[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Cryptosolv [@cryptosolv](/creator/twitter/cryptosolv) on x 2748 followers Created: 2025-07-21 08:51:28 UTC 📢 Pulsechain bridge update 📢 We saw the bridge TVL hit some near-historic lows in the last month, so lets look at what's changed since then. ✍️ The bridge hit $73m TVL on the 23rd June, midway through the whale dumping extravaganza, and remained relatively flat for a few weeks before steadily climbing since then. Note: the quoted post goes into some of the reasons why 'bridge TVL' can be a challenging surface-level metric (some of the TVL increase is due to the increased price of bridged in eHEX). 🔎 Current bridge TVL sits closer to $91m. What's changed in the last X weeks then? Well, actually not that much. 💰 The number of $ETH on the bridge is exactly the same, however the value has skyrocketed, contributing to a significant ($9m) bump in TVL alone. 💰 Stablecoin holdings have dropped by ~$1.7m. 🔎 So why is this still bullish? Three reasons. 1⃣ Over that exact same time period, the large whale dumper bridged out and sold $9.7m of $WPLS into $ETH. A stable ETH bridge value, and the loss of only $1.7m of stablecoins in the face of nearly $10m of dumping is a huge win for the ecosystem. 2⃣ It's no secret the success of Pulsechain is heavily hinged on the price of $ETH. Even with a static ETH number on the bridge, the recent rapid increase in value means that any ETH being used to buy Pulsechain assets now has significantly more buy power. 3⃣ We went into some of the details about the 'dormant capital' sitting on chain in the quoted posted (it was around $40m at the time). Over the timeframe we've considered - despite a slight net outflow of stablecoins, and no new ETH, we've seen $PLS price increase by 50%. Many more Xs are theoretically possible solely using the dormant capital on chain - lots of people are still waiting on entries. We're always monitoring bridge flows, and it'll become glaringly obvious when the floodgates start opening. For now, things are relatively quiet, but that's not necessarily a bad thing. People are busy chasing ETH pumps. BTC > ETH > ALTs, right?  XXXXX engagements  **Related Topics** [liquid](/topic/liquid) [$73m](/topic/$73m) [tvl](/topic/tvl) [pulsechain](/topic/pulsechain) [coins layer 1](/topic/coins-layer-1) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/cryptosolv/status/1947217852534256011)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Cryptosolv @cryptosolv on x 2748 followers

Created: 2025-07-21 08:51:28 UTC

Cryptosolv @cryptosolv on x 2748 followers

Created: 2025-07-21 08:51:28 UTC

📢 Pulsechain bridge update 📢

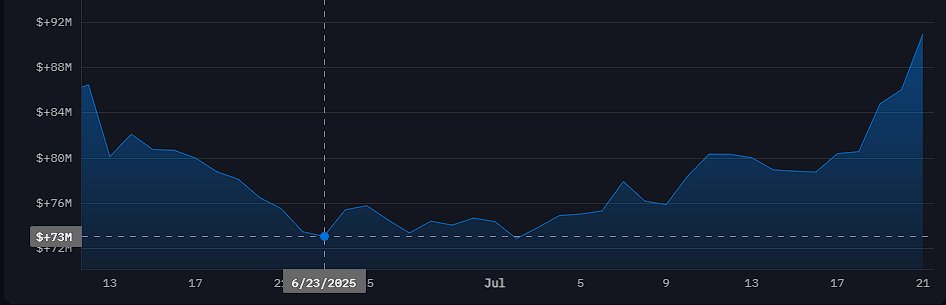

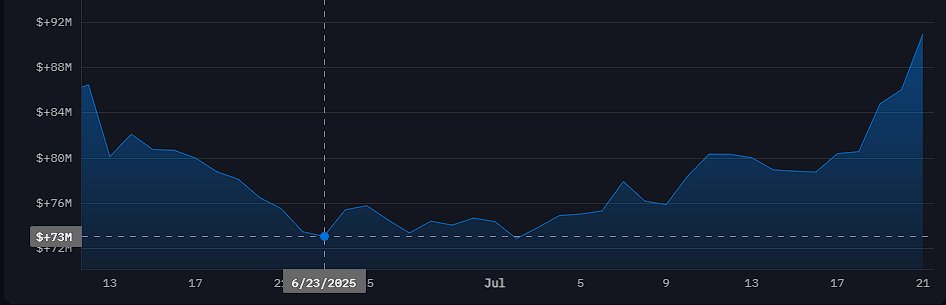

We saw the bridge TVL hit some near-historic lows in the last month, so lets look at what's changed since then.

✍️ The bridge hit $73m TVL on the 23rd June, midway through the whale dumping extravaganza, and remained relatively flat for a few weeks before steadily climbing since then. Note: the quoted post goes into some of the reasons why 'bridge TVL' can be a challenging surface-level metric (some of the TVL increase is due to the increased price of bridged in eHEX).

🔎 Current bridge TVL sits closer to $91m. What's changed in the last X weeks then?

Well, actually not that much.

💰 The number of $ETH on the bridge is exactly the same, however the value has skyrocketed, contributing to a significant ($9m) bump in TVL alone. 💰 Stablecoin holdings have dropped by ~$1.7m.

🔎 So why is this still bullish? Three reasons.

1⃣ Over that exact same time period, the large whale dumper bridged out and sold $9.7m of $WPLS into $ETH. A stable ETH bridge value, and the loss of only $1.7m of stablecoins in the face of nearly $10m of dumping is a huge win for the ecosystem.

2⃣ It's no secret the success of Pulsechain is heavily hinged on the price of $ETH. Even with a static ETH number on the bridge, the recent rapid increase in value means that any ETH being used to buy Pulsechain assets now has significantly more buy power.

3⃣ We went into some of the details about the 'dormant capital' sitting on chain in the quoted posted (it was around $40m at the time). Over the timeframe we've considered - despite a slight net outflow of stablecoins, and no new ETH, we've seen $PLS price increase by 50%. Many more Xs are theoretically possible solely using the dormant capital on chain - lots of people are still waiting on entries.

We're always monitoring bridge flows, and it'll become glaringly obvious when the floodgates start opening. For now, things are relatively quiet, but that's not necessarily a bad thing.

People are busy chasing ETH pumps. BTC > ETH > ALTs, right?

XXXXX engagements

Related Topics liquid $73m tvl pulsechain coins layer 1 coins made in usa