[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Steinat 🌊 [@CryptoLios](/creator/twitter/CryptoLios) on x 2206 followers Created: 2025-07-21 13:43:56 UTC zkSync isn’t very popular among individual users, but it’s dominating in the RWA (Real World Assets) space for a few key reasons.. ✅ X. Enterprise-Focused Projects As seen in the chart, the biggest RWA player on zkSync Era is Tradable, controlling a massive XXXXX% of the total RWA value ($2.07B) alone. These types of projects are highly institutional, built for large funds, banks, and financial institutions—not individual users. Similarly, Securitize, Sygnum Bank, and Circle are all closely tied to institutional operations rather than retail. ✅ X. zkSync’s Technical Advantages With ZK-Rollup technology, zkSync delivers fast transaction verification and low costs. This speed and cost efficiency make it an attractive choice for tokenized RWA transactions. Plus, zkSync’s potential for data privacy is a critical advantage for institutions. ✅ X. Less Retail = Less Noise With fewer retail users, zkSync’s RWA segment has seen cleaner, more focused growth driven by enterprise adoption. This positions zkSync as an ideal Layer X for major RWA protocols. 📊 Pie Chart Breakdown Total RWA Value: $2.1B ▪️Private Credit: $2.1B (majority share) ▪️Institutional Alternative Funds: $214.8M ▪️US Treasury Debt: $45M ▪️Stablecoins: $27.5M This shows zkSync’s RWA volume is heavily weighted toward private credit and institutional funds. zkSync isn’t a retail favorite, but in the RWA arena, it’s becoming an institutional powerhouse thanks to speed, low fees, and the security of ZK-Rollups.  XXXXX engagements  **Related Topics** [real world](/topic/real-world) [real world assets](/topic/real-world-assets) [$207b](/topic/$207b) [rwa](/topic/rwa) [zksync](/topic/zksync) [coins zk](/topic/coins-zk) [coins layer 2](/topic/coins-layer-2) [Post Link](https://x.com/CryptoLios/status/1947291454822363520)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Steinat 🌊 @CryptoLios on x 2206 followers

Created: 2025-07-21 13:43:56 UTC

Steinat 🌊 @CryptoLios on x 2206 followers

Created: 2025-07-21 13:43:56 UTC

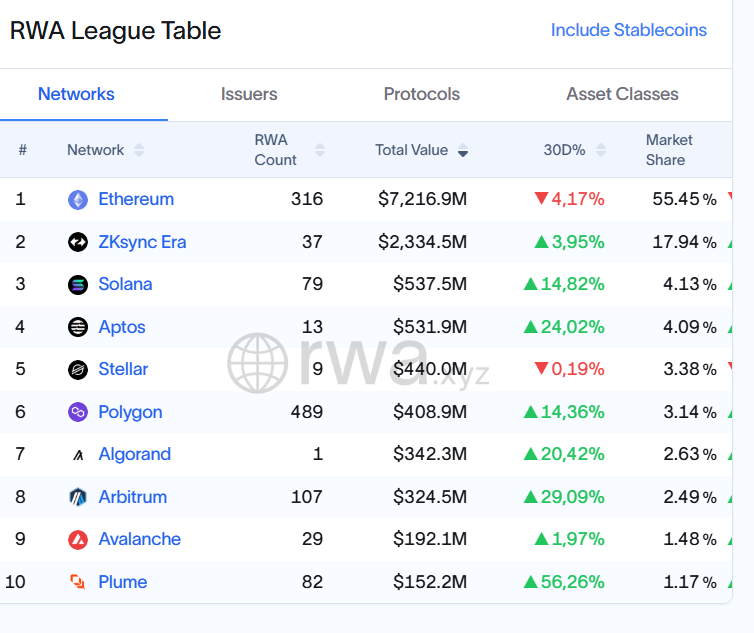

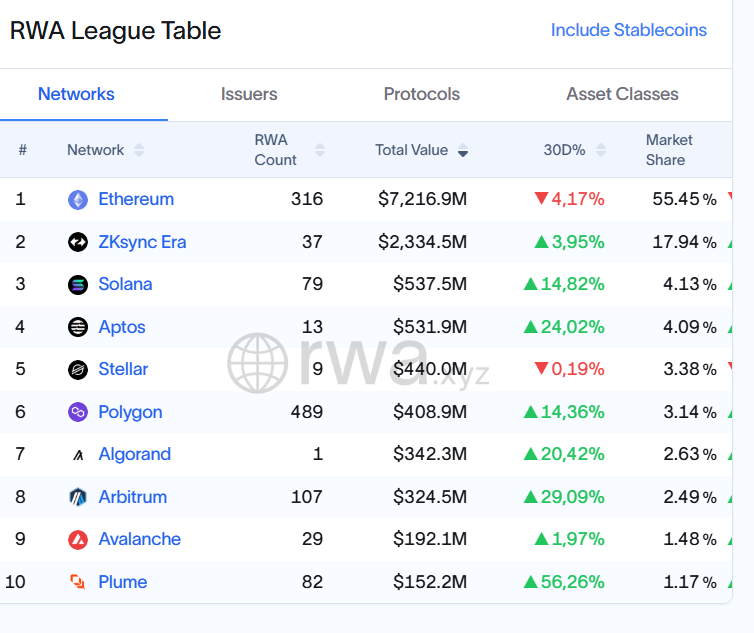

zkSync isn’t very popular among individual users, but it’s dominating in the RWA (Real World Assets) space for a few key reasons..

✅ X. Enterprise-Focused Projects As seen in the chart, the biggest RWA player on zkSync Era is Tradable, controlling a massive XXXXX% of the total RWA value ($2.07B) alone. These types of projects are highly institutional, built for large funds, banks, and financial institutions—not individual users.

Similarly, Securitize, Sygnum Bank, and Circle are all closely tied to institutional operations rather than retail.

✅ X. zkSync’s Technical Advantages With ZK-Rollup technology, zkSync delivers fast transaction verification and low costs.

This speed and cost efficiency make it an attractive choice for tokenized RWA transactions. Plus, zkSync’s potential for data privacy is a critical advantage for institutions.

✅ X. Less Retail = Less Noise With fewer retail users, zkSync’s RWA segment has seen cleaner, more focused growth driven by enterprise adoption.

This positions zkSync as an ideal Layer X for major RWA protocols.

📊 Pie Chart Breakdown Total RWA Value: $2.1B

▪️Private Credit: $2.1B (majority share)

▪️Institutional Alternative Funds: $214.8M

▪️US Treasury Debt: $45M

▪️Stablecoins: $27.5M

This shows zkSync’s RWA volume is heavily weighted toward private credit and institutional funds.

zkSync isn’t a retail favorite, but in the RWA arena, it’s becoming an institutional powerhouse thanks to speed, low fees, and the security of ZK-Rollups.

XXXXX engagements

Related Topics real world real world assets $207b rwa zksync coins zk coins layer 2