[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ragnar [@RoaringRagnar](/creator/twitter/RoaringRagnar) on x 9734 followers Created: 2025-07-21 12:21:47 UTC Summary of the $MSTR SEC filing – July 21, 2025: X. $XXXXX million raised from $MSTR ATM at $XXXXXX per share on average. $XXXXX billion capacity remaining. X. $XXX million raised from $STRK ATM at $XXXXXX per share on average. XXXXX billion capacity remaining. X. $XXX million raised from $STRF ATM at $XXX per share on average (seems low, I’m pretty sure there’s a rounding problem or an error there). $XXXX billion capacity remaining. X. $XXX million raised from $STRD ATM at $XXXXX per share on average. $XXXX billion capacity remaining. X. In total, Strategy raised just $XXX million from preferreds last week. It seems that they are actively delevering their balance sheet to have even more capacity down the road. X. $XXXXX billion of additional debt capacity remaining, under their 42/42 plan. X. In total, $XXXXX billion of capital raising capacity remaining, assuming the $STRF and $STRD ATMs count on top. $XXXXX billion if they don’t count on top. X. The market was open XXXX hours last week. Strategy raised $XXXXX million per hour and $XXXXXXX per minute while the market was open. Incredible performance if you compare it with other treasury companies, or what you can do personally. X. Strategy purchased XXXXX BTC last week, and is now holding XXXXXXX BTC, or XXXX% of the total Bitcoin supply. (Not considering lost coins.). Road to 1M BTC is XXXX% complete. XX. Last week’s purchase equals XXXXX days (or 1.97x) of new BTC supply last week. XX. Strategy purchased XXXX BTC per minute, and XXX BTC per hour while the stock market was open last week. XX. Strategy’s leverage ratio (debt to Bitcoin NAV) decreased to 16.5%. They still have XXXX% room left to reach their maximum of 30%. Their pref to Bitcoin NAV ratio is just 5%. Well done @saylor and team! 🔥  XXXXXX engagements  **Related Topics** [$btc](/topic/$btc) [hodl](/topic/hodl) [theres a](/topic/theres-a) [$strk](/topic/$strk) [atm](/topic/atm) [$mstr](/topic/$mstr) [strategy](/topic/strategy) [stocks financial services](/topic/stocks-financial-services) [Post Link](https://x.com/RoaringRagnar/status/1947270781819379834)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ragnar @RoaringRagnar on x 9734 followers

Created: 2025-07-21 12:21:47 UTC

Ragnar @RoaringRagnar on x 9734 followers

Created: 2025-07-21 12:21:47 UTC

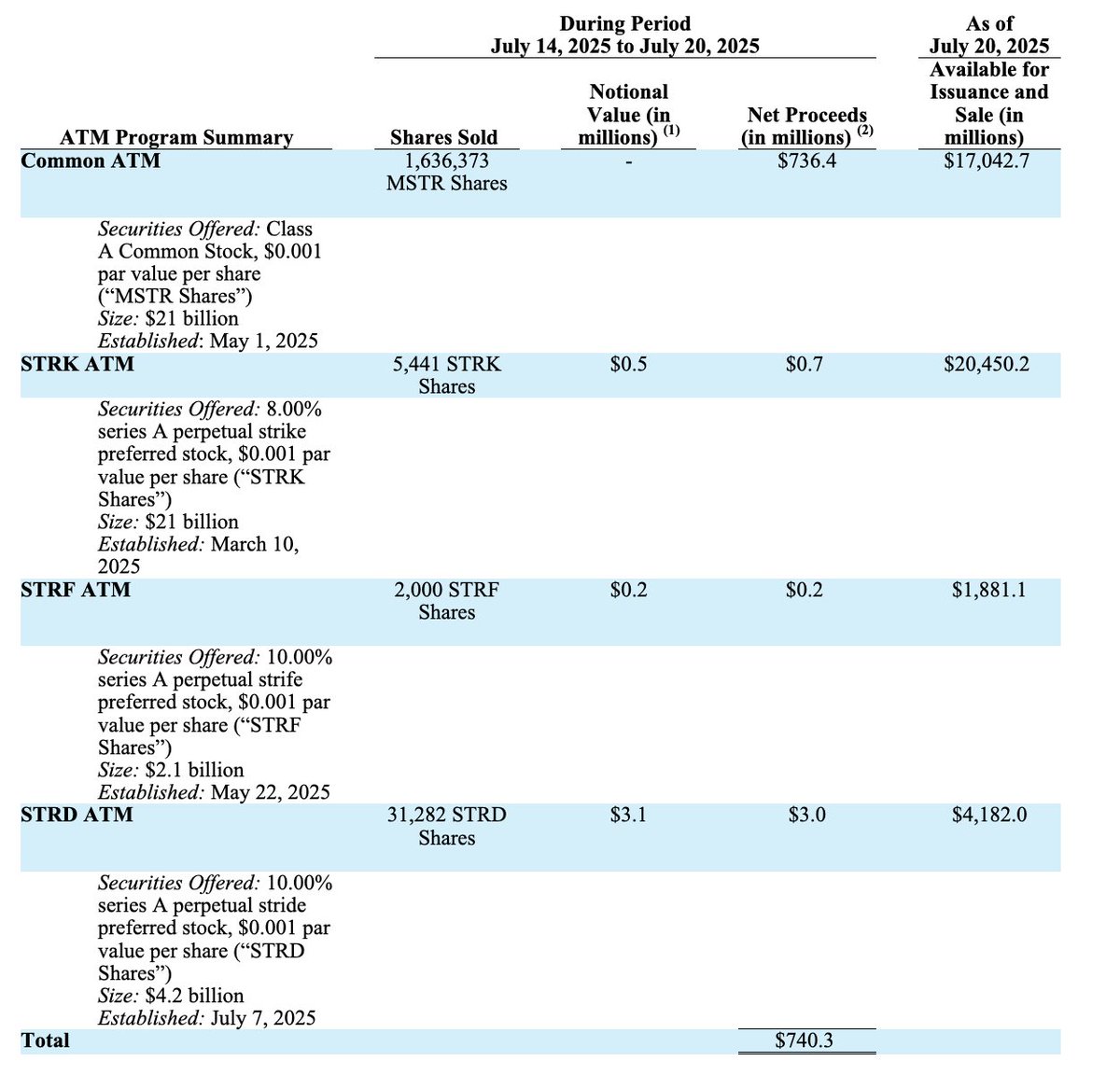

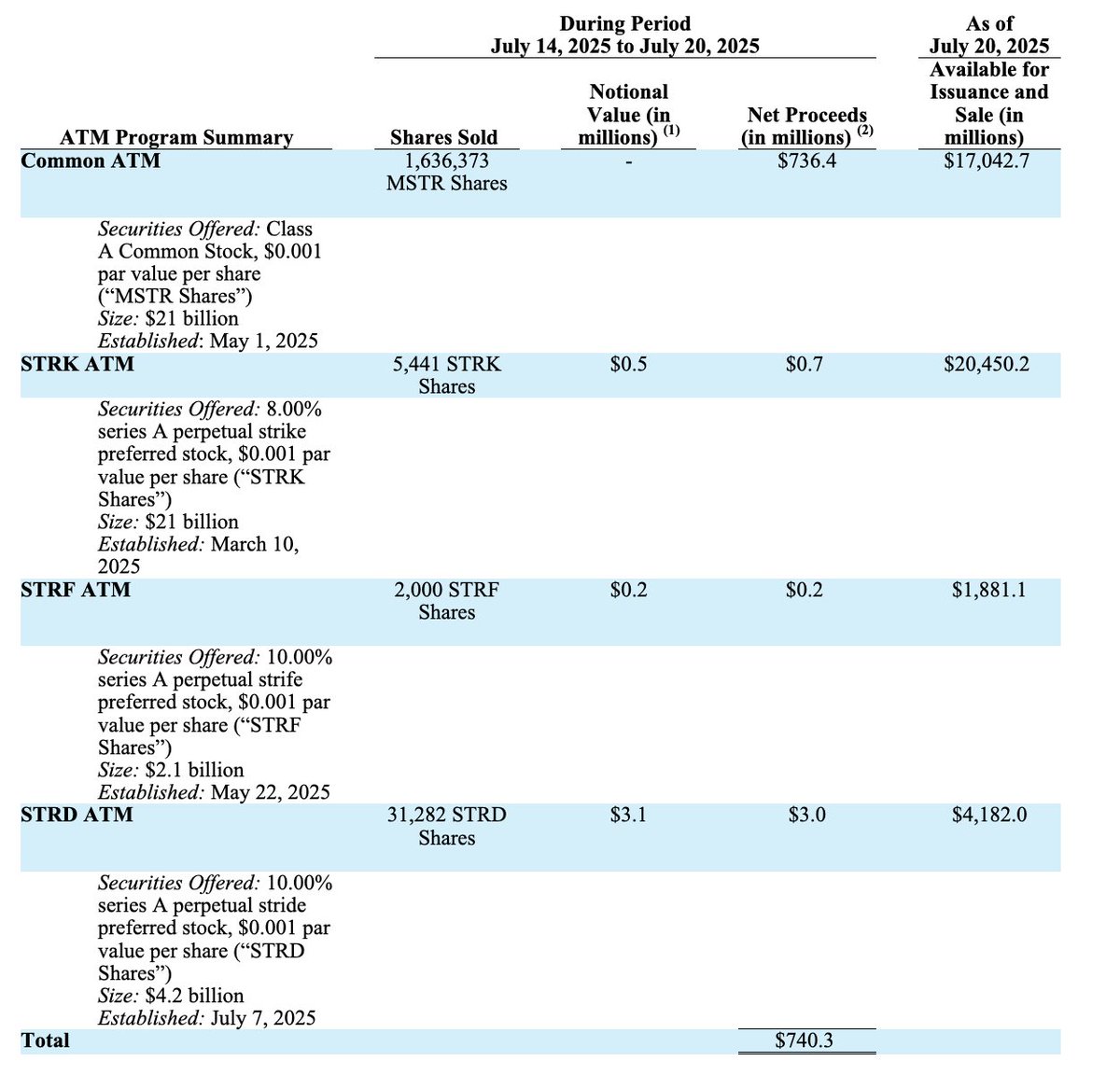

Summary of the $MSTR SEC filing – July 21, 2025:

X. $XXXXX million raised from $MSTR ATM at $XXXXXX per share on average. $XXXXX billion capacity remaining.

X. $XXX million raised from $STRK ATM at $XXXXXX per share on average. XXXXX billion capacity remaining.

X. $XXX million raised from $STRF ATM at $XXX per share on average (seems low, I’m pretty sure there’s a rounding problem or an error there). $XXXX billion capacity remaining.

X. $XXX million raised from $STRD ATM at $XXXXX per share on average. $XXXX billion capacity remaining.

X. In total, Strategy raised just $XXX million from preferreds last week. It seems that they are actively delevering their balance sheet to have even more capacity down the road.

X. $XXXXX billion of additional debt capacity remaining, under their 42/42 plan.

X. In total, $XXXXX billion of capital raising capacity remaining, assuming the $STRF and $STRD ATMs count on top. $XXXXX billion if they don’t count on top.

X. The market was open XXXX hours last week. Strategy raised $XXXXX million per hour and $XXXXXXX per minute while the market was open. Incredible performance if you compare it with other treasury companies, or what you can do personally.

X. Strategy purchased XXXXX BTC last week, and is now holding XXXXXXX BTC, or XXXX% of the total Bitcoin supply. (Not considering lost coins.). Road to 1M BTC is XXXX% complete.

XX. Last week’s purchase equals XXXXX days (or 1.97x) of new BTC supply last week.

XX. Strategy purchased XXXX BTC per minute, and XXX BTC per hour while the stock market was open last week.

XX. Strategy’s leverage ratio (debt to Bitcoin NAV) decreased to 16.5%. They still have XXXX% room left to reach their maximum of 30%. Their pref to Bitcoin NAV ratio is just 5%.

Well done @saylor and team! 🔥

XXXXXX engagements

Related Topics $btc hodl theres a $strk atm $mstr strategy stocks financial services