[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dt.Coca-Cola | 🪶/acc 🧙♂️,🧙♂️ [@0xFatih](/creator/twitter/0xFatih) on x 1185 followers Created: 2025-07-20 18:40:21 UTC Huma Finance vs Ripple I previously conducted a detailed analysis of XRP vs @HumaFinance. However, much has changed since then. We now have the $HUMA token. Let us quickly compare XRP and Huma Finance again. Why is Huma Finance better than XRP? DeFi Native Open System Huma Finance is deployed on DeFi and is fully compatible with DeFi. DeFi composable modularity stack is at the core of Huma Finance. XRP, on the other hand, has a more centralized structure controlled by Ripple Labs. It is not sufficiently decentralized. Stablecoin Usages Huma Finance minimizes volatility by using stablecoins for cross-border payments. With the GENIUS ACT law, the risk of these stablecoins depegging has been reduced. XRP uses XRP for cross-border payments, which creates significant risks for institutions due to volatility. There are rumors that they are currently developing a stablecoin called $RLUSD. Open and Composable Ecosystem Huma Finance is completely open-source, enabling faster and easier integration with other networks. As you may recall, Huma XXX was available on various EVM networks such as Scroll and Polygon. Huma 2.0, however, is fully focused on Solana in Permissionless mode. The team can expand to any network at any time. XRP, on the other hand, is based on RippleNet. It is a more closed ecosystem and is entirely under the control of RippleLabs. This structure limits flexibility and innovation opportunities. Huma partnered with Solana, Stellar, Circle, and Fireblocks to build a collaborative, scalable, and compliant ecosystem. Accessibility XRP is designed exclusively for institutions. This limits access for small businesses. Huma Finance, on the other hand, has achieved permissionless mode with Huma XXX. It caters to both institutions and SMEs. Huma Finance's user portfolio is broader than Ripple's. Additionally, anyone can deposit funds into Huma Finance and generate income from it. In contrast, income generated by small users from $XRP is entirely zero. Furthermore, it is anticipated that the $HUMA buyback program will be activated by the end of 2025, once annual revenue exceeds XX million. Decentralization Huma Finance is already on Solana, which is a decentralized network. The $HUMA token has a strong distribution with a total of 18.4K holders, and only XX% of the tokens are allocated to the team. XX% of the XRP supply is controlled by RippleLabs. This undermines the decentralized structure. RippleNet validator nodes are selected by RippleLabs. XRP's Strengths XRP has higher adoption among banks and financial institutions. Huma Finance being a new project creates adoption gaps. However, Huma Finance's adoption is growing at an unprecedented rate. Ripple reached an annual transfer volume of $70B in XX years. Huma Finance, on the other hand, reached an annual transfer volume of $5.4B in just X years. With these growth rates, it is projected that Huma Finance could catch up to Ripple in annual volume within 2-3 years. Huma's annual transfer volume is expected to exceed $10B by the end of 2025. Potential It's challenging, but if $HUMA reaches $XRP's market cap, this would mean a price of $XXX per Huma and a 3,130x increase. Let's see if @DrPayFi and @0xErbil can achieve this, lol. Thank you for reading.  XXXXX engagements  **Related Topics** [stack](/topic/stack) [token](/topic/token) [humafinance](/topic/humafinance) [finance](/topic/finance) [huma](/topic/huma) [xrp](/topic/xrp) [coins defi](/topic/coins-defi) [coins made in usa](/topic/coins-made-in-usa) [Post Link](https://x.com/0xFatih/status/1947003662955315234)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dt.Coca-Cola | 🪶/acc 🧙♂️,🧙♂️ @0xFatih on x 1185 followers

Created: 2025-07-20 18:40:21 UTC

Dt.Coca-Cola | 🪶/acc 🧙♂️,🧙♂️ @0xFatih on x 1185 followers

Created: 2025-07-20 18:40:21 UTC

Huma Finance vs Ripple

I previously conducted a detailed analysis of XRP vs @HumaFinance. However, much has changed since then. We now have the $HUMA token. Let us quickly compare XRP and Huma Finance again.

Why is Huma Finance better than XRP?

DeFi Native Open System Huma Finance is deployed on DeFi and is fully compatible with DeFi. DeFi composable modularity stack is at the core of Huma Finance. XRP, on the other hand, has a more centralized structure controlled by Ripple Labs. It is not sufficiently decentralized.

Stablecoin Usages Huma Finance minimizes volatility by using stablecoins for cross-border payments. With the GENIUS ACT law, the risk of these stablecoins depegging has been reduced. XRP uses XRP for cross-border payments, which creates significant risks for institutions due to volatility. There are rumors that they are currently developing a stablecoin called $RLUSD.

Open and Composable Ecosystem Huma Finance is completely open-source, enabling faster and easier integration with other networks. As you may recall, Huma XXX was available on various EVM networks such as Scroll and Polygon. Huma 2.0, however, is fully focused on Solana in Permissionless mode. The team can expand to any network at any time. XRP, on the other hand, is based on RippleNet. It is a more closed ecosystem and is entirely under the control of RippleLabs. This structure limits flexibility and innovation opportunities. Huma partnered with Solana, Stellar, Circle, and Fireblocks to build a collaborative, scalable, and compliant ecosystem.

Accessibility XRP is designed exclusively for institutions. This limits access for small businesses. Huma Finance, on the other hand, has achieved permissionless mode with Huma XXX. It caters to both institutions and SMEs. Huma Finance's user portfolio is broader than Ripple's.

Additionally, anyone can deposit funds into Huma Finance and generate income from it. In contrast, income generated by small users from $XRP is entirely zero. Furthermore, it is anticipated that the $HUMA buyback program will be activated by the end of 2025, once annual revenue exceeds XX million.

Decentralization Huma Finance is already on Solana, which is a decentralized network. The $HUMA token has a strong distribution with a total of 18.4K holders, and only XX% of the tokens are allocated to the team. XX% of the XRP supply is controlled by RippleLabs. This undermines the decentralized structure. RippleNet validator nodes are selected by RippleLabs.

XRP's Strengths XRP has higher adoption among banks and financial institutions. Huma Finance being a new project creates adoption gaps. However, Huma Finance's adoption is growing at an unprecedented rate. Ripple reached an annual transfer volume of $70B in XX years. Huma Finance, on the other hand, reached an annual transfer volume of $5.4B in just X years. With these growth rates, it is projected that Huma Finance could catch up to Ripple in annual volume within 2-3 years. Huma's annual transfer volume is expected to exceed $10B by the end of 2025.

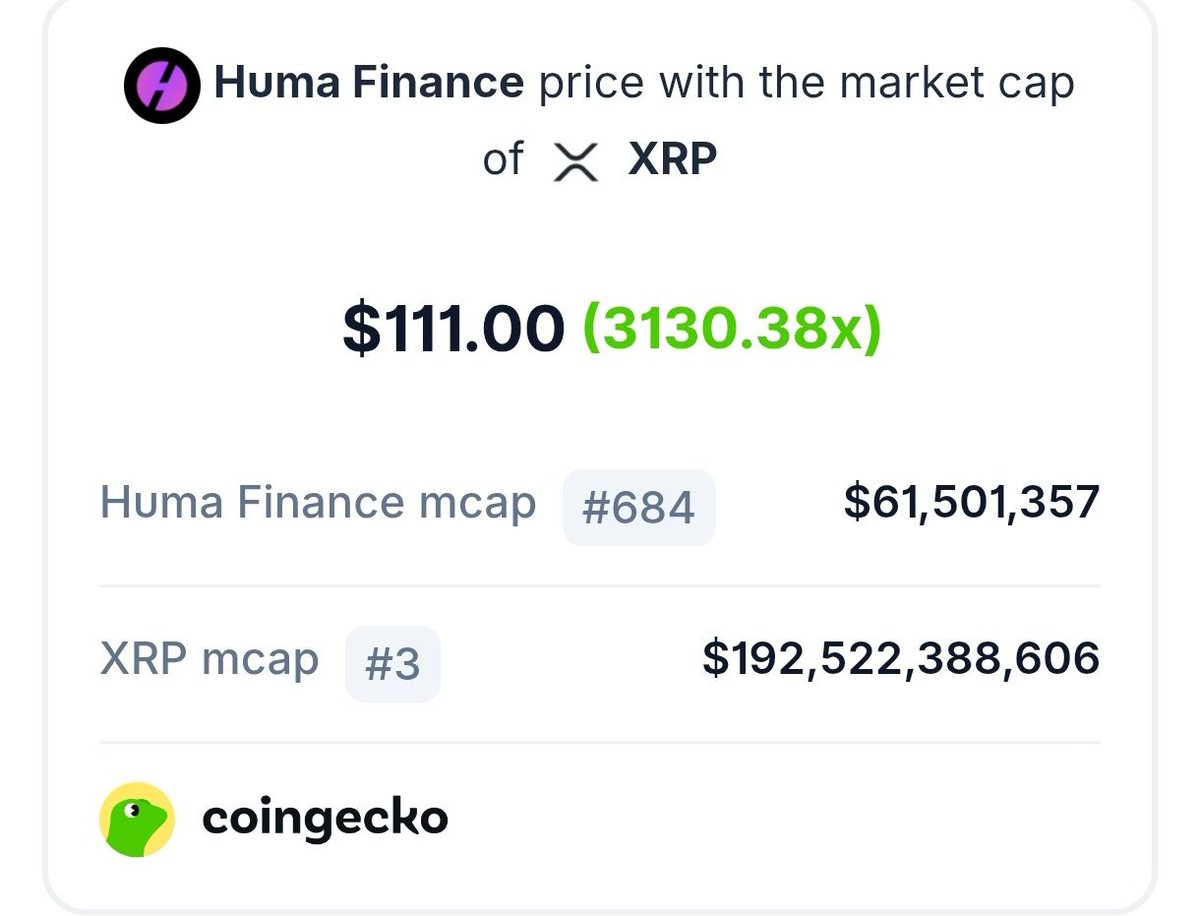

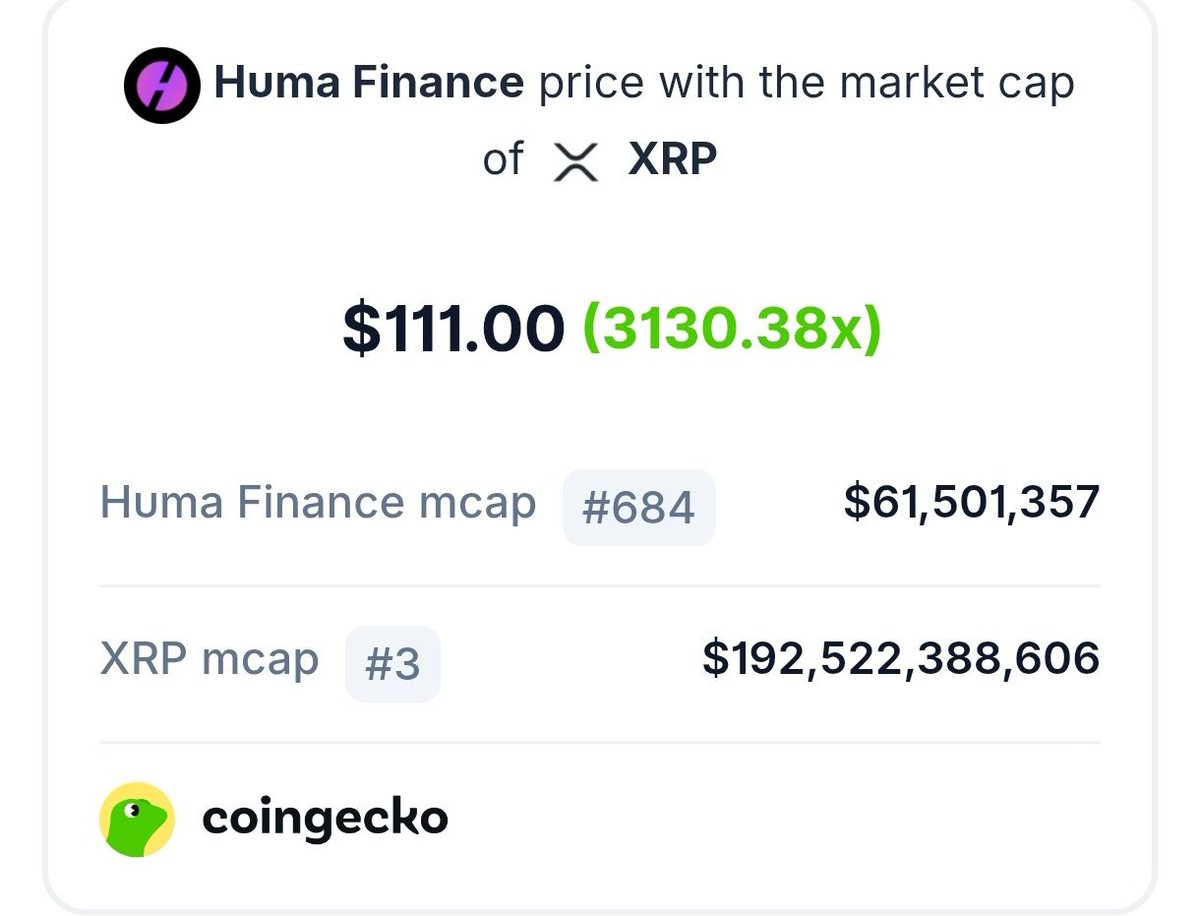

Potential It's challenging, but if $HUMA reaches $XRP's market cap, this would mean a price of $XXX per Huma and a 3,130x increase. Let's see if @DrPayFi and @0xErbil can achieve this, lol.

Thank you for reading.

XXXXX engagements

Related Topics stack token humafinance finance huma xrp coins defi coins made in usa