[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Ajah [@ajah_elube](/creator/twitter/ajah_elube) on x 6073 followers Created: 2025-07-21 07:00:01 UTC You might’ve seen the headlines. President Trump signed the GENIUS Act, giving stablecoins a clearer path in the U.S. On the heels of that, Tether’s CEO said USDT will now align with the new requirements. But here’s the thing. USDT wasn’t always welcomed with open arms. It faced serious criticism over transparency, reserve backing, and regulatory compliance. There were past fines, including an $18.5M settlement for misleading statements. No full audit, and claims that reserve reports didn’t reveal the full picture. Europe even delisted USDT under its MiCA rules for a time. Fast forward to now. Regulation is catching up, and $USDT is adapting. But let's compare that with where Lombard Finance stands today. ✓ Tether and Circle built stablecoin foundations over several cycles, becoming essential infrastructure surrounding USDT/USDC. ✓ Today, $LBTC is pulling off something similar for Bitcoin. Liquid, yield bearing, permissionless, and already integrated across chains and DeFi. ✓ Lombard has scaled to over $2B TVL in under XXX days and activated BTC in 80+ integrations. ✓ They’ve done the technical and economic work before the mainstream talks about regulation or hype. Just like USDT became a backbone for stablecoins, LBTC is on track to become the backbone for Bitcoin native capital markets. Tether’s validation through regulation proves institutional scale infrastructure matters. With LBTC, @Lombard_Finance is already laying that same groundwork, only this time, it’s Bitcoin at the foundation. The stablecoin era showed us what’s possible. Now Lombard is showing what’s next.  XXX engagements  **Related Topics** [usdt](/topic/usdt) [stablecoins](/topic/stablecoins) [donald trump](/topic/donald-trump) [Post Link](https://x.com/ajah_elube/status/1947189805172793622)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Ajah @ajah_elube on x 6073 followers

Created: 2025-07-21 07:00:01 UTC

Ajah @ajah_elube on x 6073 followers

Created: 2025-07-21 07:00:01 UTC

You might’ve seen the headlines.

President Trump signed the GENIUS Act, giving stablecoins a clearer path in the U.S. On the heels of that, Tether’s CEO said USDT will now align with the new requirements.

But here’s the thing.

USDT wasn’t always welcomed with open arms. It faced serious criticism over transparency, reserve backing, and regulatory compliance. There were past fines, including an $18.5M settlement for misleading statements. No full audit, and claims that reserve reports didn’t reveal the full picture.

Europe even delisted USDT under its MiCA rules for a time.

Fast forward to now.

Regulation is catching up, and $USDT is adapting. But let's compare that with where Lombard Finance stands today.

✓ Tether and Circle built stablecoin foundations over several cycles, becoming essential infrastructure surrounding USDT/USDC.

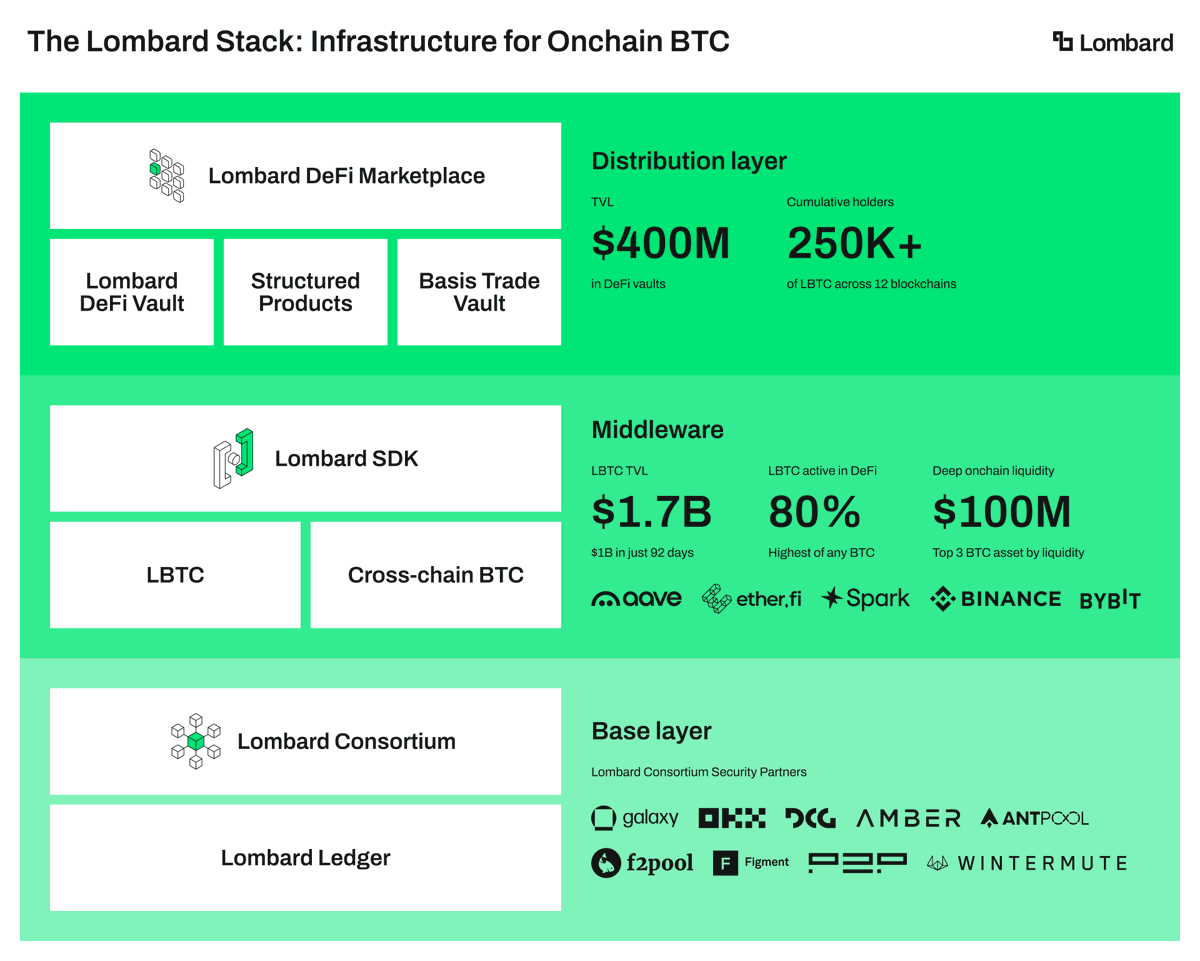

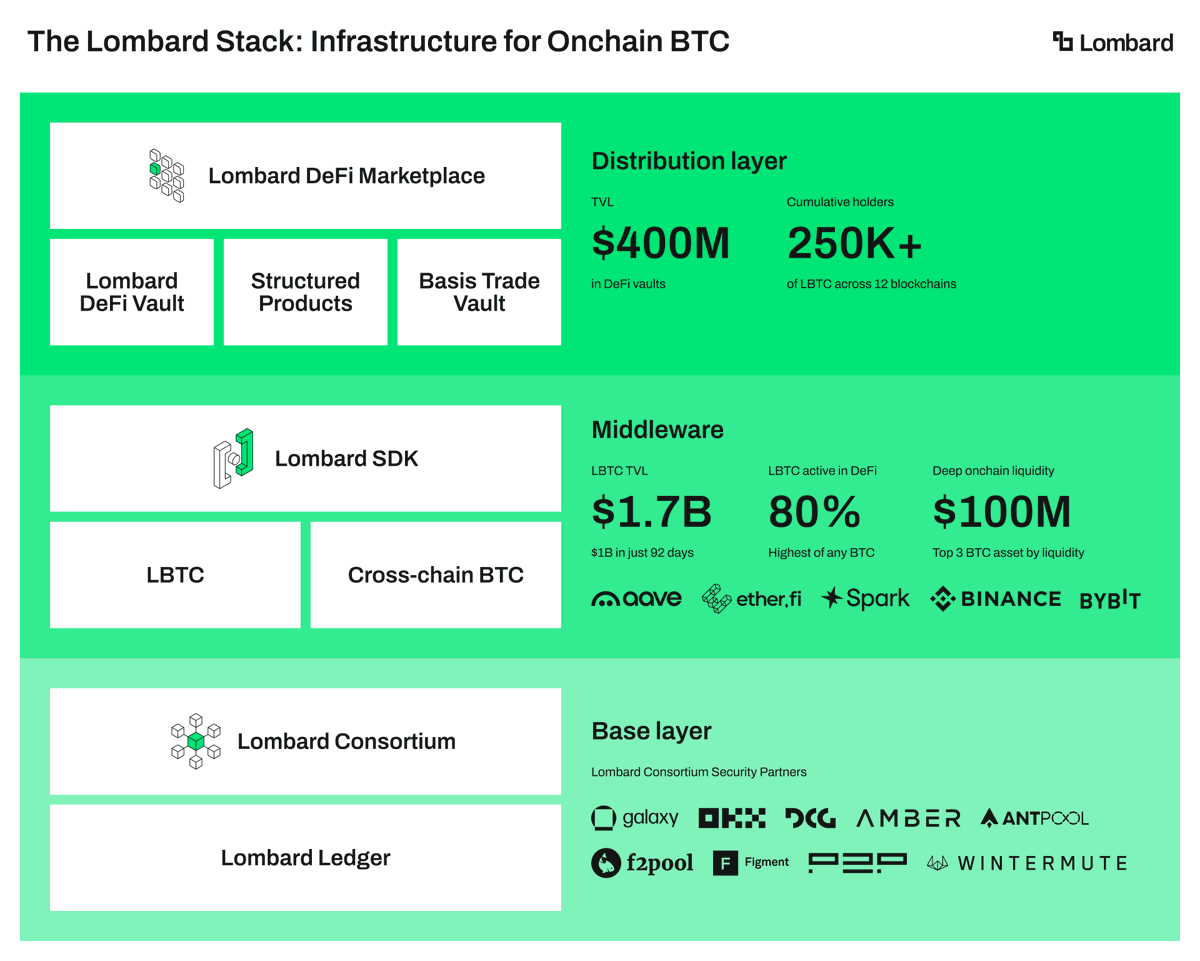

✓ Today, $LBTC is pulling off something similar for Bitcoin. Liquid, yield bearing, permissionless, and already integrated across chains and DeFi.

✓ Lombard has scaled to over $2B TVL in under XXX days and activated BTC in 80+ integrations.

✓ They’ve done the technical and economic work before the mainstream talks about regulation or hype.

Just like USDT became a backbone for stablecoins, LBTC is on track to become the backbone for Bitcoin native capital markets.

Tether’s validation through regulation proves institutional scale infrastructure matters. With LBTC, @Lombard_Finance is already laying that same groundwork, only this time, it’s Bitcoin at the foundation.

The stablecoin era showed us what’s possible. Now Lombard is showing what’s next.

XXX engagements

Related Topics usdt stablecoins donald trump