[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Javilo [@JaviLopezDiaz_](/creator/twitter/JaviLopezDiaz_) on x 1585 followers Created: 2025-07-21 11:19:04 UTC 🧵 DYDX deep guide for winners Forget the “DEX vs CEX” meme; @dYdX is quietly morphing into a Binance-grade perp engine that you run from a wallet. Grab a coffee, let’s unpack the tech, the token, the money flows, and the 2025 roadmap. ✔️ What is dYdX now? After five iterations it’s a sovereign Cosmos-SDK L1 (dYdX Chain) with an off-chain order book + on-chain settlement. Result: CEX-like speed, self-custody security. Daily stats still dwarf the rest of Cosmos perps: $XXX M XX h volume, $XXX M open interest, XXX markets. ✔️ Battle scars count Since 2021, traders have pushed $XXXX T lifetime volume through the protocol, surviving the 2022 blow-ups and 2024 crab markets. ✔️ The tech arc • v1–v3: Ethereum smart contracts → StarkEx L2 • v4 (Oct-2023): full L1, XX validators, IBC native • 2025+: XX % faster txs, Ethereum spot bridge, any-asset listing, new mobile UI. ✔️ Real yield, not headline APY Fees are paid XXX % in USDC, auto-streamed to stakers. Avg network reward in 2024: XXXX % (net of validator cut). ✔️ Where those fees come from • Chaos Labs’ Surge Season X review: • $XXX B volume in XX days • $XXX M OI (+8 %) $XX M cumulative fees to stakers since chain launch That’s real cash, not printed inflation. ✔️ Token-utility trident 1️⃣ Security – dYdX Chain is delegated-PoS collateral; slashable. 2️⃣ Fee share – all proto fees → stakers in USDC. 3️⃣ Governance – validators + holders vote on DRCs (parameter tweaks) & DIPs (code). Last week’s vote had XX % turnout, XX % “Yes”. CEXs dream of that engagement. Blockchain News ✔️ Supply map & unlocks • X B total minted (Aug 2021) • ~50 % circulating after the chain migration • Next unlock: XXXX M DYDX (0.47 %) on X Aug 2025. Vester cliff schedule winds down fully in Q3-2026, no perpetual emissions. ✔️ Buybacks = token sink Since Mar XX 2025, XX % of net fees buy @DYDX monthly (proposals on the table to scale to XXX %). Market-buy then stake, so float keeps shrinking while yield compounds. ✔️ Validator game theory Foundation just re-delegated X M $DYDX to tighten stake distribution across mid-tier node, fewer whales, more resilience. Expect more “stick diplomacy” (slash rules, MEV policies) in 2025. ✔️ Incentives ≠ Ponzinomics Surge Seasons are capped, transparent trading-point rewards (no emission spigot). Season X volumes dipped XX % yet OI and active traders climbed; evidence that the exchange can stand after the candy stops. dYdX’s edge: CEX-style order book + organic USDC yield. ✔️ 2025 Catalysts to watch Ethereum spot bridge (capital efficiency → new users) • “Trade Anything” engine (synthetics, RWAs, options) • Validator set shrink (60 → 50) = higher staking APR • Buyback ratio hike (25 → XX → XXX %) • Front-run the governance threads, not the headlines. ✔️ Risks (call them what they are) Liquidity wars: CEXs & on-chain perps will match fees. • Reg-drag: Perp DEXs are in every policymaker’s cross-hairs. • Cosmos fragmentation: IBC exploits, cross-chain UX friction. • Bridging sunset: Ethereum wethDYDX bridge ends June-2025—any laggards could create supply overhang (arbitrage). ✔️ My take DYDX today isn’t a speculative farm token; it’s a cash-flow asset secured by a validated order book that already does mid-nine-figure daily volume. If L1s are nation-states, dYdX is Wall Street. ✔️ How I’m positioning • XX % core stack staked (capture USDC flow) • XX % liquid for governance & LPing once spot bridge opens • XX % dry powder to ape Surge Seasons / buyback dips gDydx  XX engagements  **Related Topics** [onchain](/topic/onchain) [roadmap](/topic/roadmap) [money](/topic/money) [token](/topic/token) [perp](/topic/perp) [cex](/topic/cex) [Post Link](https://x.com/JaviLopezDiaz_/status/1947254998728880168)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Javilo @JaviLopezDiaz_ on x 1585 followers

Created: 2025-07-21 11:19:04 UTC

Javilo @JaviLopezDiaz_ on x 1585 followers

Created: 2025-07-21 11:19:04 UTC

🧵 DYDX deep guide for winners

Forget the “DEX vs CEX” meme; @dYdX is quietly morphing into a Binance-grade perp engine that you run from a wallet.

Grab a coffee, let’s unpack the tech, the token, the money flows, and the 2025 roadmap.

✔️ What is dYdX now?

After five iterations it’s a sovereign Cosmos-SDK L1 (dYdX Chain) with an off-chain order book + on-chain settlement.

Result: CEX-like speed, self-custody security. Daily stats still dwarf the rest of Cosmos perps: $XXX M XX h volume, $XXX M open interest, XXX markets.

✔️ Battle scars count

Since 2021, traders have pushed $XXXX T lifetime volume through the protocol, surviving the 2022 blow-ups and 2024 crab markets.

✔️ The tech arc

• v1–v3: Ethereum smart contracts → StarkEx L2 • v4 (Oct-2023): full L1, XX validators, IBC native • 2025+: XX % faster txs, Ethereum spot bridge, any-asset listing, new mobile UI.

✔️ Real yield, not headline APY

Fees are paid XXX % in USDC, auto-streamed to stakers.

Avg network reward in 2024: XXXX % (net of validator cut).

✔️ Where those fees come from

• Chaos Labs’ Surge Season X review: • $XXX B volume in XX days • $XXX M OI (+8 %)

$XX M cumulative fees to stakers since chain launch That’s real cash, not printed inflation.

✔️ Token-utility trident

1️⃣ Security – dYdX Chain is delegated-PoS collateral; slashable. 2️⃣ Fee share – all proto fees → stakers in USDC. 3️⃣ Governance – validators + holders vote on DRCs (parameter tweaks) & DIPs (code).

Last week’s vote had XX % turnout, XX % “Yes”. CEXs dream of that engagement. Blockchain News

✔️ Supply map & unlocks

• X B total minted (Aug 2021) • ~50 % circulating after the chain migration • Next unlock: XXXX M DYDX (0.47 %) on X Aug 2025.

Vester cliff schedule winds down fully in Q3-2026, no perpetual emissions.

✔️ Buybacks = token sink

Since Mar XX 2025, XX % of net fees buy @DYDX monthly (proposals on the table to scale to XXX %).

Market-buy then stake, so float keeps shrinking while yield compounds.

✔️ Validator game theory

Foundation just re-delegated X M $DYDX to tighten stake distribution across mid-tier node, fewer whales, more resilience.

Expect more “stick diplomacy” (slash rules, MEV policies) in 2025.

✔️ Incentives ≠ Ponzinomics

Surge Seasons are capped, transparent trading-point rewards (no emission spigot).

Season X volumes dipped XX % yet OI and active traders climbed; evidence that the exchange can stand after the candy stops. dYdX’s edge: CEX-style order book + organic USDC yield.

✔️ 2025 Catalysts to watch

Ethereum spot bridge (capital efficiency → new users)

• “Trade Anything” engine (synthetics, RWAs, options) • Validator set shrink (60 → 50) = higher staking APR • Buyback ratio hike (25 → XX → XXX %) • Front-run the governance threads, not the headlines.

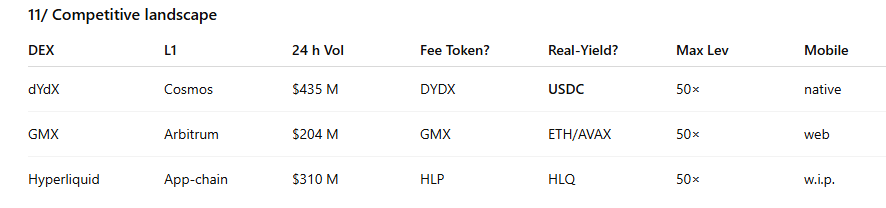

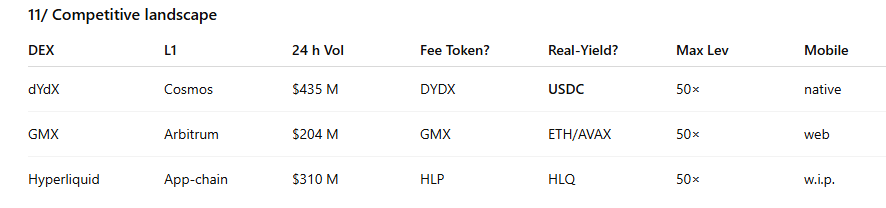

✔️ Risks (call them what they are) Liquidity wars: CEXs & on-chain perps will match fees.

• Reg-drag: Perp DEXs are in every policymaker’s cross-hairs. • Cosmos fragmentation: IBC exploits, cross-chain UX friction. • Bridging sunset: Ethereum wethDYDX bridge ends June-2025—any laggards could create supply overhang (arbitrage).

✔️ My take

DYDX today isn’t a speculative farm token; it’s a cash-flow asset secured by a validated order book that already does mid-nine-figure daily volume.

If L1s are nation-states, dYdX is Wall Street.

✔️ How I’m positioning

• XX % core stack staked (capture USDC flow) • XX % liquid for governance & LPing once spot bridge opens • XX % dry powder to ape Surge Seasons / buyback dips

gDydx

XX engagements