[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Investors Compass [@selvaprathee](/creator/twitter/selvaprathee) on x 11.6K followers Created: 2025-07-20 19:45:08 UTC Core Portfolio Strategy: Phases of Rerating Cycle for compounders 1️⃣ Phase 1: Valuation Catch-up - Sector tailwinds (policy, capex, demand surge) drive FOMO. Multiple expansion fuels the rally, not earnings. ➡️ Focus: Growth story priced in 12–18 months. ➡️ Challenge: High risk of overvaluation if execution falls short. 2️⃣ Phase 2: Earnings Delivery - Execution quality, margin durability, and scalability take centre stage. Stocks move with EPS compounding. ➡️ Challenge: Stocks move with EPS compounding; derating risks if performance falters. 3️⃣ Phase 3: Terminal Value Compression - Growth normalizes, and the market starts questioning "What’s next?" Unless reinvention occurs, multiples compress. ➡️ Focus: Smart money exits, dumb money enters. ➡️ Challenge: Companies must innovate or face stagnation. - True wealth is built not just by riding Phase X euphoria, but by holding conviction through Phase X and exiting rationally in Phase X. Designing Your Core Portfolio with This Strategy X. Phase 1: Valuation Catch-up - Stocks with sector tailwinds or growth priced in (12–18 months ahead). Example: - Waaree Energies: Solar growth driven by policy tailwinds. - JSW Energy: Capex boost in renewable energy priced in. X. Phase 2: Earnings Delivery - Execution, margins, and scalability. Stocks move with EPS compounding. Example: - Transrail: Strong order book execution in T&D infrastructure. X. Phase 3: Terminal Value Compression - Growth normalizes, market questions "What's next?" and multiples compress. Example: - Dixon Technologies: Growth slows as competition rises and government incentives expire, will lead to valuation compression. No Buy/Sell recommendation #StocksInFocus #StocksToWatch #Transrail #waareeenergies #Jswenergy  XXXXX engagements  **Related Topics** [visibility](/topic/visibility) [stocks](/topic/stocks) [fomo](/topic/fomo) [Post Link](https://x.com/selvaprathee/status/1947019965242191929)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Investors Compass @selvaprathee on x 11.6K followers

Created: 2025-07-20 19:45:08 UTC

Investors Compass @selvaprathee on x 11.6K followers

Created: 2025-07-20 19:45:08 UTC

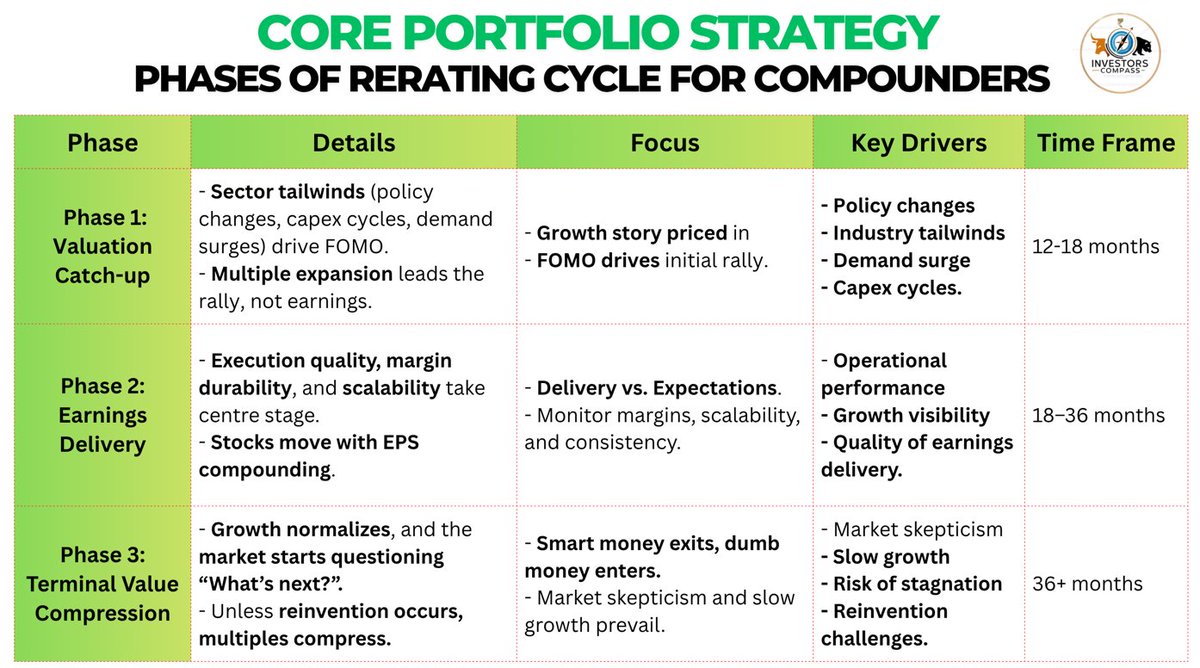

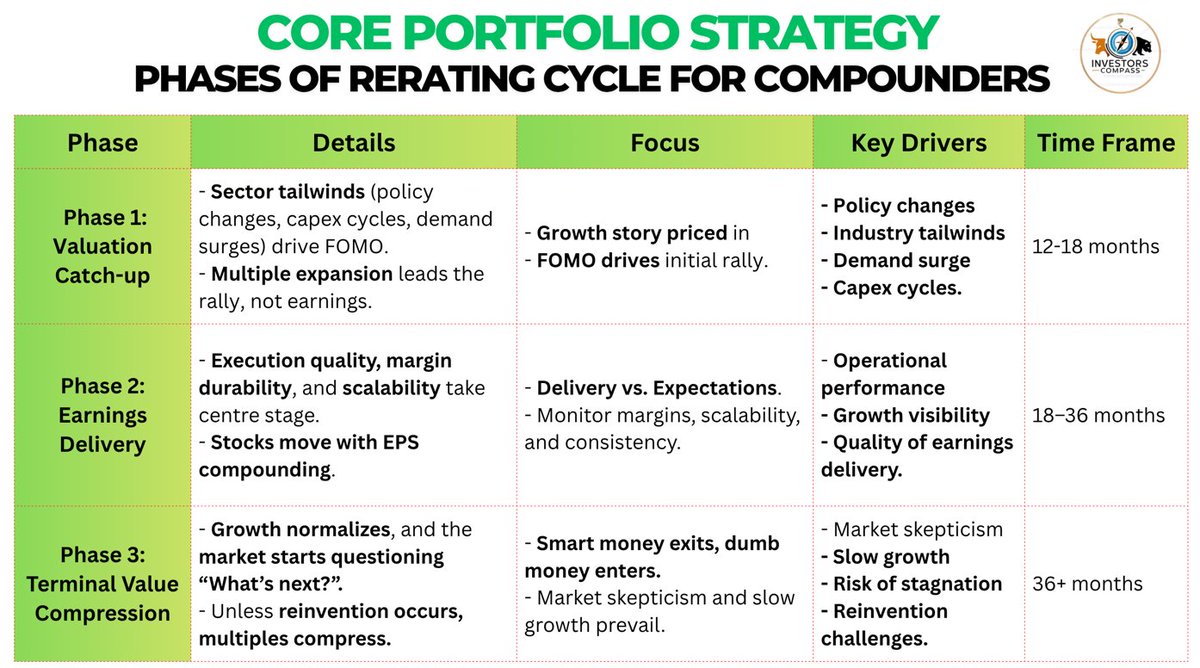

Core Portfolio Strategy: Phases of Rerating Cycle for compounders

1️⃣ Phase 1: Valuation Catch-up

- Sector tailwinds (policy, capex, demand surge) drive FOMO. Multiple expansion fuels the rally, not earnings. ➡️ Focus: Growth story priced in 12–18 months. ➡️ Challenge: High risk of overvaluation if execution falls short.

2️⃣ Phase 2: Earnings Delivery

- Execution quality, margin durability, and scalability take centre stage. Stocks move with EPS compounding. ➡️ Challenge: Stocks move with EPS compounding; derating risks if performance falters.

3️⃣ Phase 3: Terminal Value Compression

Growth normalizes, and the market starts questioning "What’s next?" Unless reinvention occurs, multiples compress. ➡️ Focus: Smart money exits, dumb money enters. ➡️ Challenge: Companies must innovate or face stagnation.

True wealth is built not just by riding Phase X euphoria, but by holding conviction through Phase X and exiting rationally in Phase X.

Designing Your Core Portfolio with This Strategy

X. Phase 1: Valuation Catch-up

- Stocks with sector tailwinds or growth priced in (12–18 months ahead). Example:

- Waaree Energies: Solar growth driven by policy tailwinds.

- JSW Energy: Capex boost in renewable energy priced in.

X. Phase 2: Earnings Delivery

- Execution, margins, and scalability. Stocks move with EPS compounding. Example:

- Transrail: Strong order book execution in T&D infrastructure.

X. Phase 3: Terminal Value Compression

- Growth normalizes, market questions "What's next?" and multiples compress. Example:

- Dixon Technologies: Growth slows as competition rises and government incentives expire, will lead to valuation compression.

No Buy/Sell recommendation #StocksInFocus #StocksToWatch #Transrail #waareeenergies #Jswenergy

XXXXX engagements

Related Topics visibility stocks fomo