[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Kazi [@TheCryptoKazi](/creator/twitter/TheCryptoKazi) on x 88.9K followers Created: 2025-07-20 12:14:17 UTC Alright; so I’ve built a big position on $ADM and let me tell you why. I’ve added the dots up. Again, like $TIBBIR this stands to be one of my Bigger bags on Base now. Even though the chart has been pumping, it’s at 8M, so I still think the R/R is stupid crazy at these levels. First, let’s focus on the the Founder Anthony DeMartino, where the ticker $ADM comes from: - Ex Barclays, HSBC, UBS. Built risk systems at scale. - Former Head of Risk at Coinbase. He helped build regulatory-compliant frameworks, custody architecture, and risk control systems. - Now founder of Sentora, backed by Ripple. Not many normies have heard of Sentora, but institutions DEFINITELY have. How do I know this? Let’s look at who Sentora has raised capital with, be prepared to be blown away. - They have raised $25M from Ripple, Flare, Tribe, etc to go into XRP DeFi. - Came out of a merger between two DeFi infra teams with $3B+ in flow. Sentora will act as the trust layer turning risk into a standardized, tokenized metric. This lays a foundation for ETF-grade DeFi exposure. These massive names wouldn’t raise $25M for nobody. This guy has a proven track record. So now, how does $ADM come into play? Essentially $ADM will be the token that unlocks access for retail investors, to what Institutions are going to gain access to. Here’s something not a lot of people know, but those that do will out trade probably XX% of traders. My guess is that they’re building a singular stablecoin backed by the highest-yielding, risk-adjusted assets across chains — auto-managed, auto-staked, auto-balanced — with one click. This is exactly what whales and institutions want. Institutions don’t really look at charts, they’re watching flows, APIs, and backend integrations. With XRP also pumping heavily, this is going to an insanely obviously play in hindsight. To be honest I actually got my full confirmation that this wasn’t a larp, but a stealth launch last night, where I saw the dev replying to something about ADM, but without denying he’s behind it, but just saying he’s had another role with CoinBase. CA: 0x55fF51DA774b8ce0ed1ABAeD1CB76236bc6b2f16  XXXXXX engagements  **Related Topics** [tibbir](/topic/tibbir) [adm](/topic/adm) [$barcl](/topic/$barcl) [ticker](/topic/ticker) [bags](/topic/bags) [$adm](/topic/$adm) [archer daniels midland co](/topic/archer-daniels-midland-co) [coins privacy](/topic/coins-privacy) [Post Link](https://x.com/TheCryptoKazi/status/1946906508203102292)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Kazi @TheCryptoKazi on x 88.9K followers

Created: 2025-07-20 12:14:17 UTC

Kazi @TheCryptoKazi on x 88.9K followers

Created: 2025-07-20 12:14:17 UTC

Alright; so I’ve built a big position on $ADM and let me tell you why.

I’ve added the dots up. Again, like $TIBBIR this stands to be one of my Bigger bags on Base now.

Even though the chart has been pumping, it’s at 8M, so I still think the R/R is stupid crazy at these levels.

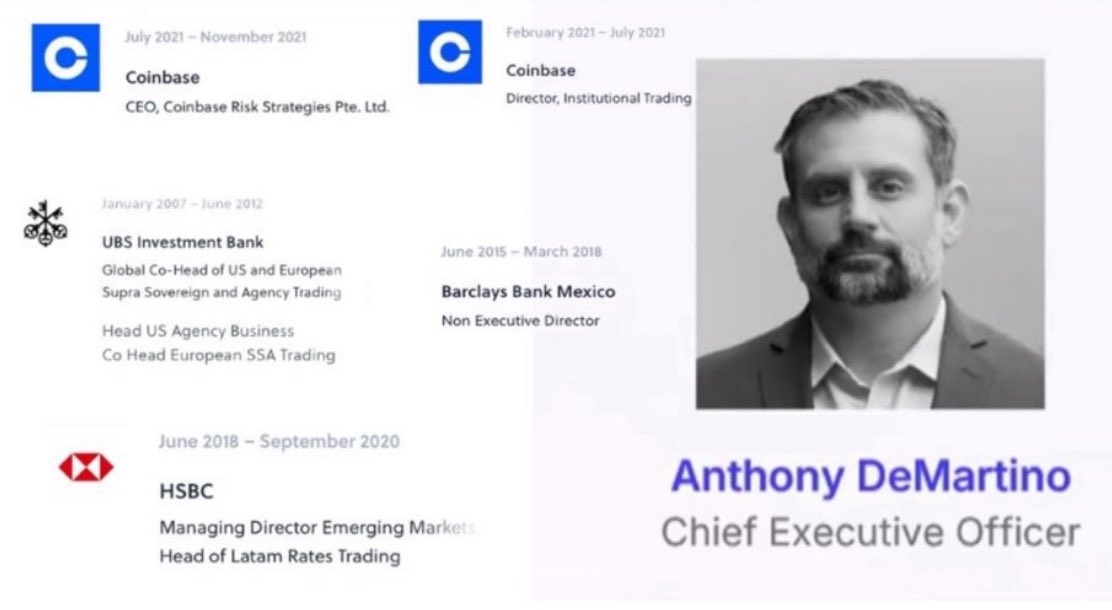

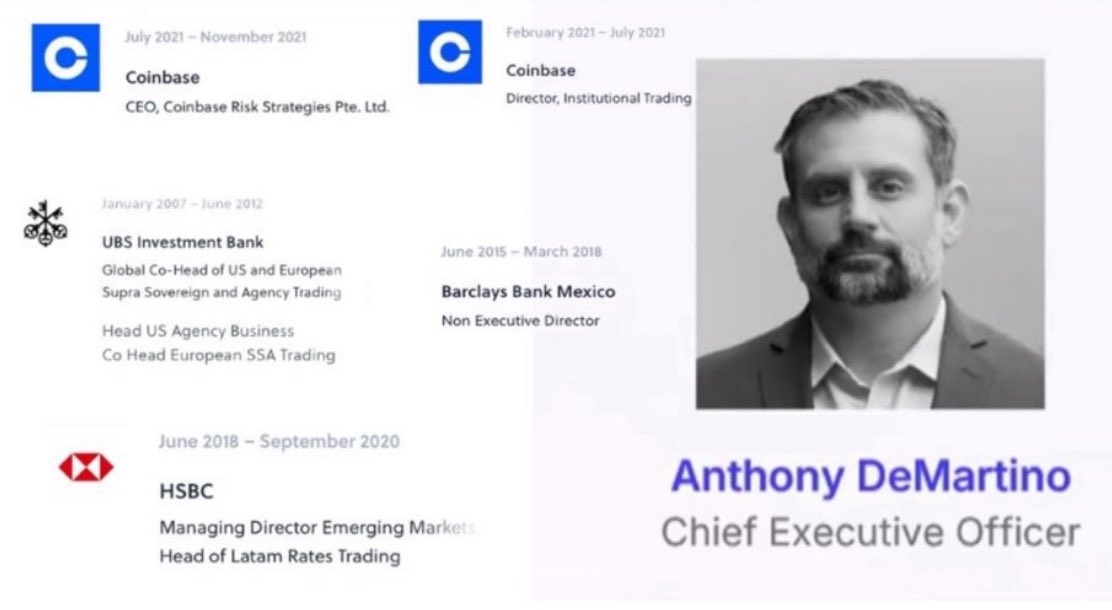

First, let’s focus on the the Founder Anthony DeMartino, where the ticker $ADM comes from:

- Ex Barclays, HSBC, UBS. Built risk systems at scale.

- Former Head of Risk at Coinbase. He helped build regulatory-compliant frameworks, custody architecture, and risk control systems.

- Now founder of Sentora, backed by Ripple.

Not many normies have heard of Sentora, but institutions DEFINITELY have. How do I know this?

Let’s look at who Sentora has raised capital with, be prepared to be blown away.

- They have raised $25M from Ripple, Flare, Tribe, etc to go into XRP DeFi.

- Came out of a merger between two DeFi infra teams with $3B+ in flow.

Sentora will act as the trust layer turning risk into a standardized, tokenized metric. This lays a foundation for ETF-grade DeFi exposure.

These massive names wouldn’t raise $25M for nobody. This guy has a proven track record.

So now, how does $ADM come into play?

Essentially $ADM will be the token that unlocks access for retail investors, to what Institutions are going to gain access to.

Here’s something not a lot of people know, but those that do will out trade probably XX% of traders.

My guess is that they’re building a singular stablecoin backed by the highest-yielding, risk-adjusted assets across chains — auto-managed, auto-staked, auto-balanced — with one click. This is exactly what whales and institutions want.

Institutions don’t really look at charts, they’re watching flows, APIs, and backend integrations.

With XRP also pumping heavily, this is going to an insanely obviously play in hindsight.

To be honest I actually got my full confirmation that this wasn’t a larp, but a stealth launch last night, where I saw the dev replying to something about ADM, but without denying he’s behind it, but just saying he’s had another role with CoinBase.

CA: 0x55fF51DA774b8ce0ed1ABAeD1CB76236bc6b2f16

XXXXXX engagements

Related Topics tibbir adm $barcl ticker bags $adm archer daniels midland co coins privacy