[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]  Alpha Insiders [@AlphaInsiders](/creator/twitter/AlphaInsiders) on x 107.2K followers Created: 2025-07-20 06:10:34 UTC 🪙 From Bitcoin to Ethereum: The Evolution of Crypto Treasury Strategies A growing number of companies are adopting crypto treasury strategies, inspired by MicroStrategy’s bold move to invest heavily in bitcoin starting in 2020. With over XXXXXXX BTC now worth more than $XX billion, MicroStrategy’s stock has soared over 3,000%, prompting others to follow suit. Japan’s Metaplanet, for example, has acquired over XXXXXX bitcoins since 2024, benefiting from favorable tax treatment and seeing its stock jump more than 4,000%, reflecting the market’s enthusiasm for crypto-focused corporate strategies. ⭕️ Ethereum Takes Center Stage in Corporate Treasury Strategies Following bitcoin’s lead, Ethereum is now gaining traction in corporate treasury strategies. In June 2025, SharpLink Gaming raised $XXX million, primarily to purchase ether, and appointed Ethereum co-founder Joseph Lubin as chairman, resulting in a stock surge of nearly 900%. Similarly, BitMine Immersion Technologies allocated 40–50% of its treasury to ether after major names like Tom Lee and Peter Thiel joined the company, pushing its stock up by 1,300%, signaling growing corporate confidence in Ethereum as a strategic asset. ⭕️ Beyond Bitcoin: Diversifying Corporate Crypto Holdings Crypto treasury strategies are now expanding beyond Bitcoin and Ethereum, with companies like Tron Inc. (formerly SRM Entertainment) investing heavily in TRX, while others explore assets like BNB, Hyperliquid, and Litecoin. A notable case was YHC Corporation, whose stock surged and crashed after a high-profile acquisition plan tied to crypto fell apart amid legal issues. This growing trend has sparked skepticism, as some firms with no crypto background appear to adopt these strategies purely to inflate their stock prices. Critics warn the hype resembles a bubble, driven more by speculation than solid fundamentals. Credit: @Forbes  XXXXX engagements  **Related Topics** [investment](/topic/investment) [bold](/topic/bold) [bitcoin](/topic/bitcoin) [coins layer 1](/topic/coins-layer-1) [coins bitcoin ecosystem](/topic/coins-bitcoin-ecosystem) [coins pow](/topic/coins-pow) [ethereum](/topic/ethereum) [$mtplf](/topic/$mtplf) [Post Link](https://x.com/AlphaInsiders/status/1946814973487059292)

[GUEST ACCESS MODE: Data is scrambled or limited to provide examples. Make requests using your API key to unlock full data. Check https://lunarcrush.ai/auth for authentication information.]

Alpha Insiders @AlphaInsiders on x 107.2K followers

Created: 2025-07-20 06:10:34 UTC

Alpha Insiders @AlphaInsiders on x 107.2K followers

Created: 2025-07-20 06:10:34 UTC

🪙 From Bitcoin to Ethereum: The Evolution of Crypto Treasury Strategies

A growing number of companies are adopting crypto treasury strategies, inspired by MicroStrategy’s bold move to invest heavily in bitcoin starting in 2020. With over XXXXXXX BTC now worth more than $XX billion, MicroStrategy’s stock has soared over 3,000%, prompting others to follow suit. Japan’s Metaplanet, for example, has acquired over XXXXXX bitcoins since 2024, benefiting from favorable tax treatment and seeing its stock jump more than 4,000%, reflecting the market’s enthusiasm for crypto-focused corporate strategies.

⭕️ Ethereum Takes Center Stage in Corporate Treasury Strategies

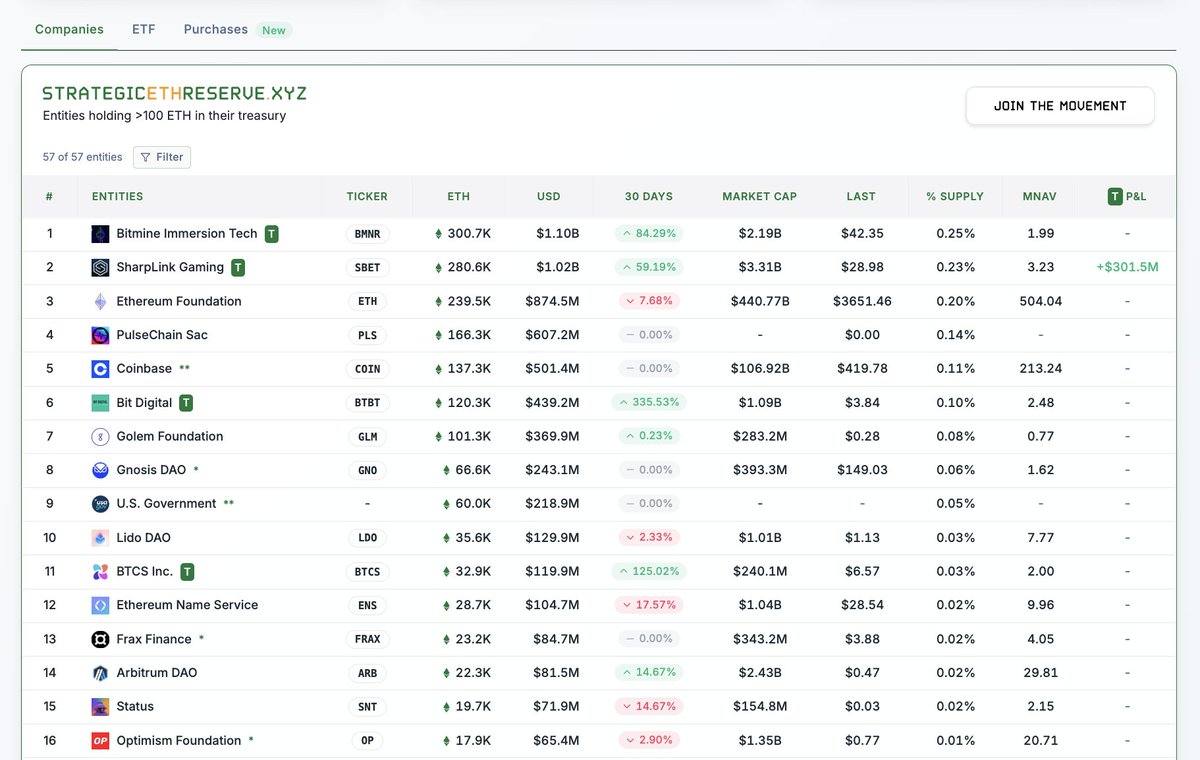

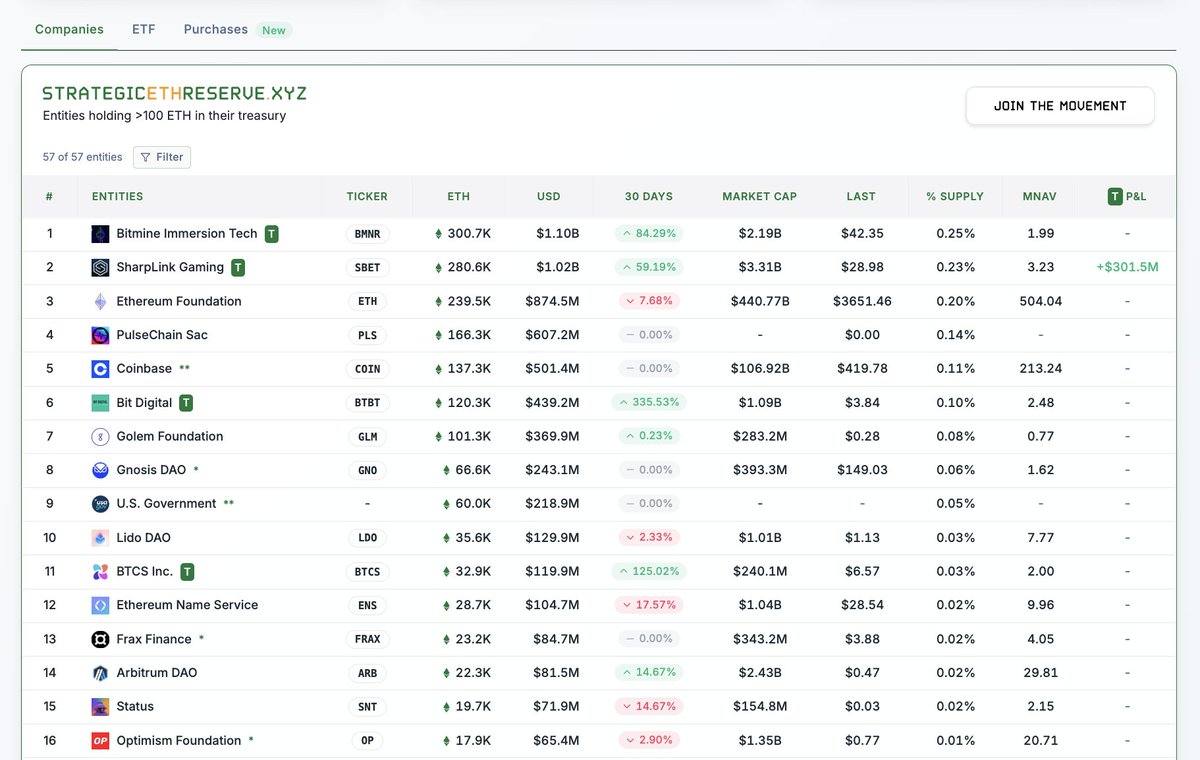

Following bitcoin’s lead, Ethereum is now gaining traction in corporate treasury strategies. In June 2025, SharpLink Gaming raised $XXX million, primarily to purchase ether, and appointed Ethereum co-founder Joseph Lubin as chairman, resulting in a stock surge of nearly 900%. Similarly, BitMine Immersion Technologies allocated 40–50% of its treasury to ether after major names like Tom Lee and Peter Thiel joined the company, pushing its stock up by 1,300%, signaling growing corporate confidence in Ethereum as a strategic asset.

⭕️ Beyond Bitcoin: Diversifying Corporate Crypto Holdings

Crypto treasury strategies are now expanding beyond Bitcoin and Ethereum, with companies like Tron Inc. (formerly SRM Entertainment) investing heavily in TRX, while others explore assets like BNB, Hyperliquid, and Litecoin. A notable case was YHC Corporation, whose stock surged and crashed after a high-profile acquisition plan tied to crypto fell apart amid legal issues. This growing trend has sparked skepticism, as some firms with no crypto background appear to adopt these strategies purely to inflate their stock prices. Critics warn the hype resembles a bubble, driven more by speculation than solid fundamentals.

Credit: @Forbes

XXXXX engagements

Related Topics investment bold bitcoin coins layer 1 coins bitcoin ecosystem coins pow ethereum $mtplf