[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  AoI Ventures [@aoiventures](/creator/twitter/aoiventures) on x 10.8K followers Created: 2025-07-21 03:02:57 UTC 📊 Reliance: Mixed bag, upside seen up to XX% 👉🏻 JPMorgan: Maintains Overweight; TP hiked to ₹1,695 (from ₹1,568) 🔹 Better telecom margins & new energy outlook positive 🔹 Retail growth at XX% YoY, below estimates 🔹 O2C EBITDA below forecast, PAT growth seen in FY26/27 👉🏻 Macquarie: Outperform; TP ₹1,500 🔹 Jio strong, retail lags 🔹 Jun-Q beat helped by one-off gains 🔹 Cautious near term; gradual O2C recovery 👉🏻 Morgan Stanley: Overweight; TP ₹1,617 🔹 Retail & refining weak; new energy, telecom shine 🔹 Optimistic guidance, impact of Russian oil sanctions being watched 👉🏻 Nuvama: Highest TP ₹1,767 (↓ from ₹1,801) → XX% upside seen 🔹 Sees new energy as multi-decade driver 👉🏻 Jefferies: Buy; TP ₹1,726 🔹 Constructive refining outlook despite shutdown 🔹 AGM, Jio listing & tariff hike in focus 👉🏻 Nomura: Buy; TP ₹1,600 🔹 Cuts FY26/27 PAT & EBITDA estimates 🔹 Key triggers: new energy scale-up, Jio tariff hikes, IPO hopes 📌 CMP: ₹1,476 (as of 18-Jul-2025) 💡 XX% analysts maintain “Buy” rating #Reliance #Brokerage #Q1Results #Jio #O2C #Retail #NewEnergy #PAT #RIL  XXX engagements  **Related Topics** [coins energy](/topic/coins-energy) [aoi](/topic/aoi) [jpmorgan chase](/topic/jpmorgan-chase) [stocks financial services](/topic/stocks-financial-services) [stocks banks](/topic/stocks-banks) [Post Link](https://x.com/aoiventures/status/1947130148215808220)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

AoI Ventures @aoiventures on x 10.8K followers

Created: 2025-07-21 03:02:57 UTC

AoI Ventures @aoiventures on x 10.8K followers

Created: 2025-07-21 03:02:57 UTC

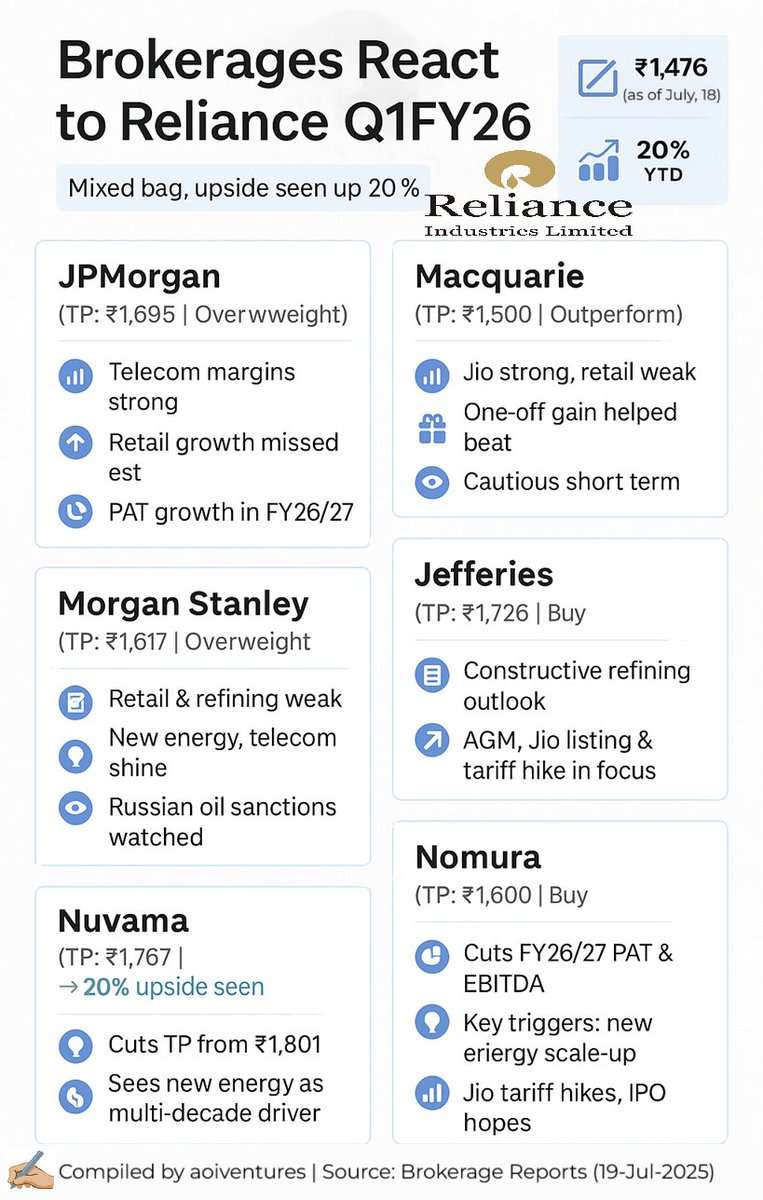

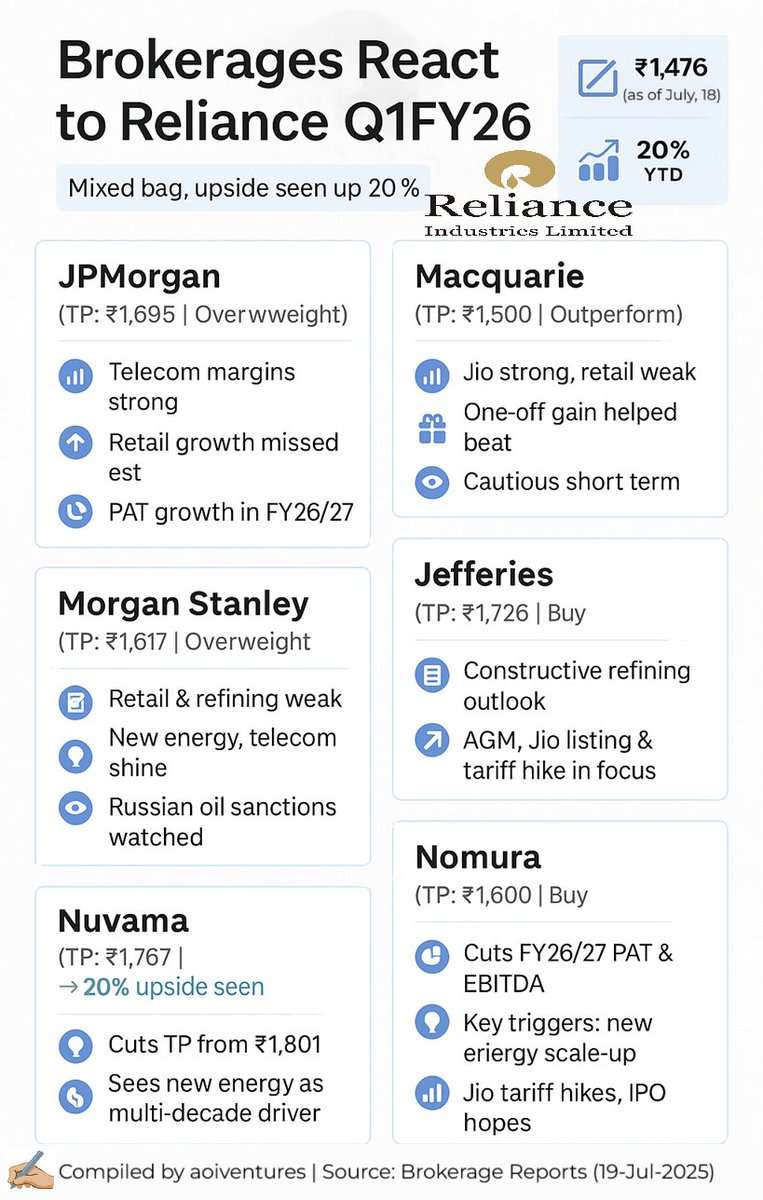

📊 Reliance: Mixed bag, upside seen up to XX%

👉🏻 JPMorgan: Maintains Overweight; TP hiked to ₹1,695 (from ₹1,568) 🔹 Better telecom margins & new energy outlook positive 🔹 Retail growth at XX% YoY, below estimates 🔹 O2C EBITDA below forecast, PAT growth seen in FY26/27

👉🏻 Macquarie: Outperform; TP ₹1,500 🔹 Jio strong, retail lags 🔹 Jun-Q beat helped by one-off gains 🔹 Cautious near term; gradual O2C recovery

👉🏻 Morgan Stanley: Overweight; TP ₹1,617 🔹 Retail & refining weak; new energy, telecom shine 🔹 Optimistic guidance, impact of Russian oil sanctions being watched

👉🏻 Nuvama: Highest TP ₹1,767 (↓ from ₹1,801) → XX% upside seen 🔹 Sees new energy as multi-decade driver

👉🏻 Jefferies: Buy; TP ₹1,726 🔹 Constructive refining outlook despite shutdown 🔹 AGM, Jio listing & tariff hike in focus

👉🏻 Nomura: Buy; TP ₹1,600 🔹 Cuts FY26/27 PAT & EBITDA estimates 🔹 Key triggers: new energy scale-up, Jio tariff hikes, IPO hopes

📌 CMP: ₹1,476 (as of 18-Jul-2025) 💡 XX% analysts maintain “Buy” rating #Reliance #Brokerage #Q1Results #Jio #O2C #Retail #NewEnergy #PAT #RIL

XXX engagements

Related Topics coins energy aoi jpmorgan chase stocks financial services stocks banks