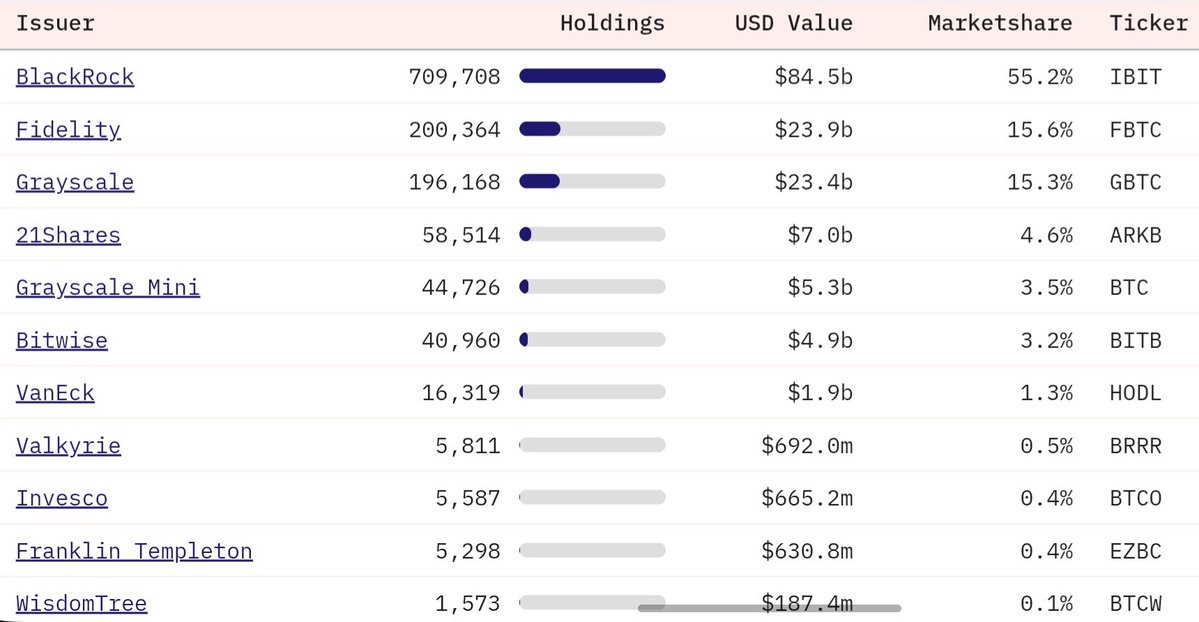

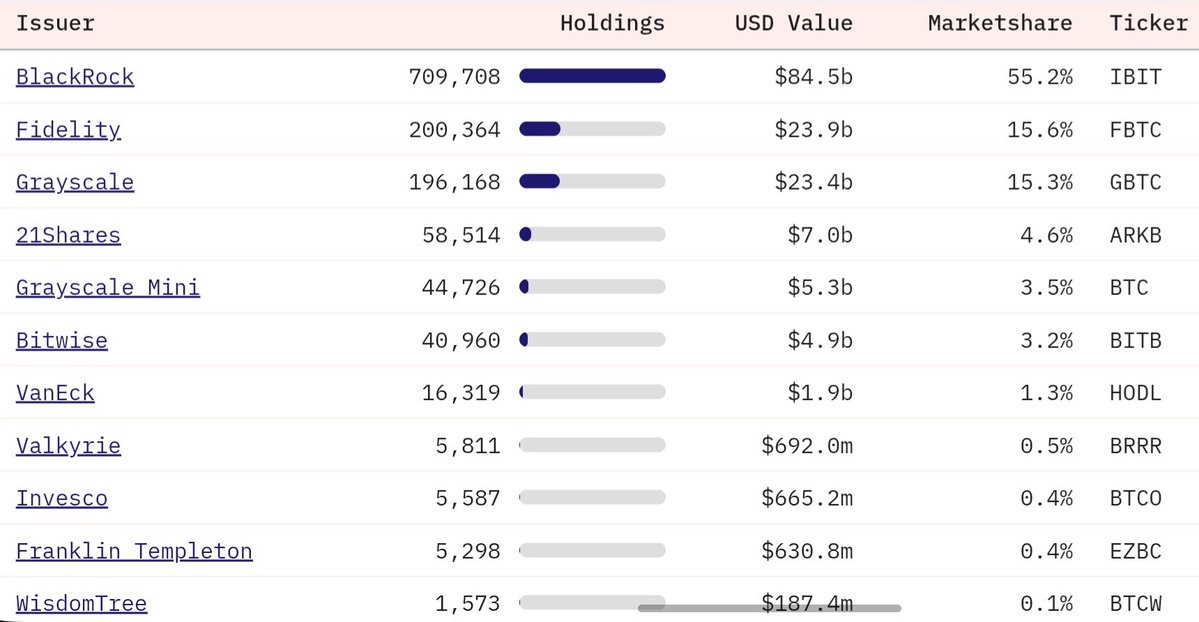

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  The Chain Analyst [@thechainanalyst](/creator/twitter/thechainanalyst) on x XXX followers Created: 2025-07-21 10:46:28 UTC 🚨 Curious about who’s dominating the Bitcoin ETF game, Check this out! BlackRock: Leads with XXXXXXX holdings, $XXX billion USD value, and XXXX% market share (IBIT). Fidelity: XXXXXXX holdings, $XXX billion, XXXX% share (FBTC). Grayscale: XXXXXXX holdings, $XXX billion, XXXX% share (GBTC). 21Shares: XXXXXX holdings, $XXX billion, XXX% share (ARKB). Grayscale Mini: XXXXXX holdings, $XXX billion, XXX% share (BTC). Bitwise: XXXXXX holdings, $XXX billion, XXX% share (BITB). VanEck: XXXXXX holdings, $XXX billion, XXX% share (HODL). Valkyrie: XXXXX holdings, $XXX million, XXX% share (BRRR). Invesco: XXXXX holdings, $XXX million, XXX% share (BTCO). Franklin Templeton: XXXXX holdings, $XXX million, XXX% share (EZBC). WisdomTree: XXXXX holdings, $XXX million, XXX% share (BTCW). BlackRock’s dominance is clear, but the pack is tight—Fidelity and Grayscale are hot on their heels! #BitcoinETF #CryptoInvesting #BlackRock #Fidelity #Grayscale #MarketTrends  XX engagements  **Related Topics** [ibit](/topic/ibit) [united states dollar](/topic/united-states-dollar) [fund manager](/topic/fund-manager) [bitcoin etf](/topic/bitcoin-etf) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [Post Link](https://x.com/thechainanalyst/status/1947246795912007725)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

The Chain Analyst @thechainanalyst on x XXX followers

Created: 2025-07-21 10:46:28 UTC

The Chain Analyst @thechainanalyst on x XXX followers

Created: 2025-07-21 10:46:28 UTC

🚨 Curious about who’s dominating the Bitcoin ETF game, Check this out!

BlackRock: Leads with XXXXXXX holdings, $XXX billion USD value, and XXXX% market share (IBIT).

Fidelity: XXXXXXX holdings, $XXX billion, XXXX% share (FBTC).

Grayscale: XXXXXXX holdings, $XXX billion, XXXX% share (GBTC).

21Shares: XXXXXX holdings, $XXX billion, XXX% share (ARKB).

Grayscale Mini: XXXXXX holdings, $XXX billion, XXX% share (BTC).

Bitwise: XXXXXX holdings, $XXX billion, XXX% share (BITB).

VanEck: XXXXXX holdings, $XXX billion, XXX% share (HODL).

Valkyrie: XXXXX holdings, $XXX million, XXX% share (BRRR).

Invesco: XXXXX holdings, $XXX million, XXX% share (BTCO).

Franklin Templeton: XXXXX holdings, $XXX million, XXX% share (EZBC).

WisdomTree: XXXXX holdings, $XXX million, XXX% share (BTCW).

BlackRock’s dominance is clear, but the pack is tight—Fidelity and

Grayscale are hot on their heels!

#BitcoinETF #CryptoInvesting #BlackRock #Fidelity #Grayscale #MarketTrends

XX engagements

Related Topics ibit united states dollar fund manager bitcoin etf bitcoin coins layer 1 coins bitcoin ecosystem coins pow