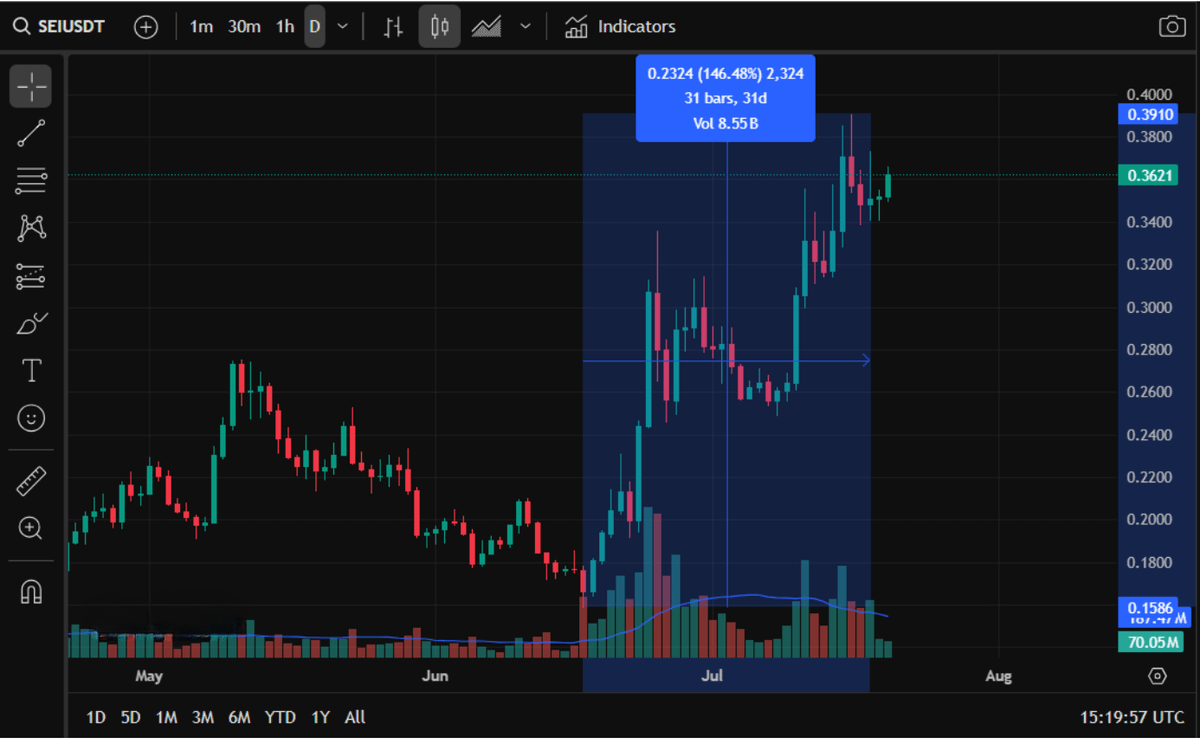

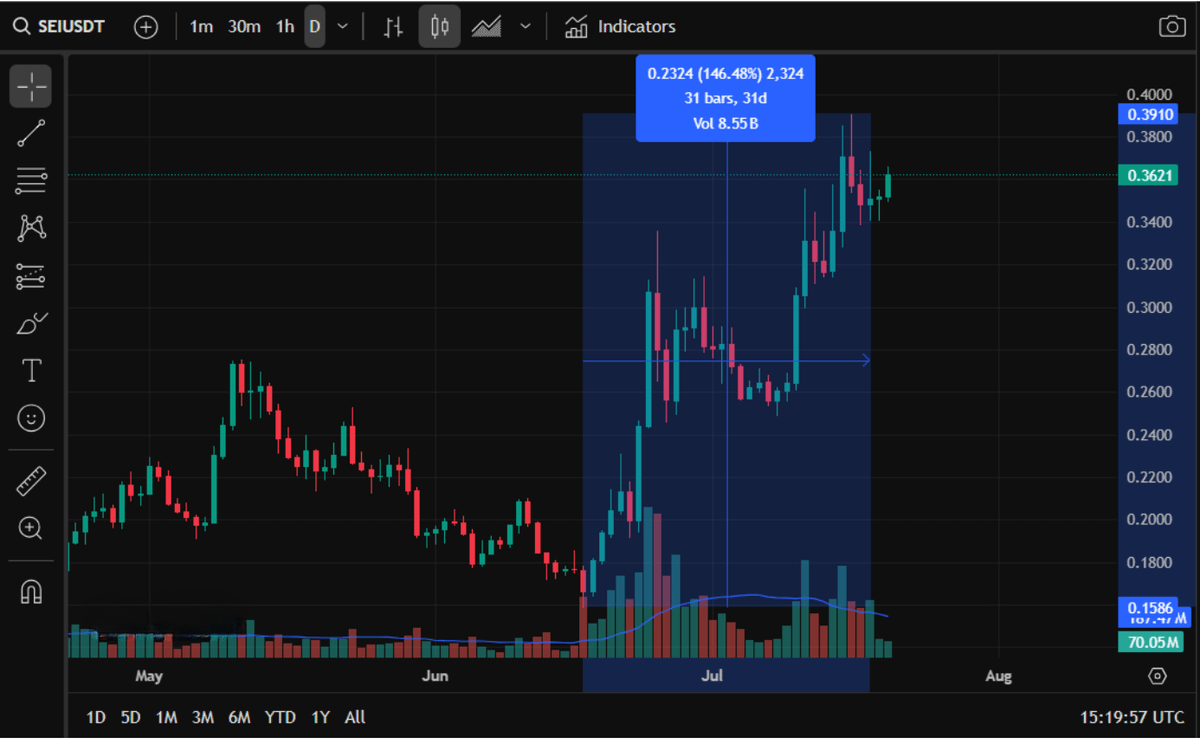

Why did SEI surge XXX% in just X month? 📊

$SEI jumped from around $XXXX in mid-June to nearly $XXXX by mid-July (~145%)

It’s now trading around $XXXX with a market cap of ~$2.1B.

This breakout came from a mix of solid fundamentals and well-timed catalysts.

Let's break down the reasons behind this 👇

🔹 Rapid ecosystem growth from @SeiNetwork

▸ TVL hit a new ATH at $680M – up almost 8x in just a year ▸ 3.3M active wallets, out of a total 40M+ ▸ 4M+ daily transactions (peaking at 12M+ recently) ▸ Stablecoin TVL reached nearly $300M in just four months (since March)

These numbers don’t lie.

The DeFi/GameFi activity on SEI is exploding with real liquidity, real usage.

And that builds a very real floor for the price.

🔹 Binance support

Since @SeiNetwork launched in August 2023, Binance has quietly been backing the ecosystem.

Launchpool campaigns let users stake BNB, TUSD, FDUSD to farm SEI.

Even better – if you were using BNB Vault, you automatically participated and received daily SEI rewards.

These are long-form campaigns that create passive income for users, deepen liquidity, and increase community stickiness.

That matters – because it feeds the growth loop.

Without looking like forced promotion.

🔹 Tech advantage

Sei runs on a Twin-Turbo consensus and parallel order execution model, which brings transaction finality down to <400ms.

That’s near-instant – built for high-frequency trading, fast GameFi, and DeFi with a web2 feel.

It’s also fully EVM-compatible. Which means ERC-20s and Ethereum-native apps can plug in without friction.

After the Sei V2 upgrade: ▸ Transactions surged +3691% ▸ TVL climbed +794%

- The recent integration of native USDC added even more weight.

$SEI is positioning as a cross-chain liquidity hub, tapping into XX chains and fiat access via Circle Mint.

In short: SEI’s infra is scaling outward, and that opens the door to new flows.

🔹 Positive policies & sentiment

Then came a string of catalysts.

– On June 19, 2025, SEI was selected by the state of Wyoming as a candidate for its stablecoin pilot (WYST) – ahead of Ethereum and Solana.

The community took that as a clear signal.

Speculation around $XXXX started circulating on X, and momentum built from there.

– Back in May, Canary Capital had already filed a proposal for SEI ETF in the U.S.

That brought SEI onto the radar of institutional players.

Altcoins were already recovering, and SEI had both the tech and the news cycle aligned.

🔹 Strategic partnerships

▸ Chainlink is bringing CCIP to SEI, connecting it to 60+ blockchains and 140+ tokens

▸ Circle brought native USDC to SEI using CCTP V2 – billions in stablecoins can now move directly on-chain

▸ Ondo Finance launched USDY – tokenized U.S. Treasuries – now on SEI

That last one was a first. Government bonds, fully tokenized, running at scale on a chain like SEI – and offering real yield to investors.

To me, it's a clear signal that SEI is ready for the next phase of institutional finance.

🔹Conclusion

The numbers and the headlines all point in the same direction.

@SeiNetwork was built on a structure with real infra, active users, and layered liquidity.

The alignment between onchain growth and offchain validation created a dual-engine rally.

And that’s why "Market moves faster on Sei"

$/acc!

XXXXXX engagements

Related Topics market cap $680m $21b sei $sei coins layer 1 coins made in usa