[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Dulce [@litigious_dulce](/creator/twitter/litigious_dulce) on x 2754 followers Created: 2025-07-20 14:47:24 UTC Here are some interesting slides from Coatue’s keynote deck. Coatue predicts that in this AI wave of innovation, many insurgents will replace tech incumbents. I believe this is in large part because of the incredible demand for AI/HPC cloud services, which are generally much more lucrative than traditional IT services. Customers often pay $2–$5 per GPU hour (or more) for access to the latest AI hardware, with gross margins typically ranging from 60-90%. In contrast, revenue and margins for managed IT services, legacy data center colocation, or general outsourcing are typically much lower. Now that $IREN is no longer facing an existential risk, leadership can afford to envision a future in which the company thrives. They should be asking, “What is the most IREN can accomplish given its assets and competencies?” Can $IREN realistically become a larger CSP than $CRWV? Can $IREN someday compete with a hyperscaler? CRWV is already considered a hyperscaler and by the end of this year will own a total of about 750k GPUs (250k Hoppers / 500k Blackwells), representing about XX% of the total NVDA GPUs. Assuming CRWV deploys all of those GPUs by the end of 2026, can IREN catch up? The answer is yes, but that will require doing CSP in Canada and Childress, and even then IREN will probably own fewer GPUs, e.g., around 250k Blackwells. That said, IREN will have better margins so that its CSP business may be about as profitable, if not more so. After mulling over IREN’s future growth, my conclusion is that capital is the biggest constraint. For instance, the decision of what % of IREN’s pipeline should be used for CSP vs colocation is dependent on how much financing IREN can access (i.e., more financing = more CSP). X GW of the latest GPUs will cost about $20B, and IREN obviously can’t afford that. But these are the sums IREN needs to compete with a hyperscaler in earnest. A lot of responsibility rests on IREN’s new Chief Capital Officer Anthony Lewis. Capital is in my mind what will determine whether IREN is ultimately a $100B company or a $1T company.  XXXXX engagements  **Related Topics** [gpu](/topic/gpu) [coins ai](/topic/coins-ai) [Post Link](https://x.com/litigious_dulce/status/1946945038346572021)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Dulce @litigious_dulce on x 2754 followers

Created: 2025-07-20 14:47:24 UTC

Dulce @litigious_dulce on x 2754 followers

Created: 2025-07-20 14:47:24 UTC

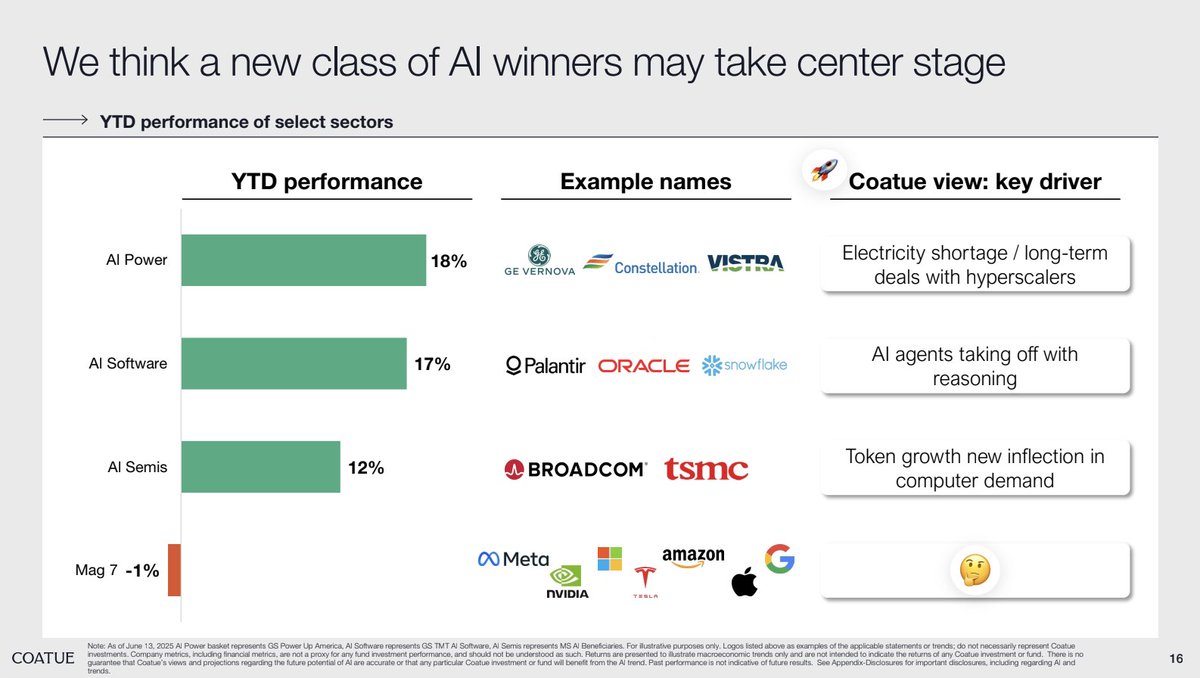

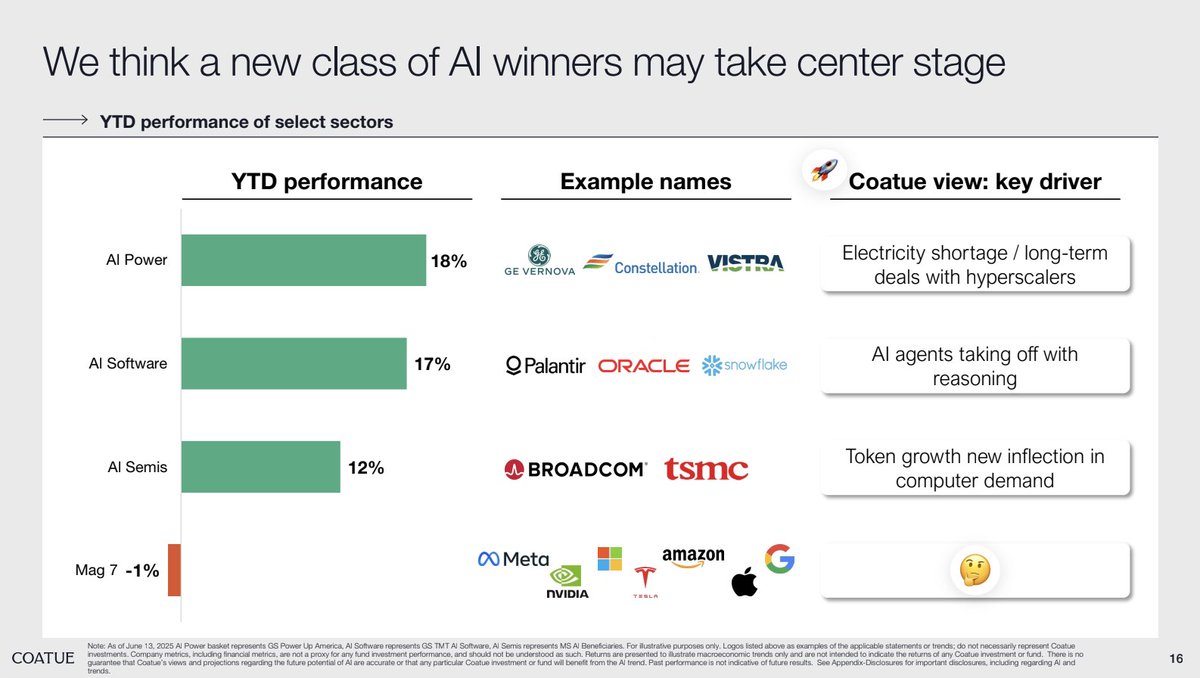

Here are some interesting slides from Coatue’s keynote deck. Coatue predicts that in this AI wave of innovation, many insurgents will replace tech incumbents. I believe this is in large part because of the incredible demand for AI/HPC cloud services, which are generally much more lucrative than traditional IT services. Customers often pay $2–$5 per GPU hour (or more) for access to the latest AI hardware, with gross margins typically ranging from 60-90%. In contrast, revenue and margins for managed IT services, legacy data center colocation, or general outsourcing are typically much lower.

Now that $IREN is no longer facing an existential risk, leadership can afford to envision a future in which the company thrives. They should be asking, “What is the most IREN can accomplish given its assets and competencies?” Can $IREN realistically become a larger CSP than $CRWV? Can $IREN someday compete with a hyperscaler?

CRWV is already considered a hyperscaler and by the end of this year will own a total of about 750k GPUs (250k Hoppers / 500k Blackwells), representing about XX% of the total NVDA GPUs. Assuming CRWV deploys all of those GPUs by the end of 2026, can IREN catch up? The answer is yes, but that will require doing CSP in Canada and Childress, and even then IREN will probably own fewer GPUs, e.g., around 250k Blackwells. That said, IREN will have better margins so that its CSP business may be about as profitable, if not more so.

After mulling over IREN’s future growth, my conclusion is that capital is the biggest constraint. For instance, the decision of what % of IREN’s pipeline should be used for CSP vs colocation is dependent on how much financing IREN can access (i.e., more financing = more CSP). X GW of the latest GPUs will cost about $20B, and IREN obviously can’t afford that. But these are the sums IREN needs to compete with a hyperscaler in earnest.

A lot of responsibility rests on IREN’s new Chief Capital Officer Anthony Lewis. Capital is in my mind what will determine whether IREN is ultimately a $100B company or a $1T company.

XXXXX engagements