[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  DarwinKnows [@Darwin_Knows](/creator/twitter/Darwin_Knows) on x XXX followers Created: 2025-07-21 05:01:50 UTC Intel Corp (Valuation - Very Expensive) US Large Caps: Intel Corp has a total darwin score of -XX The valuation rating for Intel Corp is deemed "very expensive." This conclusion is drawn from the forward price-to-earnings (P/E) ratio of 84.746, which is significantly higher than the peer average of XXXXXX. Such a high P/E ratio suggests that investors are paying a premium for the stock relative to its earnings potential. Furthermore, the enterprise value to EBITDA ratio stands at 87.158, again far exceeding the peer average of XXXXXX. These metrics indicate that the stock is overvalued compared to its peers, making it less attractive for value-oriented investors. #DarwinKnows #Intel #INTC $INTC #FreeTrialAvailable #AskDarwin #StockToWatch  XX engagements  **Related Topics** [$intc](/topic/$intc) [stocks technology](/topic/stocks-technology) [Post Link](https://x.com/Darwin_Knows/status/1947160062809772520)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-21 05:01:50 UTC

DarwinKnows @Darwin_Knows on x XXX followers

Created: 2025-07-21 05:01:50 UTC

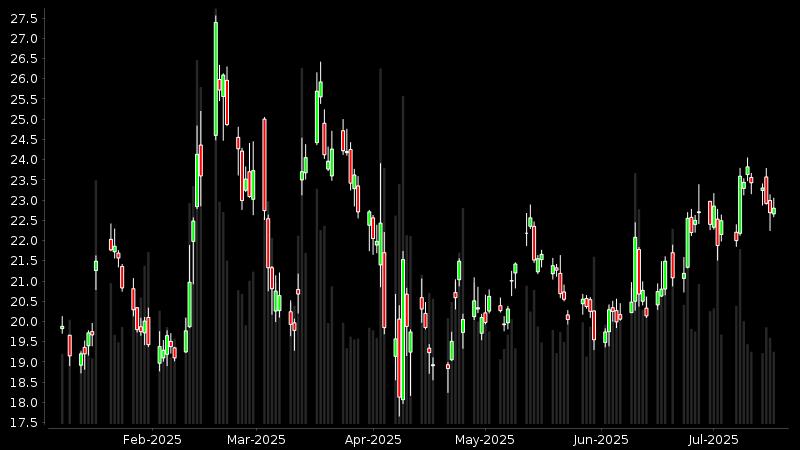

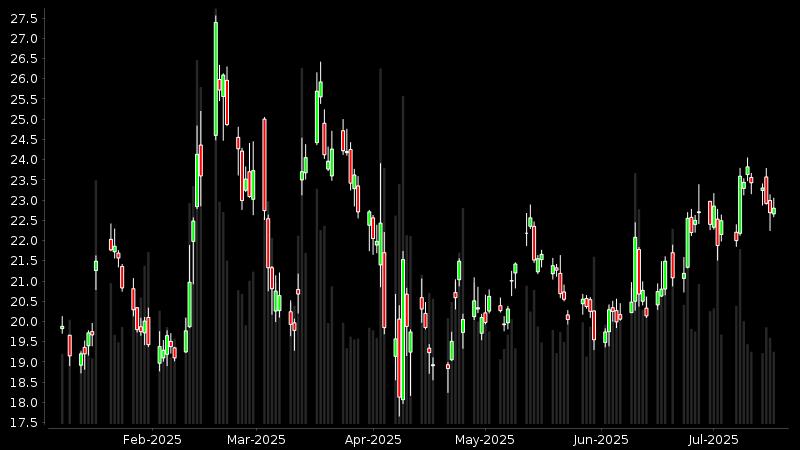

Intel Corp (Valuation - Very Expensive)

US Large Caps: Intel Corp has a total darwin score of -XX

The valuation rating for Intel Corp is deemed "very expensive." This conclusion is drawn from the forward price-to-earnings (P/E) ratio of 84.746, which is significantly higher than the peer average of XXXXXX. Such a high P/E ratio suggests that investors are paying a premium for the stock relative to its earnings potential. Furthermore, the enterprise value to EBITDA ratio stands at 87.158, again far exceeding the peer average of XXXXXX. These metrics indicate that the stock is overvalued compared to its peers, making it less attractive for value-oriented investors.

#DarwinKnows #Intel #INTC $INTC

#FreeTrialAvailable #AskDarwin #StockToWatch

XX engagements

Related Topics $intc stocks technology